Bitcoin (BTC) tried to violate local lows on Sep. 16 because the latest mix-crypto downtrend intensified.

No relief for BTC bulls publish Merge

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD approaching $19,600 during the time of writing, with buyer support just staying away from an additional drop.

The amount had continued to be in position being an intraday floor because the Ethereum Merge concluded, simply to spark a sell-off, which required Ether (ETH)/BTC toward three-week lows.

Among the gloomy mood, traders and analysts demonstrated little inclination to reflect on their market outlooks.

“I feel at ease with the scenario of quick pump to 23k on BTC and 1800 on ETH and large dump after that,” Il Capo of Crypto authored, reiterating a lengthy-held theory:

“Time will inform.”

Warning the situation “doesn’t look great,” meanwhile, popular account CryptoBullet required a reclaim from the 100-period moving average (MA) to switch bullish around the 4-hour chart.

This does not look great

Same condition – reclaim the MA100 and I’ll be bullish pic.twitter.com/sbogDrqkcE

— CryptoBullet (@CryptoBullet1) September 16, 2022

Given rate hikes might find stocks tumble — Dalio

Following a further day’s losses on U . s . States equities, meanwhile, investor Ray Dalio came some fresh bearish conclusions by what the present inflationary climate means for that markets.

Related: Ethereum traders shorted ETH cost in record figures throughout the Merge — 50% crash ahead?

In the latest blog post printed on Sep. 13, Dalio predicted the combined harm to stocks would cost them 30% of the current valuation.

“The increase in rates of interest may have two kinds of unwanted effects on asset prices: 1) the current value discount rate and a pair of) the loss of incomes created by assets due to the less strong economy. We must take a look at both,” he described:

“What are the estimates of these? I estimate that a boost in rates where they’re to around 4.five percent will produce in regards to a 20 % negative effect on equity prices (typically, though greater for extended duration assets and fewer for shorter duration ones) in line with the present value discount effect contributing to a ten percent negative impact from declining incomes.”

That will spell danger across highly-correlated crypto markets, with Bitcoin thus taking are designed for levels nearer to $10,000.

As Cointelegraph reported, time is presently no stranger to lengthy-term forecasters’ radar.

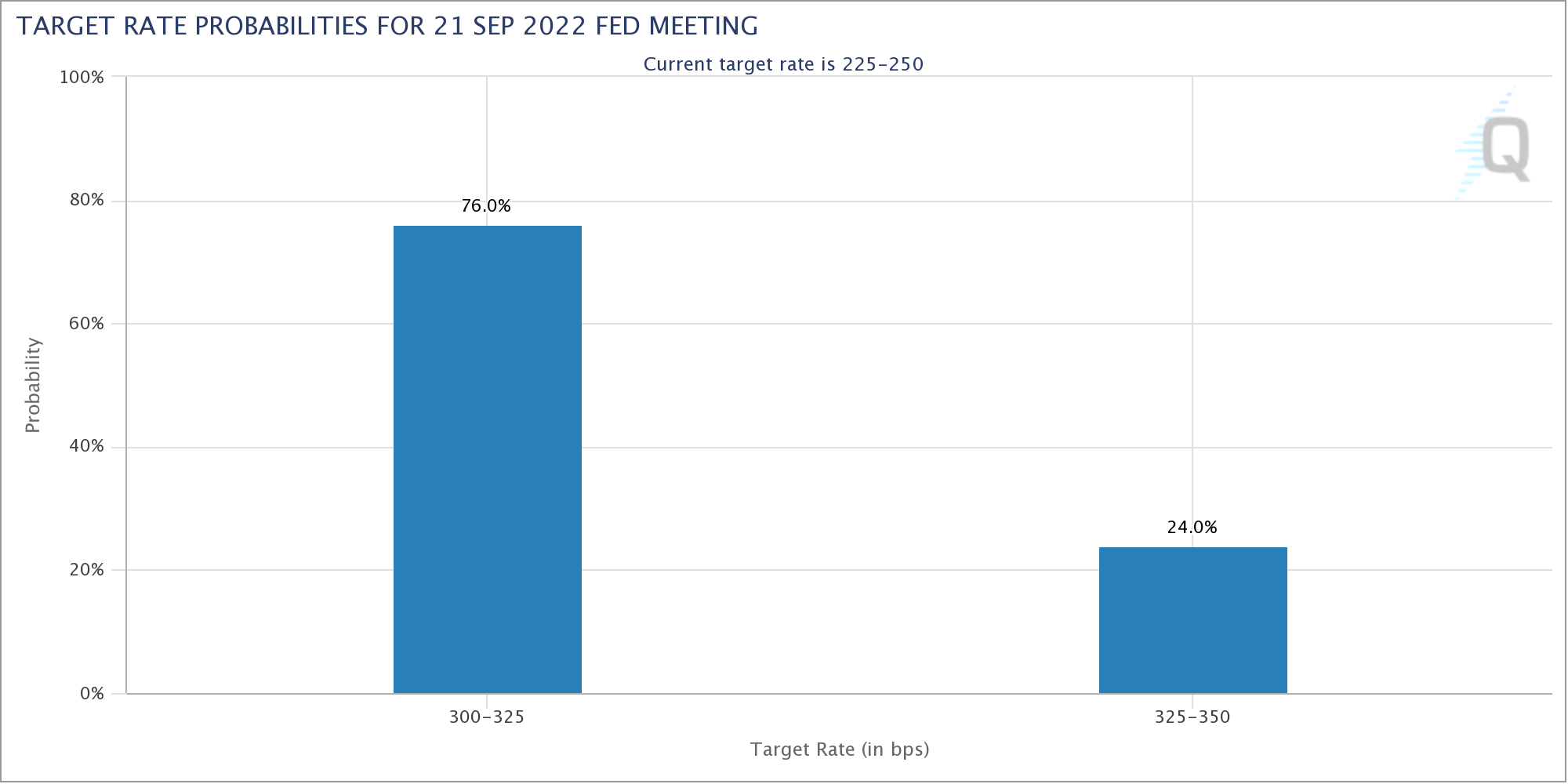

The Fed is tipped to enact an additional 75-basis-point rate of interest hike at next week’s meeting from the Federal Open Markets Committee (FOMC), with a few market participants even expecting 100 basis points, according to data in the CME FedWatch Tool.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.