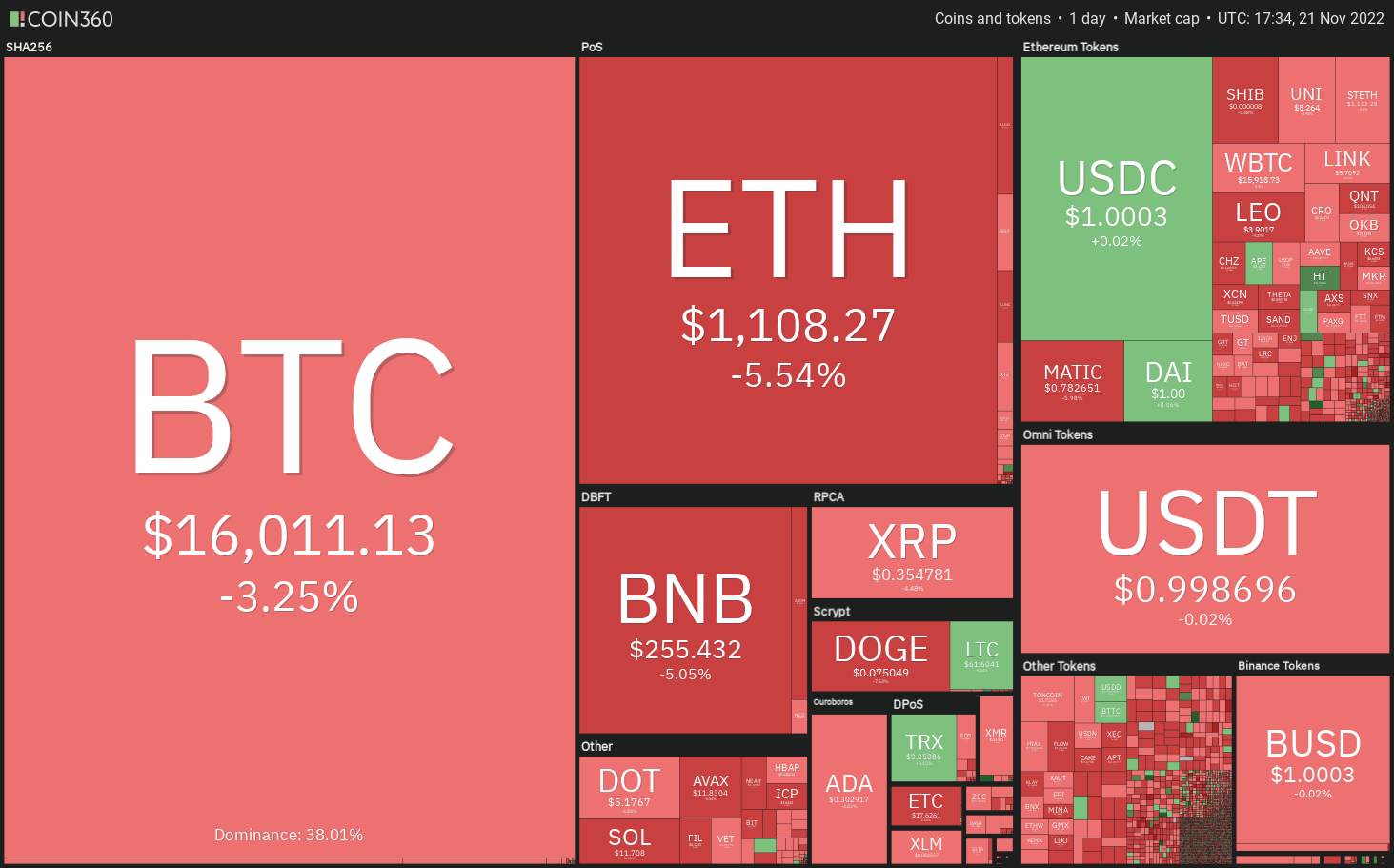

Ongoing selling within the cryptocurrency markets pulled the entire market capital below $800 billion on November. 21. Traders are more and more concern about the level of harm FTX’s collapse might have on several crypto firms. Before the uncertainty clears, it’s futile to anticipate a sustained recovery in cryptocurrency prices.

