Cardano (ADA) has began painting a bearish continuation pattern on its longer-time-frame charts, raising its probability of having a major cost crash by August.

ADA cost at risk of a 60% plunge

Dubbed “bear pennant,” the pattern forms once the cost consolidates in the range based on a falling trendline resistance and rising trendline support following a strong move downside. Furthermore, the consolidation moves accompany home loan business buying and selling volumes.

Bear pennants typically resolve following the cost breaks below their trendline support and, usually, could fall up to the peak from the previous big downtrend, known as “flagpole,” as highlighted within the chart below.

Consequently, a decisive breakdown below ADA’s bear pennant structure can often mean extended declines to the stage in more detail comparable to the flagpole. Quite simply, the prospective for Cardano’s cost will be $.20, lower over 60% from today’s cost.

Meanwhile, ADA shows indications of consolidating within the pennant’s range using its imminent bias searching skewed toward bulls. This paves the way for ADA/USD to rebound in the pennant’s rising trendline support near $.46 to rally toward its falling trendline resistance around $.60 by This summer.

Cardano’s Vasil hard fork

Regardless of the interim bearish outlook, Cardano might get a lift from the approaching “Vasil” hard fork.

The upgrade, originally scheduled for June finish, will go live between This summer and aims to enhance the Cardano network’s speed and scalability.

Related: Institutional crypto asset products saw record weekly outflows of $423M

Additionally, Vasil is anticipated to create Cardano more developer-friendly, which proponents argue may even attract projects from rivaling layer-one blockchains, resulting in a greater interest in ADA.

ADA’s cost includes a history of rising dads and moms prior to Cardano hard forks, that ought to boost its chances in a rally alongside favorable technicals, as proven below.

In addition, ADA also offers a good reputation for plunging hard after its difficult forks inside a sell-the-news fashion.

Thus, Cardano might be establishing to resume its downtrend after Vasil goes reside in This summer, which may fall using the bear pennant discussed above.

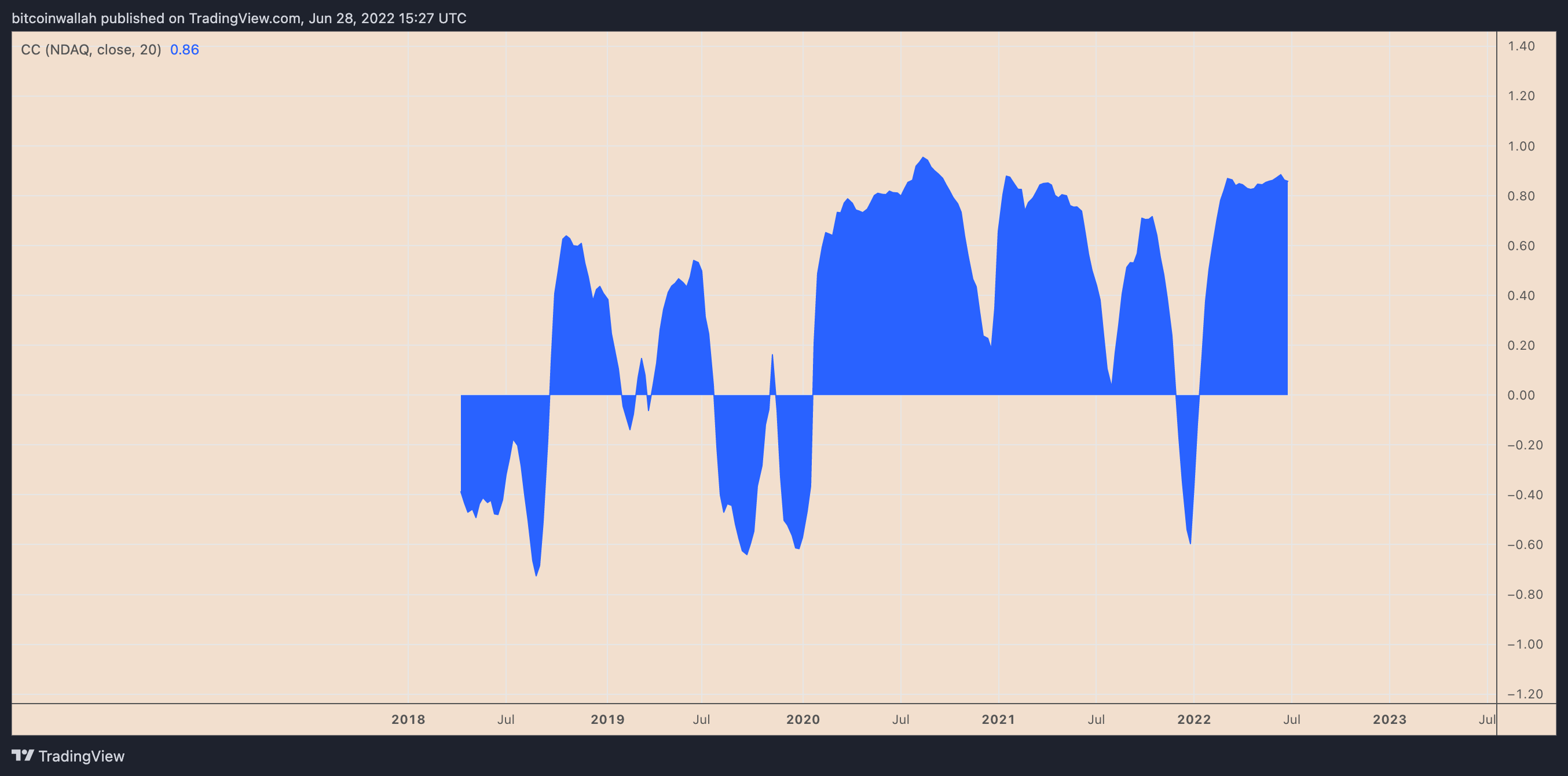

Simultaneously, Cardano’s cost remains almost in lockstep with U.S. equities among Federal Reserve’s rate of interest hiking, that ought to still put downward pressure on its cost within the short to medium term.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.