Bitcoin (BTC) is facing fresh competition from altcoins this month as data implies that — technically — it’s already “alt season.”

Figures from CoinMarketCap and TradingView reveal that BTC presently comprises around 41% from the overall crypto market capital — its cheapest since the beginning of 2022.

Bitcoin sheds market cap prowess

After having suffered as a result of the Terra LUNA — now renamed Terra Classic (LUNC) — collapse, altcoin markets have rallied significantly in recent several weeks.

Alongside Bitcoin’s return from 18-month lows of $17,600 in June, altcoins have enjoyed their very own renaissance, one tha has become giving Bitcoin bulls a run for his or her money.

Based on CoinMarketCap, Bitcoin’s market cap share has become at its cheapest since mid-The month of january, using the largest altcoin Ether (ETH), particularly, stealing the limelight in recent days.

From lows of 14.3% on June 19, Ethereum’s market cap dominance now is 19%.

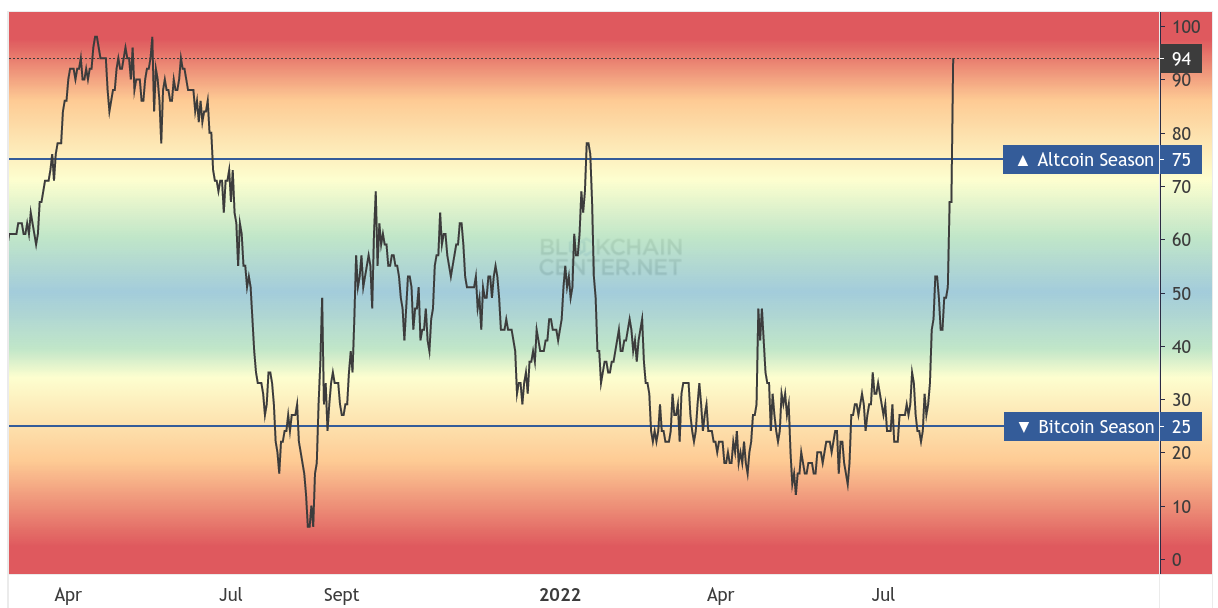

The situation for altcoin bets is further bolstered with a dedicated metric given the job of calling “altseason” — a period of time where altcoins outshine Bitcoin as investments.

Having a normalized score of 94/100, the Altcoin Season Index is presently flashing its most convincing altseason studying since June 2021.

The nearer to zero the score is, the greater the metric favors Bitcoin over altcoins. Alt months are known as once “75% from the Top 50 coins performed much better than Bitcoin during the last season,” its description explains, adding that the “season” means yesteryear 3 months.

Bitfinex ETH lengthy bets crash to May lows

Debate within the approaching Merge event, meanwhile, resulted in ETH performed similarly unconvincingly on short timeframes now.

Related: Exactly what the fork? Ethereum’s potential forked ETHW token is buying and selling under $100

Within the 24 hrs towards the duration of writing on August. 9, ETH/USD was lower almost 7%, while BTC/USD shed $1,000 in hrs at the time.

Nerves within the August. 10 U . s . States Consumer Cost Index (CPI) readout led to the down-side, analysts including Cointelegraph contributor Michaël van de Poppe contended.

Whale closed 300.000 Lengthy positions on Bitfinex

Let us discover WHY this will be significant and just what it might mean for that market #Bitcoin #Ethereum #Crypto #Bitfinex #Futures pic.twitter.com/oiAotLM1Ll

— Maartunn (@JA_Maartun) August 8, 2022

On-chain monitors, meanwhile, noted that the major player on exchange Bitfinex had drastically reduced their lengthy ETH exposure, suggestive of a thought that downside was basically guaranteed next.

During the time of writing, longs were in the same lows as immediately before May’s Terra incident.

Van de Poppe nevertheless known as for constraint if this found approaching ETH cost action.

“People already flashing targets of $300 or $600 for Ethereum around the first slight correction,” he tweeted.

“There’s literally no requirement for that, even though individuals are heavily stuck within their bias. Because of that bias, they will not have the ability to watch markets fairly.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.