Publish Ethereum merge, layer-2 blockchains happen to be catching your eyes of users and investors alike. Research firm Delphi Digital continues to be tracking Arbitrum since August and lately shared its analysis inside a monthly market report.

Based on data, user behavior and historic analysis show multiple trends of rapid development in transactions, total value locked and daily active users at Arbitrum-based platforms.

Arbitrum reaches the very best 10 in monthly earnings

When projects hand out more token incentives compared to revenue they incur, they’ve negative earnings. Token incentives which are greater compared to charges a protocol receives are typically an indication the growth isn’t sustainable and it is, most likely, wash buying and selling.

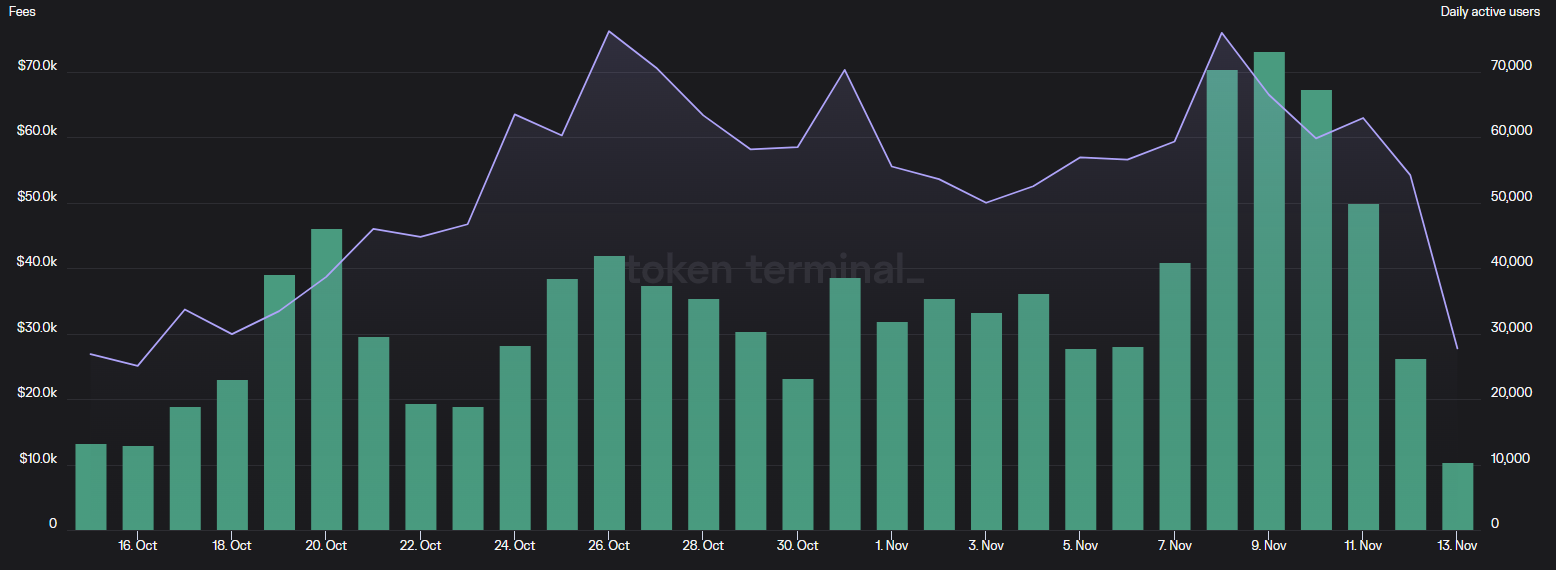

During the last thirty days, Arbitrum has earned $a million in charges, a 134.41% increase. The rise in charges also elevated the 30-day revenue for that Arbitrum protocol by 46.91%. Such growth puts Arbitrum as No. 8 of all decentralized finance (DeFi) protocols, with $240,000 in earnings.

User growth hits 70,000 daily active users as Optimism investors proceed to Arbitrum

