Avalanche (AVAX) is lower 45% in thirty days as well as in the same time frame the cryptocurrencies’ total market capital shrank by 29%.

Regardless of the recent downturn, this decentralized application (DApp) platform remains a high contender within the layer1 and layer2 race also it will rank very well when it comes to smart contract deposits and active addresses. Yet, the lackluster token cost continues to be causing investors to re-think if the network remains a “serious” competitor.

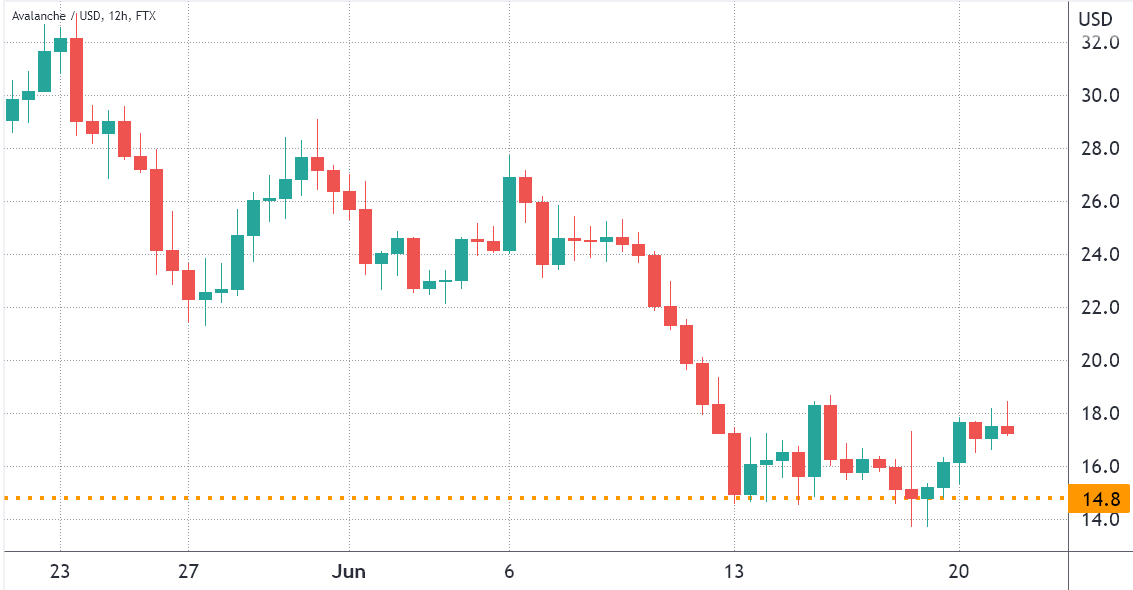

The brutal sell-off on risk assets caused AVAX to check the $14.80 support multiple occasions, as the market capital is $4.8 billion. It’s vital that you also observe that the network’s total value locked (TVL) holds a remarkable $3.2 billion.

Like a comparison, Solana (SOL) offers incredibly low network charges and holds a $2.1 billion TVL. Yet, SOL token’s market cap is $12.9 billion, that is almost 3 occasions bigger than Avalanche’s valuation in the $14.8 cost level.

The TVL indicator is very relevant since it measures the deposits around the network’s smart contracts. When we use Polygon (MATIC), an Ethereum layer-2 solution, like a proxy, the network holds a $1.8 billion TVL as the token’s market capital is $3.5 billion.

In a nutshell, Avalanche looks heavily discounted thinking about how similar networks’ market capital vastly exceed their particular TVL.

