ApeCoin (APE), the brand new cryptocurrency which was lately launched by Yuga Labs, aims is the foundation from the Otherside metaverse and lately, the token has experienced massive volatility leading into after its digital land purchase. APE’s cost dropped from $26 in the peak on Apr. 28 to $14 on May. 2 — greater than a 45% drop inside a couple of times of the mint. The cost has dropped towards the $6 range.

Because of the current volatility, investors is going to be wondering if ApeCoin cost is ever going to recover to the previous buying and selling range. Let’s first check out the historic cost trend, particularly what went down around the Otherdeed mint day then have a much deeper dive into the quantity of APE that’ll be locked and released within the next 3 years. This can give a better knowledge of the demand and supply dynamics that may modify the cost moving forward.

ApeCoin surged following the Otherdeed announcement

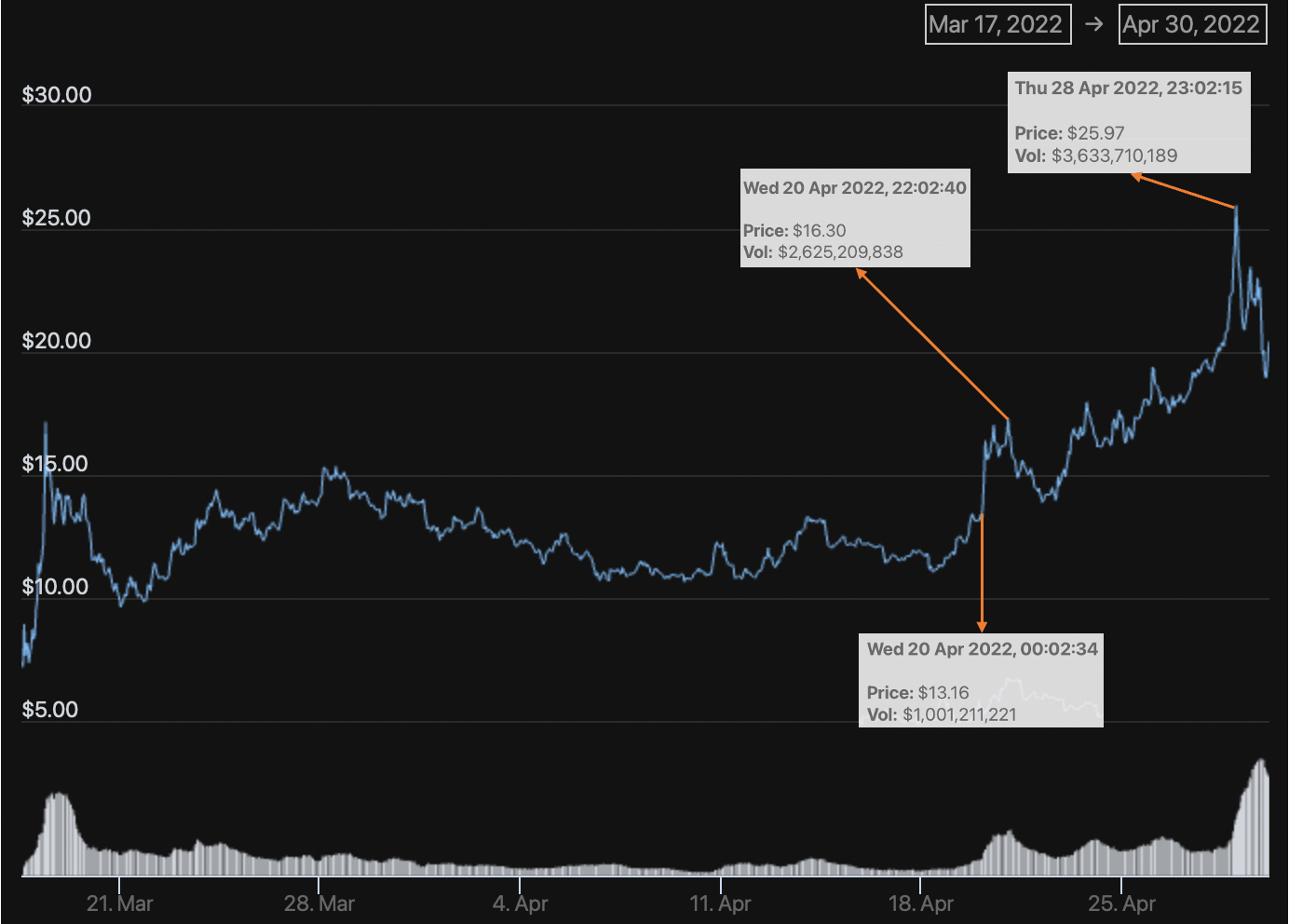

Within the initial few days since APE’s listing on March 17, 2022, the cost leaped from roughly $7 to $17 in the peak a rise of 143%! The cost had since fluctuated between $10 to $15 until rumors started circulating from the Otherside metaverse land purchase.

The chart above shows APE designed a sharp progress of just about 24% in a day from $13.16 to $16.30. Once the Otherdeed rumours surfaced on Twitter on April 20, APE catapulted to $26 on April 28 following the purchase was formally confirmed by OthersideMeta 2 days prior.

