Bitcoin (BTC) remained strictly rangebound on August. 24 as consumers tried to spark an outbreak.

Place cost squeeze around the cards

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD hovering near $21,500 in the Wall Street open.

The happy couple saw little action within the 24 hrs prior, entering the 5th day’s sideways movement inside an more and more tight range.

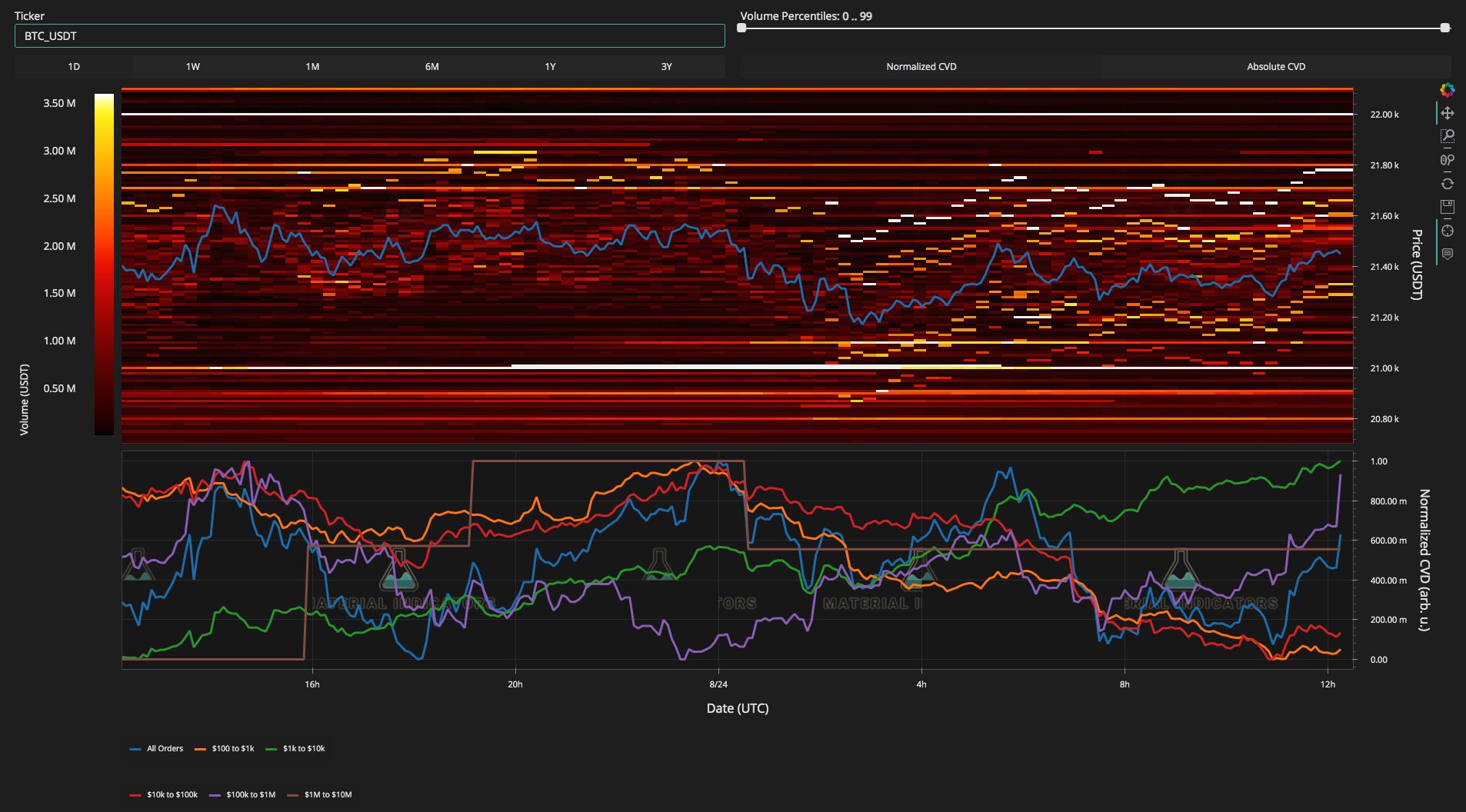

Data in the order book of major exchange Binance submitted to social networking by on-chain monitoring resource Material Indicators hinted the established order was frustrating exchange users, including whales.

During the time of writing, bids were inching greater towards place cost, while seller interest was building at $21,600.

The end result might be volatility as liquidity cuts down on the range by which BTC/USD floats — with the idea to the upside or downside, based on whether buyers or seller win out.

“Really very little has altered since yesterday, I’m still searching for your one leg lower to get your swing lows, adopted with a relief wave,” popular trader Crypto Tony meanwhile told Twitter supporters within an update at the time.

Fellow trader Crypto Erectile dysfunction meanwhile stated he was “not convinced” about the effectiveness of the bounce in the weekend lows around $20,800.

In the latest YouTube video, he highlighted potential market entry levels between individuals lows and also the current place by having an eye to visiting a retest. Before that, he added, Bitcoin could revisit the number highs just above $22,000.

Dollar creeps back towards two-decade peak

Stocks meanwhile put into a feeling that the risk asset resurgence could characterize your day.

Related: Bitcoin bulls may win big as two key moving averages prepare to mix

The S&P 500 and Nasdaq Composite Index both headed greater in the Wall Street open, leading Cointelegraph contributor Michaël van de Poppe to eye knock-on effects for BTC/USD.

#Nasdaq bouncing upwards, while #Bitcoin looks primed for any break above $21.5K.

— Michaël van de Poppe (@CryptoMichNL) August 24, 2022

Popular Twitter account Bet on Trades contributed an extended-term bullish view for U.S. equities, noting that 90% of S&P 500 stocks were now above their 50-day moving average.

“This studying has presented investors with jaw shedding returns inside a 6–12 month time period. Stock up,” he advised supporters.

A potential headwind came by means of the U.S. dollar. After shedding quickly on the rear of U.S. manufacturing data, the U.S. dollar index (DXY) canceled out its losses at the time, heading back toward new twenty-year highs.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.