Avalanche (AVAX) bulls snubbed the sensational claims produced by a self-announced whistleblower site that the project’s parent firm, Ava Labs, compensated lawyers to break its competitors’ status.

Avalanche cost recovers from serious allegations

AVAX’s cost established an intraday a lot of $19.75 on August. 30, 2 days after bottoming out in your area at $17.50, amounting to some 15% rise. The token’s modest recovery adopted selloffs incurred with a sensational CryptoLeaks report.

️ #Avalanche may be the top rising subject in #crypto carrying out a declare that its #blockchain was trying to manipulate regulatory systems. After hitting a 7-week low about 9 hrs ago, $AVAX expires +7.5% since. We are watching how news of the unfolds. https://t.co/Ry1mGvdMap https://t.co/OHmNMkpAzS pic.twitter.com/kk3zue4d3G

— Santiment (@santimentfeed) August 29, 2022

AVAX’s cost fell 3.5% on August. 26, your day which CryptoLeaks released an unverified video showing Kyle Roche, the partner at Roche Freedman, stating that he could sue Solana, certainly one of Avalanche’s top rivals, with respect to Ava Labs.

Related: Ava Labs Chief executive officer denies CryptoLeaks’ claims as ‘conspiracy theory nonsense’

The token fell by another 7.5% the following day following the whistleblower website released the entire report, including another unverified video featuring Roche.

Additionally, Avalanche’s intraday losses aligned with similar negative moves across some of the best crypto assets.

AVAX can rise 55%

Avalanche’s fundamentals are strongly associated with the general cryptocurrency market, which will keep it vulnerable to undergoing additional downtrends.

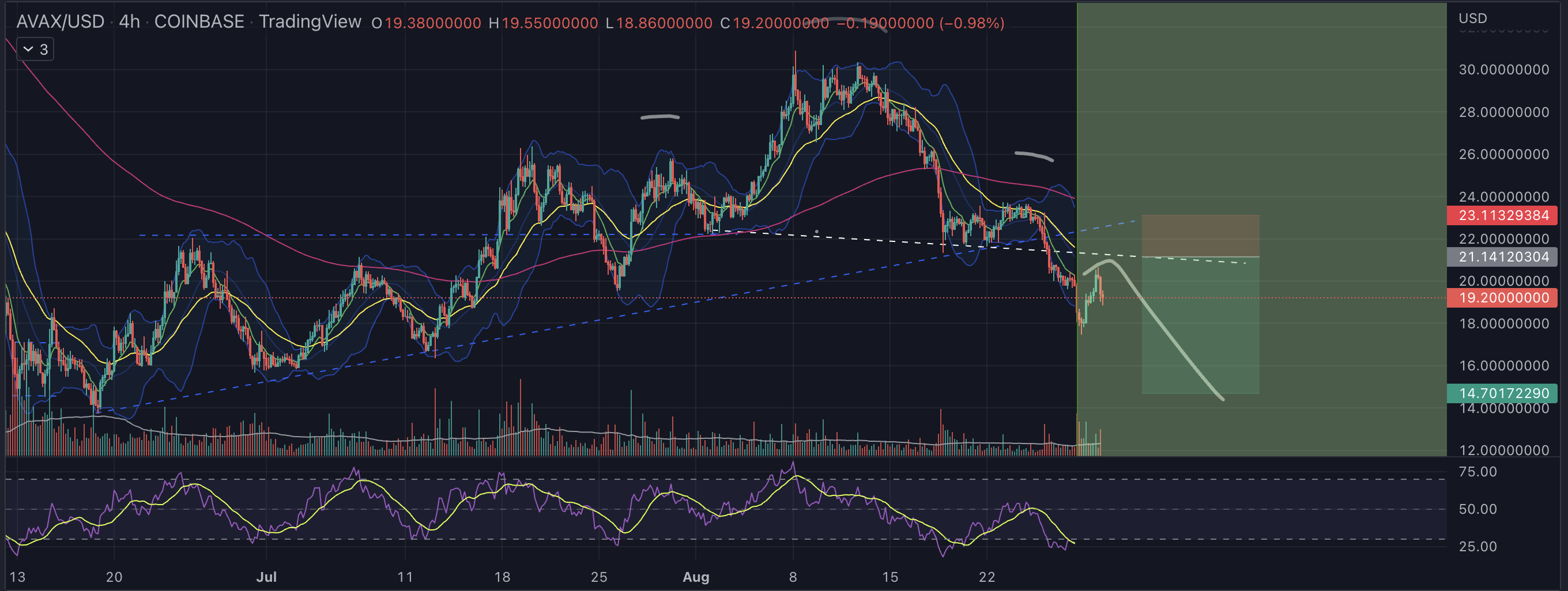

Independent analyst PostyXBT noted that AVAX’s cost could decline towards the $13-$15 range next and also to “keep BTC in your mind” while putting a short position toward the region.

Textbook short setup developing.

Only concern being deviation brought on by $BTC running greater towards $20.8k.

Manage position size accordingly and btc in your mind when setting invalidation levels pic.twitter.com/8wRgZxkOcv

— Posty (@PostyXBT) August 30, 2022

Analyst BrechTP also anticipates the cost to crash toward $14 with different “mind and shoulder” setup, as proven below.

Related: A clear, crisp stop by TVL and DApp use preceded Avalanche’s (AVAX) 16% correction

On the other hand, analyst TraderSZ sees AVAX’s cost tcontinue its recovery trend within the future. His setup, as highlighted below, envisions the Avalanche token to achieve roughly $30 in September.

The upside target aligns with AVAX’s prevailing “symmetrical triangular” setup. Particularly, the cost has rebounded after testing the triangle’s lower trendline as support and today sees the structure’s upper trendline since it’s interim upside target.

Top of the trendline is close to the TraderSZ’s cost target of $30, as proven below.

Quite simply, AVAX could rally by over 55% from the current cost levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.