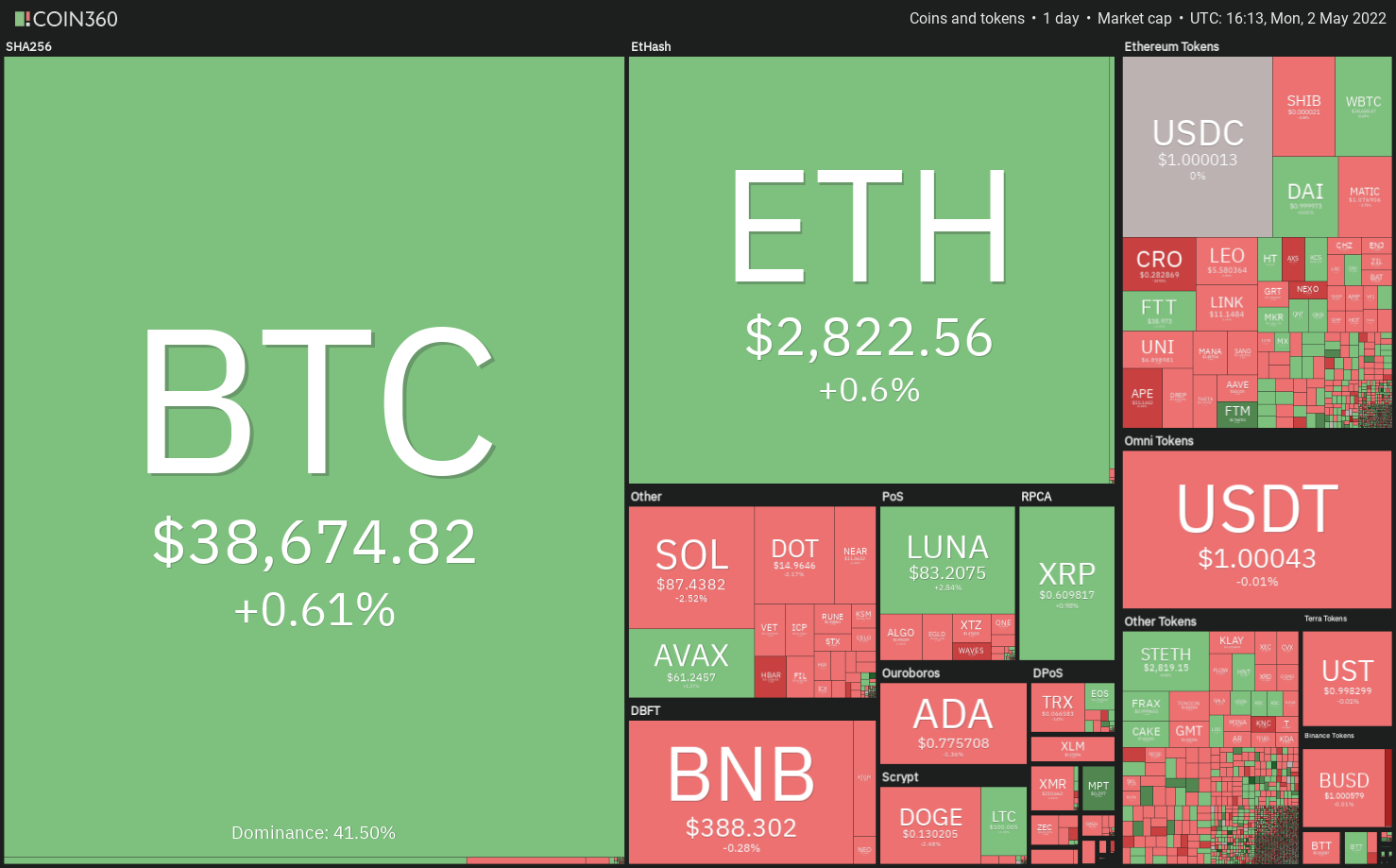

The U.S. equity markets opened up on the tentative note on May 2 however a minor positive would be that the crypto markets brought by Bitcoin (BTC) are holding above their immediate support levels. The cost action within the next couple of days is going to be determined through the results of the government Open Markets Committee (FOMC) on May 4.

