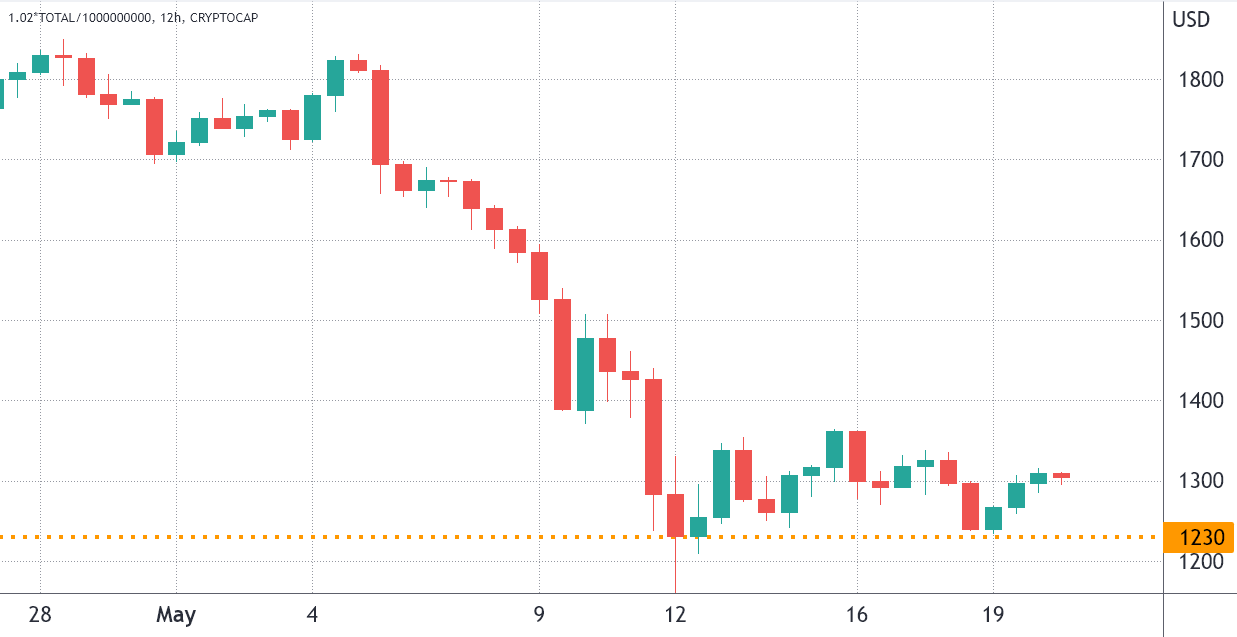

On May 12, the entire crypto market capital arrived at its cheapest near the coast 10 several weeks and also the metric is constantly on the test the $1.23 trillion support level. However, the next 7 days were reasonably calm while Bitcoin (BTC) acquired 3.4% and Ether (ETH) added a modest 1.5%. Presently, the mixture crypto cap is $1.31 trillion.

Ripples from Terra’s (LUNA) collapse still impact crypto markets, particularly the decentralized finance industry. Furthermore, the current loss of traditional markets has brought to a loss of revenue of $7.6 trillion in market cap in the Nasdaq Stock Market Index, that is greater compared to us dot-com bubble and also the March 2020 sell-offs.

On May 17, U.S. Fed Chairman Jerome Powell confirmed their intention to suppress inflation by raising rates of interest but he cautioned the Fed’s tightening movement could change up the unemployment rate.

The bearish sentiment spilled to crypto markets and also the “Fear and Avarice Index,” an information-driven sentiment gauge, hit 8/100 on May 17. This is actually the metric’s cheapest value since March 28, 2020, two days following the generalized crash that sent oil futures to negative levels and introduced Bitcoin (BTC) below $4,000.

