Bitcoin (BTC) saw further losses on June 12 as thin weekend buying and selling volumes fueled a continuing sell-off.

Analyst likens risk asset ‘pump’ to 1929

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD hitting lows of $27,150 on its sixth straight day’s downside.

With hrs to visit before the weekly close, the happy couple was at risk of resuming the losing streak, which in fact had formerly seen an archive nine days of red candle lights consecutively.

To prevent that outcome and include a second “green” close, BTC/USD required to gain over $2,000 from current place cost, which during the time of writing was $27,400.

With support levels neglecting to alter the mood because of the thinner liquidity throughout the weekend’s “out-of-hours” buying and selling, analysts feared that the retest of May’s ten-month lows was due.

“Well, Bitcoin could not hold $29.3K and began shedding lower more. Searching to determine the way the $28.5K area will react,” Cointelegraph contributor Michaël van de Poppe authored in the latest BTC update on June 11.

“If that does not hold, $26/24K around the cards.”

Among ongoing talk of “capitulation” across cryptoassets, others centered on the fate of highly-correlated stock markets. Mike McGlone, senior goods strategist at Bloomberg Intelligence, risk assets more broadly would be able to have experienced peak exuberance previously 2 yrs.

“If the stock exchange keeps going lower, virtually everything may have peaked,” he told Twitter supporters.

“Just some normal reversion can seem to be just like a crash and also the 2020-21 risk asset pump might have to go lower ever like 1929 and 1999.”

In the day’s lows near $27,000, meanwhile, Bitcoin traded the nearest to the May “mini” capitulation event since on that day of turmoil required place as a result of the Terra LUNA implosion.

For a lot of, the issue was thus how you can know in which the true macro cost floor for Bitcoin could lie.

“If cost reaches low 20ks, you will notice the majority of CT with 10k or perhaps lower. That’ll be the underside confirmation,” popular Twitter account Il Capo of Crypto contended.

As Cointelegraph reported, guesses for any generational bottom vary from up to $27,000 to some grimly bearish $14,000 or perhaps lower.

Ethereum makes key recognized cost crossover

For altcoins, meanwhile, the image was more precarious.

Related: Bitcoin cost threatens cheapest weekly close since 2020 as inflation spooks markets

Phone top cryptocurrencies by market cap revealed heavier daily losses than BTC/USD, with a few shedding over 10%.

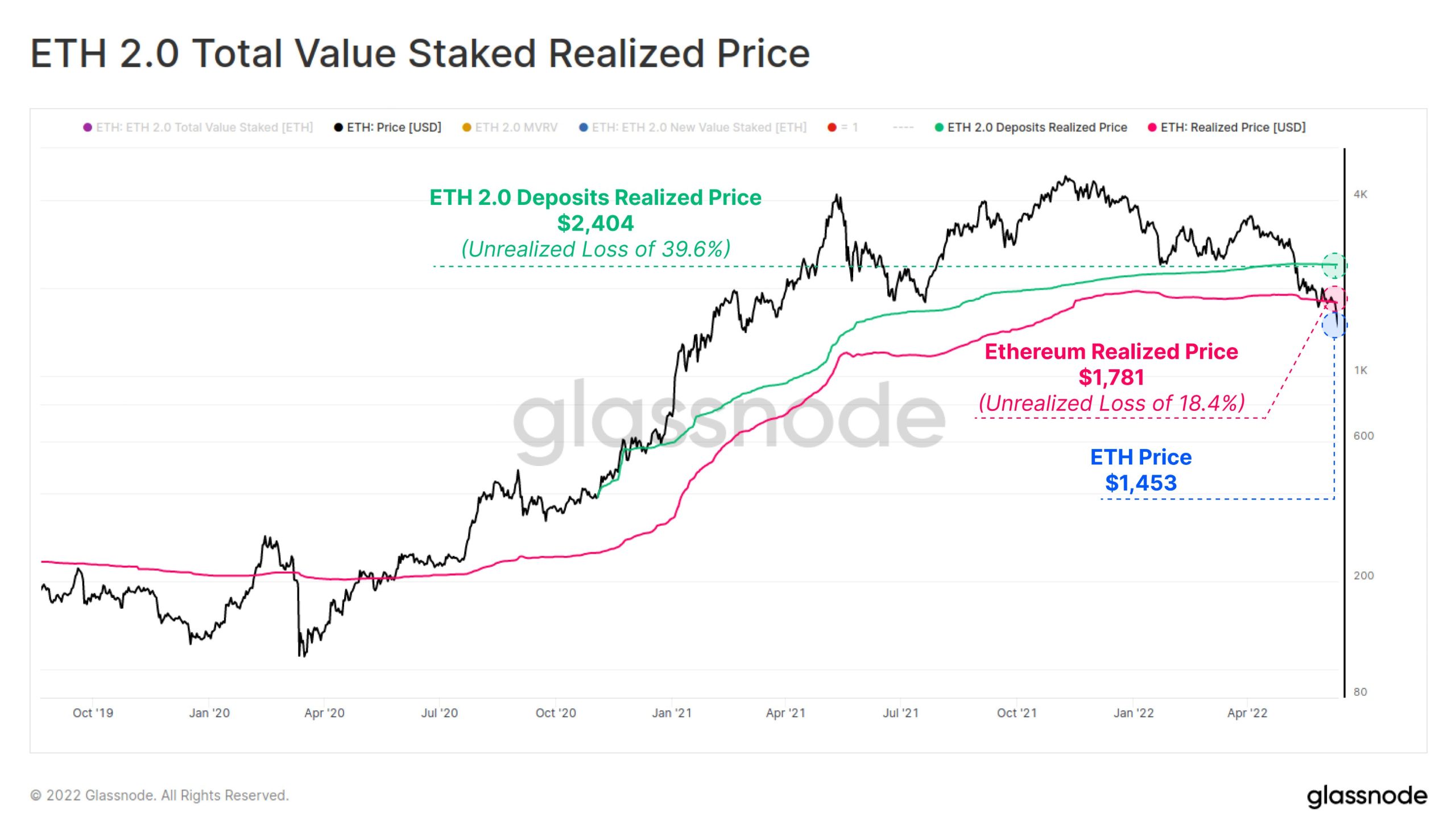

Ether (ETH), the largest altcoin, fell around 7% at the time, taking place cost below recognized cost the very first time since May.

Recognized cost refers back to the combined cost where each token last moved, and it is breach put ETH at elevated chance of panic-based capitulation. Bitcoin’s recognized cost, around $24,000, was barely touched throughout the May dip.

“With the cost declines over the past weekend, the Ethereum market has fallen underneath the $ETH Recognized Cost of $1,781,” on-chain analytics firm Glassnode commented with an associated chart.

“This means the marketplace is holding a typical unrealized lack of -18.4%. The Recognized Cost of ETH 2. deposits is greater at $2,404, by having an unrealized lack of -39.6%.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.