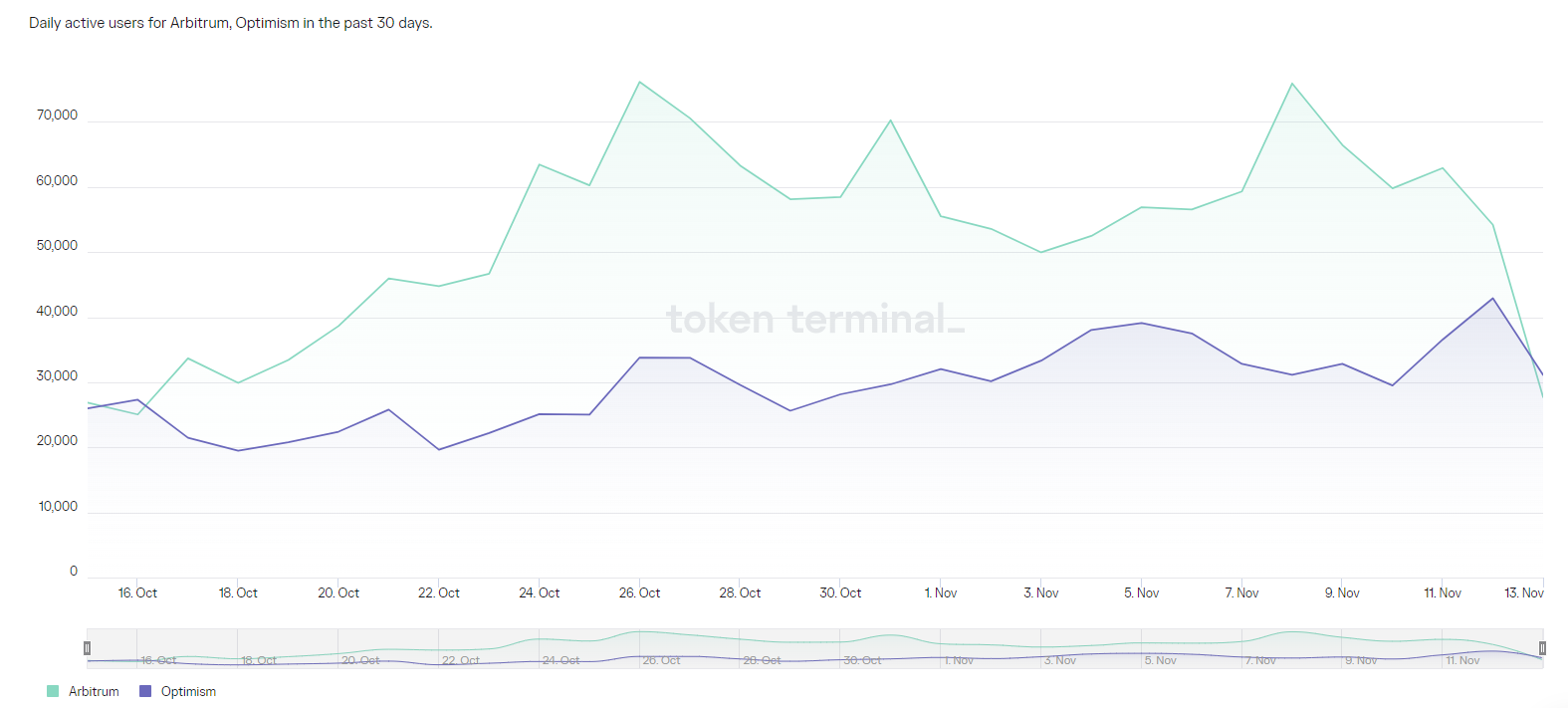

For a protocol to get revenue and earnings, it requires daily active users. Daily active users transacting and getting together with Arbitrum is when charges increase. In the last thirty days, Arbitrum has observed user growth double to greater than 70,000, but more lately, user count has returned to under 30,000.

Optimism is yet another blockchain protocol that resembles Arbitrum but does not have an expression. When Optimism released the OP token, users who have been participating in the blockchain received airdrops.

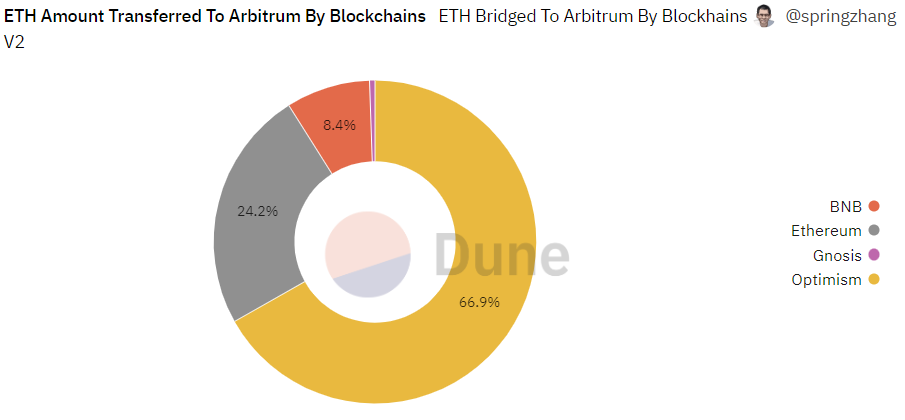

Because of the similar launch structure of Optimism, some investors are speculating that Arbitrum may also do an airdrop. This speculation may be why users are buying and selling frequently around the Arbitrum blockchain. New Arbitrum users are overwhelmingly bridging from Optimism, comprising 66.9% of transfers, with Ethereum and BNB Chain only equaling 32% combined.

