The decentralized application industry pressed above $40 billion in smart contract deposits in Feb 2021, and presently the figure is $59 billion. Up to now, “real money” is constantly on the flow in to the sector, as well as on August. 29, gaming startup Limit Break elevated $200 million. The work acquired recognition following the effective launch of their DigiDaigaku free-mint NFT collection.

Based on a study by Dove Metrics and Messari, the crypto industry saw $30.3 billion in funds elevated in H1 2022. This amount surpassed the $30.2 billion observed in 2021. Excluding the $10.2 billion in funding elevated for that centralized finance sector leaves an astonishing $20 billion which was committed to DApps, nonfungible tokens (NFTs) and Web 3 infrastructure.

One might question the amount of that cash has effectively been deployed or reinvested in ventures of exactly the same investment groups. Obviously, there are a few clever methods to overextend individuals announcement figures having to break any regulation, there is however unquestionably a lot of money flowing toward decentralized applications.

There’s been a proper quantity of distrust in the quantity of active users on DApps, but to date, no evidence of cheating continues to be presented. What exactly tools can retail users employ to identify inflated activity? Well, as it happens you will find a minimum of three: active users, community engagement and liquidity.

Evaluating users to active users

Most evidence of stake (PoS) systems charge minimal registration charges and lots of can use. This can lead to troves of “fake” active addresses that communicate with the DApp also it creates incentives for developers and investors to improve their figures.

Filtering the DApps rankings by the amount of users brings some staggering data, mainly in the Tron, WAX, Flow, EOS and Thundercore systems. A few of the DApps claim that they can convey more active users than industry leaders like OpenSea, Uniswap and Axie Infinity.

Levan Kvirkvelia, the co-founding father of Jugger, a Web3 bot prevention service, examined over 60 games and DApps and located that 40% from the active users are really automated bots or perhaps a single entity controlling multiple accounts.

after analyzing 60+ games and services, we found 200 000 bots. typically, every web3 game has 40% bots.

connect to the database using the results in the finish of the thread pic.twitter.com/vvvuhgeRLV

— Levan (@LevanKvirkvelia) August 29, 2022

In some instances, like the AnRKey X game around the Polygon network, the number of bots to holders arrived at 84%. Despite the fact that there might be a plausible reason behind distancing the work developers in the bot deployment, Kvirkvelia’s studies have shown that analysts should avoid using the amount of token holders like a proxy for active users.

Faking community engagement is amazingly hard

An indication to look for is sporadic community engagement around the project’s social systems whether or not the DAU metric is high. Well funded projects try to “buy” real users whereas bots aren’t skilled enough to lead to discussions inside a significant and consistent way.

This analysis doesn’t take more time than ten minutes since it only requires someone to log to the official group and scroll with the last 40 or 60 messages. Exist real questions and constructive debates through the community or just activity from group admins and shilling from bot accounts?

Getting to the project’s official Twitter, Twitch, YouTube or Instagram page, stick to the same procedure for reviewing posts and comments in the community. This qualitative data should yield an even more accurate analysis versus the amount of shares, likes or active blockchain addresses.

Discovering fake token liquidity

Surprisingly, market makers offer liquidity services for tokens. For any certain fee, they are able to keep bids while offering at trustworthy exchanges whatsoever occasions, moving the cost using algorithms in line with the orderflow.

A skilled investor will note nuances that distinguish fake volumes and order book depth from actual buying and selling activity. To begin with, analyzing the twoPercent depth on bids while offering provides a good way to prevent illiquid tokens.

