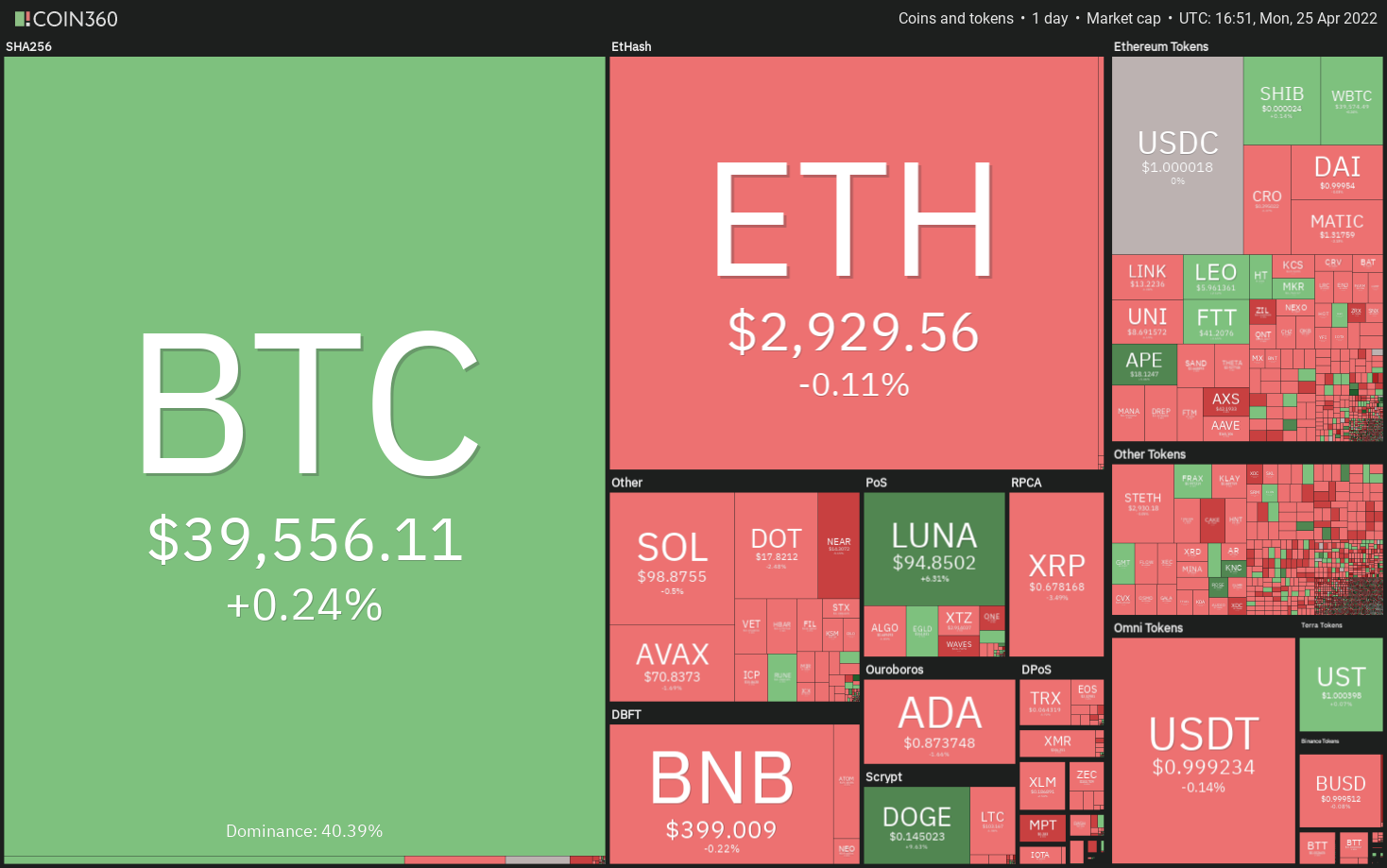

Bitcoin (BTC) is constantly on the trade below $40,000 as bears attempt to switch the amount into resistance. The soaring U.S. dollar index (DXY), that is usually inversely associated with Bitcoin, favors the sellers. However, it’s not all gloom and disaster since the Bitcoin bulls appear to become taking clues in the Nasdaq (NDX), that has been hovering near to positive territory.

