In the monthly crypto tech column, Israeli serial entrepreneur Ariel Shapira covers emerging technologies inside the crypto, decentralized finance (DeFi) and blockchain space, in addition to their roles in shaping the economy from the twenty-first century.

The crypto marketplace is inside a volitile manner, with Bitcoin (BTC) plunging 50 plusPercent below its peak cost. In a much more dramatic slump that’s now making all of the headlines, Terra’s LUNA dropped 99% in one month. The Economical Occasions known as it a “massacre of Terra investors who have been slaughtered within 48 hrs.”

For the time being, nobody will easily notice how deep this plunge is going to be, but investors don’t need to go lower using their investments. Tokens supported by real assets can permit them to hedge from the ongoing downturn.

Related: Stablecoins will need to reflect and evolve to meet their name

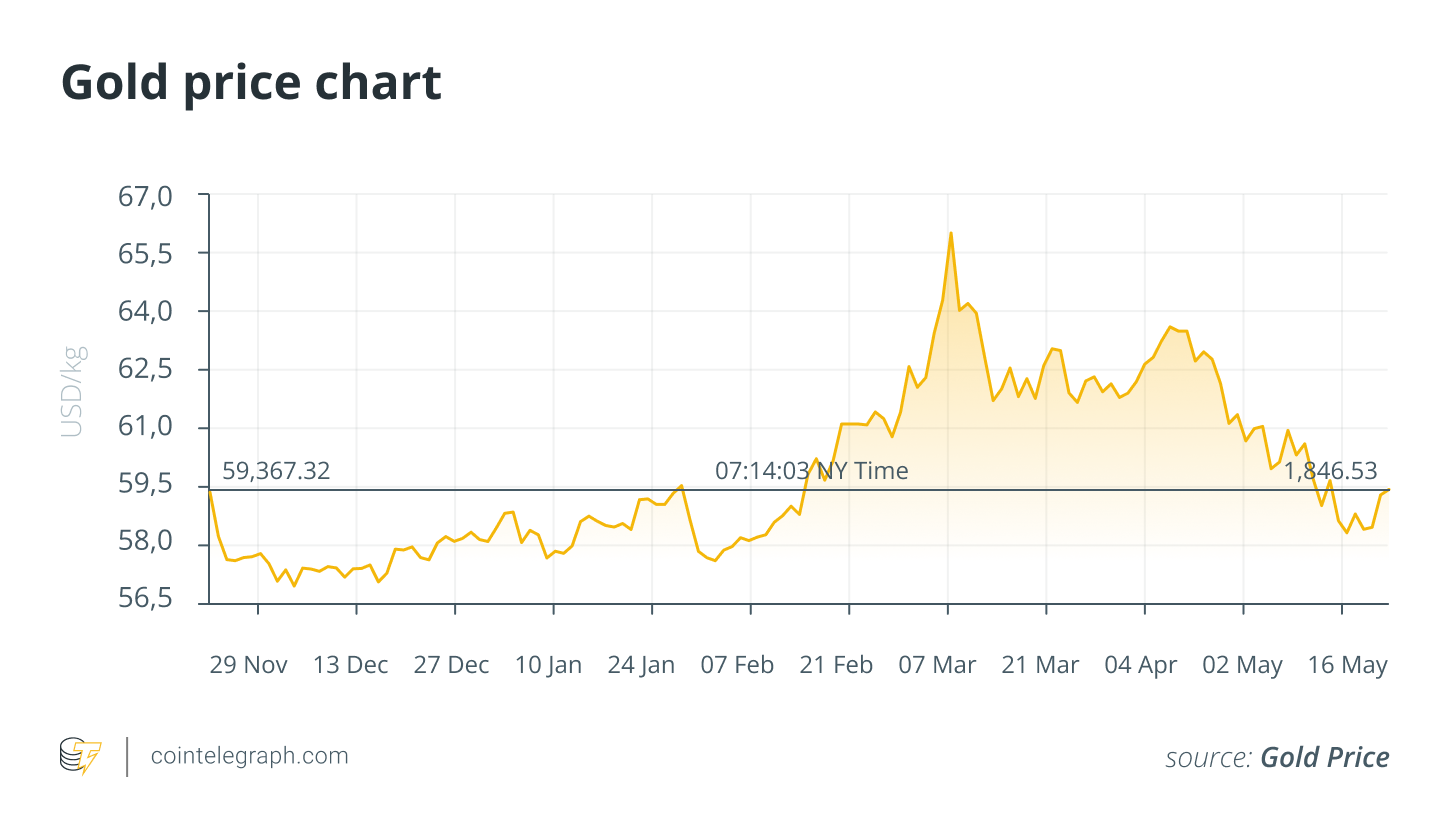

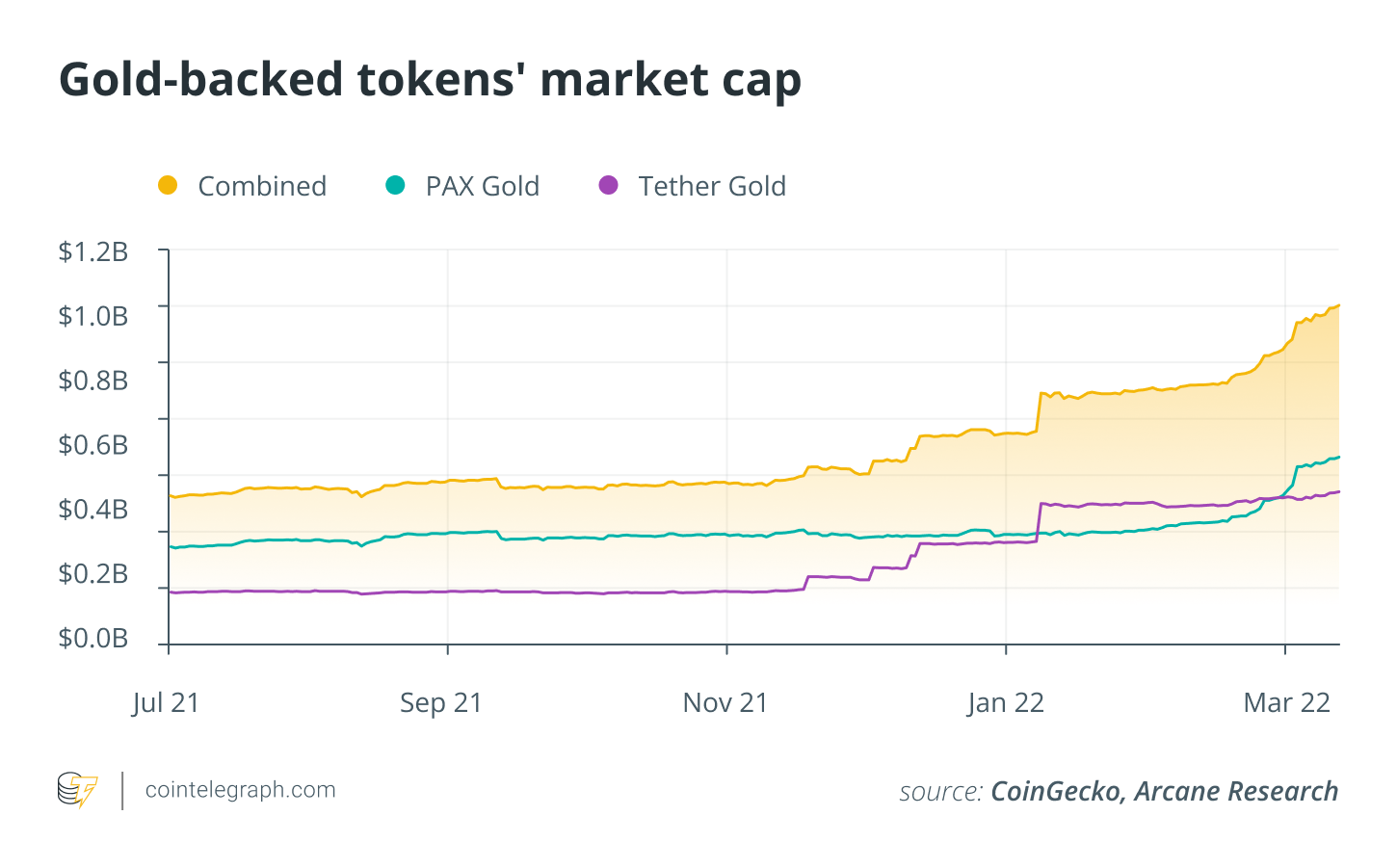

Gold happens to be a lucrative investment and it has was the ages, consistently preserving its value regardless of market conditions. Just lately, gold was surging, and a few expect it to keep climbing up all year round among persistent economic shakeups. Because of tokenization, gold has become a brand new shine and it is offering its security to everything about crypto. Here are the gold-backed projects which are offering investors stability when it’s from the menu within the general crypto market.