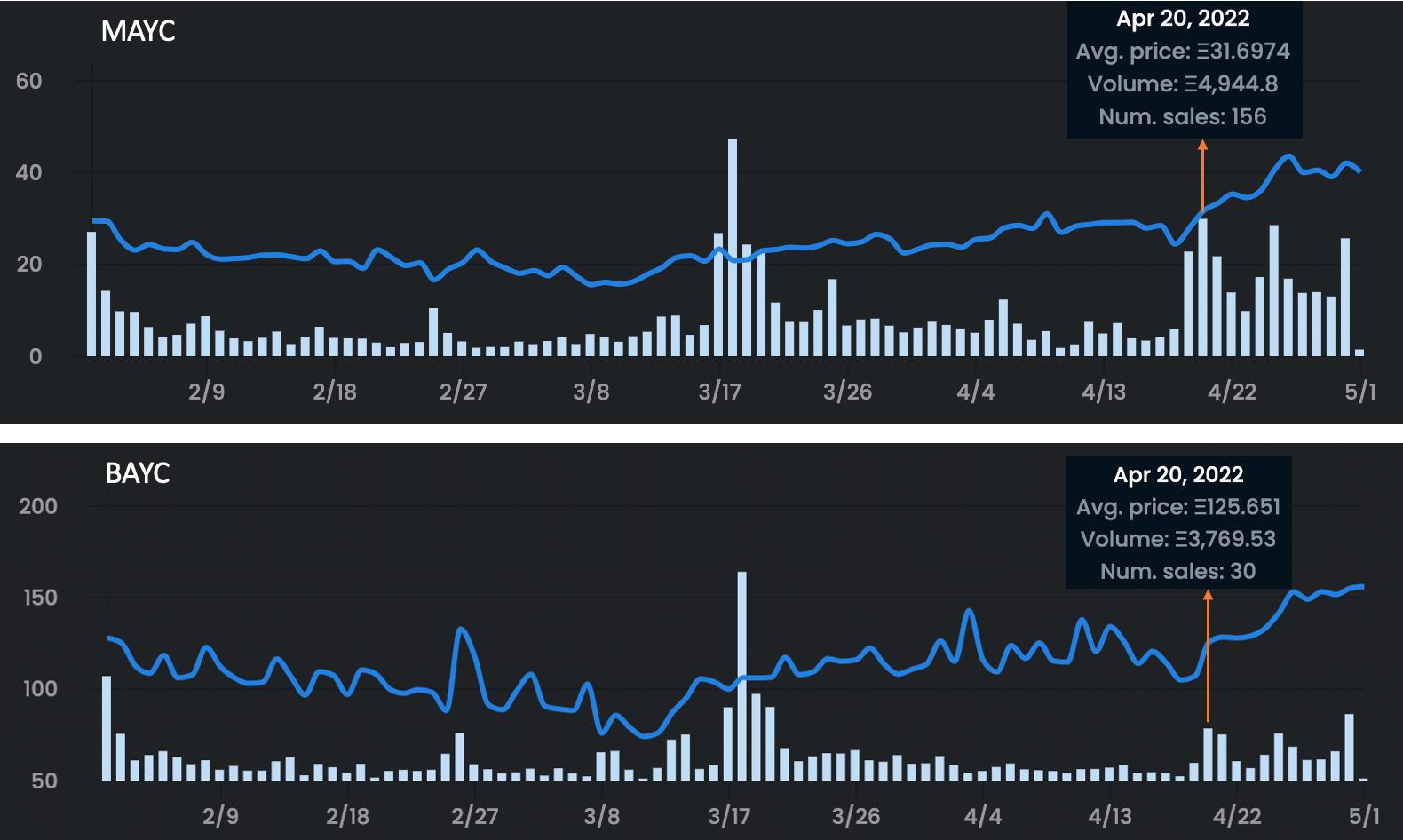

The cost of Yuga Lab’s Bored Ape Yacht Club (BAYC) and also the Mutant Ape Yacht Club (MAYC) nonfungible token (NFT) also adopted an identical pattern on April 20. MAYC arrived at an exciting-time high at 43 Ether (ETH) on April 26, that was your day the purchase was confirmed and BAYC began to recover from the 105 ETH low to a different all-time high at 168 ETH on May 1.

Chaos ensued as Yuga confused users throughout the Otherdeed purchase

Otherdeed was seen as chance for brand new investors who’ve been priced from BAYC, MAYC and BAKC to end up part of the Ape community.

The bullish conviction toward APE was driven because it’s the only currency within the Otherside metaverse and also the land purchase within the secondary market would be also traded in APE additionally to ETH.

Investors who supported Yuga Labs and also the idea behind the Otherside metaverse rushed to get APE when preparing for that mint in the cost of 305 APE per plot. The growing interest in APE because the minting date contacted was broadly expected and the rise in cost pre-mint seemed to be foreseeable.

What came like a shock later is when chaotic the operation of minting Otherdeeds was. APE’s cost stepped from $24 to $14 on May 2, which reflected a far more than 40% reduction in 2 days! The immediate cost drop to $20 at the time from the mint might be described through the sudden reduction in interest in APE following the mint began.

