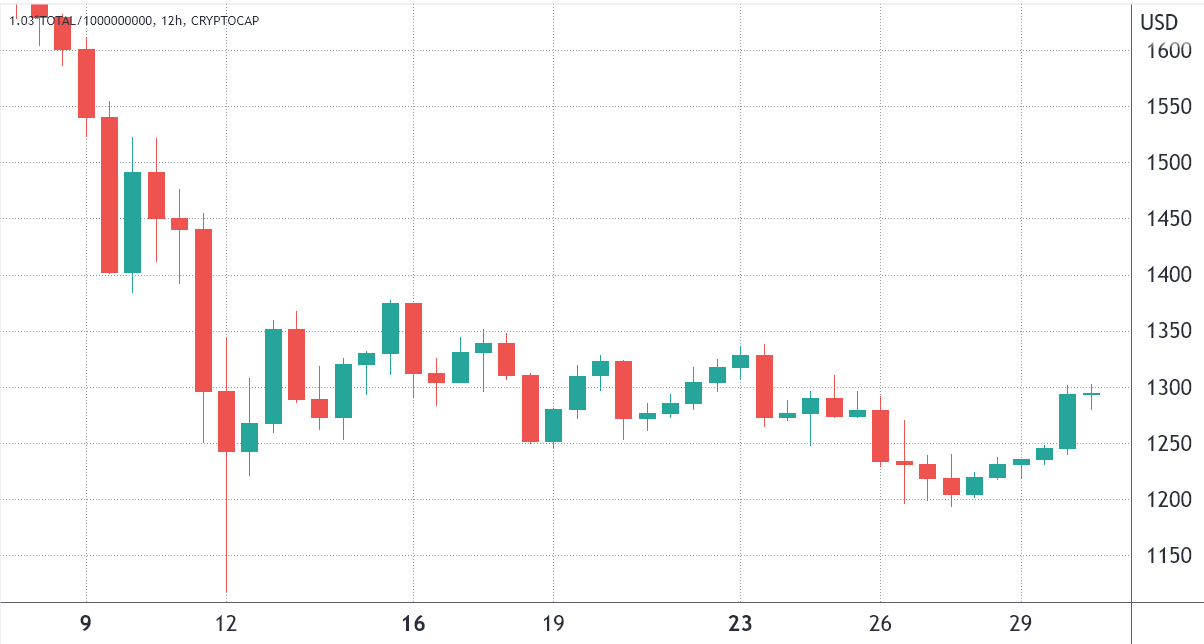

On May 30, the entire crypto market capital acquired 4% and presently is at achieve of the $1.3 trillion market capital. The move was enough to erase the losses in the previous 7 days and it was driven largely by Bitcoin’s (BTC) 4.9% gain in that time period.

Aside from Bitcoin, Cardano (ADA) was the only real large-cap cryptocurrency that were able to close a few days having a positive 4.5% performance. Meanwhile, Ether (ETH), BNB, Ripple (XRP) and Solana (SOL) unsuccessful to provide weekly gains.

Bitcoin’s turn-around happened following the U . s . States stock exchange presented gains the very first time after seven consecutive negative days. A long losing streak in more than a decade for that S&P 500 was adopted with a 6.6% positive performance in the closing bell on May 22.

Based on Yahoo! Finance, “a favorable batch of quarterly is a result of major retailers helped for the time being mitigate concerns within the toll [that …] inflationary headwinds might take on income.Inches For example, Macy’s (M) acquired 29.1% within the week, adopted by Nordstrom (JWN) 25.4% positive performance and Ross Stores (ROST) rallied by 21.5%.

Strangely enough, JP Morgan sent an investigation note to clients on May 25, claiming that $38,000 was the fair value for Bitcoin. The worldwide investment bank also stated that Terra’s (LUNA) collapse didn’t harm the crypto investment capital demand.

On May 23, throughout the World Economic Forum (WEF) in Davos, Europe, PayPal v . p . Richard Nash mentioned their intention to embrace all possible crypto and blockchain services. After moving out its Bitcoin buying and selling over the U . s . States in 2020, PayPal continues to grow its digital currency-related offering.

