The U . s . States Fed continues to be strongly hiking rates so that they can awesome lower inflation which has stored the U.S. equities markets pressurized. Investors happen to be watching the inflation figures carefully for early indications of topping out but with no success.

Wholesale prices rose .4% in September, exceeding the Dow jones Jones’ estimate for any .2% gain. This means that inflation is yet to reply to the Fed’s financial tightening. All eyes will be fixed around the Consumer Cost Index data to be sold on March. 13.

Equity traders can get volatility to get following a discharge of the figures as well as the crypto traders, it is not easy to calculate whether this trigger is enough for Bitcoin (BTC) to get out of the $18,500 to $24,500 range it’s been stuck in within the last a few days.

Do you know the critical levels around the upside and downside that may signal the beginning of a trending relocate Bitcoin and altcoins? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

Bitcoin is trying to bounce from the first support at $18,843 however the relief rally will probably hit a wall in the 20-day exponential moving average (EMA) ($19,482). When the cost turns lower out of this resistance, it’ll claim that bears can sell on rallies.

A rest and shut below $18,843 could pull the cost towards the $18,125 to $17,622 support zone. Bulls are anticipated to protect this zone with all of their might if they fail to achieve that, the BTC/USDT pair could resume its downtrend. The happy couple could then drop to $15,800 and then to $15,000.

The very first manifestation of relief for that bulls is a break over the downtrend line and also the recovery could get steam following the pair increases above $20,500. That may set happens for any possible rally to $22,800.

ETH/USDT

Ether (ETH) tucked underneath the symmetrical triangular on March. 11 however a positive sign would be that the bulls purchased the dip and are attempting to push the cost into the triangular on March. 12.

The 20-day EMA ($1,339) is sloping lower and also the relative strength index (RSI) is incorporated in the negative territory, indicating that bears have been in control. The sellers will attempt to stall the recovery in the 20-day EMA.

When the cost turns lower in the current level or even the 20-day EMA and breaks below $1,267, it’ll suggest the resumption from the lower move. The ETH/USDT pair could then decline to another support at $1,109.

The very first manifestation of strength is a break and shut over the triangular. That may create a potential rally towards the resistance type of the funnel.

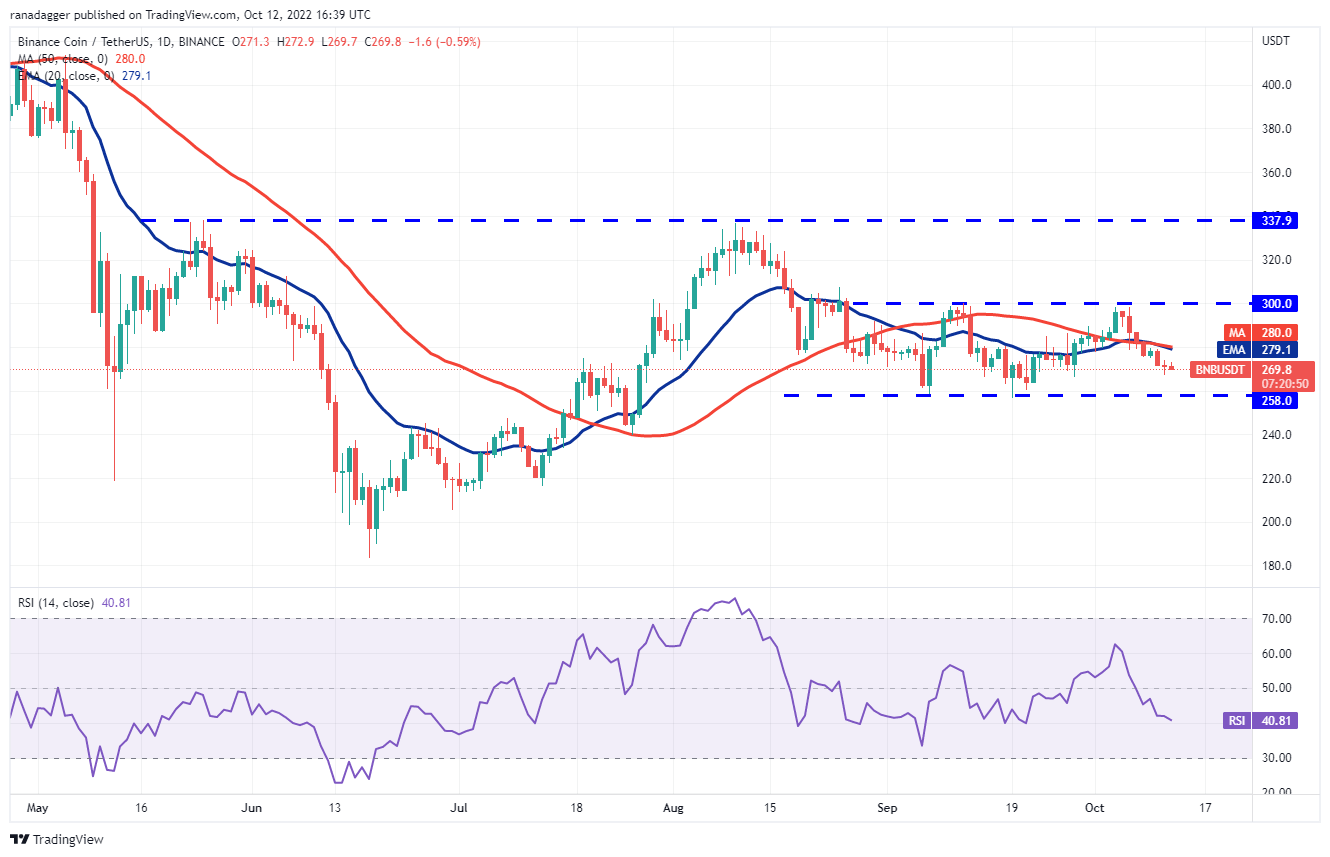

BNB/USDT

BNB formed a Doji candlepower unit pattern on March. 11, suggesting indecision one of the bulls and also the bears. Buyers are trying to begin a rebound in the support at $266.