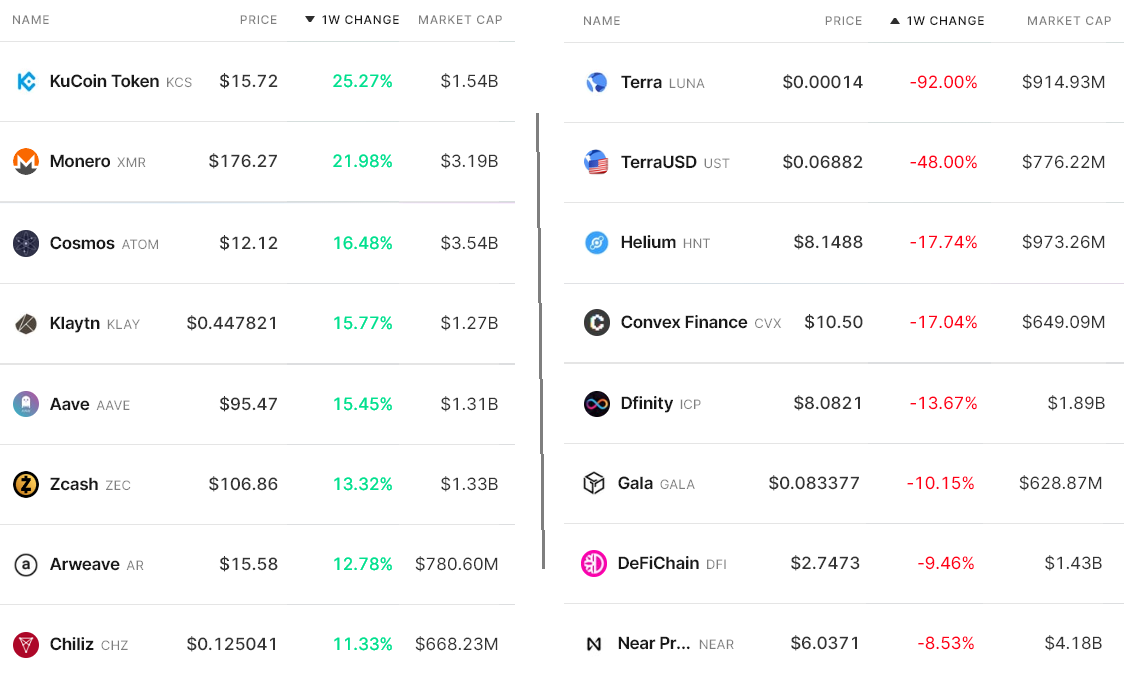

Here are the winners and losers in the past 7 days. As the two leading cryptocurrencies presented modest gains, a number of mid-capital altcoins rallied 15% or greater.

Monero (XMR) rallied 22% as investors anticipated the “tail emission” to become implemented at block 2,641,623 or sometime around June 4. The city made the decision to incorporate a .6 XMR minimum reward in each and every block, so miners aren’t 100% dependent on transaction charges.

Cosmos (ATOM) acquired 16.5%, a movement that appears part of a wider retracement that began on May 12 when ATOM fell to the eleven-month low near $8. It’s important to note that it is parent chain, Cosmos Hub, observed massive capital outflows from the liquidity pools, based on reporting from Cointelegraph.

Klaytn (KLAY), a blockchain-supported by South Korean internet giant Kakao, announced on May 16 it provides infrastructure, and initial nodes, and develop early use cases for that Blockchain-based Service Network (BSN), supplying an entry in to the Chinese market

The Tether premium shows slight discomfort

The OKX Tether (USDT) premium is a great gauge of China-based retail trader crypto demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100% and through bearish markets, Tether’s market offers are flooded and results in a 4% or greater discount.

The Tether premium peaked at 5.4% on May 12, its greatest level in additional than six several weeks, however the movement might have been associated with the Terra ecosystem’s massive outflows, that have been mainly the USD Terra (UST) stablecoin.

More lately, the indicator demonstrated a modest degeneration because it presently holds single.8% discount. The possible lack of retail demand isn’t especially concerning since the total cryptocurrency market capital lost 34% previously month.

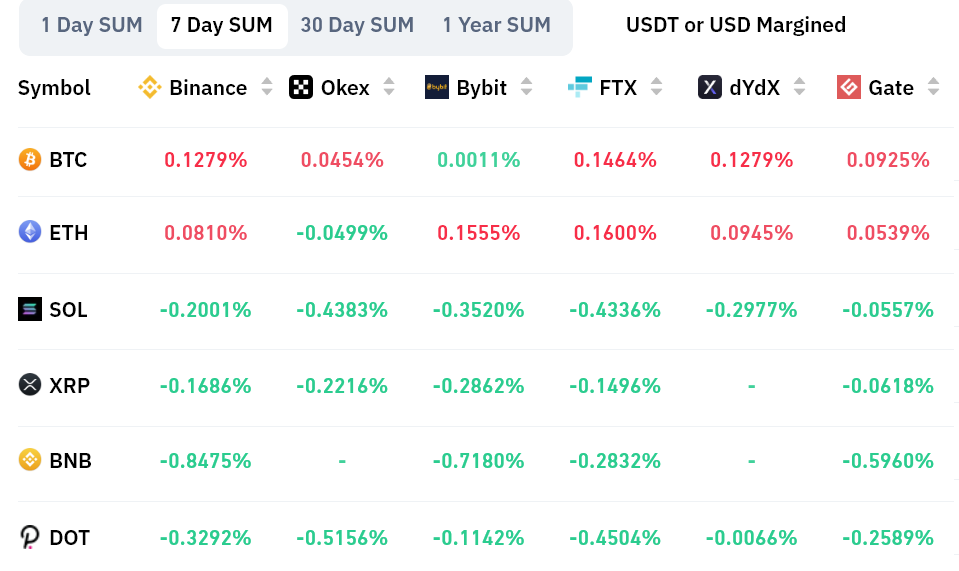

Altcoin futures reflect disinterest in leverage

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts are reflecting mixed sentiment as Bitcoin and Ethereum hold a rather positive (bullish) funding rate, but altcoins signal the alternative. For instance, Solana’s (SOL) negative .35% weekly rate equals 1.5% monthly, which isn’t an issue for many derivatives traders.

Thinking about that derivatives indicators are showing little improvement, there’s too little trust from investors because the total crypto market capital battles to help keep the $1.23 trillion support. Until this sentiment improves, the chances of the adverse cost movement remain high.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.