An additional 30% stop by the next 2 days is really a obvious reflection of investors’ lack of confidence within the project following the mint debacle. BAYC and MAYC cost also reflected exactly the same sentiment by falling greater than the marketplace worth of the airdropped Otherdeed.

Despite efforts produced by the Otherside team to ensure new investors via a Know Your Customer (KYC) process prior to the mint and to give the purchase in a fixed cost, these measures weren’t enough to avoid a gas war. The data wasn’t obvious and often plain wrong before the mint and a lot of money continues to be misspent and burnt on gas because of poor people communication by Yuga Labs.

Below are the major issues experienced by investors at the time from the mint.

What went down towards the Nederlander auction?

On April 26, OthersideMeta tweeted the mint will be a Nederlander auction but 72 hours later they altered their mind and stated “Dutch auctions are really bullshit,” an entire pivot along with a brutal slap hard to investors.

A Nederlander auction could have been an ideal way to mitigate gas wars because of its unique style of a really high start cost along with a decreasing cost with time. Investors might have selected to mint in the cost they might afford at different occasions, staying away from everybody minting simultaneously, in the same cost, and developing a gas war.

Mint is going to be Nederlander auction style, therefore the ApeCoin cost will decline with time. The beginning cost from the Nederlander auction is going to be announced in a few days.

