Bitcoin (BTC) fell from its lengthy-term buying and selling range on May 12 as ongoing sell pressure reduced markets to 2020 levels.

Tether wobbles as UST stays under $.60

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD because it exited the number that had traded since the beginning of 2021.

During the time of writing, the happy couple circled $26,700 on Bitstamp, marking its cheapest since 12 , 28, 2020.

The weakness came as fallout in the Terra stablecoin meltdown ongoing to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues because of losses on LUNA and UST.

“Individuals are still processing this but this is actually the Lehman moment for crypto”

Listening to lots of funds possibly insolvent from Luna meltdown

— Frank Chaparro (@fintechfrank) May 12, 2022

LUNA, Tether’s in-house token, had basically capitulated in value during the time of writing, buying and selling around $.22. At the beginning of May, LUNA/USD traded at $80.

UST, presently the main focus of Terra executives dedicated to restoring its U.S. dollar peg, what food was in around $.60, still not even close to $1 but greater than double the amount week’s record lows.

Nonetheless, the stress was more and more visible across crypto, as largest stablecoin Tether (USDT) itself started to provide worrying signs it had become copying UST’s downfall.

During the time of writing, USDT/USD was under $.99 on major exchanges.

Commenting on system stability, Tether chief technology officer Paolo Ardoino stated that withdrawals of USDT were proceeding normally.

“>300M redeemed in last 24h without hassle drop,” a part of a tweet read.

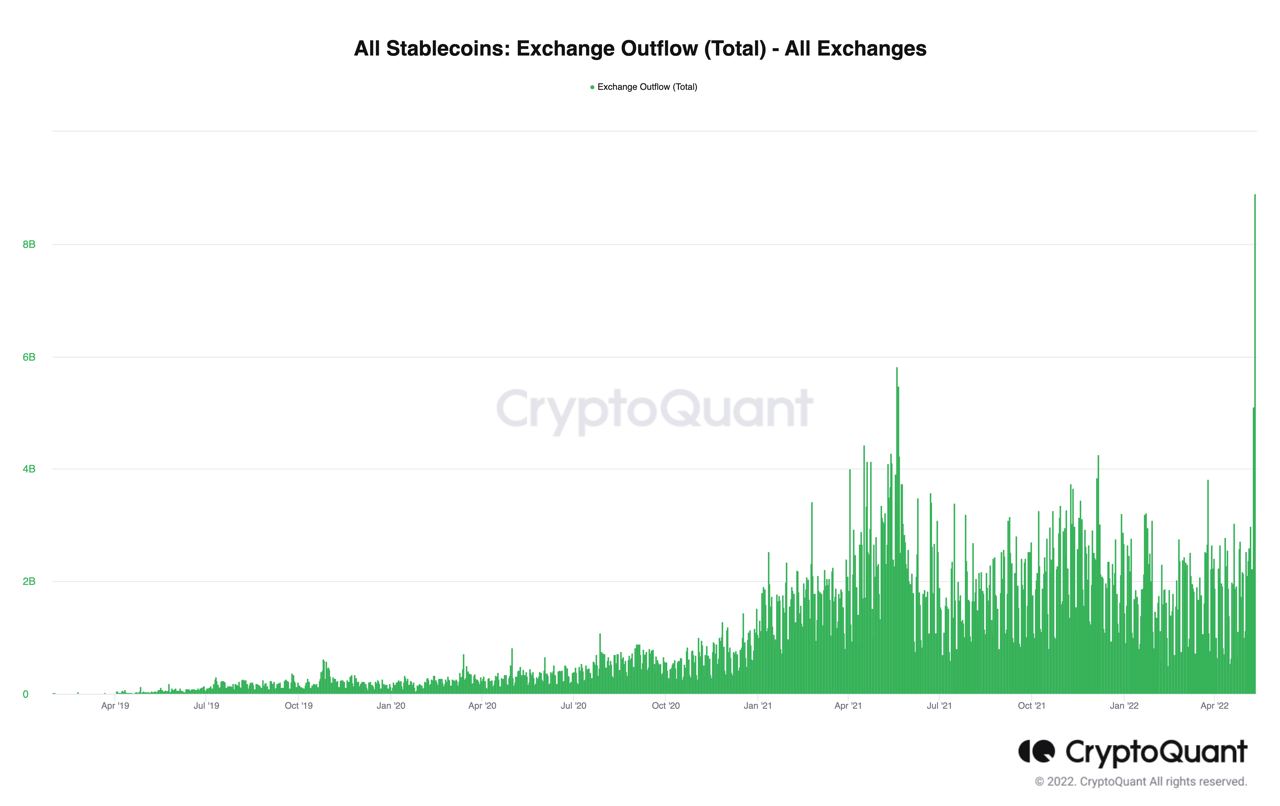

Data from on-chain analytics firm CryptoQuant added that record outflows of stablecoins have been observed on major exchanges.

$1.22 billion liquidated in 24 hrs

Around the subject of losing the macro range low produced in The month of january 2021, analysts remained as prepared to see current levels like a potential chance.

Related: Ethereum whales outside, hurry up as transactions hit greatest point since The month of january

“Anything you lose inside a macro downtrend, you’ll gain multiples in a macro upward trend. All you need to do is take notice of the markets when they’re ultra bearish,” popular trader Rekt Capital contended.

An earlier tweet on May 11 highlighted the macro range.

If #BTC loses this eco-friendly area as support…

That’ll be the confirmation that $BTC will enter a multi-month downtrend#Crypto #Bitcoin pic.twitter.com/ReIa6D4yw3

— Rekt Capital (@rektcapital) May 11, 2022

The level from the losses was reflected in market liquidations. Data from on-chain monitoring resource Coinglass demonstrated that for Bitcoin and altcoins combined, these capped $1.2 billion within the 24 hrs towards the duration of writing.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.