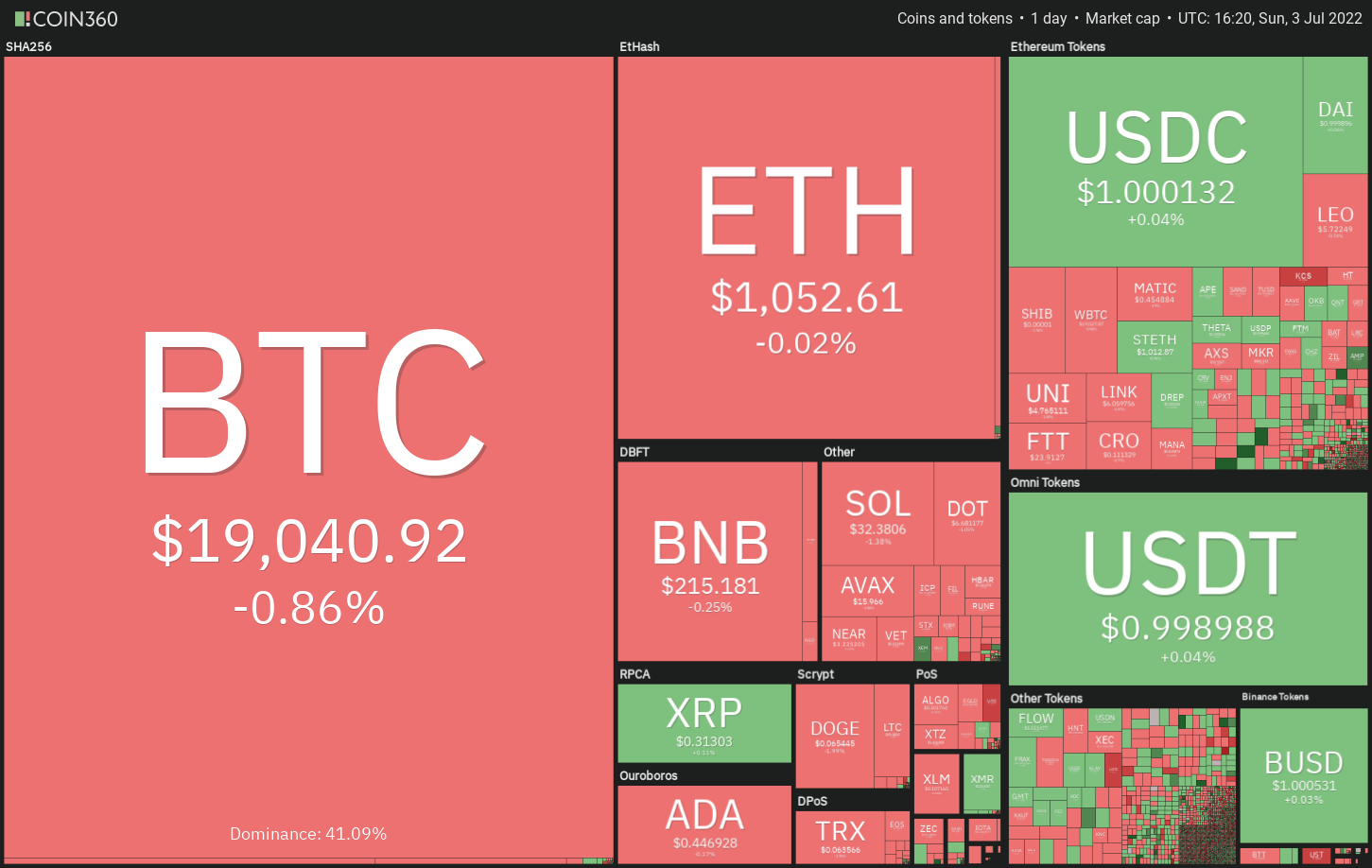

The bears are trying to sink Bitcoin (BTC) below $19,000 to help cement their edge on the crypto market. Analysts watching Bitcoin’s MVRV-Z Score, a metric which measures how low or high Bitcoin’s cost is in accordance with “fair value,” expect a level much deeper fall prior to the bottom is finally arrived at.

However, economist, trader and entrepreneur Alex Krueger noticed that Bitcoin’s volume hit an exciting-time full of June. Usually, the greatest volume inside a downtrend is suggestive of capitulation which “creates major bottoms.” If Bitcoin follows the historic pattern of the 2018 bear market, Krueger expects the underside to create in This summer.

Because of the tight correlation between Bitcoin and also the S&P 500, crypto traders will need to keep an eye on the performance from the U . s . States equities markets in a few days, which can be influenced through the discharge of minutes in the U.S. Federal Reserve’s last meeting and also the June jobs report.

Could Bitcoin form a greater low and lead the crypto markets toward the road of recovery? Let’s read the charts from the top-5 cryptocurrencies that indicate the potential of a relief rally for the short term.

BTC/USDT

The lengthy wick on Bitcoin’s This summer 1 candlepower unit implies that bears still sell on rallies close to the 20-day exponential moving average ($21,396). Although bears pulled the cost below $19,637, they haven’t yet had the ability to build upon the momentum.

The bulls are trying to push the cost back above $19,637. When they succeed, the BTC/USDT pair could again rise toward the 20-day EMA. A rest and shut above $22,000 could indicate a possible trend change. The happy couple could then chance a rally towards the 50-day simple moving average ($25,938).

On the other hand, when the cost turns lower in the current level, it’ll claim that bears stay in control. The sellers will make an effort to pull the cost below $18,626. When they do this, the happy couple could slide towards the important support zone of $17,960 to $17,622.

