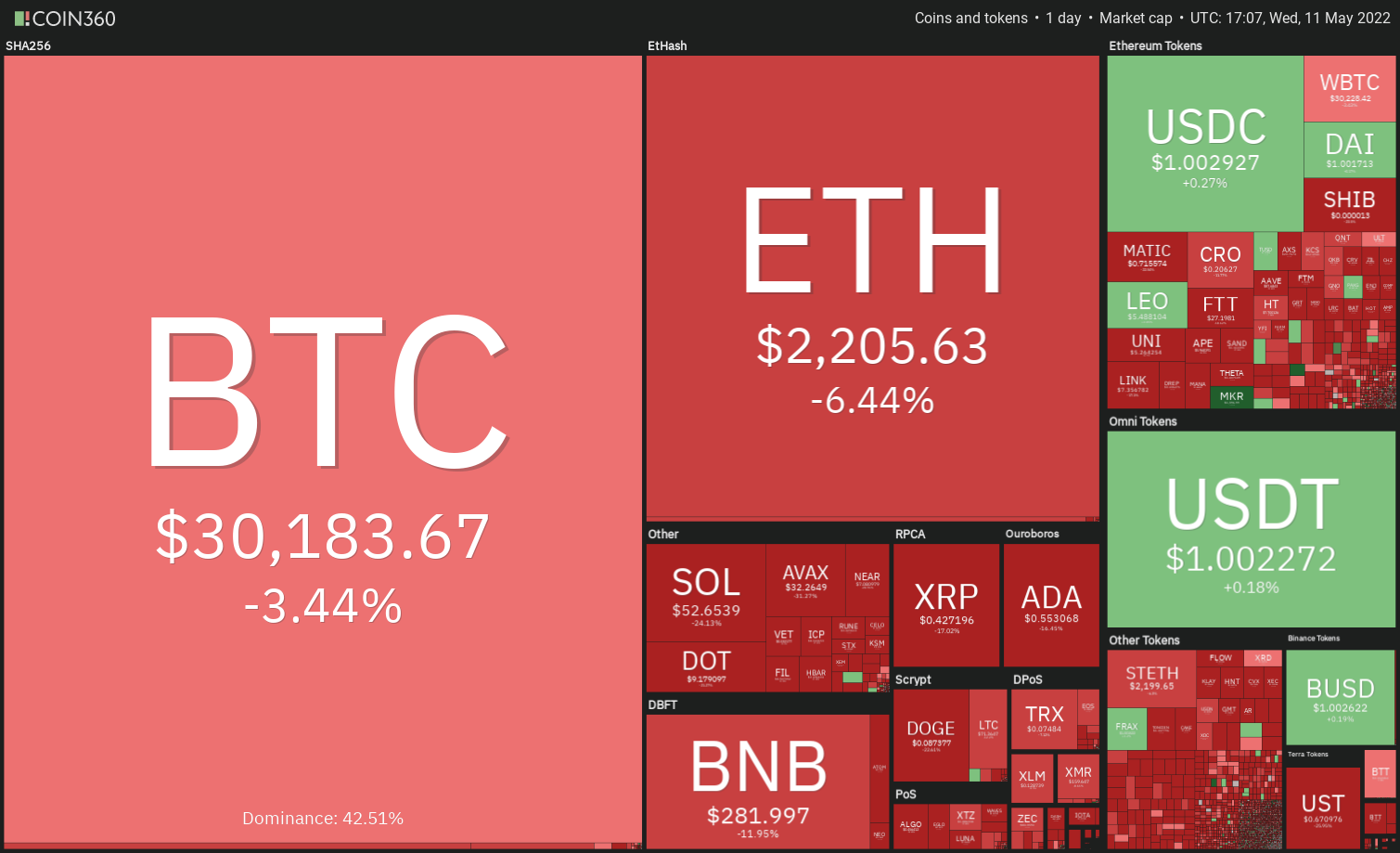

The crisis with Terra’s stablecoin TerraUSD (UST) and also the freefall in Terra’s LUNA token has dented crypto sentiment further. Although Terraform Labs Chief executive officer Do Kwon announced a relief plan, the city doesn’t appear too hopeful concerning the revival.