Although dangerous assets have been receiving the receiving finish within the last couple of days, Bitcoin hodlers are concentrating on the lengthy-term bullish projections and ignoring rapid-term weakness. Glassnode data implies that Bitcoin’s supply which has not moved for more than a year has hit above “64% the very first time ever.”

While talking with Bloomberg, SkyBridge Capital founder Anthony Scaramucci stated the firm is bullish on cryptocurrency markets “over the 3 to 5 years.” The hedge fund now intends to reposition itself by allocating most its assets under management to digital assets and be the “leading cryptocurrency asset manager and advisor:”

Could an additional loss of Bitcoin and altcoins attract purchasing from lengthy-term investors? Do you know the key levels to keep close track of? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin dipped underneath the immediate support at $38,536 on April 2 however the bears couldn’t build upon their advantage. The lengthy tail around the day’s candlepower unit suggests strong buying close to the support type of the climbing funnel.

The buyers will make an effort to push the cost over the 20-day exponential moving average (EMA) ($40,974). When they manage to achieve that, the BTC/USDT pair could rise to $43,000.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the sentiment remains negative and bears can sell on rallies to strong overhead resistance levels. The happy couple could then decline towards the support type of the funnel.

A rest and shut underneath the funnel could accelerate selling and also the pair may slide towards the strong support zone between $34,300 and $32,917. The bulls are anticipated to protect this level with all of their might.

ETH/USDT

Ether (ETH) broke and closed underneath the 50-day simple moving average (SMA) ($3,022) on April 21 indicating weakness. The buyers attempted to push the cost back over the 50-day SMA on April 22 but unsuccessful, suggesting the bears have flipped the amount into resistance.

The bears pulled the cost underneath the immediate support at $2,883 on April 25 however the lengthy tail around the day’s candlepower unit shows that bulls are strongly buying at ‘abnormal’ amounts. If buyers propel the cost over the 20-day EMA ($3,045), the ETH/USDT pair could rise to $3,200 and after that rally towards the 200-day SMA ($3,477).

On the other hand, when the cost turns lower in the mental level at $3,000, it’ll claim that bears still sell at greater levels. When the pair slips below $2,797, the happy couple could drop towards the upward trend line.

BNB/USDT

BNB broke underneath the immediate support at $391 on April 25 however the lengthy tail around the day’s candlepower unit implies that bulls are purchasing at ‘abnormal’ amounts.

When the cost sustains and closes above $391, the bulls will make an effort to push the BNB/USDT pair over the 20-day EMA ($411). When they succeed, the happy couple could rally towards the overhead resistance at $445.

On the other hand, when the cost turns lower in the current level or even the 20-day EMA and breaks below $382, it’ll claim that bears can sell on rallies. That may pull the happy couple towards the strong support at $350. The downsloping 20-day EMA and also the relative strength index (RSI) within the negative zone claim that bears come with an edge.

XRP/USDT

Ripple (XRP) broke underneath the strong support at $.69 on April 25, indicating the range-bound action has resolved in support of the sellers. The 20-day EMA ($.74) has switched lower and also the RSI is close to the oversold territory, indicating that bears have been in command.

When the cost sustains below $.69, the XRP/USDT pair could drop towards the immediate support at $.62. When the cost rebounds off this level but doesn’t rise back above $.69, it’ll claim that bears have flipped the amount into resistance. That will raise the chance of a drop towards the strong support at $.54.

On the other hand, when the cost appears and increases back above $.69, it’ll claim that the markets have rejected the low levels. The happy couple could on the other hand make an effort to break over the 50-day SMA ($.78).

SOL/USDT

Solana’s (SOL) tight range buying and selling resolved towards the downside and also the cost has tucked towards the support type of the climbing funnel. It is really an important level to keep close track of.

