The rumors concerning the possible liquidity crisis for that world’s third-largest crypto exchange switched out to be real. Only a next day of assuring money is fine, and they’ve the assets to back customer’s funds, FTX Chief executive officer Mike Bankman-Fried (SBF) announced on Tuesday that Binance has proven intent to get the global crypto platform to assist using the liquidity crisis.

The liquidity crunch came like a surprise to a lot of, given FTX bailed out numerous firms throughout the crypto contagion brought on by the downfall of LUNA and also the insolvency of 3AC.

Even while the crypto community process the occasions of history 24 hrs, the main focus has shifted toward other SBF-owned entities, especially Alameda Research, a number one principal buying and selling firm. Alameda and FTX merged their investment capital operations in August 2022. Speculation mills are rife that Alameda apparently faced an emergency itself throughout the crypto contagion within the second quarter and FTX bailed it, which eventually found bite it back.

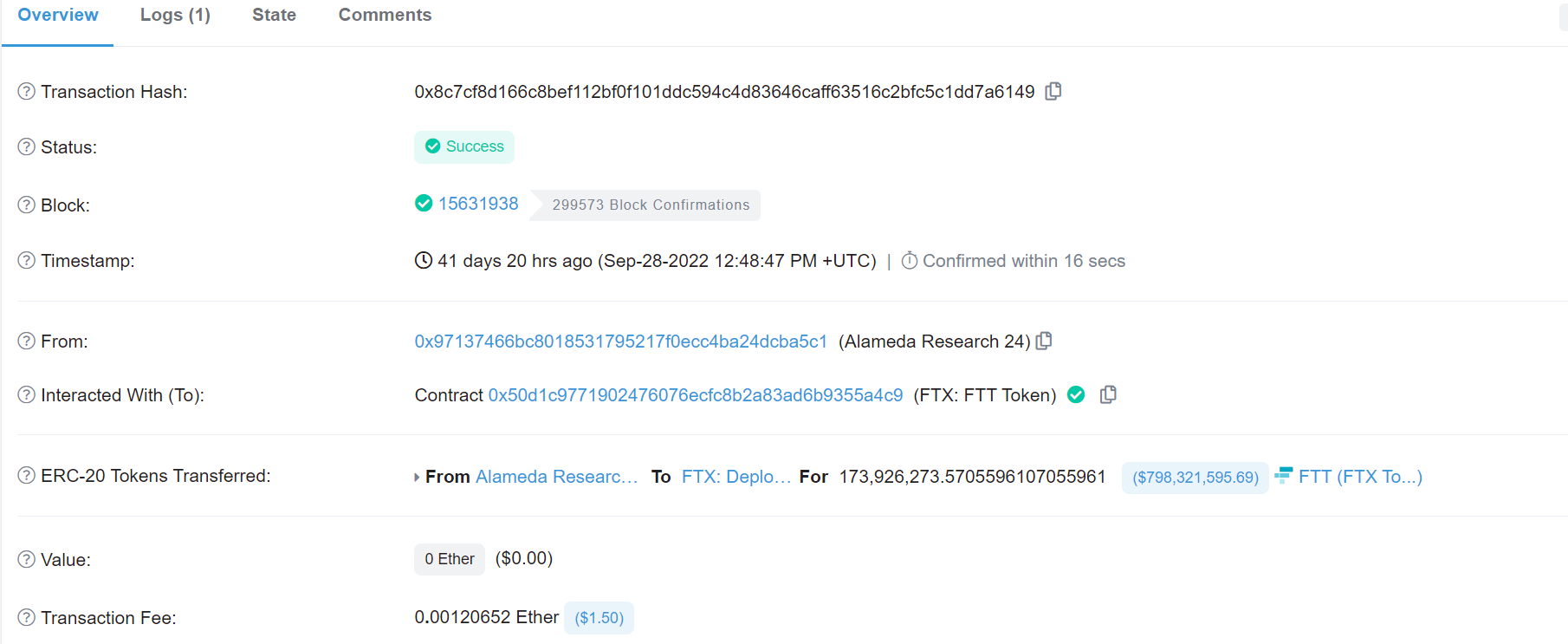

Lucas Nuzzi, the mind from the crypto analytic firm Coinmetric, required to Twitter to indicate the FTT market cap elevated 124.3% on September 28 when 173 million FTX Token (FTT) worth over $4 billion grew to become participating in-chain. Nuzzi noticed that on the day that, as many as $8.6 billion price of FTT tokens were managed to move on-chain.

Related: SBF tumbles off Bloomberg’s millionaire index after trouble at FTX

Tracking the fund transfers during the day, Nuzzi found 173 million FTT tokens from the 2019 ICO-era contract and also the person receiving the $4 billion mint was apparently Alameda Research.

4/ The person receiving the $4.19 B USD price of FTT tokens wasn’t any one but Alameda Research!

What exactly? Alameda and FTX were intrinsically connected from first day and Alameda clearly took part in the FTX ICO.

What happened next was interesting…

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

On-chain data confirms identical to the entire 173 million FTT tokens were then transferred in the Alameda Research address for an FTT ERC-20 deployer controlled by FTX.

Based on Nuzz’s theory, Alameda blew up together with 3AC along with other crypto lenders because of its overleveraged position but survived because of funding from FTX. The crypto exchange saved Alameda from imploding throughout the Q2 contagion using 173 million FTT as collateral vested for September. Nuzz believes that FTX not just helped Alameda from imploding but subsequently saved 173 million vested FTT from liquidation.

6/ Remember, the FTT ICO contract vests instantly.

Had FTX let Alameda implode in May, their collapse might have ensured the following liquidation of FTT tokens vested in September.

It could have been terrible for FTX, so that they had to find away out to avert this scenario.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

The Alameda bailout eventually demonstrated too pricey for FTX to fill, mainly in the wake from the Binance feud-brought FTT selling spree. This eventually made FTX insolvent forcing it to visit under. Cointelegraph arrived at to FTX for clearness around the issue but didn’t obtain a response at press time.