The U . s . States equities markets observed a clear, crisp comeback a week ago, brought through the Nasdaq Composite, which acquired 7.5%. The S&P was up about 6.5% for that week, as the Dow jones Johnson Industrial Average managed an increase of 5.4%.

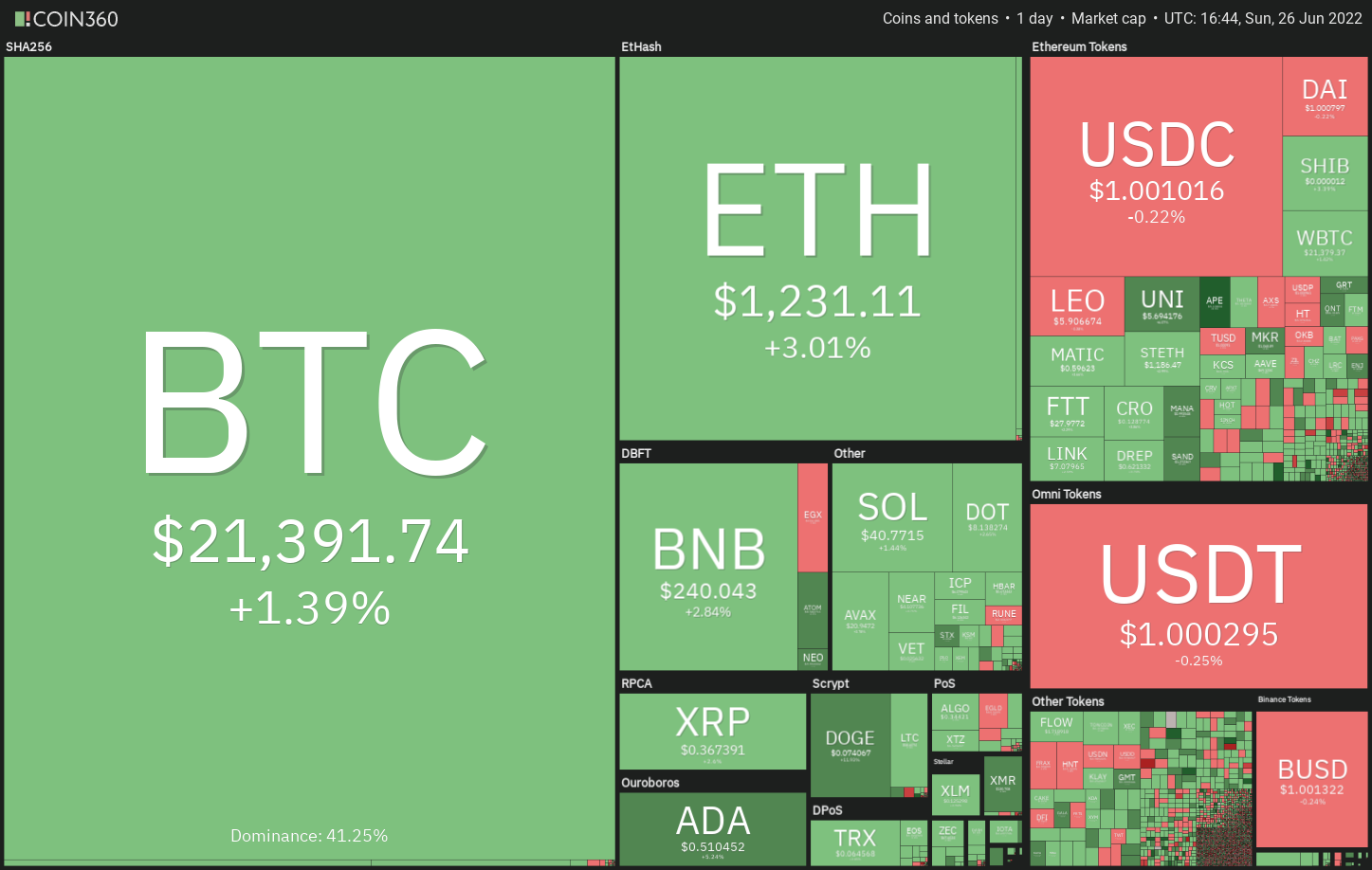

Ongoing its tight correlation using the equities market, the crypto financial markets are also attempting a relief rally. Bitcoin (BTC) has witnessed a modest recovery, however, many altcoins have risen dramatically previously week. This means that investors are benefiting from the sharp fall within the cost to amass altcoins at ‘abnormal’ amounts.

Smaller sized-sized investors have used the loss of Bitcoin to construct their position to a single Bitcoin. Glassnode data implies that the amount of Bitcoin wallet addresses which have several Bitcoin rose by 873 between June 15 to June 25.

Is the recovery in Bitcoin and altcoins get momentum? Let’s read the charts of the top five cryptocurrencies that may charge greater for the short term.

BTC/USDT

Bitcoin’s relief rally is facing stiff resistance near $22,000 as seen in the lengthy wick around the June 26 candlepower unit. This signifies the bears will not quit their advantage and therefore are selling on rallies.

The sellers will attempt to drag the cost toward the vital support of $20,000. It is really an important level to take into consideration just because a bounce off it’ll claim that bulls are trying to form a greater low.

That may boost the prospects of the break over the 20-day exponential moving average (EMA) of $23,155. In the event that happens, the BTC/Tether (USDT) pair could indicate a possible trend change. The bulls will attempt to drive the cost toward the 50-day simple moving average (SMA) of $27,424.

On the other hand, when the cost turns lower and plummets below $20,000, it’ll claim that bears stay in control. The sellers will attempt to sink the BTC/USDT pair towards the crucial degree of $17,622.