The bounce will probably face stiff resistance in the moving averages. When the cost turns lower in the current level or even the moving averages, the BNB/USDT pair could drop towards the strong support at $258. The bulls are anticipated to intensely defend this level just because a break and shut below it might sink the happy couple to $216.

Another possibility would be that the cost appears and breaks over the moving averages. That may obvious the road for any potential rally towards the stiff overhead resistance at $300.

XRP/USDT

XRP’s (XRP) failure to obvious the overhead hurdle at $.56 on March. 9 might have attracted profit-booking through the short-term traders. That pulled the cost towards the 20-day EMA ($.47) on March. 11.

When the rebound does not climb above $.51, it’ll claim that the bulls aren’t viewing the dip like a buying chance. That may boost the likelihood of a rest underneath the 20-day EMA. In the event that happens, the selling could intensify and also the XRP/USDT pair may drop towards the breakout degree of $.41. The bulls will probably forcefully defend this level.

Unlike this assumption, when the cost appears and increases above $.51, the bulls will again make an effort to drive the happy couple above $.56. Whether they can accomplish it, the happy couple could rally to $.66.

ADA/USDT

Cardano (ADA) switched lower dramatically and broke underneath the critical support of $.40 on March. 10. Which was adopted by further selling on March. 11, which pulled the cost to $.38. The break and shut below $.40 signal the beginning of the following leg from the downtrend.

Buyers come with an chance to salvage the problem by rapidly pushing the cost over the breakdown degree of $.40. That may trap the aggressive bears and also the ADA/USDT pair could rally towards the 20-day EMA ($.42).

On the other hand, when the cost turns lower from $.40, it’ll claim that bears have flipped the amount into resistance. That may boost the prospects from the continuation from the downtrend toward the following major support at $.33.

SOL/USDT

Solana (SOL) rose over the moving averages on March. 10 however that demonstrated to become a bear trap. The cost rapidly switched lower and dipped underneath the support at $31.65 on March. 11.

Buyers purchased the drop and are trying to push the cost back over the breakdown degree of $31.65. When they manage to achieve that, the SOL/USDT pair will again rise towards the moving averages. The bears may again attempt to stall the recovery only at that level.

The downsloping moving averages and also the RSI within the negative territory claim that bears possess the upper hands. A rest and shut underneath the support at $30 could increase the probability of a drop towards the vital support at $26.

DOGE/USDT

Dogecoin (DOGE) dropped near to the support line on March. 11. This attracted buying through the bulls as seen in the lengthy tail around the candlepower unit. Buyers are attempting to push the cost back over the moving averages on March. 12.

When they succeed, the DOGE/USDT pair could rise towards the overhead resistance at $.07. This level may again behave as a powerful barrier but when bulls overcome it, the happy couple could get momentum and rise toward $.09.

Alternatively, when the cost turns lower in the moving averages, it’ll reveal that the bears still sell on rallies. That may again pull the cost toward the support below $.06. If the level gives way, the happy couple could rest the June low near $.05.

Related: BTC cost wobbles upon us PPI as Bitcoin futures open interest hits peak

Us dot/USDT

Polkadot (Us dot) nudged over the 20-day EMA ($6.40) on March. 10 however the bears offered strongly at greater levels. That pulled the cost underneath the immediate support at $6.25.

The bears will make an effort to sink the cost towards the critical degree of $6. It is really an important level for that bulls to protect if the support cracks, the Us dot/USDT pair could signal the resumption from the downtrend. The following support on however $5.36.

The 20-day EMA continues to be the short-term resistance to take into consideration around the upside. If bulls push the cost above this obstacle, the happy couple could rally towards the overhead zone between $6.64 and also the 50-day simple moving average (SMA) ($6.79). A rest above this zone can lead to a powerful recovery.

MATIC/USDT

Polygon (MATIC) unsuccessful to interrupt over the downtrend line on March. 10, indicating that bears still defend the amount with vigor. That could have attracted profit-booking by short-term traders, which pulled the cost underneath the 20-day EMA ($.80) on March. 11.

Buyers are attempting to arrest the decline and push the cost back over the moving averages. When they do this, the bulls could make yet another make an effort to obvious the overhead hurdle in the downtrend line. The repeated retest of the level of resistance has a tendency to weaken it.

When the cost breaks and sustains over the downtrend line, the MATIC/USDT pair could chance a rally to $.94. However, when the cost turns lower in the moving averages or even the downtrend line, the happy couple could drop to $.75 after which to $.69.

SHIB/USDT

Shiba Inu (SHIB) switched lower dramatically in the 20-day EMA ($.000011) on March. 10 and tucked underneath the immediate support at $.000010 on March. 11. A small positive is the fact that ‘abnormal’ amounts attracted buying.

The 20-day EMA is sloping lower and also the RSI is incorporated in the negative territory, indicating benefit to bears. The present rebound could again face strong selling in the 20-day EMA. When the cost turns lower out of this resistance, the potential of a rest below $.000010 increases. The SHIB/USDT pair could then start its decline toward $.000007.

To avert this bearish view, buyers will need to push and sustain the cost over the moving averages. That may open the doorways for any possible rise to $.000014.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.