ThCardano (ADA) market has observed back-to-back bits of great news since August. 31, from the listing on Robinhood, a U.S.-based retail investment platform, to the release of their first lending and borrowing protocol, Aada Finance.

Furthermore, Cardano developer IOHK mentioned that they’re near to clinching “three critical mass indicators” that will result in the launch of the lengthy-anticipated Vasil hard fork in September. Vasil aims to enhance Cardano’s scalability and transaction throughput through pipelining.

The upgrade may also enhance the decentralized application (DApp) and smart contract abilities by altering the Plutus script, a programming language employed for smart contracts around the Cardano blockchain.

Now, we’re well on the method to hitting our indicators. Over 80% of SPOs have upgraded and most 70% from the top DApps we’re tracking have confirmed effective pre-production testing.✅4/8

— Input Output (@InputOutputHK) August 31, 2022

However the uplifting updates have unsuccessful to draw in sufficient buyers as ADA’s cost trend within the last 24 hrs reveals.

Bear market rally

Around the daily chart, ADA’s cost rose for an intraday a lot of $.462 on Sep. 1, each day after bouncing from the sessional low of $.424, up nearly 9%.

Related: Cardano outranks Bitcoin in global top intimate brands in new report

Nevertheless, the move supported lower buying and selling volumes, suggesting less strong conviction among traders a good extended rally.

ADA’s modest cost rise also came following a sharp 28.5% decline, typically because of short covering, i.e., when traders buy back lent tokens to shut their open bearish position, thus lifting the place cost briefly.

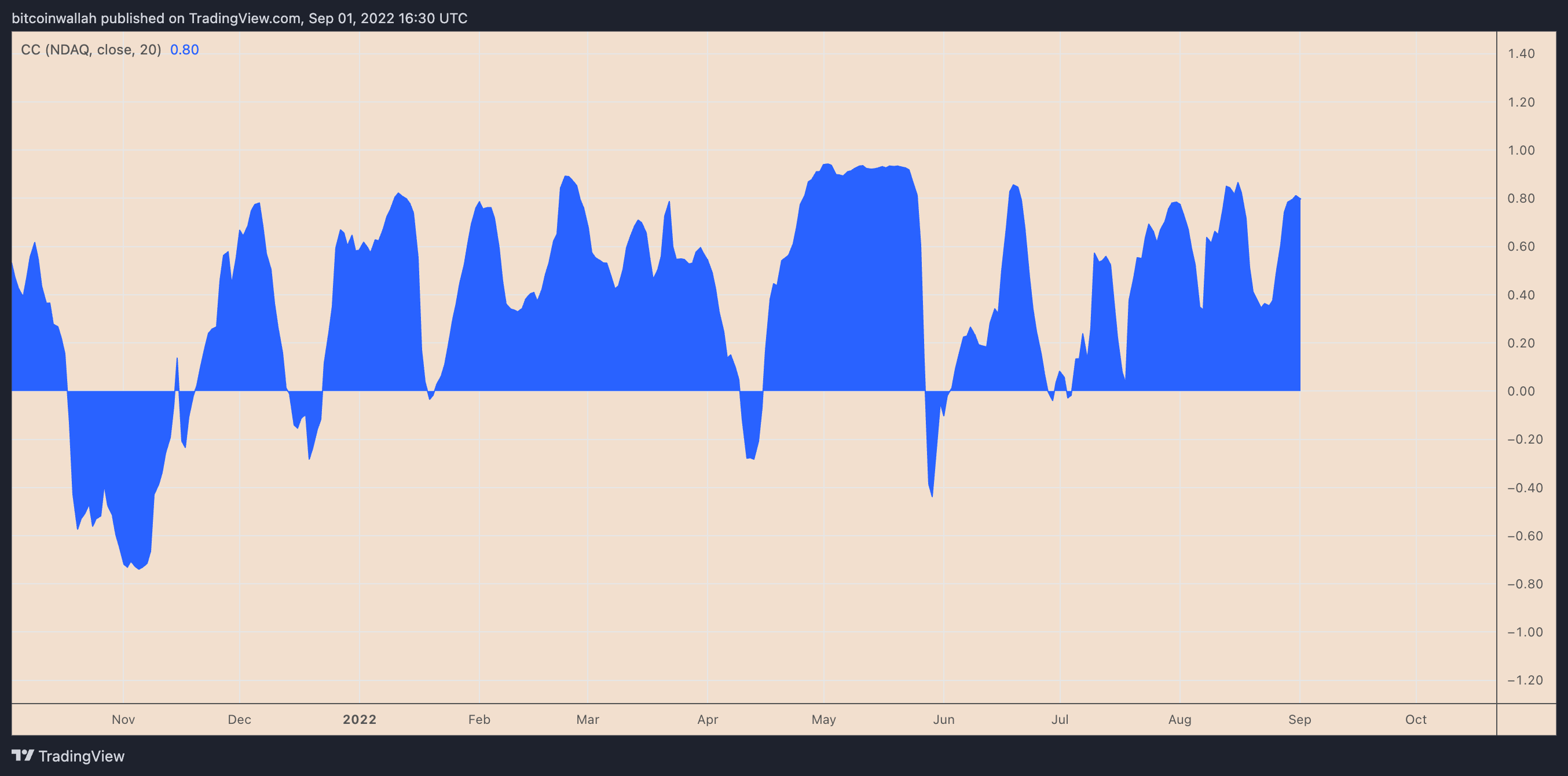

Consequently, Cardano’s rebound can be a bear market rally. This expectation emerges from ADA’s contact with macroeconomic risks that have stored the ADA/USD pair nearly in lockstep with U.S. stocks.

For example, the correlation coefficient between ADA and Nasdaq was .80 on Sept. 1.

Climbing down triangular breakdown ahead?

Theoretically speaking, ADA continues to be painting a climbing down triangular pattern on its daily chart since May 7.

At length, climbing down triangles appear because the cost consolidates in the range based on a falling upper trendline along with a horizontal lower trendline. They sometimes resolve following the cost breaks underneath the lower trendline and, usually, can fall up to the utmost triangular height.

ADA now tests the low trendline of their climbing down triangular setup for any potential breakdown, as proven below. The token will fall to $.268 by September when the pattern plays out as pointed out above, or perhaps a 40% drop from current prices.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.