Bitcoin (BTC) rebounded from overnight lows on This summer 13 as markets nervously anxiously waited for U . s . States inflation data.

Countdown to “highly elevated” inflation reveal

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD climbing from $19,250 to $19,900 during the time of writing, up 3.3% at the time.

With three hrs to visit before the discharge of Consumer Cost Index (CPI) data for June, crypto markets demonstrated little manifestation of advance volatility.

Formerly, the U.S. government had cautioned the CPI figures were expected to become “highly elevated,” with unofficial projections using their company sources indicating annually-on-year inflation increase of nearly 9%.

NEW #inflation record high in year!

A minimum of that is what I am now forecasting for June CPI, released in five days

I forecast 8.8% annually, smashing the previous

41 year record of 8.6% set recentlyMonth over month this is 1.2% pic.twitter.com/5IochMzP6f

— TheHappyHawaiian (@ThHappyHawaiian) This summer 9, 2022

“CPI being released at 8.8% today. Watch. There is a powerful feeling this is actually the number,” popular crypto YouTuber Ben Lance armstrong agreed.

Biding it is time meanwhile was the U.S. dollar index (DXY), which lingered just above 108 following a corrective move from fresh twenty-year highs.

Analyzing the opportunity of the Fed to carry on rate of interest hikes to tame inflation, meanwhile, one analyst contended there had been little, or no, room for maneuver.

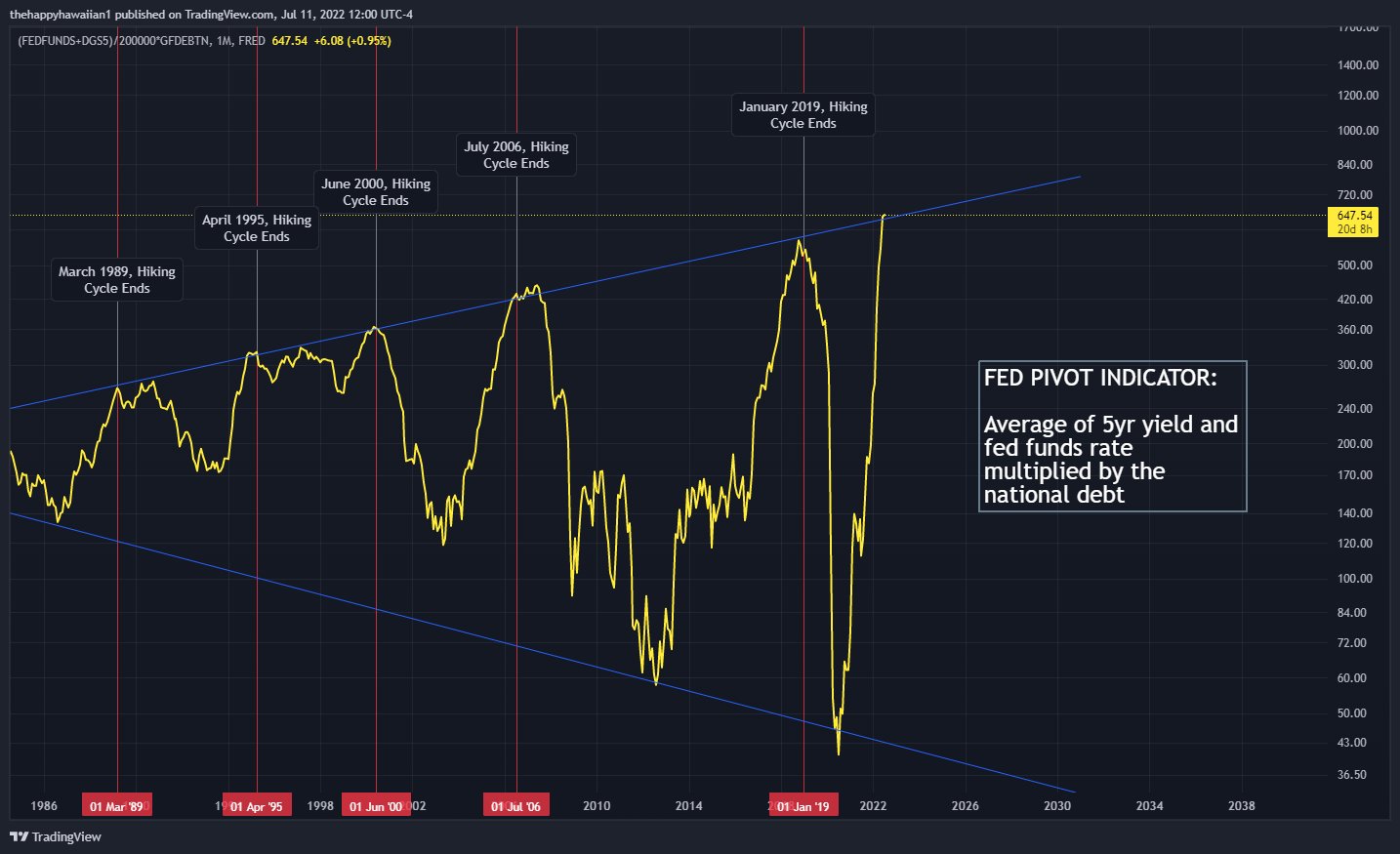

“We are in the stage where the given would usually halt rate hikes and start easing again,” Reddit and Twitter user TheHappyHawaiian described.

“As they prepare for 75bp inside a couple days, they’d be knowingly growing the machine.”

An associated “Given Pivot Indicator” chart demonstrated Given rate direction change in the last thirty-3 years, and recommended that hikes had already hit their maximum permitted levels.

Trader highlights $22,000 importance

Altcoins were somewhat predictably in lockstep with BTC in front of the inflation figures.

Related: Ethereum cost risks ‘bear flag’ breakdown, 20% drop against Bitcoin

Ether (ETH), after losing 8% your day prior, circled $1,075 during the time of writing, still lower 6.3% in the last 7 days.

Other tokens within the top cryptocurrencies by market cap were static on daily timeframes.

For Cointelegraph contributor Michaël van de Poppe, however, there is still need to think that selling pressure was circumstantial as opposed to a longer-term trend.

“Yes, the markets must have been correcting, but at this time, the valuations of crypto and Bitcoin are way less than what they must be, because of forced selling from 3AC, $LUNA, and much more,” he contended.

“That’s why a rest through $22K will accelerate the cost to $30K too.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.