The 13% gains within the six days resulting in Sept. 12 introduced the entire crypto market capital nearer to $1.1 trillion, however this wasn’t enough to interrupt the climbing down trend. Consequently, the general trend within the last 55 days continues to be bearish, using the latest support test on Sept. 7 in a $950 billion total market cap.

A noticable difference in traditional markets has supported the current 13% crypto market rally. The tech-heavy Nasdaq Composite Index acquired 6.2% since Sept. 6 and WTI oil prices rallied 7.8% since Sept. 7. This data reinforces our prime correlation versus traditional assets and places the spotlight on the significance of carefully monitoring macroeconomic conditions.

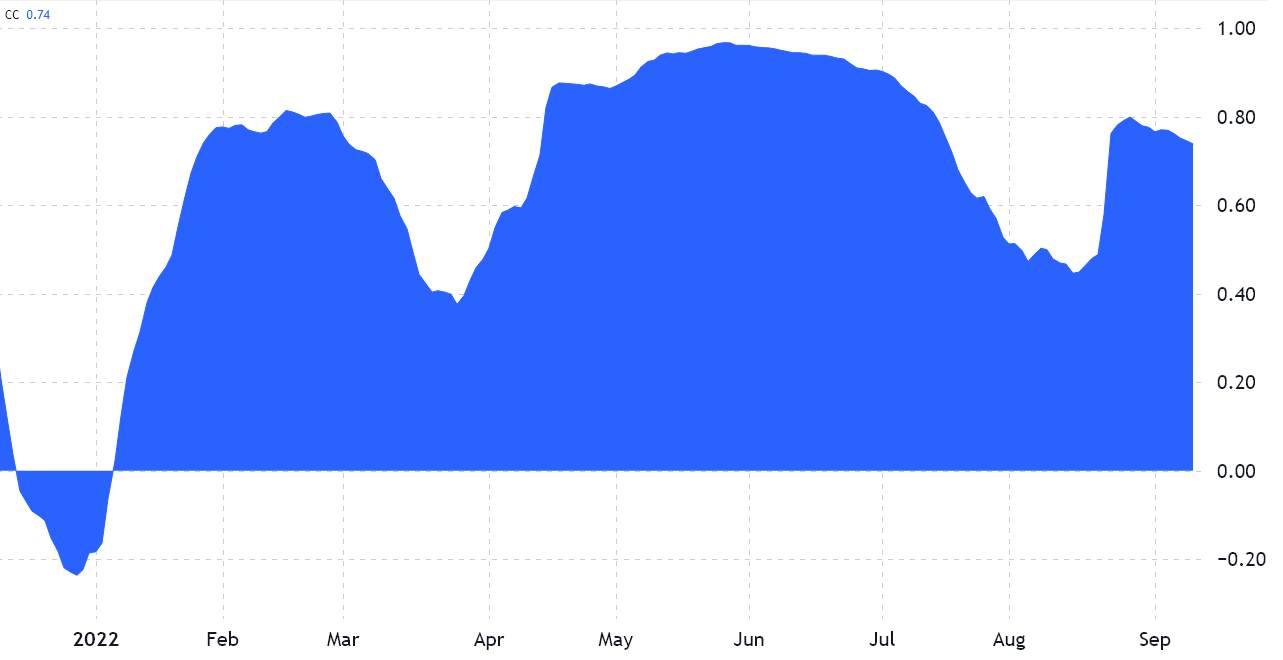

The correlation metric varies from an adverse 1, meaning select markets relocate opposite directions, to some positive 1, which reflects a wonderfully symmetrical movement. A disparity or too little relationship backward and forward assets could be symbolized by .

As displayed above, the Nasdaq composite index and Bitcoin 50-day correlation presently stand at .74, that has been standard throughout 2022.

The FED’s Sept. 21 decision sets the atmosphere

Stock exchange investors are seriously waiting for the Sept. 21 U.S. Fed meeting, in which the central bank is anticipated to boost rates of interest again. As the market consensus is really a third consecutive .75 percentage point rate hike, investors are searching for signs the economic tightening is disappearing.

A study around the U.S. Consumer Cost Index, another inflation metric, is anticipated on Sept. 13 as well as on Sept. 15, investor attention is going to be glued towards the U.S. retail sales and industrial production data.

Presently, the regulatory sentiment remains largely unfavorable, especially following the enforcement director for that U . s . States Registration (SEC), Gurbir Grewal, stated the financial regulator would still investigate and produce enforcement actions against crypto firms.