— OthersideMeta (@OthersideMeta) April 25, 2022

The delayed mint produced additional problems

Following the team delayed the mint date, APE cost experienced a few of the largest hourly downside re-pricings.

The hourly chart below shows APE elevated slightly within the first three hrs following the initially planned mint time, then dropped from $22 completely to $18 when the particular mint required place at 9 pm EST (1:00 am UTC).

It’s difficult to say when the delay exacerbated the downward pressure, however the cost fluctuation in APE considerably elevated the potential risks taken by investors, particularly when the mint wasn’t even guaranteed for that KYC’d wallet holders.

The guaranteed mint for KYC’d wallets disappeared

It was the greatest issue and misunderstanding within the whole minting process. Based on Otherside’s article, at the beginning of the purchase (wave 1) each KYC’d wallet would simply be permitted to mint 2 plots. When the gas fee came lower, the limit would rise for an additional 4 NFTs (wave 2). Since the amount of KYC’d wallets aren’t disclosed towards the public and there’s merely a fixed quantity of plots to mint, it’s uncertain whether all KYC’d wallets could mint a minumum of one.

Presuming no more than 6 plots per wallet because of the total of 55,000 plots, to ensure each wallet can mint a minumum of one plot, the utmost quantity of KYC wallets permitted ought to be 9,166.

It switched available were much more KYC’d wallets than the dpi and lots of investors unsuccessful to mint anything after having to pay a really high cost to get APE and experiencing stratospheric gas charges throughout the mint.

Gas charges skyrocketed throughout the actual mint

Waves 1 and a pair of specified for to mitigate the gas war by restricting the amount of plots each wallet can mint. The issue was the entire quantity of KYC’d wallets was too big. The amount of people hurrying to mint simultaneously wasn’t reduced and gas charges never came lower. As the early minted NFTs were selling within the secondary marketplace for 2 or 3 occasions greater than the price of the mint, the interest in further mints and also the ferocious gas war ongoing until all 55,000 plots were gone. Numerous users compensated between 2.6 ETH and 5 ETH for gas charges along the way and lots of lost all of their fee because of transaction failures over the Ethereum network