VNX Gold

VNX, Europe’s first controlled platform for purchasing tokenized gold and silver, lately launched VNX Gold (VNXAU), according to Ethereum. Each VNXAU represents an possession stake inside a physical gold bullion certified through the London Bullion Market Association (LBMA), offering investors maximum security and certainty.

VNX Gold grants investors all the benefits of the actual commodity combined with versatility of the crypto asset. Every VNX Gold token is related having a unique serial number placed on the particular gold bar, that is kept in a vault in Liechtenstein. This permits investors to effectively maintain their gold within their crypto wallet without getting to bother with its physical storage.

VNX Gold holders can choose to redeem their physical gold, either throughout an in-person visit or, for shipments more than one kilogram, via delivery to their doorstep all over the world. With VNX Gold, investors have reassurance in knowing exactly how and where secure their gold is.

Paxos Gold

Paxos, a controlled blockchain infrastructure platform, offers PAXG, an electronic token supported by physical gold. Each token represents one fine troy ounce of merely one 400-ounce LBMA Good Delivery-standard gold bar. PAXG proprietors don’t just own the token, but the underlying physical gold, which Paxos Trust Company stores in vaults.

Paxos includes a across the country-ranking auditor validate the matching way to obtain PAXG tokens as well as their underlying gold monthly to verify the tokens’ sufficient backing. The organization lately decreased the minimum needed purchase amount and removed child custody charges, making PAXG a possible option for investors searching to begin small when purchasing gold.

Meld Gold

While, with many gold-backed tokens, a main issuer supports the physical gold in the child custody, Australian startup Meld Gold requires a different approach. Each token represents just one gram of gold that’s held by various companies over the logistics, including Melbourne Mint, a number one Australian bullion store, for ultimate decentralization. Meld vets all entities prior to being recognized to participate the network. Gm of Meld Gold AJ Milne believes that with no single entity holding all the issued gold, there won’t be any central reason for failure.

The Meld Gold token doesn’t have fixed supply, but rather the marketplace demand and supply for traditional and digital gold determine its minting and burning.

GoldCoin

A varied number of finance, IT, and blockchain experts produced GoldCoin (GLC) this year, with the aim of making gold more broadly accessible and frictionless. GLC may be the first fractionalized gold-backed token that investors can buy using any national currency or cryptocurrency.

The ERC-20 gold-backed gold coin enables investors to right away buy gold inside a secure and anonymous way. GLC’s fractionalized nature gives holders total economic control and freedom to buy any volume of gold anytime.

Investors can buy and hold their GLC around the GoldCoin Wallet without transaction charges. With only two-minute confirmation speeds, GLC provides the quickest transaction of gold-pegged tokens.

Tether Gold

Tether Gold (XAUt) is really a digital asset provided by TG Goods Limited. One full XAUt token represents one fine troy ounce of gold inside a LBMA Good Delivery-standard bar. Holders of XAUt can certainly transfer it between any on-chain addresses from the Tether wallet where it’s issued. Investors can identify their specific gold bar and the amount of gold ounces they hold simply by entering the Ethereum address using their XAUt tokens around the Tether website.

Investors have to purchase no less than 50 XAUt or 50 fine troy ounces, which comes down to roughly $90,000 around this The month of january. They are able to fractionalize their token and redeem it for physical gold or pocket arises from selling it. However, investors must hold one full bar of gold to be able to redeem anywhere. This is often a potential downside for investors searching to carry a smaller sized quantity of gold that’s still simple to redeem.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Ariel Shapira is really a father, entrepreneur, speaker and cyclist and can serve as founder and Chief executive officer of Social-Knowledge, a talking to agency dealing with Israeli startups and helping them establish connections with worldwide markets.