Bitcoin (BTC) lost 3% within an hour and Ether (ETH) drifted toward $1,000 on June 30 as pessimism required charge of crypto markets.

Traders eye “sweep of lows” for BTC

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD hitting $19,224 on Bitstamp during Asian buying and selling, its cheapest since June 19.

Too little momentum on upticks coupled with a failure to reclaim critical support in the 200-week moving average set the scene for fresh weakness on Bitcoin. The biggest cryptocurrency thus dived towards the support area defined each day prior by Cointelegraph contributor Michaël van de Poppe.

In fresh analysis at the time, meanwhile, traders considered the thought of a relief bounce towards $20,000.

I expect more range buying and selling in this particular prices as breakouts and breakdowns take more time to occur and costs are becoming pretty extended using their averages.#BTC by using this hourly 50MA for brief term retraces of the downtrend, so I’d expect a reversion soon to that particular mean. pic.twitter.com/ImYg5udA5I

— pedma (@pedma7) June 30, 2022

“We’re searching for any sweep from the lows along with a reclaim before we consider longing since this is a really strong downtrend so we first need to see some strength,” buying and selling platform Cryptop told Twitter supporters partly of the new update.

News the U . s . States Registration (SEC) had rejected a request by Grayscale to show its Bitcoin investment instrument, the Grayscale Bitcoin Investment Trust (GBTC) into an exchange-traded fund (ETF) meanwhile didn’t help sentiment.

Regulatory pressure had also range from Eu, which dicated to increase limitations on crypto movements within the bloc.

“The agreement extends the so-known as ‘travel rule’, already established in traditional finance, to pay for transfers in crypto assets. This rule mandates that info on the origin from the asset and it is beneficiary travels using the transaction and it is stored on sides from the transfer,” an announcement concerning the move described.

“Crypto-assets providers (CASPs) will need to provide these details to competent government bodies if the analysis is carried out into money washing and terrorist financing.”

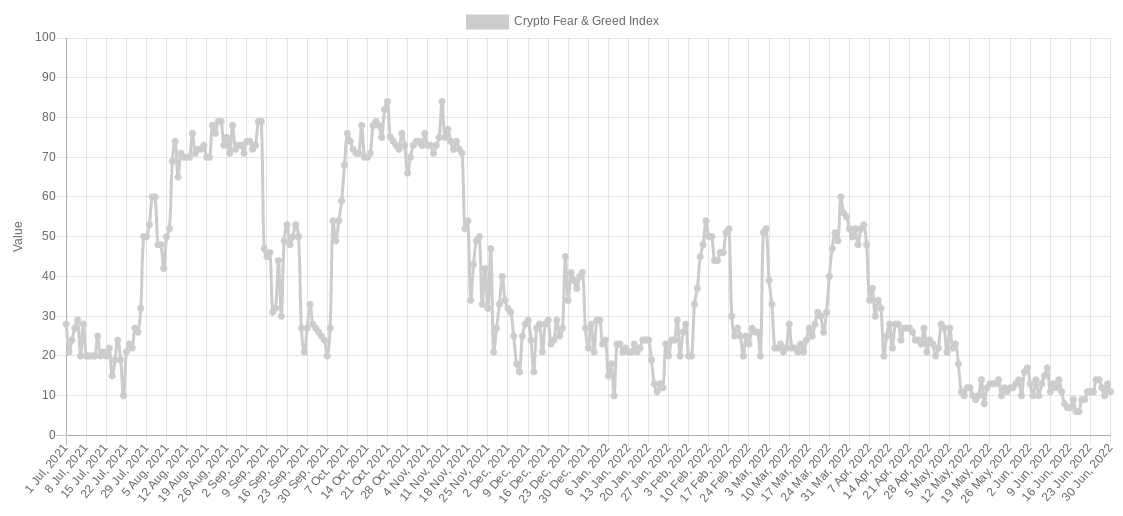

Sentiment gauge the Crypto Fear & Avarice Index was at 11/100, or “extreme fear,” during the time of writing.

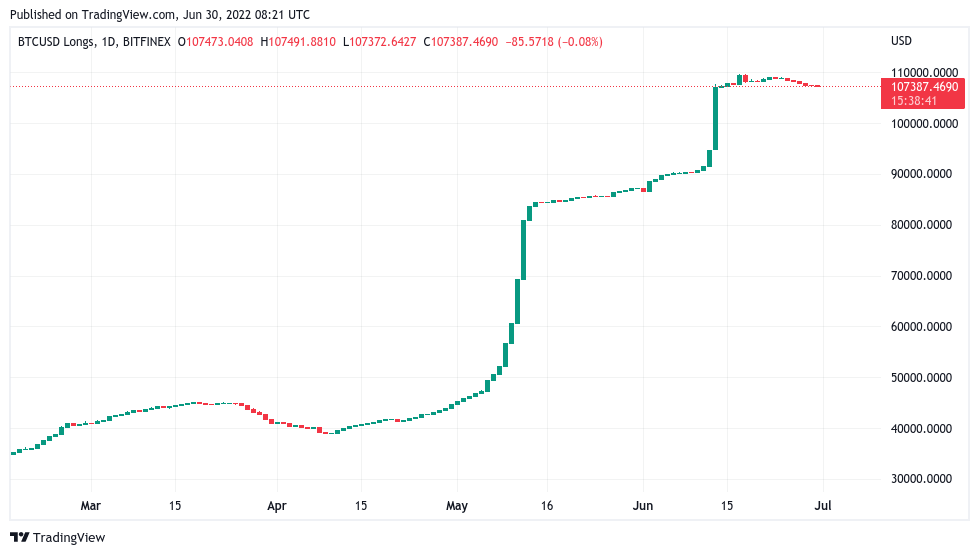

UNUS SED LEO gains as Bitfinex longs awesome

Altcoins predictably ongoing the depressed mood at the time, with ETH/USD targeting $1,000 support the very first time in 10 days.

Related: Cost analysis 6/29: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, Us dot, SHIB, LEO

Only major exchange Bitfinex’s UNUS SED LEO (LEO) token ongoing to buck the popularity conspicuously, gaining 3.5% at the time and increasing monthly returns to above 20%.

The woking platform had formerly made this news for that exponential development of its BTC/USD lengthy positions, these since plateauing within the other half of June.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.