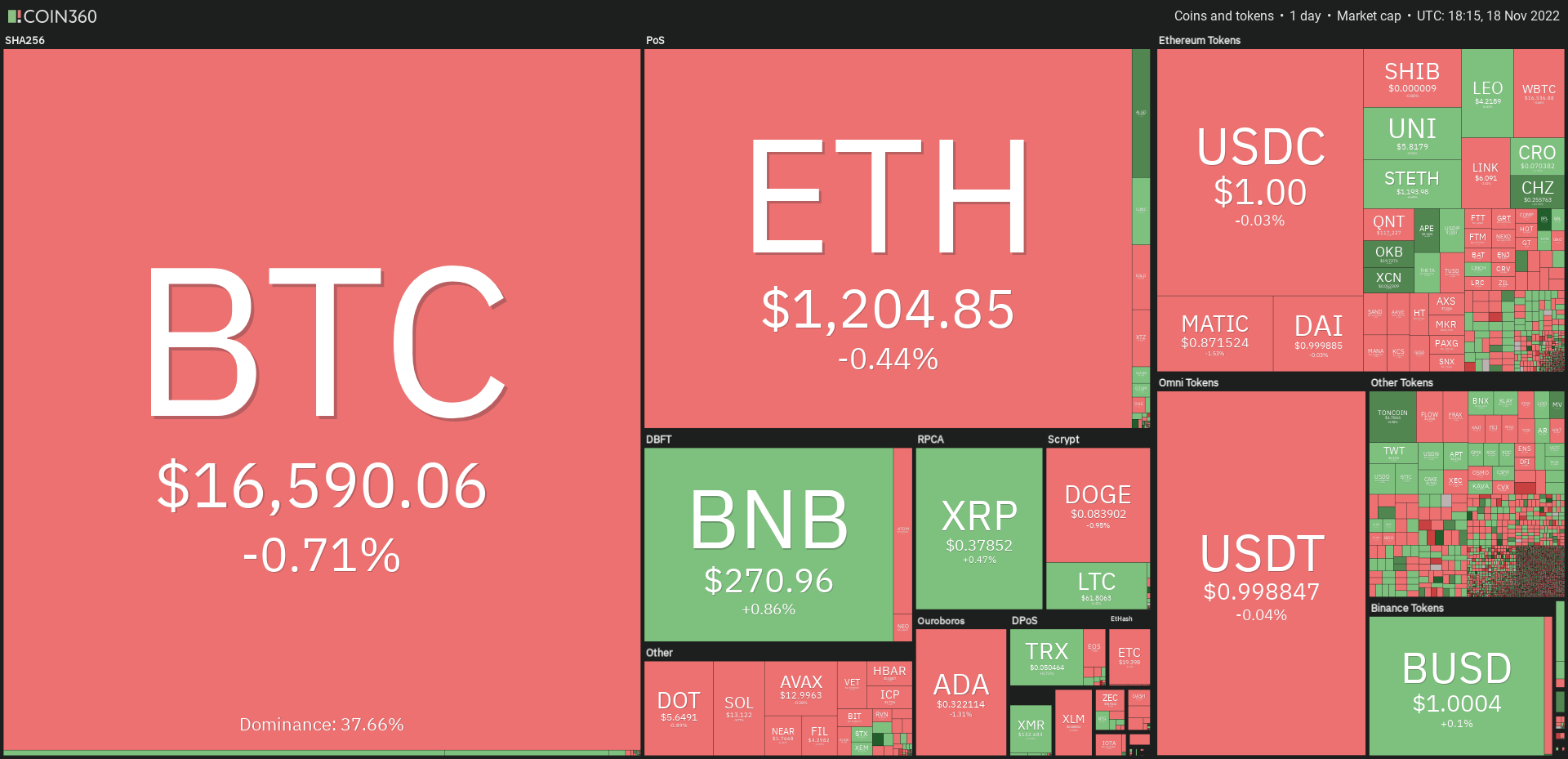

The sentiment over the cryptocurrency ecosystem remains fragile as market participants measure the impact from the FTX crisis on various companies within and outdoors from the crypto sector. Buying and selling firm QCP Capital stated in the latest circular on Telegram that crypto assets may continue their underperformance till 2012. QCP projects Bitcoin (BTC) to plunge to $12,000 and Ether (ETH) to $800.