The failure from the bulls to push the cost towards the 38.2% Fibonacci retracement degree of $23,024 suggests too little demand at greater levels. The moving averages have flattened out, and also the relative strength index (RSI) is simply over the midpoint, suggesting a variety-bound action soon.

When the cost slips underneath the moving averages, the happy couple could drop to $20,000. A rest below this support could signal weakness.

Alternatively, when the cost rebounds from the moving averages, it’ll claim that bulls are purchasing on dips. The bulls will make an effort to push the cost toward $23,024. If the level is entered, the following stop may be the 50% retracement degree of $24,693.

UNI/USDT

Uniswap (UNI) rebounded dramatically from $3.33 on June 18 and it has arrived at the stiff overhead resistance at $6.08. The bears are protecting the amount strongly, however a minor positive would be that the bulls haven’t quit much ground.

The moving averages are near to finishing a bullish crossover and also the RSI is incorporated in the positive zone, indicating the road to least resistance would be to the upside.

If buyers drive the cost above $6.08, the bullish momentum could get and also the UNI/USDT pair could rally to $8.00. This level could again behave as a stiff hurdle, but when bulls overcome it, the following stop might be $10.

On the other hand, when the cost turns lower in the current level and breaks underneath the 20-day EMA of $4.90, it’ll claim that the popularity remains negative and traders can sell near resistance levels. The happy couple could then decline toward $4.00.

The bears are trying to stall the recovery close to the overhead resistance at $6.08 however the rising moving averages around the 4-hour chart claim that bulls possess the upper hands soon.

When the rebound from the 20-EMA sustains, it might increase the potential of a rest above $6.08. In the event that happens, the happy couple could get momentum and rally to $6.66 after which to $7.34.

Another possibility would be that the pair turns lower and breaks underneath the 20-EMA. For the reason that situation, the happy couple could slide towards the 50-SMA. A rest below this support could invalidate the bullish view.

XLM/USDT

Stellar (XLM) has been around a powerful downtrend however the bulls are trying to form a bottom near $.10. The buyers pressed the cost over the 20-day EMA of $.12 on June 24, but tend to not obvious the hurdle in the 50-day SMA of $.13.

A small positive is the fact that bulls haven’t permitted the cost to slide back underneath the 20-day EMA of $.12. The flattening 20-day EMA and also the RSI close to the midpoint claim that bulls try a comeback.

If buyers drive the cost over the 50-day SMA, the XLM/USDT pair could chance a rally towards the overhead resistance at $.15. If the level is removed, it might signal the beginning of a brand new upward trend.

This positive view could invalidate for the short term when the cost continues lower and breaks underneath the 20-day EMA. The happy couple could then slip to $.11.

The moving averages around the 4-hour chart are sloping up and also the RSI is incorporated in the positive territory, suggesting a benefit to buyers. The buyers will need to propel the cost above $.13 to spread out the doorways for any possible rally to $.14 after which $.15.

Unlike this assumption, when the cost slips underneath the 20-EMA, the happy couple could drop towards the upward trend line. A rest below this support could tilt the benefit back in support of the bears. The happy couple could then slide to $.11.

Related: How low can Ethereum cost drop versus Bitcoin among the DeFi contagion?

THETA/USDT

Theta Network (THETA) continues to be consolidating inside a tight range from $1.00 and $1.55 within the last a few days. The more time spent in the range, the more powerful the breakout is going to be from this.

Both moving averages are near finishing a bullish crossover and also the RSI is incorporated in the positive territory. This means that bulls possess a slight edge. If buyers push the cost above $1.55, it’ll suggest the beginning of a brand new up-move. The THETA/USDT pair could then rise towards the pattern target of $2.10.

Unlike this assumption, when the cost turns lower from $1.55, it’ll claim that bears still defend the resistance strongly. That may keep your pair stuck within the range for any couple of more days.

Some-hour chart implies that the cost switched lower in the overhead resistance at $1.55 however a positive sign would be that the bulls are trying to defend the 20-EMA. This means the sentiment is popping positive and traders are purchasing the dips.

When the cost rebounds from the current level, the bulls will again attempt to obvious the overhead hurdle at $1.55. Whether they can accomplish it, it might suggest the beginning of a brand new upward trend. On the other hand, when the cost breaks underneath the 20-EMA, the happy couple could drop towards the 50-SMA.

HNT/USDT

Helium (HNT) has created a symmetrical triangular pattern, indicating indecision one of the bulls and also the bears. Usually, the symmetrical triangular functions like a continuation pattern but in some instances, it signifies a reversal.

The moving averages have finished a bullish crossover and also the RSI is incorporated in the positive territory, suggesting that bulls possess a slight edge.

The cost continues to be stuck between your resistance type of the triangular and also the 20-day EMA of $10.50 within the last couple of days. This can be a positive sign because it shows a general change in sentiment from selling on rallies to purchasing on dips.

If buyers propel the cost over the resistance type of the funnel, it’ll advise a potential alternation in trend. The HNT/USDT pair could then rally to $16.50 and then towards the pattern target of $18.50.

This positive view could invalidate for the short term when the cost turns lower and plummets underneath the 20-day EMA. That may open the doorways for any possible drop towards the support type of the triangular.

The bulls are battling to sustain the cost above $12, which implies that bears are protecting the overhead zone between $12.50 and $13.50 with vigor. When the cost slips underneath the upward trend line, it might tilt rapid-term advantage in support of sellers.

Alternatively, when the cost rebounds from the 20-EMA, it’ll claim that bulls are purchasing on dips. The bulls will make yet another make an effort to obvious the overhead zone. When they succeed, it’ll suggest the beginning of a brand new up-move.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.