If bears sink and sustain the cost underneath the funnel, the selling could intensify and also the SOL/USDT pair could slide towards the strong support at $75. The downsloping 20-day EMA ($104) and also the RSI within the negative territory indicate that bears have been in control.

On the other hand, when the cost rebounds from the current level with strength, it’ll claim that bulls still defend this support with vigor. The buyers will on the other hand attempt to push the happy couple over the 20-day EMA. When they do this, the happy couple could rise toward $122.

LUNA/USDT

Terra’s LUNA token tucked underneath the 20-day EMA ($91) on April 23 however the bears couldn’t utilize this advantage. This means that selling dries up at ‘abnormal’ amounts.

The 20-day EMA ($91) is flat and also the RSI is simply over the midpoint, indicating an account balance between demand and supply.

When the cost breaks over the 50-day SMA ($94), the bulls can make another make an effort to obvious the overhead hurdle at $100. When they succeed, the LUNA/USDT pair could start its march toward the all-time high at $119.

The total amount could tilt in support of the sellers when the cost turns lower in the 50-day SMA and plummets below $87. That may pull the happy couple towards the strong support at $75.

ADA/USDT

Cardano (ADA) continues to be stuck inside a wide range between $.74 and $1.26 within the last a few days. This means that traders buy close to the support then sell near to the resistance from the range.

After neglecting to mix over the resistance at $1.26 on April 4, the ADA/USDT pair continues to be declining toward the support from the range. The downsloping 20-day EMA ($.95) and also the RSI within the negative territory indicate that bears have been in control.

The happy couple broke underneath the support at $.87 on April 25 clearing the road for any possible drop to $.74. This level will probably attract strong buying through the bulls. In the event that happens, the bulls will attempt to push the happy couple over the 20-day EMA. When they manage to achieve that, it’ll claim that the number-bound action may go on for a couple of more days.

Related: Could XRP cost lose another 70% by Q3?

AVAX/USDT

Avalanche (AVAX) broke and closed underneath the upward trend line on April 21, which invalidated the potential climbing triangular pattern. The bears pressed upon their advantage and pulled the cost close to the strong support at $65.

The lengthy tail on April 25’s candlepower unit shows that bulls are purchasing the dips near $65. They’ll now chance a relief rally, that could hit a wall in the 20-day EMA ($77).

When the cost turns lower out of this resistance, it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will make yet another make an effort to sink the cost below $65.

On the other hand, a rest over the 20-day EMA will claim that the AVAX/USDT pair could remain range-bound between $65 and $99 for many additional time.

DOGE/USDT

Dogecoin (DOGE) broke underneath the 50-day SMA ($.13) on April 24 and also the bears pulled the cost towards the strong support at $.12 on April 25. The bulls bought this dip strongly and also have pressed the cost back over the 50-day SMA.

If buyers sustain the cost over the 20-day EMA ($.14), the DOGE/USDT pair could make an effort to rally to $.15 and then towards the strong overhead resistance at $.17. The 200-day SMA ($.17) is positioned just above this level, therefore, the bears are anticipated to mount a powerful defense at $.17.

Alternatively, when the cost turns lower and breaks underneath the 50-day SMA, it’ll claim that bears are reluctant to surrender plus they still sell on rallies. The more the cost sustains underneath the 50-day SMA, the higher the chance of a drop towards the mental level at $.10.

Us dot/USDT

Polkadot (Us dot) switched lower in the overhead resistance at $19 on April 24 and also the bears are trying to build this advantage and sink the cost underneath the immediate support at $17.

When they manage to achieve that, the Us dot/USDT pair could decline towards the strong support at $16. The downsloping 20-day EMA ($19) and also the RSI in negative territory indicate that bears possess the upper hands.

Unlike this assumption, when the cost appears in the current level, the bulls can make yet another make an effort to obvious the overhead hurdle. A rest and shut over the 50-day SMA ($19) could obvious the road for any possible rally to $23.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.