The FTX saga has damaged the close correlation between your U . s . States equities markets and Bitcoin (BTC). While Bitcoin is buying and selling near to its 52-week low, the S&P 500 (SPX) has retrieved dramatically from the low made on March. 13.

The U.S. dollar index (DXY) is generally inversely correlated to Bitcoin nevertheless its recent drop in the multi-year high didn’t benefit Bitcoin. This means that crypto buyers stick to the sidelines and aren’t venturing directly into buy.

However, Millionaire investor and hedge fund manager Bill Ackman stated inside a Twitter thread on November. 20 that crypto was “here to stick with proper oversight and regulation.”He also highlighted the potential for cryptocurrencies to “greatly benefit society and also be the worldwide economy.”

Is the cryptocurrency market meet up with the U.S. stock markets? Let’s read the charts from the S&P 500 index, the U.S. dollar index (DXY) and also the major cryptocurrencies to discover.

SPX

The S&P 500 index has been around a powerful recovery since bottoming out at 3,491 on March. 13. Even though the 4,000 level continues to be serving as a resistance previously couple of days, an optimistic sign would be that the bulls haven’t quit much ground.

The increasing 20-day exponential moving average (3,879) and also the relative strength index (RSI) within the positive territory indicate benefit to buyers. If bulls push the cost above 4,029, the up-move could achieve the downtrend line.

The bears have effectively stopped previous relief rallies close to the downtrend line so they will attempt to complete exactly the same again.

When the cost turns lower in the downtrend line but doesn’t slip underneath the 20-day EMA, it’ll claim that bulls are purchasing on dips. That may increase the probability of a rest over the downtrend line.

The very first manifestation of weakness is a break and shut underneath the 20-day EMA. The index could then decline towards the 50-day simple moving average (3,786).

DXY

The U.S. dollar index stepped underneath the upward trend line on November. 10. This is actually the first indication the index might have capped out soon.

The index rebounded from the support near 105, indicating strong buying on dips. The 20-day EMA (108) is sloping lower and also the RSI is incorporated in the negative territory, suggesting that bears come with an edge for the short term.

When the relief rally stalls close to the 20-day EMA, the bears can make another make an effort to pull the index below 105. When they succeed, the following stop might be 103.50 after which 102.

Alternatively, if buyers drive the cost over the 20-day EMA, the index could rise towards the upward trend line. The bulls will need to push the cost back above this level to point the corrective phase might be over.

BTC/USDT

Bitcoin remains inside a downtrend. The bears pulled the cost underneath the immediate support of $16,229 on November. 21, which implies too little demand in the bulls.

When the cost sustains below $16,229, the BTC/USDT pair could retest the vital support at $15,588. It is really an important level to keep close track of just because a break and shut below it might signal the beginning of the following leg from the downtrend. The happy couple could then start its downward journey toward $12,200.

On the other hand, when the cost appears and breaks back above $16,229, it’ll claim that the bulls are purchasing the dips below $16,000. The bulls will make an effort to push the cost toward the overhead resistance at $17,190.

ETH/USDT

Ether (ETH) is constantly on the progressively slide toward the support type of the climbing down funnel pattern. It is really an important level for that bulls to protect just because a break underneath the funnel could intensify selling.

The ETH/USDT pair could then drop towards the mental degree of $1,000 and after that towards the vital support at $881. The downsloping 20-day EMA ($1,381) and also the RSI within the negative territory indicate that bears have been in control.

Unlike this assumption, when the cost rebounds from the support line with strength, it’ll claim that buyers are protecting the amount with all of their might. They’ll then attempt to obvious the moving averages and open the doorways for any possible rally towards the downtrend type of the funnel.

