Crypto lending platform Celsius Network comes with an roughly $1.2 billion gap in the balance sheet, with many liabilities owed to the users. Additionally, the firm has filed for personal bankruptcy protection, so its future looks bleak.

Still, Celsius Network’s native utility token CEL has soared in valuation by over 4,100% within the last two several weeks, reaching around $3.93 on August. 13 when compared with its mid-June bottom of $.093.

Compared, top coins Bitcoin (BTC) and Ether (ETH) rallied 40% and 130% within the same period.

Takeover rumors behind CEL explosion?

Technically, the cost rally made CEL an excessively valued token at the begining of August when its relative strength index (RSI) entered over the 70 threshold.

Takeover rumors seem to be behind CEL’s upside strength. Particularly, Ripple wants to buy Celsius Network’s assets, based on an anonymous source reported by Reuters on August. 10.

Reuters reported that Ripple has an interest in Celsius assets there is however no confirmation yet from either companies. Celsius has stopped withdrawals in the platform since June and it has declared Chapter 11 personal bankruptcy that will enable them progressively payback the things they owe.

— Tajo Crypto (@TajoCrypto) August 10, 2022

CEL’s cost greater than bending following the bit of news hit the wire.

In This summer, rumors also surfaced about Goldman Sachs’ intention to get Celsius Network for $2 billion. CEL was altering hands for as little as $.39 around that point.

CEL cost short squeeze

A military of retail traders also seems to become behind the CEL’s giant upside push within the last two several weeks.

Some traders have organized a short squeeze to limit CEL’s downside prospects. A brief squeeze happens when an asset’s cost increases all of a sudden, forcing short sellers to purchase back the asset in a greater cost to shut their positions.

Bitcoin & Celsius Update

BTC is extremely choppy so my focus is on altcoins & CEL. I would like btc to carry 22k for bullish bias. Cel wants breakout again, Iam searching to purchase more above 2.6 with #CELShortSqueeze army behind it, could CEL pump to $3 next?

LIKES/RETWEETS APPRECIATED pic.twitter.com/5axZiwcl1Q

— WSB Crypto Mod (@traderrocko) August 12, 2022

You’ll be able to produce a short squeeze due to CEL’s lowering circulating supply, mainly because of the freeze on Celsius Network’s token transfers.

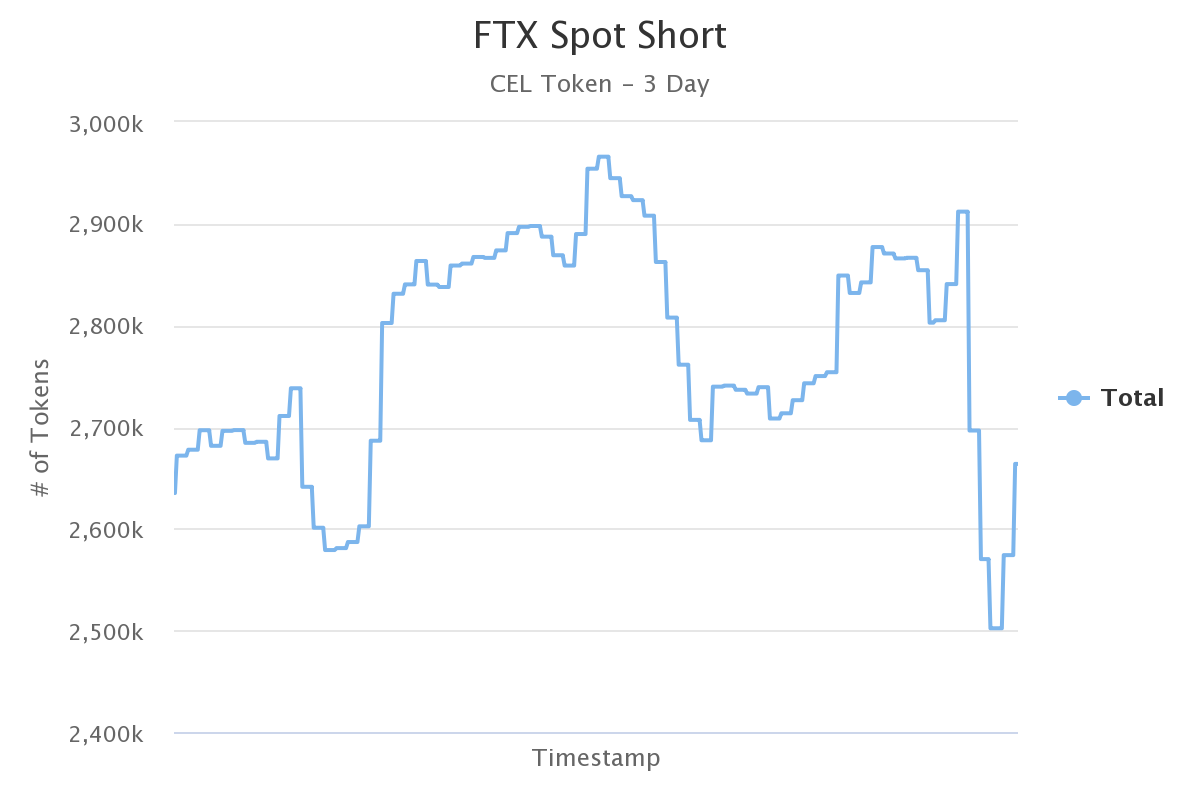

Interestingly, FTX had about 5.a million CEL tokens on August. 13, roughly 90% of all of the total circulation across exchanges. Meanwhile, the quantity of open short positions around the exchange was around 2.66 million CEL in comparison to the monthly a lot of 2.96 million CEL on August. 11.

Quite simply, short traders have closed about 300,000 CEL positions in only 2 days.

What’s next for Celsius toke?

Short squeezes are difficult to sustain more than a lengthy period, history shows.

Such prospects put CEL at perils of facing extreme correction within the coming days or several weeks. As stated, the token has already been overbought, which further results in the down-side outlook.

Drawing a Fibonacci retracement graph from $6.5-swing high to $.39-swing low churns out interim support and resistance levels for CEL. Particularly, the token now eyes an outbreak above its .618 Fib line (~$4.21), using its upside target at $5.25, up 45% from today’s cost.

Related: Crypto markets bounced and sentiment improved, but retail has yet to FOMO

On the other hand, a rest underneath the support level in the .5 Fib line (~$3.48) risks crashing CEL toward $2.75, lower 25% in the current cost level.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.