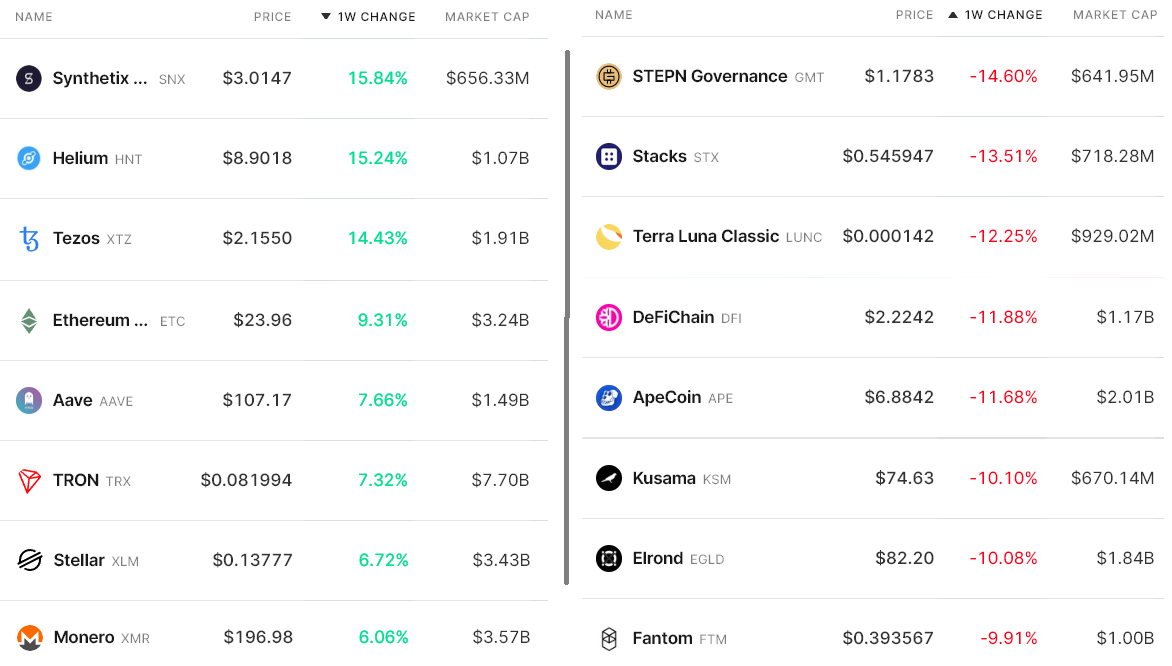

Here are the winners and losers in the past 7 days. As the leading cryptocurrencies presented modest movements, some mid-capital altcoins presented high volatility.

Synthetix (SNX) rallied 15.8% after Kwenta, a zero-slippage derivatives buying and selling application powered by Synthetix, arrived at $325 million in volume.

Helium (HNT) acquired 15.2% after details regarding improvement proposal #51 were released on May 27. The modification introduces a framework to allow subnets using their own token and governance.

STEPN Governance (GMT) lost 14.6% after blocking users located in landmass China from the mobile application.

Terra Luna Classic (LUNC), formerly referred to as LUNA, moved lower 12.2% following the South Korean government bodies called all employees at Terraform Labs included in a complete-scale analysis.

Because of the mixed performance of altcoin markets, it’s worth investigating how traders are situated based on buying and selling and derivatives indicators.