BNB/USDT

BNB (BNB) has declined towards the critical support at $258 that could witness a difficult fight between your bulls and also the bears.

The downsloping 20-day EMA ($284) and also the RSI below 37 indicate that bears possess the upper hands. If bears sink and sustain the cost below $258, the selling could get momentum and also the BNB/USDT pair could drop to $239 and after that to $216.

Alternatively, when the cost appears in the current level, it’ll claim that the bulls still purchase the dips to $258. The happy couple could then rise towards the moving averages in which the bears may again mount a powerful defense.

XRP/USDT

Buyers pressed XRP (XRP) over the downtrend line on November. 20 but tend to not obvious the hurdle in the 20-day EMA ($.39). This means the sentiment remains negative and traders can sell on rallies.

The XRP/USDT pair could drop towards the support line where buyers may part of. A powerful rebound from the support line will claim that the happy couple has created a symmetrical triangular pattern.

However, when the cost slips underneath the support line, the happy couple could drop towards the $.32 to $.30 support zone. A powerful rebound off this zone will indicate the pair may remain stuck between $.30 and $.41 for any couple of days.

The bears will need to pull the cost below $.30 to signal the beginning of the following leg from the downtrend.

ADA/USDT

Cardano (ADA) remains inside a strong downtrend. The bears pulled the cost underneath the immediate support at $.31 on November. 21 opening the doorways for any possible drop towards the support line.

A small positive for that bulls would be that the RSI is developing a bullish divergence. This means the bearish momentum might be waning. The ADA/USDT pair could chance a recovery in the support line, which will probably hit a wall in the 20-day EMA ($.34).

When the cost turns lower out of this level, it’ll claim that bears still sell on rallies. That could cause a retest from the support line. If the level cracks, the selling could accelerate and also the pair may drop to $.25. Contrarily, a rest over the 20-day EMA could embolden the clients who may push the happy couple towards the downtrend line.

Related: Bitcoin cost levels to look at as traders bet on sub-$14K BTC

DOGE/USDT

After buying and selling between your moving averages for a few days, Dogecoin (DOGE) stepped underneath the 50-day SMA ($.08) on November. 20. This signifies the uncertainty resolved in support of the bears.

The 20-day EMA ($.09) is sloping lower and also the RSI is incorporated in the negative area, indicating the DOGE/USDT pair could decline towards the immediate support at $.07. If the level also gives way, the happy couple could develop a 100% retracement from the entire rally and drop to $.06.

On the other hand, when the cost rebounds from the current level or $.07, the bulls will again attempt to propel the happy couple above $.09. A detailed above this resistance could signal the corrective phase might be over. The happy couple could then rally to $.12.

MATIC/USDT

Polygon (MATIC) dropped towards the upward trend line on November. 21. This level has acted like a support on two previous occasions, therefore, the bulls will again attempt to defend it.

A recovery in the upward trend line could face strong selling close to the 20-day EMA ($.91). When the cost turns lower out of this level, the happy couple could again retest the upward trend line. A rest below this level could pull the happy couple towards the important support at $.69. This level will probably attract buyers.

Around the upside, the 20-day EMA continues to be the key potential to deal with keep close track of. If buyers drive the cost over the 20-day EMA, the happy couple could rise to $.97 and then towards the stiff overhead resistance at $1.05.

Us dot/USDT

Polkadot (Us dot) remains inside a strong downtrend. The bears pulled the cost underneath the pennant formation and also the November. 10 intraday low of $5.32 on November. 20. This signifies the resumption from the downtrend.

Buyers may make an effort to begin a recovery in the mental degree of $5 that could achieve the breakdown level in the pennant. If bears switch this level into resistance, the prospects of the decline to $4.08 increase.

On the other hand, if buyers thrust the cost over the 20-day EMA ($5.86), it’ll indicate aggressive buying at ‘abnormal’ amounts. That could trigger short covering in the aggressive bulls, clearing the road for any possible rally to $6.50.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.