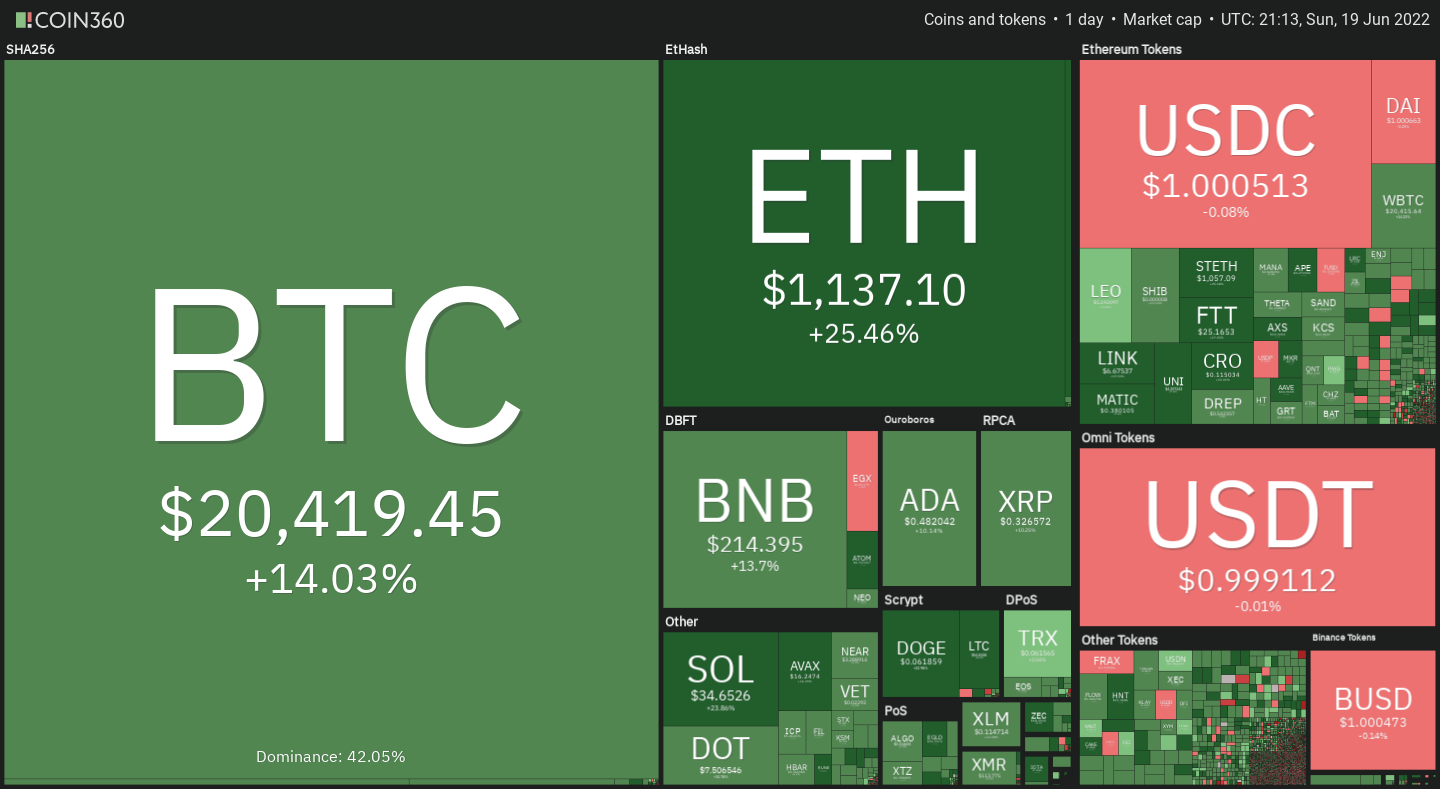

Bitcoin (BTC) plummeted to $17,622 on June 18. This marked the very first time in Bitcoin’s history it has fallen below its previous cycle high. The U . s . States Federal Reserve’s aggressive financial tightening, an emergency at crypto lending platform Celsius and liquidity issues at investment fund Three Arrows Capital are coming up with a feeling of panic among traders.

Markets commentator Holger Zschaepitz stated that Bitcoin has crashed greater than 80% four occasions ever. That puts the present fall of approximately 74% within historic standards. Previous bear markets have bottomed out just beneath the 200-week moving average, based on market analyst Rekt Capital. If history repeats itself, Bitcoin is not likely to remain in the current depressed levels for any lengthy time.

Coinglass data shows that Bitcoin’s 39% reduction in June of the year may be the worst since 2013. While several investors expect Bitcoin to bottom out soon, crypto critic Peter Schiff cautioned the selling could continue and also the largest cryptocurrency may drop to $3,000.

Could bulls arrest the loss of Bitcoin for the short term? In the event that happens, let’s read the charts from the top-5 cryptocurrencies that could outshine another coins.

BTC/USDT

Bitcoin plummeted underneath the crucial support of $20,111 on June 18, indicating the resumption from the downtrend. A small positive would be that the bulls purchased the dip as seen in the lengthy tail around the day’s candlepower unit.

The buyers are trying to push the cost back over the breakdown degree of $20,111. When they manage to achieve that, it’ll claim that the drop to $17,622 on June 18 might have been a bear trap. The BTC/USDT pair could then rally to $23,362 in which the bears may again mount a powerful resistance.