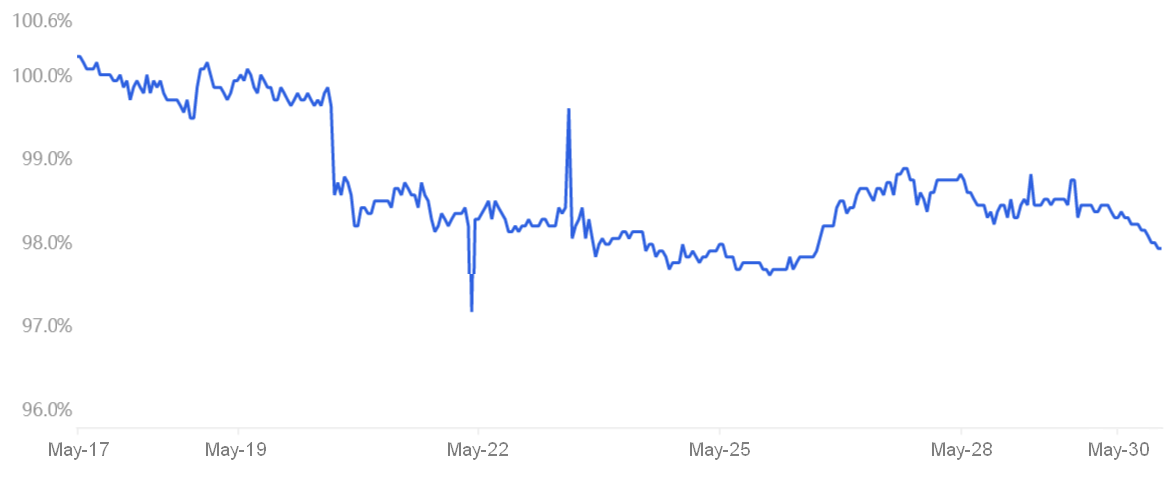

The Tether premium shows too little retail demand

The OKX Tether (USDT) premium is a great gauge of China-based retail trader crypto demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value. However, during bearish markets, Tether’s market offers are flooded, creating a 4% or greater discount.

Between May 23 and 30, the Tether premium in CNY terms has averaged a couplePercent discount, signaling too little retail demand. More to the point, somePercent crypto market capital rally on May 30 didn’t change investors’ sentiment.

Related: Crypto’s youngest investors hold firm against headwinds — and headlines

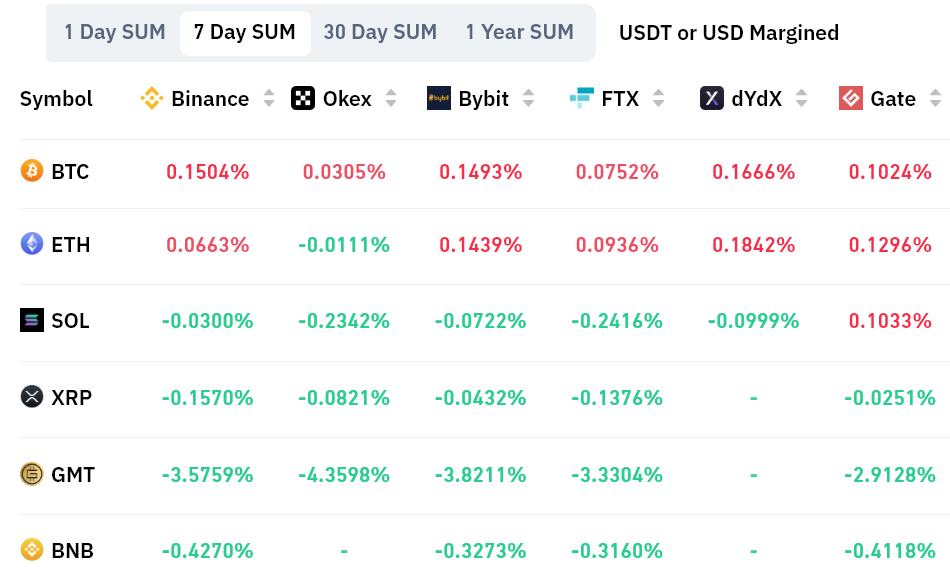

Derivatives indicators are slightly bearish for altcoins

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflect mixed sentiment as Bitcoin and Ether held a rather positive (bullish) funding rate, but altcoins signaled the alternative. For instance, Solana’s negative .20% weekly rate equals .8% monthly, that is irrelevant for many derivatives traders.

The information shows that investors aren’t hurrying directly into make sure the current cost recovery represents a pattern change. As the total crypto market capital broke over the $1.3 trillion support, traders are prices greater likelihood of a downturn. To date, there’s no obvious symbol of an industry bottom based on buying and selling metrics.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.