Chainlink (LINK) came back to imitate the broader crypto market downtrend since it’s cost fell alongside top coins Bitcoin (BTC) and Ether (ETH) on November. 8.

LINK stepped up to 10% in to the day-to achieve $8. While BTC and ETH tucked by roughly 6.5% and 9%. That contrasts using the trend observed on November. 7, in which LINK rallied 14% to $9.25, its three-month high, while BTC and ETH dropped 1.5% and .5%, correspondingly.

Overall, on the week-to-date time-frame, Chainlink has outperformed both Bitcoin and Ethereum.

What’s making Chainlink more powerful

LINK’s cost has rebounded by nearly 75% after bottoming out at $5.29 in May. Particularly, the Chainlink token’s recovery rally has coincided having a persistent rise in the availability held by its whales (entities that hold a minimum of 1,000 LINK).

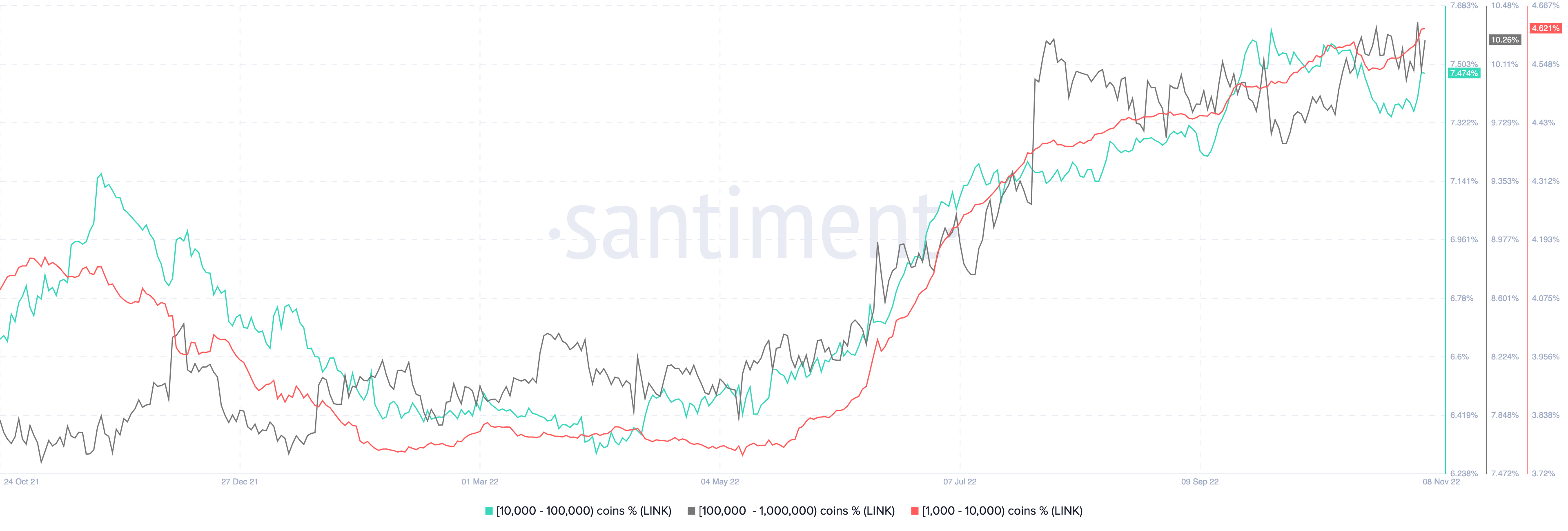

The Chainlink supply percentage held by addresses having a balance between 1,000 LINK and a million LINK has risen to almost 23% in November from 18.2% in May, based on Santiment data. This signifies that wealthy investors might have been the important thing players behind the hyperlink cost recovery.

Interestingly, the hyperlink accumulation trend is booming dads and moms prior to the launch of “Chainlink Staking.”

Chainlink Co-founder Sergey Nazarov announced at SmartCon 2022 their lengthy-anticipated LINK staking reward function would go reside in December. Additionally, the project’s official website confirms it would enable “qualified community people” to stake LINK into its pool in December.

The Hyperlink staking service is going to be opened up for that public within the same month, using the initial annual percentage yield set at 5%. The big event has began drawing speculations about elevated interest in the Chainlink tokens through the finish of 2022.

LINK seems to possess benefited within the short-term because of the excitement round the Chainlink Staking function, given other coins have tumbled in symphony as a result of the crypto hedge fund Alameda Research’s insolvency rumors.

#Chainlink spiked completely above $9.20 the very first time since August 13th, a ~three month high despite very volatile markets. This rise continues to be based on the biggest quantity of active $LINK addresses in five days, and traders are longing strongly. https://t.co/ZxsZnveURm pic.twitter.com/lia6XAgSar

— Santiment (@santimentfeed) November 8, 2022

A 25% correction setup continues to be in play

Theoretically speaking, LINK’s recovery rally since May continues to be limited in a climbing triangular range.

Related: Bitcoin heads to all of us midterms as research states dollar ‘closing in’ on the market top

Climbing Triangles are continuation patterns, meaning they sometimes send the cost in direction of its previous trend following a consolidation period. LINK was trending downward before it created its climbing triangular.

The token’s probability of ongoing its downtrend and reaching its profit target is 44%, per the observation of climbing triangles by veteran investor Thomas Bulkowski. The net income target is measured after adding the utmost triangular height to the breakdown point, as highlighted below.

That puts LINK on the way to around $4.15 by December 2022, lower about 50% from today’s cost.

On the other hand, independent market analyst Pentoshi anticipates Connect to achieve $12 within the same period, because of the token continues to be floating over the same support which was instrumental in delivering its cost to some record full of May 2021.

“While individuals are quiet onto it now. I do not think that’ll be the situation 3-4 days from now,” Pentoshi stated.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.