Bitcoin (BTC) fell quickly on August. 19 because the culmination of the week’s sideways action led to disappointment for bulls.

New lows “just dependent on time”

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it dropped 6.2% in one hourly candle.

Reacting, traders wished that the rebound could permit consolidation greater than current place cost levels, that have been under $22,000 during the time of writing.

“Well, hopefully which was liquidity seeking, otherwise it’s over,” a gloomy Crypto Chase told Twitter supporters.

Fellow account Il Capo of Crypto, who’d lengthy forecast coming back to reduce levels, was resigned to new lows being “just dependent on time.”

Consolidation under $22,500, he cautioned in the latest update, could be “very bearish.”

Second item happening. Any test of 23500 as resistance is a great sell chance.

Consolidation below 22500 (clean break + make use of the level as resistance) could be very bearish = 21k or lower

New lows are only a matter of time. https://t.co/MzxrDCZuiZ pic.twitter.com/I5PatYduNW

— il Capo Of Crypto (@CryptoCapo_) August 19, 2022

Before the drop, meanwhile, analyst Venturefounder stated that any cost below $23,000 will be a “decent cost to purchase within the lengthy term,” adding it had become unlikely that Bitcoin had exited its bear market to date.

Relative strength index (RSI) being still near all-time lows spoke towards the extent that BTC/USD was oversold, he contended.

There have been nevertheless indications of buying emerging below key bear market support levels such as the 200-week moving average and key whale entry levels.

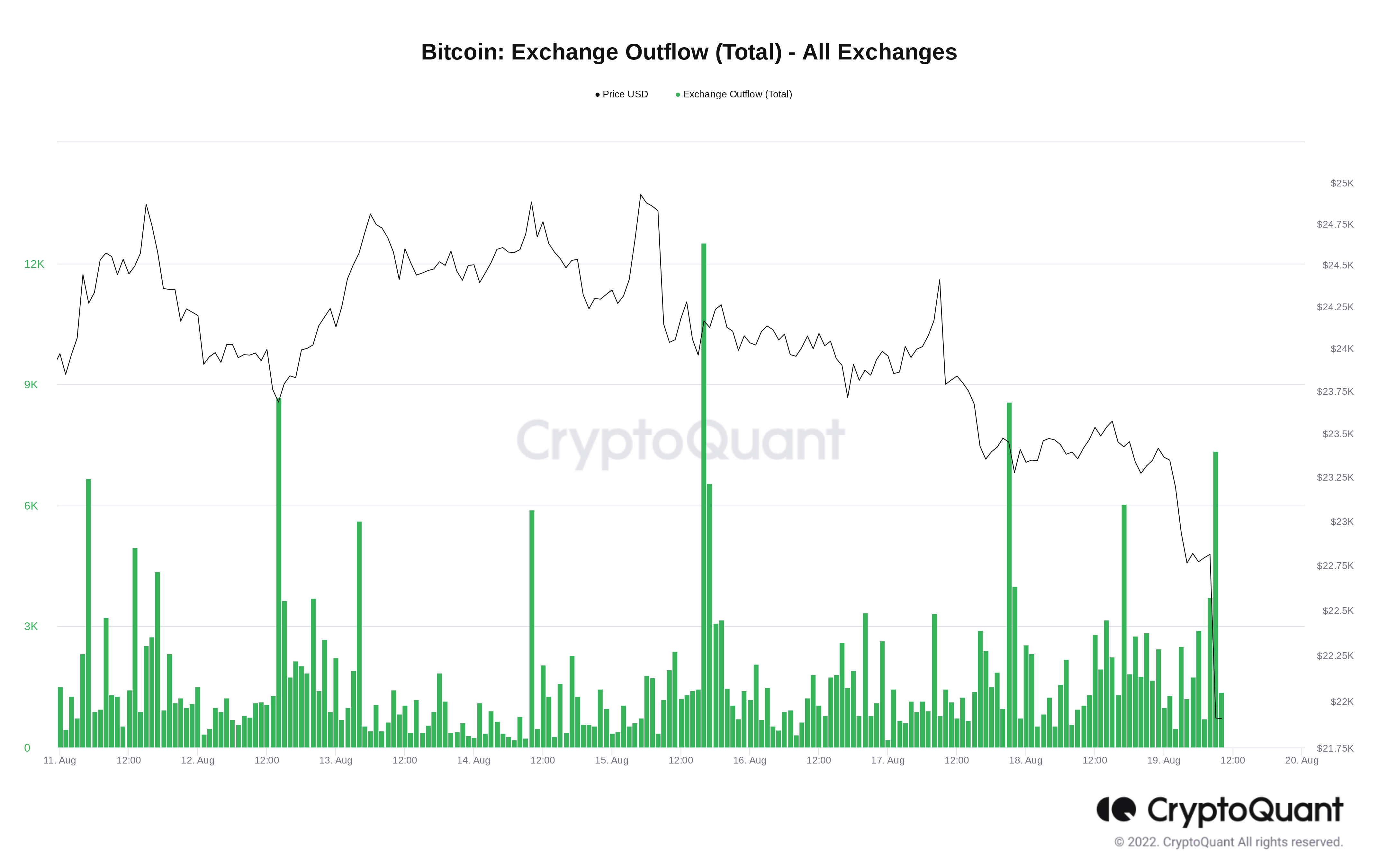

Based on data from on-chain analytics firm CryptoQuant, exchange outflows for that first couple of hrs of August. 19 already totaled 21,500 BTC.

Ether retraces August gains

On altcoins, the knock-on impact of Bitcoin’s go back to three-week lows was predictably acutely felt.

Related: Options data shows Bitcoin’s short-term upward trend reaches risk if BTC falls below $23K

Ether (ETH), the biggest altcoin by market cap, was lower 5.2% at the time during the time of writing, buying and selling near $1,750.

Elsewhere, other major tokens lost more than 11%, with Dogecoin (DOGE) the worst artist within the top, lower 13.6%.

“Bear bias now unless of course $1790 is reclaimed/flipped to aid,” Crypto Chase added about ETH partly of the separate tweet.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.