When the Given springs an adverse surprise, the markets could interact with a knee-jerk response to the down-side. However, when the policy meets market expectations, the equity and crypto markets could chance a recovery.

If history would repeat itself, Bitcoin could witness a sizable relocate the month of May. Based on data from on-chain analytics platform Coinglass, Bitcoin rose greater than 50% in May on two occasions previously nine years, once in 2019 and the other in 2017.

Compared, the worst fall is at 2021 when Bitcoin stepped by greater than 35%. Thinking about the elevated volatility since 2017, traders should be prepared for a potential roller-coaster ride.

Could Bitcoin and altcoins sustain the recovery? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin bounced from the support type of the climbing funnel on May 1, indicating the bulls are purchasing the dips for this level. The buyers will make an effort to push the cost over the 20-day exponential moving average (EMA)($39,824).

When they manage to achieve that, it’ll claim that the bears might be losing their grip. The positive divergence around the relative strength index (RSI) also shows that the bearish momentum might be reducing.

Over the 20-day EMA, the BTC/USDT pair could rally towards the 50-day simple moving average (SMA) ($41,970). A rest and shut above this level could obvious the road for any rally towards the 200-day SMA ($47,154).

On the other hand, when the cost once more turns lower in the 20-day EMA, it’ll claim that bears still sell on every minor rally. That may boost the prospects of the break underneath the funnel.

In the event that happens, the selling momentum could increase and also the pair could plummet to $34,300 and then to $32,917.

ETH/USDT

Ether (ETH) began a recovery on May 1 however the bears have been in no mood to forget about their advantage. The lengthy wick on May 2’s candlepower unit shows that bears still sell close to the 20-day EMA ($2,939).

The bears will attempt to sink the cost towards the upward trend line. It is really an important level to keep close track of just because a break and shut below it might obvious the road for any possible decline to another support at $2,450.

On the other hand, when the cost appears in the current level or rebounds from the upward trend line, it’ll claim that the bulls are attempting to keep your climbing triangular pattern intact. A rest and shut over the 50-day SMA ($3,059) could open the doorways for any possible up-proceed to the 200-day SMA ($3,451).

BNB/USDT

BNB turned lower in the 50-day SMA ($411) on April 29 and broke underneath the support at $391 on April 30. The buyers tried to push the cost back above $391 on May 1 but they are facing selling at greater levels.

When the cost turns lower in the current level or even the 20-day EMA ($401), it’ll claim that the sentiment remains negative and traders can sell near overhead resistance levels. That may obvious the road for any possible drop towards the strong support at $350.

This negative view could invalidate for the short term when the bulls push and sustain the cost over the 50-day SMA. When they do this, the BNB/USDT pair could rally to $431 and then attempt an up-proceed to the 200-day SMA ($469).

SOL/USDT

Solana (SOL) broke underneath the support type of the climbing funnel on April 29, invalidating the pattern. The selling ongoing on April 30 and also the cost dipped to $82.

The buyers tried to push the cost into the funnel on May 1 however the lengthy wick around the day’s candlepower unit shows that bears offered at greater levels.

When the cost does not climb into the funnel, the SOL/USDT pair could decline towards the strong support at $75. It is really an important level for that bulls to protect since the failure to do this may resume the downtrend.

Around the upside, a rest and shut over the 50-day SMA ($103) will claim that the bears might be losing their grip.

XRP/USDT

Ripple (XRP) plummeted underneath the $.62 support on April 29 and also the bears extended the decline to $.56 on April 30. The cost rebounded on May 1 indicating buying at ‘abnormal’ amounts.

The bulls are presently attempting to push the cost over the breakdown level at $.62. When they succeed, the recovery could achieve the 20-day EMA ($.68).