It is really an important zone for that bulls to protect just because a failure to do this could start the following leg from the downtrend. The happy couple could then slide to $15,000.

Some-hour chart implies that bears are strongly protecting the 20-EMA. Both moving averages are sloping lower and also the relative strength index (RSI) is incorporated in the negative zone, indicating that bears possess the upper hands. A rest below $18,626 could further strengthen the bears.

This bearish view might be negated for the short term if bulls push the cost over the 20-EMA. The happy couple could then rise towards the 50-SMA in which the bears may again pose a powerful challenge. When the cost increases above this resistance, the happy couple could rally to $21,000 and after that to $22,000.

SHIB/USDT

Shiba Inu (SHIB) continues to be buying and selling inside a tight range close to the moving averages because the bulls attempt to create a greater low near $.000009. Usually, a good range buying and selling is adopted with a range expansion.

When the cost breaks over the 50-day SMA ($.000010), the SHIB/USDT pair could get momentum and rally to $.000012 after which toward $.000014. A rest and shut above this level could signal a possible alternation in trend.

Unlike this assumption, when the cost breaks below $.000009, it might trap the bulls and also require bought the break over the 50-day SMA. That may obvious the road for any possible retest of $.000007. A rest below this important support may suggest the resumption from the downtrend.

Some-hour chart shows the development of the symmetrical triangular pattern. The happy couple continues to be stuck between your 20-EMA and also the support type of the triangular. If bears sink and sustain the cost underneath the support line, the happy couple could drop to $.000009. A rest below this support could signal that bears are during the driver’s seat.

On the other hand, if bulls push the cost over the 20-EMA, the happy couple could rise towards the resistance type of the triangular. If the level is entered, the happy couple could rise to $.000011 after which dash toward $.000012.

MATIC/USDT

Polygon (MATIC) switched lower in the strong overhead resistance of $.61 on June 26 and also the bears pulled the cost underneath the 20-day EMA ($.50) on June 28. A small positive would be that the bulls didn’t permit the bears to construct upon their advantage and purchased the dip on June 30.

Since that time, the MATIC/USDT pair continues to be buying and selling close to the 20-day EMA. This means the bulls are trying to push the cost back over the level. When they succeed, the happy couple could again attempt to obvious the hurdle at $.61.

The RSI makes an optimistic divergence, indicating the bears might be losing their grip. A rest above $.61 could obvious the road for any possible rally to $.75.

Unlike this assumption, when the cost turns lower in the current level and slips below $.41, it’ll claim that the current recovery might have been a bear market rally. The sellers will make an effort to pull the cost back toward the important support at $.31.

The buyers pressed the cost over the downtrend line and also the 20-EMA but tend to not obvious the mental degree of $.50. This attracted selling and also the bears have pulled the cost to $.45. If the support cracks, a retest of $.41 is probably.

On the other hand, when the cost rebounds from the current level, it’ll claim that the bulls are purchasing on dips. The bulls will make another make an effort to obvious the overhead resistance at $.50. When they succeed, the happy couple could rally to $.55 after which to $.61.

Related: Bitcoin’s inverse correlation around dollar hits 17-month highs — what’s next for BTC?

ATOM/USDT

Following a prolonged downtrend, Cosmos (ATOM) is trying to form a bottom. The buyers pressed the cost over the 20-day EMA ($7.84) on This summer 1 however the 50-day SMA ($8.81) will probably behave as a powerful barrier.

The flattish 20-day EMA and also the RSI close to the midpoint indicate the selling pressure might be reducing. If buyers thrust the cost over the 50-day SMA, the bullish momentum may get and also the ATOM/USDT pair could rally to $10.84 after which to $12.50. A rest and shut above this level could advise a potential trend change.

This bullish could invalidate for the short term when the cost turns lower in the current level and breaks below $6.89. In the event that happens, the happy couple could again retest the critical support at $5.55.

Some-hour chart implies that bulls are trying to switch the 50-SMA into support. When the cost increases in the current level and breaks above $8.38, the bulls could challenge the immediate resistance at $8.75. A rest above this level could signal the resumption from the up-move. The happy couple could then rise to $9.

On the other hand, when the cost turns lower and plummets underneath the moving averages, it’ll claim that bears still sell at greater levels. The happy couple could then slide toward $7.18 after which $6.89.

APE/USDT

Buyers pressed and closed ApeCoin (APE) over the 20-day EMA ($4.69) on June 27 but they couldn’t build upon the recovery. The bears pulled the cost back underneath the 20-day EMA on June 29 however a positive sign would be that the bulls haven’t quit much ground.

This means the buyers aren’t dumping their position because they anticipate moving greater. The flattening 20-day EMA and also the RSI just beneath the midpoint claim that the selling pressure might be reducing.

If buyers drive the cost over the 20-day EMA, it might tilt the benefit within their favor. The APE/USDT pair could then rally towards the 50-day SMA ($5.72) in which the bears are anticipated to mount a powerful defense.

Unlike this assumption, when the cost turns lower in the current level and plummets below $4.21, the following stop might be $3.85.

Some-hour chart shows a symmetrical triangular formation, indicating indecision among consumers. Both moving averages are flat and also the RSI is close to the midpoint, suggesting a standing of equilibrium.

When the cost dips underneath the triangular, it’ll claim that bears have asserted their supremacy. The happy couple could then decline towards the pattern target of $3.78.

Alternatively, when the cost increases in the current level and breaks over the triangular, it might signal benefit to the bulls. The happy couple could then rise to $5.38 and then to $5.57.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.