The cost of CEL, the native token of Celsius Network, has almost quadrupled since June 19 with what seems to become a craze stirred up during the day traders.

CEL cost short squeeze

CEL’s cost rose from $.67 on June 19 to $1.59 on June 21, a 180% spike when compared to crypto market’s 12.37% increase in exactly the same period.

Particularly, the rally began after PlanC, a completely independent market analyst, announced a $20 million bounty for anybody who can be the Celsius Network endured a coordinated attack as a result of a 3rd party, which motivated the crypto finance company to suspend withdrawals last week.

The announcement brought to some craze on Twitter, with lots of accounts placing the hashtag #CelShortSqueeze in their bio and therefore reflecting their intentions to focus on investors who’ve betted CEL’s cost would fall.

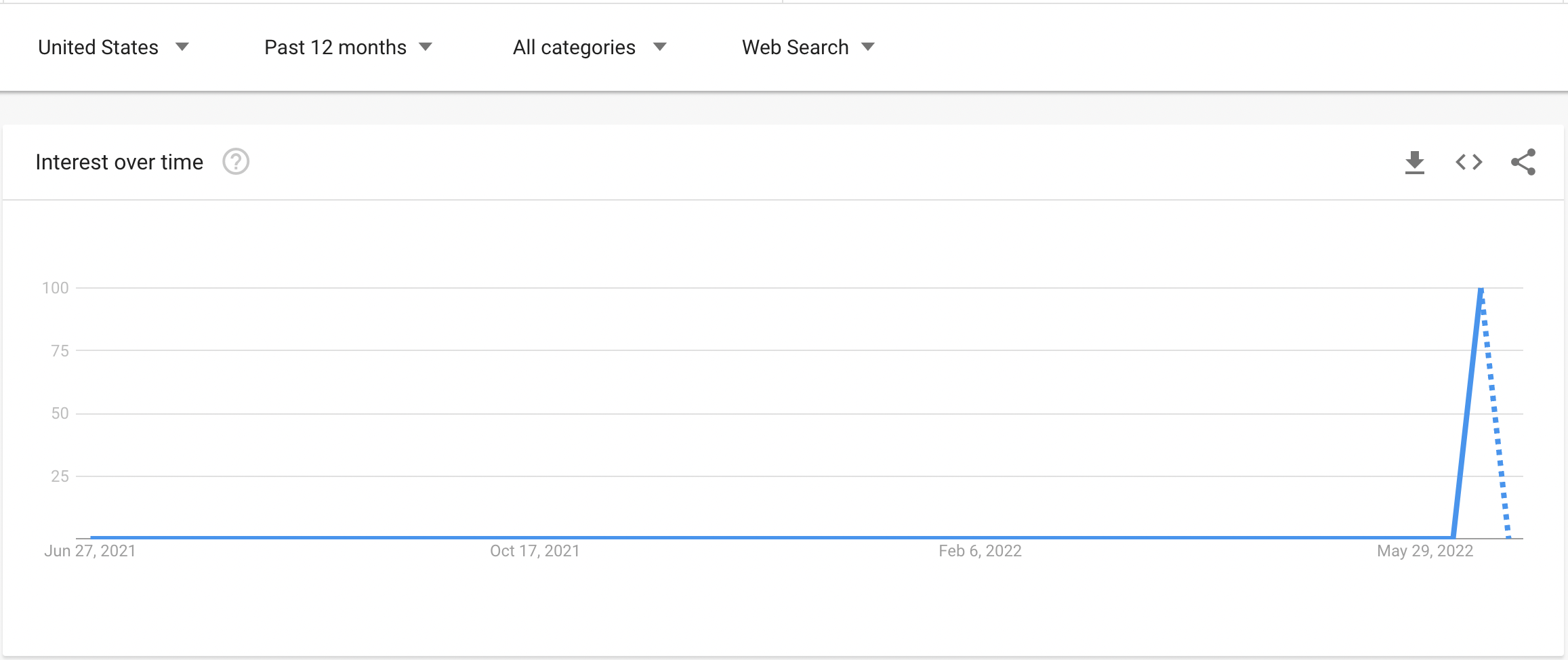

The hashtag was trending greater within the U.S. on Twitter. Meanwhile, internet queries for that keyword, “CEL short squeeze” also arrived at an ideal score of 100 between June 12 and June 18, based on data tracked by Google Trends.

The “trending” hashtag and keyword hint on that day traders bought CEL tokens en masse, thus pushing its cost upward.

Thus, investors who have been “short,” i.e., individuals who lent and offered the token in anticipations of purchasing it back in a lower cost, needed to purchase back in a greater cost rather to “cover” their bearish positions.

Consequently, the so-known as “short squeeze” demonstrated effective, producing a massive CEL rally.

$CEL this really might end up being the trade of the season. Shorters got REKT in a major way…

You cannot get this to shit up, this is exactly why I really like #Crypto #Celsius #CelShortSqueeze pic.twitter.com/A6OQwoQMhS

— DoopieCash® (@DoopieCash) June 21, 2022

The big event offered like a indication from the popular GameStock stock craze in The month of january 2021, in which a military of Redditors profited by damaging rapid positions of Melvin Capital along with other hedge funds, causing vast amounts of dollars of losses.

Insolvency risks sustain

Celsius Network, which held over $20 billion price of digital assets under management this past year, now risks just as one insolvent organization. This is because its lack of ability to pay for exorbitant yields to clients (around 18%) on their own crypto deposits.

In May, Celsius had only $12 billion price of assets, nearly half of the items it held at the outset of 2022, based on its website. The firm stopped disclosing its assets under management afterward.

CEL, a local currency within the Celsius ecosystem for earning interest earnings and having to pay back financial obligations, remains under downside pressure because it trades almost 84% below its peak degree of $8 in April 2021.

Related: Cloudflare outage affects multiple crypto exchanges

The CEL/USD pair now eyes a retest of $1.95 since it’s range level of resistance, based on the Fibonacci retracement graph proven below.

While a effective break over the level might have CEL test $3.11 since it’s next upside target, a pullback, however, could drive the cost lower toward $.34, the present range support, lower 73% from today’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.