Altcoins rallied, but pro traders were resilient to leverage longs

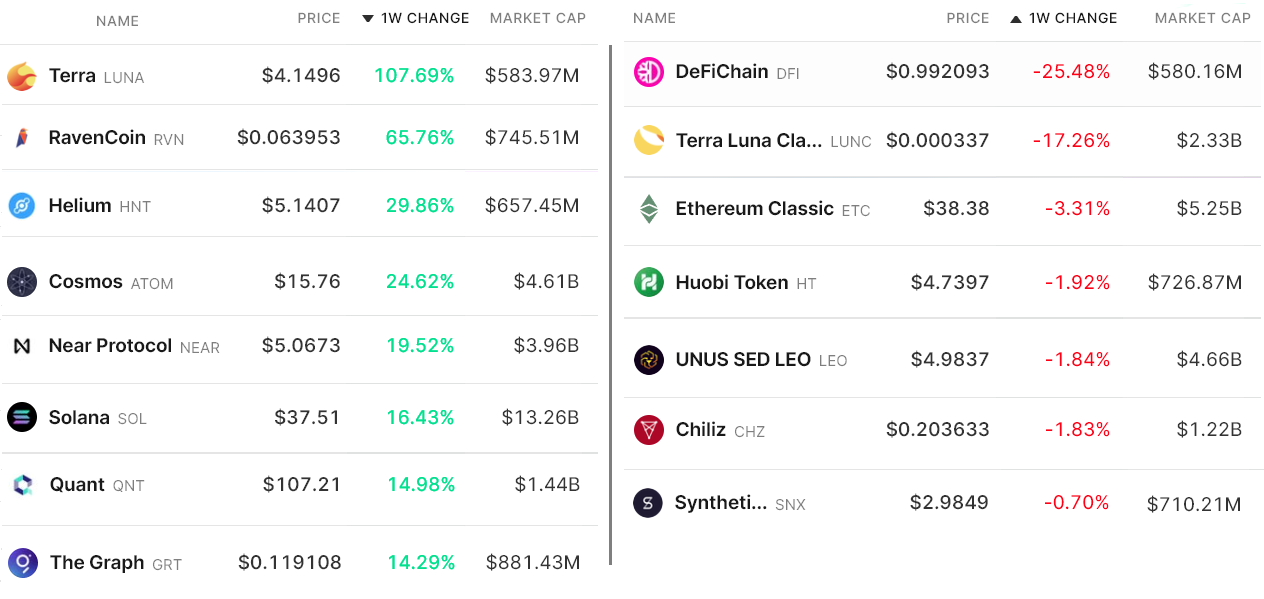

Here are the winners and losers of last week’s total crypto market capital 8.3% gain to $1.08 trillion. Bitcoin (BTC) was by helping cover their a 12.5% gain, which brought its dominance rate hitting 41.3%, the greatest since August. 9.

Terra (LUNA) leaped 107.7% after Terra approved an offer on Sept. 9 for the next airdrop well over 19 million LUNA tokens until March. 4.

RavenCoin (RVN) acquired 65.8% following the network hash rate arrived at 5.7 TH per second, the greatest level since The month of january 2022.

Cosmos (ATOM) acquired 24.6% after Crypto research firm Delphi Digital shifted the focus of their development and research arm towards the Cosmos ecosystem on Sept. 8.

Despite these gains, just one week of positive performance isn’t enough to interpret how professional traders are situated. Individuals thinking about tracking whales and market markers should evaluate derivatives markets. Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) are demanding more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected an unbiased sentiment because the accrued funding rate was relatively flat generally. The only real exceptions happen to be Ether (ETH) and Ether Classic (ETC), despite the fact that a .30% weekly cost to keep a brief (bear) position shouldn’t be considered relevant. Furthermore, individuals cases are most likely associated with the Ethereum Merge, the transition to some proof-of-stake network expected for Sept. 15.

Related: Glimpses of positive momentum within an overall bearish market? Report

The chances of the downtrend continue to be high

The positive 8.3% weekly performance can not be considered a pattern change thinking about the move was likely associated with the recovery in traditional markets. In addition, you could think that investors will probably cost in the chance of additional regulatory impact after Gary Gensler’s remarks.

There’s still uncertainty on potential macroeconomic triggers and traders will not add risk in front of important occasions such as the FOMC rate of interest decision. Because of this, bears have need to think that the current longer-term climbing down formation will resume within the approaching days.

Professional traders’ insufficient curiosity about leverage longs is apparent within the neutral futures funding rate which is another manifestation of negative sentiment from investors. When the crypto total market capital tests the bearish pattern support level at $940 million, traders should be expecting a 12.5% cost drop in the current $1.08 billion level.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.