It is really an important level to keep close track of if the cost turns lower out of this level, it’ll claim that the bears are active at greater levels. The happy couple will then drop towards the strong support at $.55. A rest below this support could open the doorways for any drop to $.50.

Alternatively, if bulls drive the cost over the 20-day EMA, the happy couple could rise towards the 50-day SMA ($.76). This type of move will claim that the XRP/USDT pair could consolidate in a wide range between $.55 and $.91 soon.

LUNA/USDT

Terra’s LUNA token bounced from the strong support at $75 on May 1, indicating the bulls are attempting to defend this level. However, the bears are unlikely to surrender easily because they will attempt to stall the recovery in the downtrend line.

When the cost turns lower in the downtrend line, the bears can make another make an effort to pull the LUNA/USDT pair below $75. When they succeed, the happy couple could develop a bearish mind and shoulders pattern.

The bulls will endeavour to arrest the decline in the 200-day SMA ($70) but when this support cracks, the selling could get momentum and also the pair may plummet to $50.

On the other hand, a rest and shut over the downtrend line could claim that the bears might be losing their grip. That may obvious the road for any possible rally towards the mental resistance at $100.

ADA/USDT

Cardano (ADA) dropped towards the strong support at $.74 on April 30, signaling that bears remain in check. The cost rebounded from the support on May 1 however the bulls are battling to sustain the greater levels.

This means that bears can sell on every minor rally. The bears will attempt to sink and sustain the cost underneath the strong support at $.74. When they manage to achieve that, the selling could accelerate and also the ADA/USDT pair may resume its downtrend. The following support around the downside where buying may emerge is $.68.

Unlike this assumption, when the cost appears in the current level or rebounds off $.74, the bulls will attempt to push the happy couple over the 20-day EMA ($.87). In the event that happens, the happy couple could chance a rally to $1.

Related: XRP cost rebounds after worst month since June 2021 — major recovery ahead?

DOGE/USDT

Dogecoin (DOGE) tucked underneath the 50-day SMA ($.13) on April 29 however the bears couldn’t challenge the strong support at $.12. This means that bulls still buy at ‘abnormal’ amounts.

The buyers tried to push the cost over the 50-day SMA on May 1 however the bears weren’t prepared to relent. This means the DOGE/USDT pair could oscillate between your 20-day EMA ($.13) and $.12 for any couple of days.

If bears sink the cost below $.12, the happy couple could drop towards the mental support at $.10. The bulls are anticipated to protect this level with vigor. Alternatively, if bulls drive the cost over the 20-day EMA, the potential of a rally to $.17 increases.

AVAX/USDT

Avalanche (AVAX) broke underneath the strong support at $65 on April 29 and adopted that track of another lower move ahead April 30. The buyers began a recovery on May 1 and therefore are presently trying to push the cost back over the breakdown level at $65.

The sellers will endeavour to switch the $65 level into resistance. When they do this, the AVAX/USDT pair could extend the decline towards the strong support at $51.

It is really an important level for that bulls to protect just because a break and shut below it might intensify selling. The happy couple will then resume its downtrend and plummet to another major support at $32.

On the other hand, if bulls push the cost above $65, the happy couple may rise towards the 20-day EMA ($70). A rest and shut above this level will claim that the selling pressure might be reducing. That may keep your pair range-bound between $51 and $99 for a while.

Us dot/USDT

Polkadot (Us dot) stepped underneath the $16 support on April 30 and arrived at the critical support at $14. A small positive would be that the cost bounced off $14 on May 1, indicating buying through the bulls.

The rebound is facing selling in the breakdown degree of $16 because the bears are attempting to switch the prior support into resistance. When the cost does not go above $16, the potential of a rest below $14 increases. In the event that happens, the Us dot/USDT pair could resume its decline and plunge towards the mental level at $10.

To invalidate this view, the bulls will need to push and sustain the cost over the 20-day EMA ($17). When they manage to achieve that, the happy couple may rise to $19 in which the bears may again pose a powerful challenge.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.