The relative strength index (RSI) continues to be buying and selling within the oversold zone within the last couple of days which implies a relief rally soon.

This positive view could invalidate when the cost turns lower from $20,111. Which will suggest the bears have flipped the amount into resistance while increasing the potential of a rest below $17,622. The following support on however $16,000.

The positive divergence around the RSI shows that the bears might be losing their grip. Some-hour chart implies that the cost has retrieved towards the 20-exponential moving average.

It is really an important level for that bears to take into consideration just because a break and shut above it might push the happy couple towards the overhead resistance zone between your 50-simple moving average and $23,362.

On the other hand, when the cost does not sustain over the 20-EMA, it’ll claim that bears are active at greater levels. The sellers will on the other hand attempt to pull the happy couple to $17,622.

SOL/USDT

Solana (SOL) has been around a powerful downtrend however the positive divergence around the RSI shows that the bearish momentum might be weakening.

The bulls will attempt to push the cost over the 20-day EMA ($36). When they succeed, it’ll claim that the bulls take presctiption a comeback. The SOL/USDT pair could after that rise towards the 50-day SMA ($50) in which the bears may again mount a powerful defense.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the bears have been in no mood to surrender their advantage. The sellers will on the other hand attempt to sink the cost below $25 and begin the following leg from the downtrend.

The bulls have pressed the cost over the moving averages around the 4-hour chart and can make an effort to obvious the overhead hurdle in the downtrend line. When they do this, it’ll claim that the downtrend might have ended for the short term. The buyers will attempt to push the cost to $42.50 and then to $45.

On the other hand, when the cost turns lower in the current level or even the downtrend line and breaks underneath the moving averages, it’ll claim that bears still defend the overhead resistance strongly. That may pull the cost to $27.50 and then to $25.

LTC/USDT

The bears tried to sink Litecoin (LTC) underneath the strong support at $40 on June 18 however the lengthy tail around the day’s candlepower unit shows that the bulls are protecting the amount strongly.

The relief rally has arrived at the 20-day EMA ($55) which is a vital level to keep close track of just because a break and shut above it might advise a potential alternation in trend. The LTC/USDT pair could after that rise towards the 50-day SMA ($68).

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that the popularity remains negative and traders can sell on rallies. The bears will make another make an effort to sink the happy couple below $40 and resume the downtrend.

The cost has damaged from a symmetrical triangular pattern around the 4-hour chart. Even though this setup usually functions like a continuation pattern, it sometimes signifies a potential reversal. The moving averages have finished a bullish crossover, suggesting benefit to buyers. If buyers sustain the cost over the triangular, the happy couple could rise towards the pattern target of $62.

This positive view could invalidate for the short term when the cost turns lower and re-enters the triangular. This type of move will claim that the break over the triangular might have been a bull trap.

Related: Elon Musk’s support for Dogecoin grows more powerful following $258B suit

LINK/USDT

Chainlink (LINK) is within a downtrend but it’s trying to create a bottom near $5.50. The bears pulled the cost below this level on June 13, June 14 and June 18 but they couldn’t sustain the low levels. This means that bulls are purchasing on dips.

The positive divergence around the RSI shows that the bearish momentum might be weakening. The buyers will attempt to push the cost toward the downtrend line, which will probably behave as a stiff resistance.

When the cost turns lower in the downtrend line, the bears will again make an effort to sink and sustain the hyperlinkOrUSDT pair underneath the $5.50 support. In the event that happens, it’ll suggest the resumption from the downtrend.

Alternatively, if buyers thrust the cost over the downtrend line, it’ll advise a potential trend change. The happy couple could then rise to $10 and then to $12.

The rebound within the pair has arrived at the 50-SMA which might behave as a small resistance. The 20-EMA is flattening out and also the RSI is close to the midpoint, suggesting the bears might be losing their grip.

If buyers push the cost over the 50-SMA, the happy couple could rise to $7.51. A rest and shut above this resistance will develop a double bottom pattern for the short term. This reversal setup includes a pattern target of $9.50.

To invalidate this bullish view, the bears will need to pull and sustain the cost underneath the strong support at $5.50.

BSV/USD

Bitcoin SV (BSV) has created a broadening pattern and also the buyers are trying to push the cost over the resistance from the setup. The RSI is showing an optimistic divergence, indicating the bearish momentum is weakening.

The BSV/USD pair could rally towards the resistance line in which the bears may attempt to stall the recovery. In the event that happens, it’ll claim that bears still sell on rallies. That may keep your pair stuck within the broadening formation for many additional time.

On the other hand, if bulls drive the cost over the resistance line, it’ll claim that the happy couple might have bottomed out. The happy couple could then begin a new up-move that could push the happy couple to $80 after which $87.

Some-hour chart implies that the happy couple continues to be buying and selling inside a wide range between $45 and $66. Following a unsuccessful attempt through the bears to drag the happy couple underneath the range, the bulls will endeavour to push the cost over the resistance.

When they succeed, the happy couple could begin a new up-move. The pattern target of the setup is $87. Another possibility would be that the cost turns lower from $66. In the event that happens, it’ll claim that the happy couple may remain range-bound for many additional time.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.