Bitcoin (BTC) hit $21,000 the very first time in a number of days on This summer 15 as markets enjoyed what one trader known as “summer time relief.”

Altcoin rebound eyed as BTC cost adds 11%

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD grinding greater overnight to simply tap the $21,000 mark on Bitstamp at the time.

An obvious change of tact had occur after initial losses around the back of forty-year highs for that U . s . States’ Consumer Cost Index (CPI). In comparison to the This summer 13 lows, BTC/USD was thus up 11%.

“Summer time relief time,” Cointelegraph contributor Michaël van de Poppe summarized.

Popular trader Crypto Tony seemed to be within the mood for modest optimism on short timeframes, eyeing moving to $21,700 to make money-taking.

Stuck hovering round the EQ presently from the range. I’m still within my lengthy and searching for any switch therefore we can push-up to my final range target of $21,700

Invalidation point now $19,600 pic.twitter.com/Q8e0oy4UuV

— Crypto Tony (@CryptoTony__) This summer 15, 2022

“When we have this, then Alts could have a nice pump and relief rally,” he put in a further tweet.

Many major altcoins had responded well towards the uptick in BTC cost action, with Ether (ETH) creating a noticeable rebound to cap over 12% daily gains.

Others within the top cryptocurrencies by market cap also fared well, with simply Solana (SOL) nevertheless managing to conquer ETH in the last 24 hrs.

ETH/USD thus been successful in staying away from coming back underneath the psychologically significant $1,000 level.

Whales “awaiting moment to awaken”

Meanwhile, on-chain data recommended the largest Bitcoin hodlers were in no mood to do something at current prices.

Related: Bitcoin cost spikes to $20K as whale-bought BTC confirms support

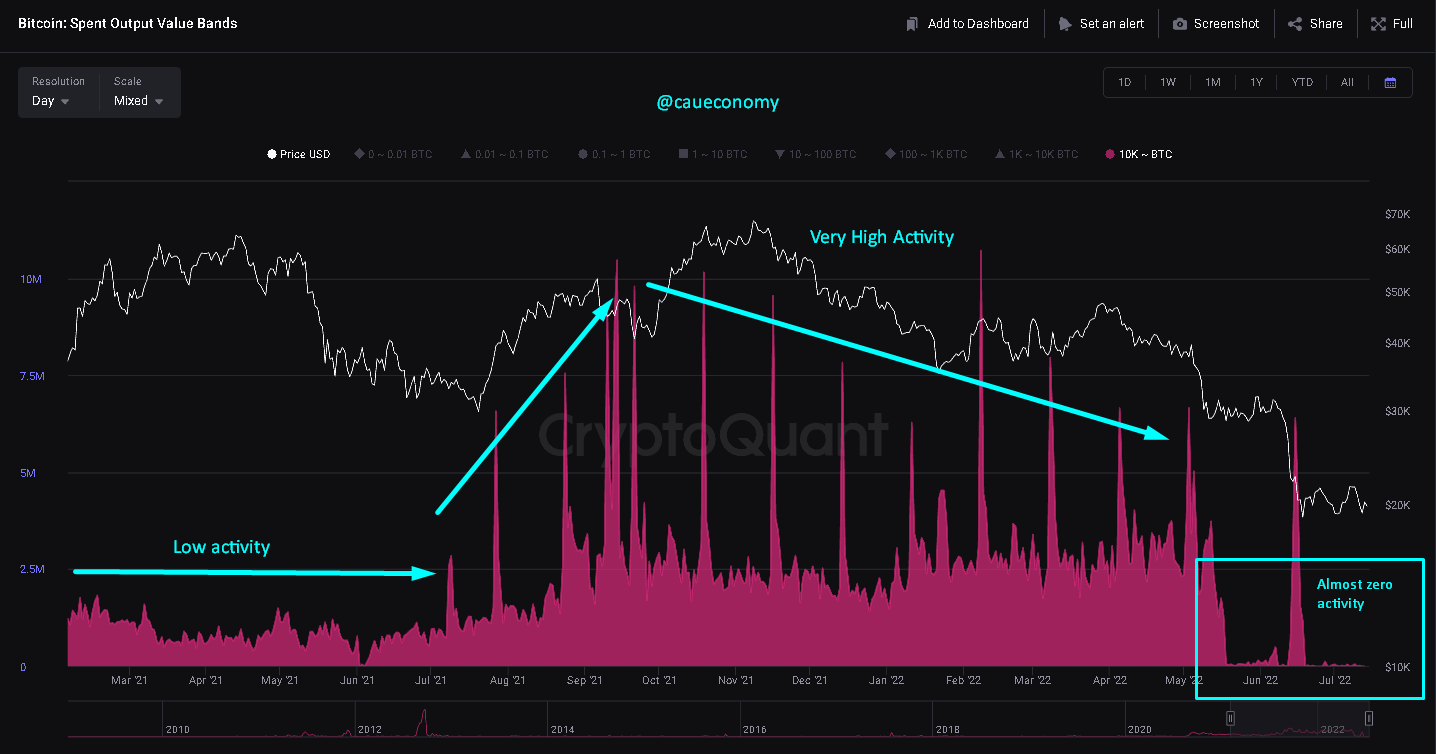

Inside a Twitter thread on This summer 14, BlockTrends analyst Caue Oliveira highlighted what he referred to as “hibernation” ongoing among whale wallets.

“Whales stay in hibernation, waiting for the best moment to awaken,” he observed.

“Institutional movements, or generally known as ‘whale activity’ could be tracked in line with the transaction volume moved more than a short time, both denominated in BTC and USD.”

An associated chart demonstrated a definite insufficient large-volume transactions around the network in recent several weeks, with simply the Terra LUNA blowout creating a temporary trend break.

“Here there exists a obvious look at the reduced institutional activity, almost non-existent following the month of May, that was briefly awakened throughout the LUNA crash but which came back to hibernation,” Oliveira added.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.