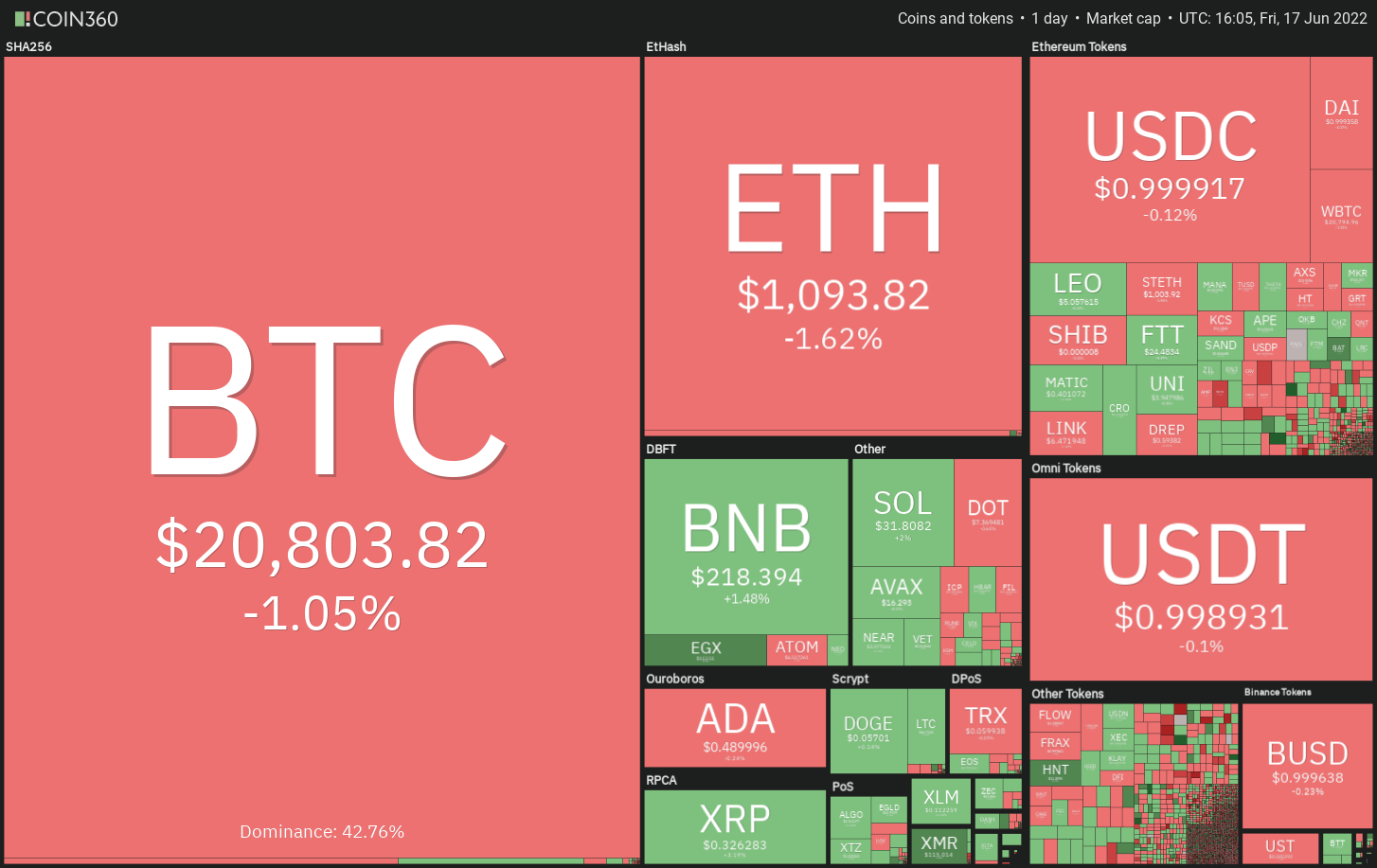

The sharp fall in cryptocurrencies has pulled the entire crypto market capital below $900 billion. Based on CoinGoLive, 72 from the top-100 tokens have declined more than 90% using their all-time highs. Compared, the very best-10 coins have outperformed throughout the fall, shedding typically 79% using their all-time high.

Bitcoin (BTC) is lower greater than 70% from the all-time high however the bulls are battling to arrest the decline. Jurrien Timmer, director of worldwide macro of Fidelity, highlighted that Bitcoin might be “cheaper of computer looks” thinking about the metric of cost-to-network ratio, which has similarities towards the cost-to-earnings ratio utilized in the equities sell to value a regular.

Millionaire investor Mark Cuban stated within an interview with Fortune that projects without valid business prospects will vanish as bear markets possess a cleansing effect available on the market. However, he added that innovation within the crypto sector will probably continue throughout the market downturn.

Could Bitcoin and major altcoins hold their particular support levels? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The bulls are trying to keep Bitcoin over the mental support of $20,000 but they’re facing strong resistance at $23,362. This means the bears haven’t quit and they still sell on rallies.

The more time spent near $20,000, the higher the chance of a rest below it. If bears sink the cost below $20,000, the BTC/USDT pair could witness panic selling. That may pull the cost to $17,500 after which to $16,000.

The main one ray of expect the buyers would be that the relative strength index (RSI) has dipped into deeply oversold levels. This means that the relief rally can be done for the short term. If bulls drive the cost above $23,362, the happy couple could rally towards the 20-day exponential moving average ($26,574).