Related: ETH gas cost surges as Yuga Labs cashes in $300M selling Otherside NFTs

Continuous supply increase adds downside pressure to APE cost

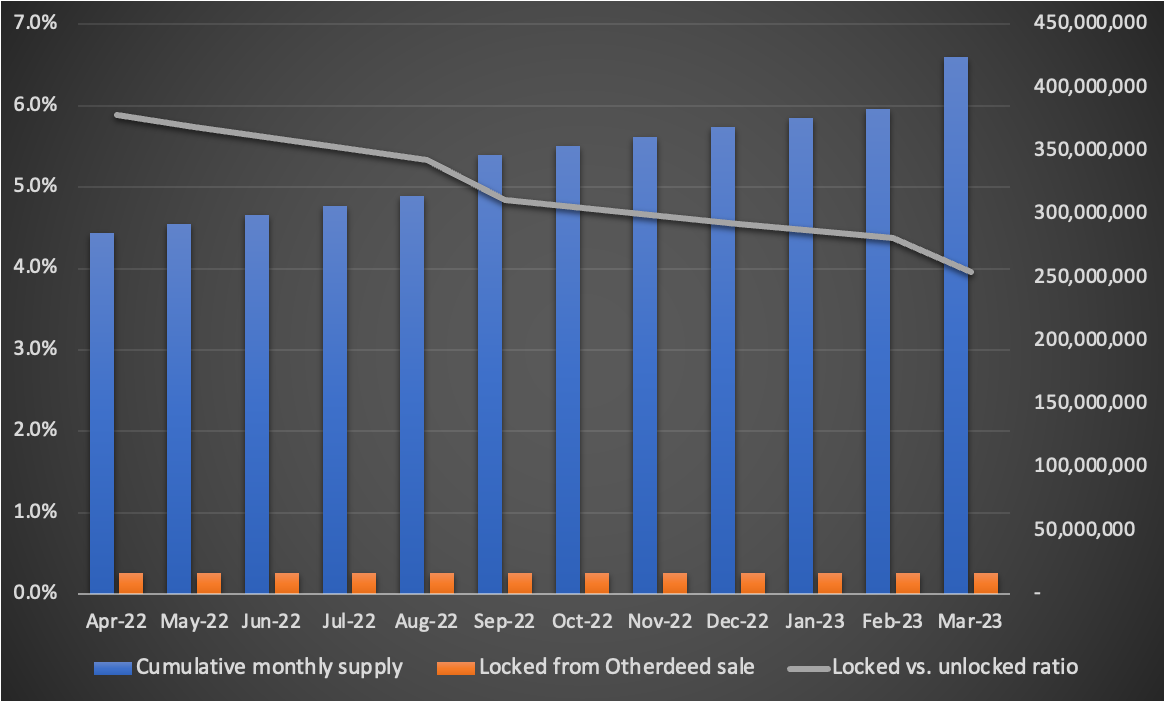

Based on OthersideMeta, all APE earned throughout the mint is going to be secured for just one year. This really is over 16 million APE (55,000 * 305) removed from the circulating supply. Will this decrease in supply save the APE cost? Regrettably not. When compared to quantity of APE being unlocked and released in to the market each month, 16 million is really a stop by the sea.

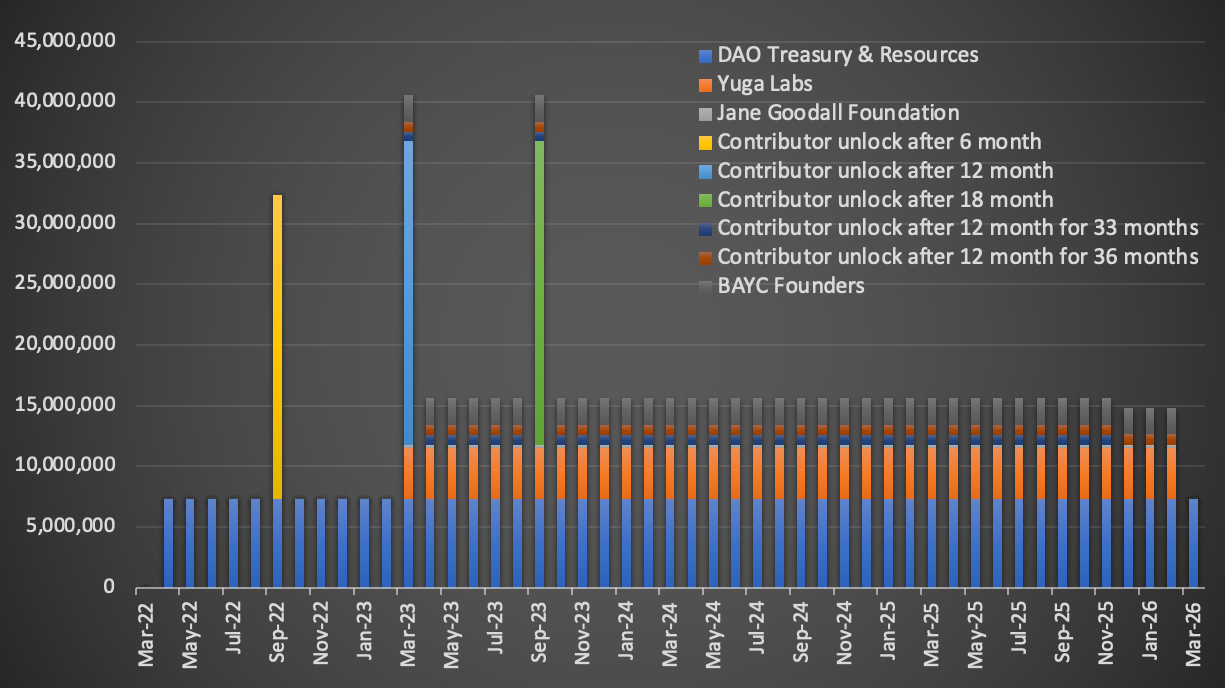

Searching at the quantity of APE that’ll be unlocked within the next 3 years monthly, a lot of the supply originates from the DAO Treasury and Yuga Labs. There’s also three large pumps in supply in the contributors in September 2022, March and September 2023.

