After a remarkable 23.7% rally between March. 25 and March. 31, Binance’s BNB (BNB) coin has faced a powerful rejection in the $330 resistance. Is it feasible the two-day 6% sell-removed from the $337.80 peak could indicate that further the issue here is ahead?

Let’s check out exactly what the data shows.

Analysts pinned the current rally towards the March. 28 news that Binance invested $500 million in Twitter. However, the network’s deposits and decentralized application (DApp) metrics haven’t supported the advance in sentiment.

The strong upward movement was largely according to reports that Binance was getting ready to assist Twitter in eradicating bots. The speculation emerged after millionaire Elon Musk elevated the $44 billion needed to accomplish his acquisition of the social networking platform.

In absolute terms, BNB’s year-to-date performance reflects a 40% decline, however it ranks in front of competitors, as Ether (ETH) is lower by 59%, Solana has lost SOL (SOL) 82%, and Polygon’s MATIC (MATIC) has registered a 79% correction.

To know if the recent 6% downturn is really a warning of the much deeper correction, traders should consider the network’s use when it comes to deposits and users.

BNB TVL dropped under its competitors

Generally, analysts have a tendency to give an excessive amount of weight towards the total value locked (TVL) metric. Even though this might hold relevance for that decentralized finance (DeFi) industry, it’s rarely needed for crypto games, nonfungible token (NFT) marketplaces, and gambling and social applications.

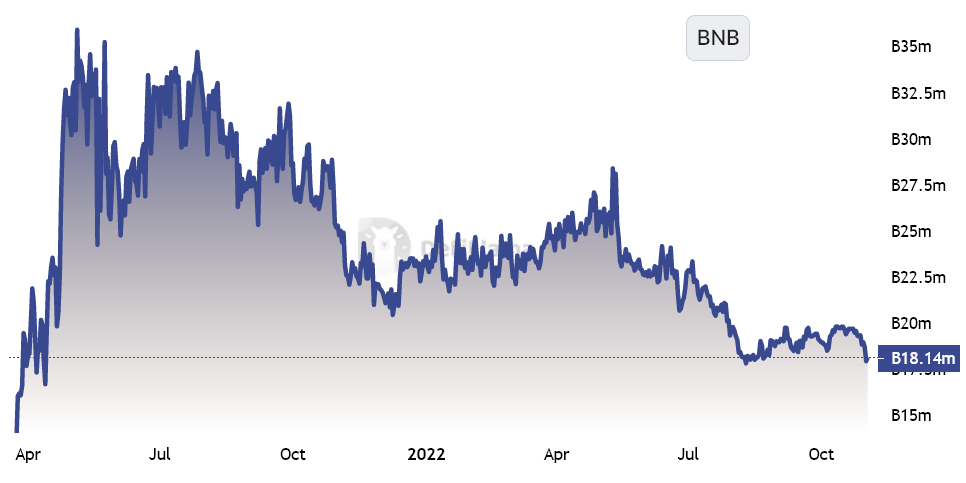

BNB Chain’s primary DApp metric demonstrated weakness at the end of This summer after its TVL dropped below 22.5 million BNB. More lately, the TVL dropped to 18 million BNB, nearing the cheapest levels seen since April 2021.

In dollar terms, the present $5.9 billion TVL may be the cheapest figure since August. 11. The dpi represents 10.9% from the cryptocurrency market aggregate TVL, based on data from DefiLlama.

Still, the monthly 5% TVL contraction was less than it’s good contract network competitors. For example, the Ethereum network’s TVL fell by 13% in ETH terms within the same period. Solana’s network TVL went lower by 22% in SOL terms, and Polygon’s network TVL declined by 19% in MATIC terms.

DApp use has additionally underperformed against competing chains

To verify if the TVL drop on BNB Chain is difficult, you ought to evaluate other DApp usage metrics.

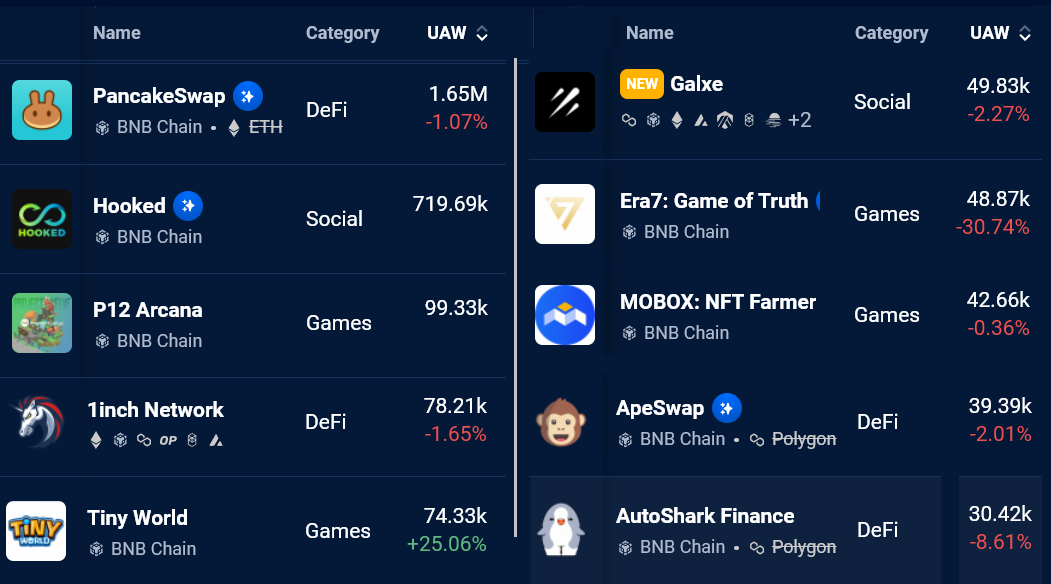

November. 2 data from DappRadar implies that the amount of BNB Chain network addresses getting together with decentralized applications declined by 5% in contrast to the prior month. Compared, Ethereum published a 5% decrease, and Solana users came by 13% within the same period.

BNB Chain’s TVL continues to be impacted minimal in contrast to similar smart contract platforms, and the amount of active addresses getting together with most DApps surpassed 40,000 in eight instances. Ethereum, however, tallied up only five decentralized applications with 40,000 or even more active addresses within the same period.

The findings above claim that BNB Chain is holding ground versus competing chains, which assists the current BNB rally. Consequently, the information should be thought about favorable for BNB investors and weaken the chances of further cost corrections.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.