Total value locked elevated, but the amount of users declined

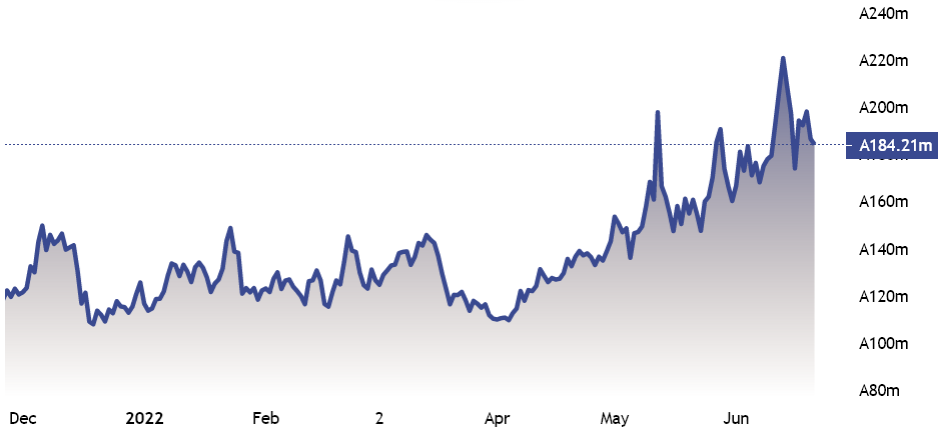

Avalanche’s primary decentralized application metric strengthened within the last two months because the network’s TVL leaped to 184 million AVAX tokens. This means that even while AVAX cost crashed, investors didn’t withdraw tokens from the decentralized applications.

When it comes to AVAX tokens, the network’s TVL has effectively grown by 35% in 2 several weeks. Like a comparison, Ethereum’s TVL elevated by 10% in Ether terms, while BNB Chain faced a 14% decrease in exactly the same period.

To verify if the TVL rise in Avalanche is encouraging, traders should evaluate DApp usage metrics. Some applications, for example games and marketplaces, don’t require large deposits, therefore the metric does not matter in individuals cases.

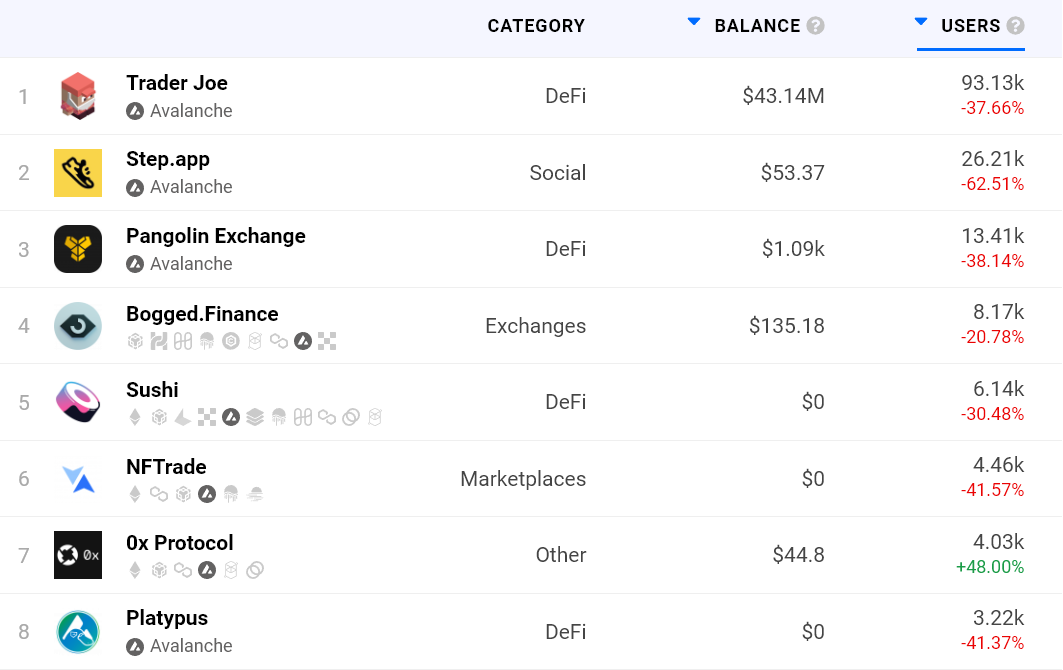

As proven by DappRadar, on June 21, the amount of Avalanche network addresses getting together with decentralized applications declined by 42% in comparison to the previous month. Compared, the BNB Chain faced a 16% user decrease, while Polygon declined by 29%.

Cost follows fundamentals, that have gone lower

Despite the fact that Avalanche’s TVL has outperformed competing Dapp systems, the reduction in network me is concerning. For example, Trader Joe’s 93,130 active addresses are smaller sized than Polygon’s leading DeFi application, QuickSwap, which holds 161,040 active users.

The above mentioned data suggest Avalanche is within troubled waters and can explain why the AVAX cost stepped 45% in thirty days. Investors will probably remain skeptical from the $14.80 support before the network usage metrics improve, especially the amount of active addresses in DeFi.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.