Searching in the better side, FTX may be the last major player to bite the dust throughout the current bear market cycle, based on CK Zheng, co-founding father of crypto hedge fund ZX Squared Capital.

Zheng also added that institutional investors who’ve a lengthy-term horizon will continue to purchase blockchain technology and choose cryptocurrencies for example Bitcoin and Ethereum.

Once the sentiment is bearish, rumors create panic among traders who dump their holdings from fear. Usually, these occasions form a bottom. Traders may remain careful and steer clear of placing large bets before the dust settles and also the markets confirm a bottom.

Do you know the important levels to keep close track of and that could claim that the correction might be over? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin is constantly on the trade underneath the breakdown degree of $17,622, that is a negative sign. Over time of high volatility, the cost continues to be stuck within the range from $16,229 and $17,190.

The 20-day exponential moving average ($17,980) is sloping lower and also the relative strength index (RSI) is incorporated in the negative territory, indicating that bears have been in control. When the cost turns lower and breaks below $16,229, the BTC/USDT pair could retest the November. 9 low of $15,588.

A rest and shut below this support might trigger panic selling, that could pull the happy couple to $12,200. On the other hand, if buyers drive the cost above $17,190, it’ll suggest strong demand at ‘abnormal’ amounts.

The happy couple could then rally towards the overhead resistance zone between $17,622 and also the 20-day EMA. A rest and shut above this zone could indicate the beginning of a brand new up-move.

ETH/USDT

Ether continues to be progressively losing ground previously couple of days. The bears may attempt to build upon their advantage by pulling the cost underneath the immediate support of $1,171. When they succeed, the happy couple could decline towards the support type of the climbing down funnel pattern.

The downsloping 20-day EMA ($1,325) and also the RSI within the negative zone indicate that sellers possess the upper hands. If bears pull the cost underneath the support type of the funnel, the selling could accelerate and also the ETH/USDT pair may drop to $1,000.

The very first manifestation of strength is a break and shut over the moving averages. This type of move could open the gates for any possible rally towards the downtrend line. The bulls will need to obvious this hurdle to signal the beginning of a brand new up-move.

BNB/USDT

BNB (BNB) once more dipped near to the strong support of $258 on November. 17 however the bulls held their ground. Buyers will make an effort to begin a relief rally that may achieve the 20-day EMA ($291).

The downsloping 20-day EMA and also the RSI within the negative territory indicate that bears have been in control. When the cost turns lower in the current level or even the 20-day EMA, the bears can make yet another make an effort to break the support at $258. Whether they can accomplish it, the BNB/USDT pair could dive to $239 after which to $216.

Contrarily, if bulls push the cost over the 20-day EMA, the happy couple could rise towards the overhead resistance at $300. The bulls will need to obvious this hurdle to spread out the doorways for any possible rally to $338.

XRP/USDT

XRP (XRP) is facing selling close to the downtrend line. This means the bears are attempting to build upon their advantage and pull the cost underneath the immediate support of $.36.

The downsloping 20-day EMA ($.41) and also the RSI within the negative territory indicate the road to least resistance would be to the down-side. When the $.36 level gives way, the XRP/USDT pair could plunge to $.32.

To invalidate this bearish view, buyers will need to overcome the stiff challenge within the zone between your downtrend line and $.41. In the event that happens, the happy couple could get momentum and rally toward the 50-day SMA ($.45).

ADA/USDT

Cardano (ADA) remains inside a strong downtrend and also the bears are attempting to sink the cost underneath the crucial support at $.31. However, the bulls will probably produce other plans plus they may attempt to defend this level strongly.