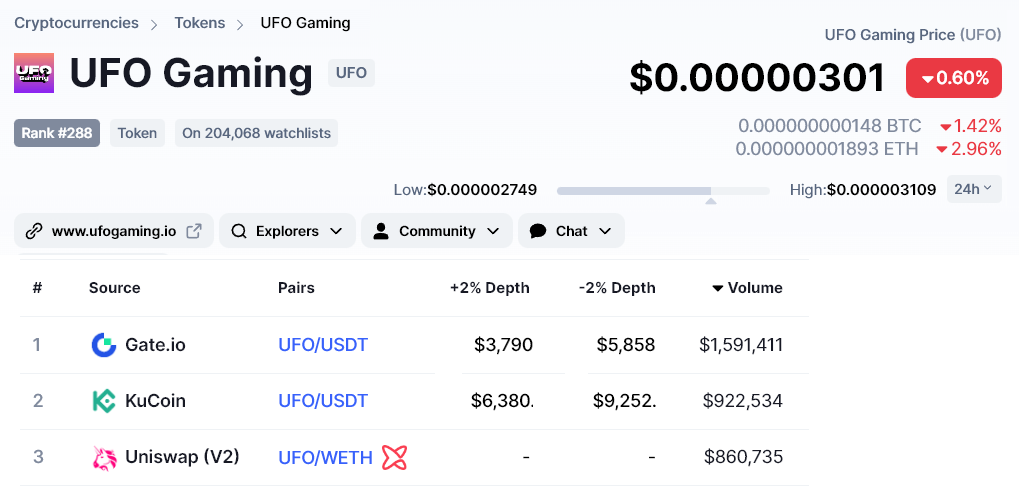

Notice the way the UFO Gaming token holds an unreasonably low quantity of bids when compared with its daily buying and selling volume. The mixture demand from buyers is 2% underneath the last trade and it is under .6% from the reported buying and selling volume.

While getting an industry maker is generally a good factor because it encourages users to trade the token positively, it doesn’t always mean buying and selling volume. Dissipating interest in the community eventually causes the token liquidity to plunge.

Related: Singapore condition investor leads $100M round for crypto firm Animoca, Report

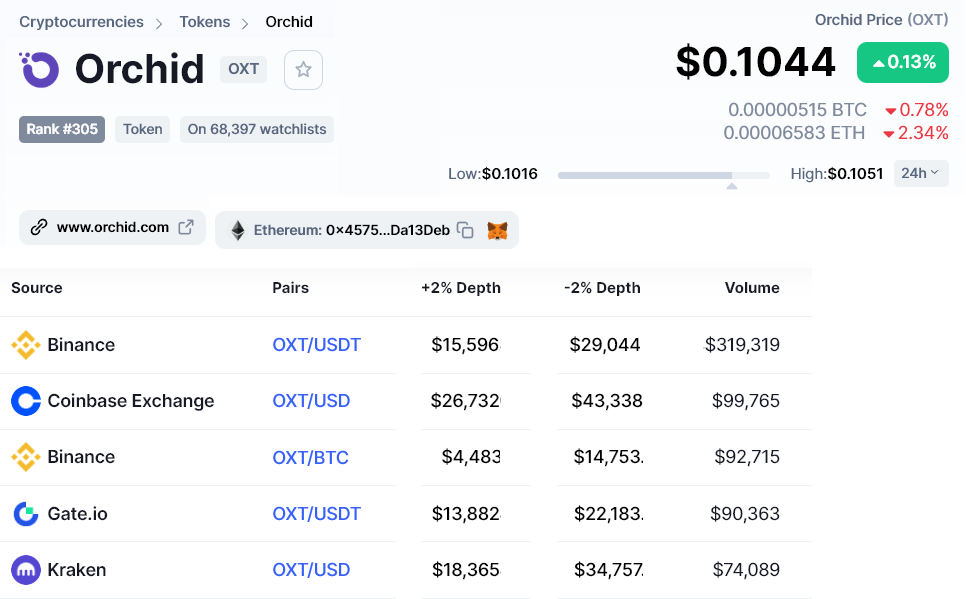

The instance above shows Orchid Protocol token, which despite being for auction on Binance, Coinbase, Kraken and Kucoin, amasses $675,000 in daily volume. This effect causes the twoPercent order book depth to range from 9% to 47% from the daily buying and selling activity, which sounds quite off.

Investors must be aware that vc’s and market makers have become much more good at hiding their manipulation. For example, locating a top-200 gold coin at Binance with distorted ratios on daily volume and order book depth is nearly impossible. Traders, gamers and investors should be certain to ‘t be fooled by high DAU metrics for popular DApps. Doing qualitative research into the platform’s social networking accounts and GitHub is a terrific way to mix-reference on-chain and buying and selling data.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.