Another hindrance to some quick improvement in sentiment would be that the U . s . States Consumer Cost Index soared 8.3% from last year, outpacing estimates by .2%. Even though the figures really are a tad bit less than March’s 8.5% print, the slow deceleration suggests no rest from more tightening through the U.S. Fed.

Even though the screen looks frightening during capitulation, additionally, it offers among the best occasions to visit from the herd and accumulate essentially strong cryptocurrencies in a bargain. Traders shouldn’t be in a rush to trap a falling knife but wait for a cost to stabilize and also the capitulation to finish before choosing inside a phased manner.

Do you know the key amounts of Bitcoin (BTC) and major altcoins that may attract buyers? Do you know the key resistance levels around the upside that could advise a potential trend change? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin fell dramatically on May 9 and attempted a recovery in the mental level at $30,000 on May 10. The lengthy wick around the day’s candlepower unit implies that bears will not decrease plus they still sell on minor rallies.

The bears attempted to construct upon their advantage on May 11 however the bulls are protecting the critical level at $28,805 with all of their might. It is really an important level to take into consideration if it cracks, the selling could intensify. The BTC/USDT pair could then slide to $25,000 and then to $20,000.

Although downsloping moving averages indicate benefit to sellers, the relative strength index (RSI) within the oversold territory shows that a relief rally or consolidation can be done.

When the cost increases in the current level, it might achieve the 20-day exponential moving average (EMA) ($36,214). It is really an important level to keep close track of if the cost turns lower from this, the bears will again make an effort to sink the happy couple below $28,805.

Alternatively, if bulls push the cost over the 20-day EMA, the happy couple could rally towards the 50-day simple moving average (SMA) ($40,792).

ETH/USDT

Ether (ETH) has arrived at a powerful support level at $2,159. The bulls will probably mount a powerful defense only at that level if the support cracks, the selling could get momentum.

When the bounce sustains, the bulls will attempt to push the cost towards the 20-day EMA ($2,698). Inside a downtrend, the bears usually attempt to stall the relief rallies in the 20-day EMA, hence this becomes an essential level to take into consideration.

When the cost turns lower in the 20-day EMA, it’ll claim that sentiment remains negative and traders still sell on rallies. The bears will on the other hand make an effort to sink the ETH/USDT pair below $2,159. When they succeed, the happy couple could plummet to $2,000 and then to $1,700.

BNB/USDT

Binance Gold coin (BNB) observed a clear, crisp fall on May 9 and broke underneath the strong support at $320. The bulls attempted to push the cost back over the breakdown level on May 10 however the bears didn’t relent.

The bears started again their selling on May 11 and pulled the BNB/USDT pair underneath the immediate support at $289. If sellers sustain the cost below $289, the happy couple get momentum and plummet to $250 and then to $225. The buyers are anticipated to mount a powerful defense within this support zone.

Alternatively, when the cost appears in the current level, the bulls will again attempt to propel and sustain the happy couple above $320. When they succeed, it’ll indicate the markets have rejected the low levels. The happy couple could then rise to $350.

XRP/USDT

Ripple (XRP) observed a difficult fight between your bulls and also the bears close to the $.50 level. Although bears pulled the cost below $.50 on May 9, the bulls reclaimed the amount on May 10.

The bears finally overpowered the bulls on May 11 and started again the downtrend. The XRP/USDT pair dropped towards the strong support at $.40 in which the bulls are trying to arrest the decline.

When the cost appears in the current level, the bulls will again make an effort to propel the happy couple over the overhead resistance zone between $.50 and $.55. On the other hand, when the cost slips below $.40, the happy couple could witness further selling and drop to $.34.

ADA/USDT

Cardano (ADA) tumbled underneath the strong support at $.74 on May 9, indicating the resumption from the downtrend. The buyers attempted a recovery on May 10 but unsuccessful to carry onto greater levels.