Any relief rally will probably face stiff resistance within the zone between $.35 and also the 20-day EMA ($.36). When the cost turns lower out of this zone, the probability of a rest below $.31 increases. The ADA/USDT pair could then plummet towards the support line. It is really an important level to keep close track of if it cracks, the following stop might be $.25.

This negative view could invalidate soon if buyers push the cost over the 20-day EMA. The happy couple could then rise towards the downtrend line. A rest and shut above this resistance could advise a potential trend change.

DOGE/USDT

Dogecoin (DOGE) continues to be buying and selling between your moving averages within the last couple of days. This means the bulls are purchasing the dips towards the 50-day SMA ($.08) and also the bears can sell the relief rallies towards the 20-day EMA ($.09).

The downsloping 20-day EMA and also the RSI just beneath the midpoint indicate a small benefit to the bears. When the cost turns lower and slips underneath the 50-day SMA, the DOGE/USDT pair could drop to $.07 and then to $.06.

The bulls will probably produce other plans because they will attempt to push and sustain the cost over the overhead resistance in the 20-day EMA. When they succeed, the happy couple could begin a more powerful recovery and rally toward $.12.

MATIC/USDT

After buying and selling between your moving averages within the last couple of days, Polygon (MATIC) closed underneath the 50-day SMA ($.89) on November. 17. Buyers attempted to push the cost back over the 50-day SMA on November. 18 but they are facing stiff resistance in the bears.

If buyers push the cost back over the 50-day SMA, the MATIC/USDT pair could rise towards the 20-day EMA ($.95). The bears will probably mount a powerful defense only at that level but when bulls overcome this barrier, the happy couple could rally to $1.05.

Alternatively, when the cost does not go above the moving averages, it’ll claim that the sentiment remains negative and traders can sell on rallies. That may increase the probability of a drop towards the upward trend line.

Related: Binance sees record 138K BTC inflows as opinions differ on which Bitcoin cost is going to do next

Us dot/USDT

The cost action of history couple of days has created a pennant, which usually functions like a continuation pattern. The downsloping moving averages and also the RSI within the negative territory indicate that sellers possess the edge in Polkadot (Us dot).

When the cost turns lower and breaks underneath the pennant, the selling could get. The Us dot/USDT pair could start the following leg from the downtrend away below $5.32. The following support on however at $4.32.

On the other hand, when the cost continues greater and breaks over the pennant, it’ll invalidate the bearish setup. The happy couple could then rise towards the 50-day SMA ($6.22). A rest and shut above this level could claim that rapid-term downturn might be over.

UNI/USDT

Uniswap (UNI) switched lower in the 50-day SMA ($6.43) on November. 16 however the bulls are trying to form a greater low at $5.66.

The bulls will need to push and sustain the cost over the 50-day SMA to achieve top of the hands. When they manage to achieve that, the UNI/USDT pair could chance a rally to $7.36 and after that to $7.79.

The lengthy wick around the November. 18 candlepower unit implies that the bears are protecting the moving averages. The downsloping 20-day EMA ($6.20) and also the RSI just beneath the midpoint claim that bears are better off. A rest and shut below $5.66 may obvious the road for any retest of $5.14.

LTC/USDT

Litecoin (LTC) broke and closed over the 20-day EMA ($59) on November. 17 and also the RSI leaped into positive territory, indicating that bulls possess a slight edge.

The up-move will probably face stiff resistance at $65. When the cost turns lower out of this level, the LTC/USDT pair could again drop toward the moving averages.

Unlike this assumption, if buyers drive and sustain the cost above $65, the bullish momentum could get and also the pair could chance a rally towards the overhead resistance at $75.

The bears are anticipated to protect this level with all of their might. When the cost turns lower from $75, it’ll claim that the happy couple may extend its stay within the $46 to $75 range for any couple of more days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.