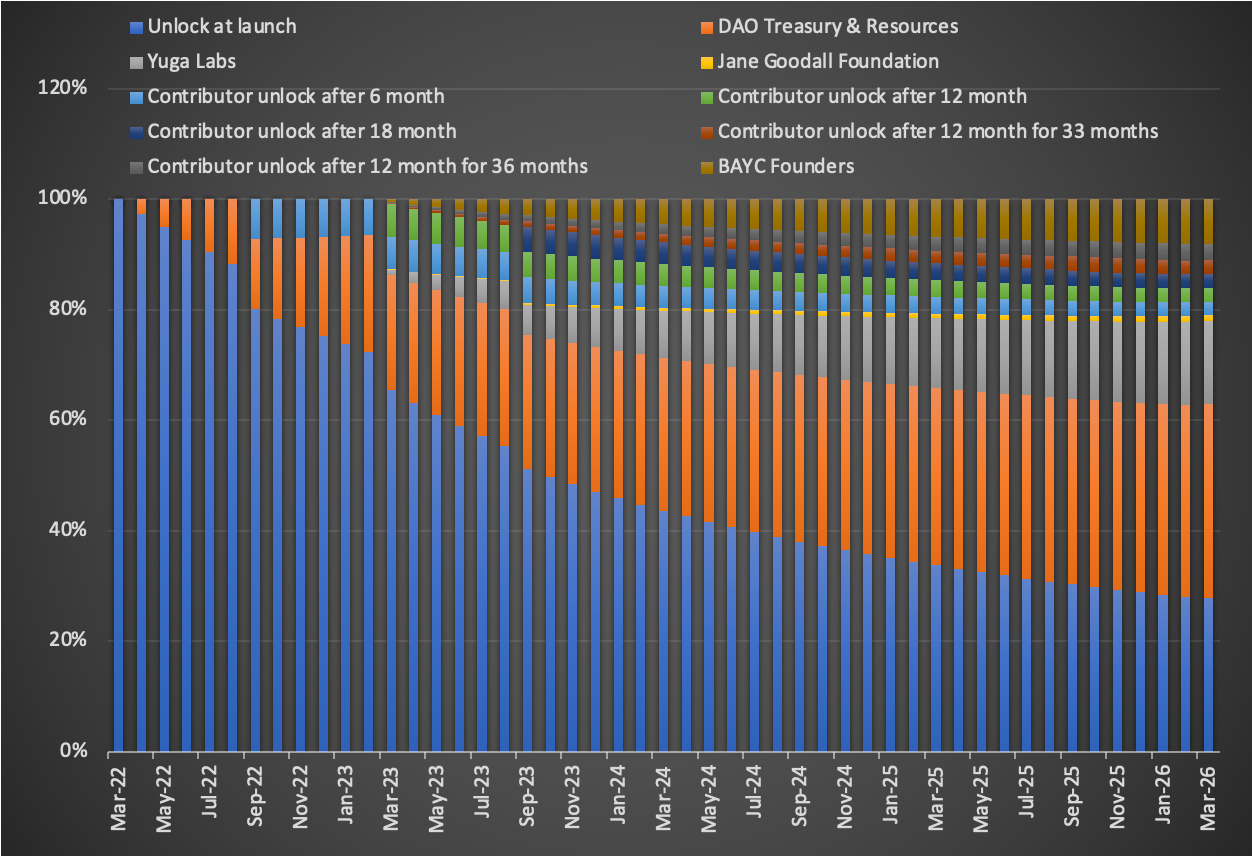

On the cumulative basis, the first quantity of APE unlocked at launch day dominates the proportion of supply until May 2025, when it’s surpassed through the DAO Treasury. In the rate of seven.3 million APE being unlocked monthly for 48 several weeks until 2026, the DAO treasury’s allocation may be the primary supply of additional APE inflation.

