The independent examiner in crypto loan provider Celsius’ personal bankruptcy situation has alleged that the organization unsuccessful to setup “sufficient” accounting and operational controls in the handling of customer funds.

Within an interim report released on November. 19, examiner Shoba Pillay made numerous stark observations in her own court-hired analysis in to the bankrupt cryptocurrency lending platform.

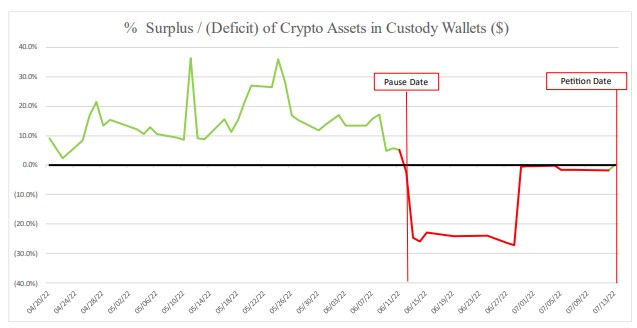

Among the primary revelations in Pillay’s report was that Celsius’ “Custody” program premiered “without sufficient accounting and operational controls or technical infrastructure,” which permitted shortfalls in Child custody wallets to become funded from the other holdings.

“[…] without trying is made to segregate or individually identify any assets connected using the Withhold accounts, that have been commingled within the Primary wallets.”

If this premiered on Apr. 15, Celsius’ Child custody program permitted users to transfer, swap and employ coins as loan collateral. It had been introduced following the firm was purchased through the Nj security regulators to produce a product which was distinguished from Celsius’ “Earn” product, which receives rewards.

This co-mingling of wallets implies that there’s now uncertainty which assets belonged towards the customer during the time of the personal bankruptcy filing, stated Pillay, noting:

“As an effect, customers now face uncertainty regarding which assets, or no, belonged for them by the personal bankruptcy filing.”

The interim report has additionally reveal what ultimately forced the lending platform to prevent withdrawals on Jun. 12.

Pillay stated the breaking point came around on Jun. 11, when customers’ Child custody wallets grew to become underfunded. By Jun. 24, this fell an additional 24% to $50.5 million in underfunding.

The thought may come as a filing using the New You are able to-based personal bankruptcy court a week ago claims that Celsius customers must file claims against Celsius by Jan. 3. 2023 to become qualified for distributions in the situation.

However, customers who accept Celsius’s scheduling of the claims don’t need to submit evidence of claim, according to some November. 20 Twitter publish from Celsius.

Related: Celsius personal bankruptcy proceedings show complexities among declining hope of recovery

Pillay stated that Celsius’ Child custody and Withdrawal programs were produced on short notice following “intense regulatory pressure” from New Jersey’s Bureau of Securities, who began an analysis into whether Celsius’ “Earn” accounts constituted securities pursuant to U.S. securities laws and regulations in mid-2021.

Other accounting insufficiencies highlighted within the report incorporate a thought that Celsius, founded in 2017 by Alex Mashinsky and Daniel Leon, didn’t start tracking its balance sheet until following this confrontation with regulators in May. 2021, so it then used Google Sheets.

The collapse from the Terra ecosystem was among the primary factors that brought to Celsius’ financial troubles in May. 2022, which saw its native gold coin, Luna Classic (LUNC), formerly LUNA, and also the network’s algorithmic stablecoin TerraClassicUSD, USTC — formerly TerraUSD (UST) — fall north of 98% in value.

Celsius also mentioned on November. 20 that it is next court date is scheduled for 12 ,. 5, where they intend on evolving discussions around its Child custody and Withhold accounts, among other matters.