The entire crypto market capital continues to be buying and selling inside a climbing down funnel for twenty-four days and also the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was adopted by Bitcoin (BTC) reaching $35,550, its cheapest cost in 70 days.

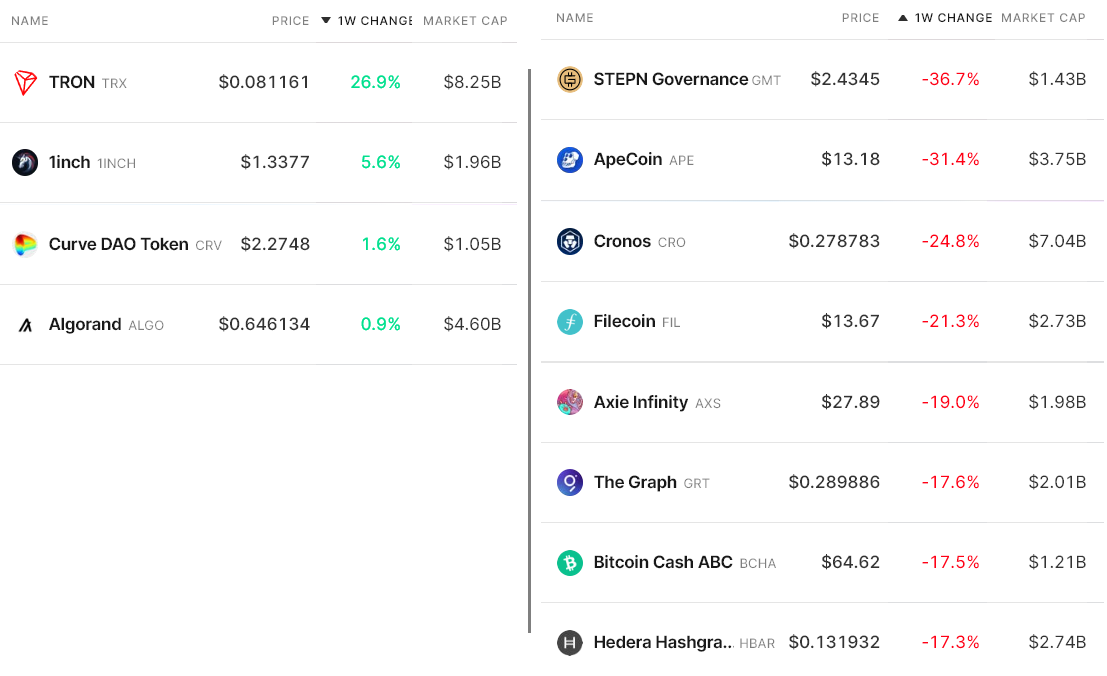

When it comes to performance, the mixture market capital of cryptocurrencies dropped 6% in the last 7 days, however this modest correction within the overall market doesn’t represent some mid-capital altcoins, which were able to lose 19% or even more within the same time period.

Not surprisingly, altcoins endured probably the most

Within the last 7 days, Bitcoin cost dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced so what can only certainly be a bloodbath. Here are the very best gainers and losers one of the 80 largest cryptocurrencies by market capital.

Tron (TRX) rallied 26.9% after TRON DAO folded out a USDD, a decentralized stablecoin, on May 5. The algorithmic stablecoin is attached to the Ethereum and BNB Chain (BNB) with the BTTC mix-chain protocol.

1inch (1INCH) acquired 5.6% following the decentralized exchange governance application grew to become Polygon’s (MATIC) network leader by finishing six million swaps around the network.

STEPN (GMT), the native token from the popular move-to-earn lifestyle application, declined 35.7%, modifying following a 70% rally between April 18 and April 28. An identical movement became of Apecoin (APE) following the token pumped 94% between April 22 and April 28.

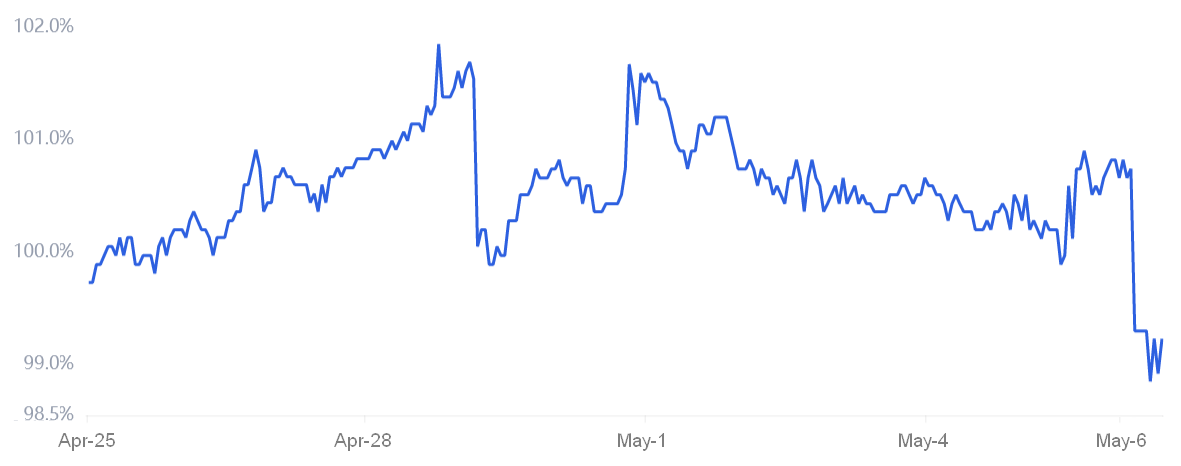

The Tether premium flipped negative on May 6

The OKX Tether (USDT) premium gauges China-based retail demand also it measures the main difference between your China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand puts the indicator above fair value at 100%. However, Tether’s market offers are flooded during bearish markets, creating a 4% or greater discount.

The OKX Tether premium peaked at 1.7% on April 30, indicating some excess demand from retail. However, the metric reverted to some % premium within the next 5 days.

More lately, in early hrs of May 6, the OKX Tether premium flipped to -1% negative. Data shows retail sentiment worsened as Bitcoin moved below $37,000.

Futures markets show mixed sentiment

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

As proven above, the accrued seven-day funding rates are slightly positive for Bitcoin and Ether. Data signifies slightly greater demand from longs (buyers), but nothing that will pressure traders to shut their positions. For example, an optimistic .15% weekly rate equals .6% monthly, thus unlikely to result in harm.

However, altcoins’ 7-day perpetual futures funding rate was -.30%. This rate is the same as 1.2% monthly and signifies greater demand from shorts (sellers).

Indications of weak retail demand as shown by OKX Tether data and also the negative funding rate on altcoins really are a signal that traders are reluctant to purchase in the critical $1.65 trillion crypto market capital. Buyers appear to become awaiting further dips before walking in, so further cost corrections will probably follow.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.