Because of the believed circulating way to obtain APE in April 2022 is about 284 million, the 16 million APE secured in the Otherdeed land purchase is just 5.9%. Such a tiny bit of one-time supply reduction is not likely to possess a lengthy-lasting impact on the APE cost, particularly when supply keeps growing.

Buying and selling volume may be the only potential saviour for APE cost

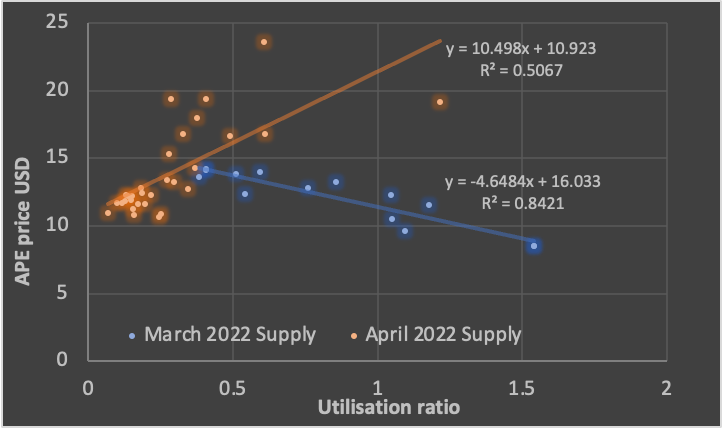

Additionally to APE’s circulating supply, the buying and selling volume is another crucial element in figuring out the long run cost. Using the number of buying and selling volume to circulating supply (utilization ratio), it’s possible to frequently look for a relationship with cost.

The chart below utilizes a simple straight line regression to exhibit the correlation between your APE utilization ratio and cost. In March 2022 once the circulating supply is comparatively small, the greater the employment ratio, the low the cost. On the other hand, in April 2022 once the circulating supply becomes bigger, the greater the employment ratio the greater the cost.

When the positive correlation between your utilization ratio and also the cost is true while circulating supply keeps growing progressively, it appears the only real savior for that APE cost is definitely an growing quantity of buying and selling volume.

However, APE will find it difficult to get more buying and selling volume following the chaotic Otherdeed land purchase. Yuga Lab’s tweet about switching off lights on Ethereum and building their very own chain appears to possess exacerbated the investors’ lack of confidence.

We are sorry for switching off the lights on Ethereum for some time. It appears abundantly obvious that ApeCoin will have to migrate to the own chain to be able to correctly scale. We want to inspire the DAO to begin thinking within this direction.

— Yuga Labs (@yugalabs) May 1, 2022

The implications of the tweet are profound. Ethereum includes a lengthy, stable history of security and stability, designed and built by, perhaps, the neatest and many established crypto talents on the planet. It’s greater than concerning if Yuga Labs moves from Ethereum and individuals have appropriately ridiculed this on Twitter.

Yuga’s NFT collections derive their extreme valuations largely simply because they take a seat on Ethereum and users trust the network to carry their sought after NFTs. Wouldso would any migration from Ethereum occur? Would users trust a house grown chain from Yuga Labs? Not one other chain has tokens buying and selling within the cost strata because the blue chips that trade on Ethereum.

It might be reasonable to visualize that APE and Ape-related NFTs could considerably re-cost using their meteoric valuations if Yuga Labs ended up being to follow-through with the thought of managing their very own chain to accommodate their collections. We view what went down with Axie Infinity around the Ronin chain. APE might be up for any bumpy road ahead.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.