The selling started again on May 11 and also the ADA/USDT pair dipped underneath the immediate support at $.58. When the cost sustains below this level, the happy couple could drop towards the mental level at $.50 and after that to $.40.

On the other hand, when the cost increases in the current level, the bulls will attempt to push the happy couple back over the breakdown level at $.74 and also the 20-day EMA ($.77). When they succeed, the recovery could get momentum and also the pair may rally towards the critical resistance at $1.

SOL/USDT

Solana (SOL) dropped and closed underneath the strong support at $75 on May 9. This signaled the beginning of the following leg from the downtrend. The bulls attempted capture the aggressive bears by pushing the cost back over the breakdown level at $75 on May 10 however the bears held their ground.

The selling started again on May 11 and also the bears pulled the cost underneath the mental support at $50. When the cost sustains below $50, the SOL/USDT pair could extend its decline to $44 and after that to $40.

On the other hand, when the cost appears in the current level, the bulls can make another make an effort to propel the happy couple above $75. When they manage to achieve that, the happy couple could rally towards the 20-day EMA ($83).

It is really an important level to take into consideration just because a break and shut above it might signal the bulls are during the game. The happy couple could then rally towards the 50-day SMA ($101).

DOGE/USDT

Dogecoin (DOGE) broke underneath the support at $.12 on May 9 and nosedived towards the mental level at $.10. The buyers attempted to begin a recovery on May 10 but hit a wall in the breakdown level at $.12.

The bears ongoing their selling and pulled the cost underneath the crucial support at $.10 on May 11. When the cost sustains below $.10, the DOGE/USDT pair could extend its decline towards the strong support zone between $.06 and $.04. The bulls will probably defend this support zone with vigor.

If bulls push the cost back above $.10 rapidly, it’ll suggest strong accumulation at ‘abnormal’ amounts. The buyers will attempt to drive the happy couple over the 20-day EMA ($.12). When they succeed, it’ll claim that the bears might be losing their grip.

Related: Avalanche drops 30% on fears Terra’s LFG will dump AVAX next

Us dot/USDT

Polkadot (Us dot) stepped to mental support at $10 on May 9 and attempted a recovery on May 10 however the lengthy wick around the day’s candlepower unit shows selling at greater levels.

The selling started again on May 11 and bears pulled the cost underneath the strong support at $10. If bears sustain the breakdown, it’ll suggest the beginning of the following leg from the downtrend. The Us dot/USDT pair could then extend its decline to $7.

On the other hand, when the cost appears in the current level and increases back above $10, it’ll indicate strong buying at ‘abnormal’ amounts. If bulls sustain the cost above $10, the potential of a rally to $14 increases.

AVAX/USDT

Avalanche (AVAX) stepped underneath the critical support at $51 on May 9 signaling the resumption from the downtrend. The buyers attempted to push the cost back over the breakdown level on May 10 however the lengthy wick around the candlepower unit implies that bears flipped the $51 level into resistance.

The AVAX/USDT pair started again its decline on May 11 and dropped underneath the crucial support at $32 however the lengthy tail around the candlepower unit shows strong buying at ‘abnormal’ amounts. The bulls are anticipated to protect the $32 level strongly if the support gives way, the selling could intensify and also the pair may drop to $18.

When the cost increases in the current level, the buyers will again attempt to push the happy couple towards the breakdown level at $51. A rest and shut above this level may be the first sign the downtrend might be weakening.

SHIB/USDT

Shiba Inu (SHIB) have been declining progressively within the last couple of days. The momentum selected on May 9 and also the cost tucked underneath the critical support at $.000017. This signaled the resumption from the downtrend.

The buyers bought the dip near $.000013 and pressed the cost back over the breakdown level at $.000017 on May 10. However, the lengthy wick around the day’s candlepower unit implies that bears can sell at greater levels and trying to switch $.000017 into resistance.

When the cost sustains below $.000013, the selling could intensify and also the SHIB/USDT pair could decline towards the mental level at $.000010. The buyers will need to push and sustain the cost over the 20-day EMA ($.000020) to point the selling pressure might be weakening.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.