Despite nearly all transfers originating from Optimism, the blockchains have the identical quantity of daily active users. On November. 13, Optimism had more daily active users with 31,117, while Arbitrum had 27,714.

User and builder behavior on Arbitrum

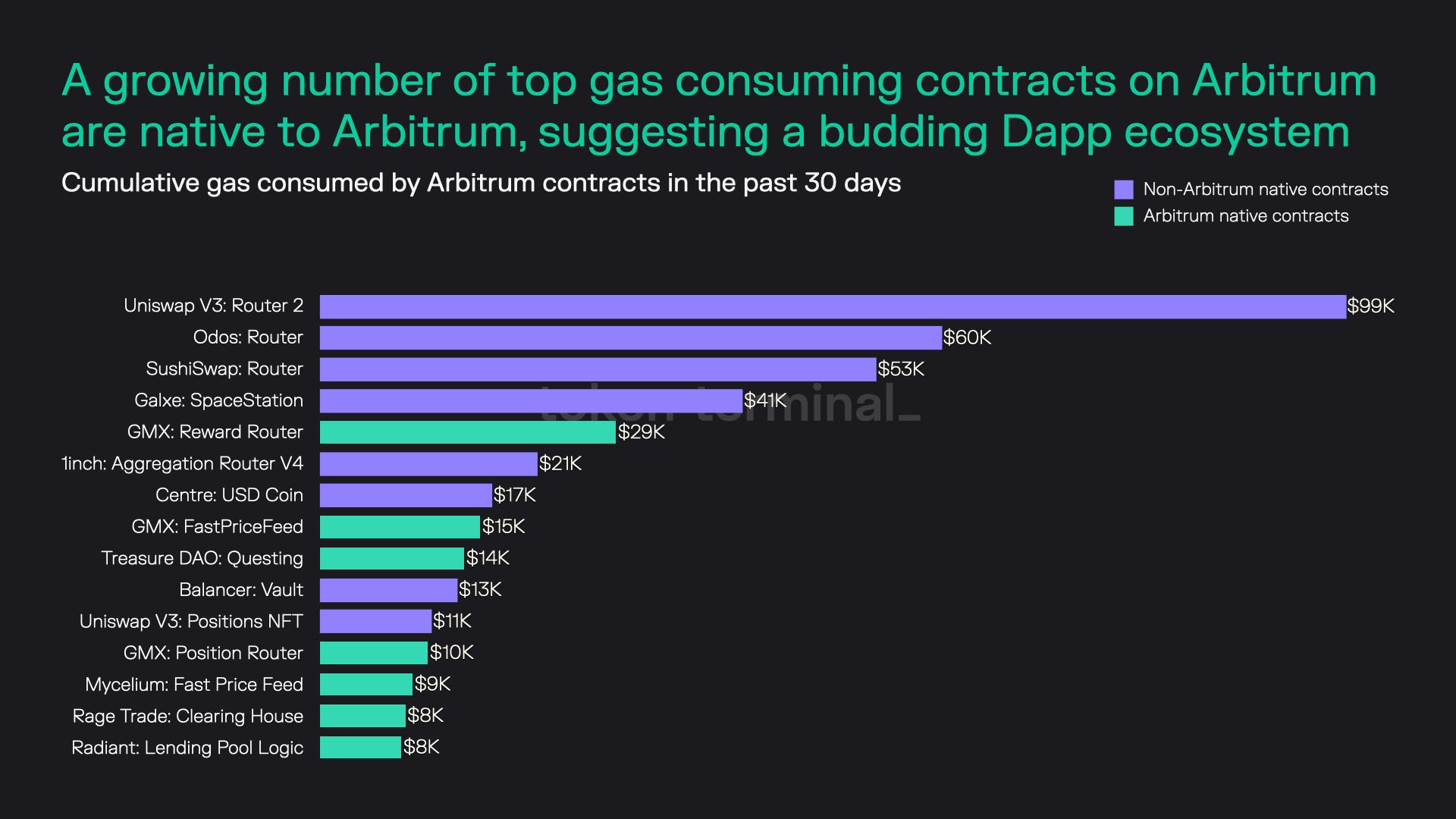

When new blockchains launch, users need decentralized applications (DApps) to build relationships the protocol inside a significant way. Popular DApps may also greatly increase charges and revenue for that blockchain.

Around the Arbitrum blockchain, to date, perpetual exchanges are showing to become popular. Five from the seven top Arbitrum contracts fit in with perpetual exchanges. Additionally towards the recognition of perpetual exchanges, seven from the 15 most gas-consuming contracts on Arbitrum previously thirty days were initially built on Arbitrum.

Arbitrum is really a growing blockchain when analyzing charges, earnings and revenue, however the daily active user growth is beginning to contract, even ceding ground to Optimism. Users may need to look in the scaling issue Optimism faced when speculating around the Arbitrum airdrop.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.