ETH/USDT

Ether (ETH) is within a strong bear grip. The bulls bought the dip to $1,014 on June 15, as seen in the lengthy tail around the day’s candlepower unit. However, the recovery was short-resided because the bears pulled the cost back below $1,100 on June 16.

If bears sink the cost below $1,000, the selling pressure could accelerate and also the ETH/USDT pair could plummet to $900. Even though the downsloping moving averages indicate benefit to bears, the deeply oversold level around the RSI shows that a relief rally might be nearby.

The bulls will need to push and sustain the cost above $1,268 to begin a sustained recovery. Above this level, the happy couple could rise towards the 20-day EMA ($1,547) in which the bears may again mount a powerful resistance.

BNB/USDT

Binance Gold coin (BNB) is consolidating close to the crucial support of $211 since June 13. The bulls began a recovery on June 15 however that fizzled out at $237 on June 16.

When the cost slips underneath the $211 to $198 support zone, the BNB/USDT pair could start the following leg from the downtrend. The happy couple could then slide to $186 and then plummet toward the strong support at $150.

However, when the cost rebounds from the $211 support, the buyers will attempt to propel the happy couple above $237. When they succeed, the happy couple could rally towards the 20-day EMA ($265). It is really an important level to take into consideration just because a break and shut above it’ll claim that the happy couple might have bottomed out.

ADA/USDT

Cardano (ADA) bounced off $.44 on June 14 and bulls pressed the cost towards the 20-day EMA ($.54) on June 15. The bears defended this level strongly and also the cost switched lower on June 16.

The cost is stuck between your 20-day EMA and $.44 however this tight range buying and selling is not likely to carry on for lengthy. If buyers propel the cost over the 20-day EMA, the ADA/USDT pair could rally towards the 50-day simple moving average ($.59). A rest above this level could open the doorways for any potential rally towards the overhead zone between $.69 and $.74.

Alternatively, when the cost turns lower and plummets below $.44, it’ll claim that bears are during the game. A rest and shut below $.40 could start the following leg from the downward move.

XRP/USDT

Ripple (XRP) bounced off $.29 on June 14 and arrived at $.35 on June 15 which switched out to become a stiff resistance. The buyers are again trying to push the cost above $.35.

When they manage to achieve that, the XRP/USDT pair could rally towards the breakdown degree of $.38. It is really an important level to keep close track of just because a break and shut above it might obvious the road for any possible rally towards the 50-day SMA ($.44). The positive divergence around the RSI signifies the bears might be losing their grip.

Unlike this assumption, when the cost turns lower in the current level and slips below $.29, it’ll suggest the resumption from the downtrend. The following support on however $.24.

SOL/USDT

Solana (SOL) attempted a recovery on June 15 which hit an obstacle in the breakdown degree of $35. The cost switched lower on June 16 however the bulls are trying to defend the amount at $30.

The buyers can make yet another make an effort to push the cost over the overhead zone between $35 and also the 20-day EMA ($37). When they succeed, the SOL/USDT pair could rally towards the 50-day SMA ($52).

On the other hand, when the cost turns lower in the overhead zone, it’ll claim that bears still sell at resistance levels. The bears will attempt to sink the happy couple below $26 and resume the downtrend. The following support on however $22 after which $20.

DOGE/USDT

Dogecoin (DOGE) is consolidating inside a downtrend. The buyers defended the mental level at $.05 and attempted a relief rally on June 15 but they couldn’t sustain the greater levels. This means that bears still sell on rallies

The buyers are trying to arrest the decline near $.06 on Next Month. When they succeed, the DOGE/USDT pair could resume its recovery.

A rest over the June 15 intraday high could obvious the road for any possible rally towards the 20-day EMA ($.07). If bulls overcome this barrier, the DOGE/USDT pair could rally towards the 50-day SMA ($.09).

Unlike this assumption, when the cost turns lower and breaks underneath the critical support at $.05, it’ll suggest the beginning of the following leg from the downtrend. The happy couple could then decline to $.04.

Related: Bitcoin whale support lines as trader states $14K ‘most bearish’ BTC cost target

Us dot/USDT

Polkadot (Us dot) rallied dramatically on June 15 and arrived at the 20-day EMA ($8.62) however the bulls couldn’t overcome this resistance. This signifies that bears are active at greater levels.

The cost switched lower dramatically on June 16 and it has dropped close to the critical support zone between $7.30 and $6.36. The buyers are anticipated to protect this zone strongly just because a failure to do this could resume the downtrend toward $4.23.

When the cost rebounds from the support zone, it’ll suggest accumulation at ‘abnormal’ amounts. The buyers will make yet another make an effort to push the cost over the 20-day EMA. When they manage to achieve that, the Us dot/USDT pair could rally towards the 50-day SMA ($10.54).

LEO/USD

UNUS SED LEO (LEO) is constantly on the trade within the climbing down funnel. The bears pulled the cost underneath the moving averages on June 15 but unsuccessful to increase the decline towards the support line.

The buyers are trying to push the cost back toward the moving averages. When the cost turns lower out of this resistance, it might boost the prospects of the retest from the support type of the funnel. A rest and shut below this level could intensify selling.

On the other hand, if buyers push the cost over the moving averages, the LEO/USD pair could rise towards the resistance line. It is really an important level for that bears to protect just because a break and shut above it might suggest the beginning of a brand new up-proceed to $6.25.

AVAX/USDT

Avalanche (AVAX) is consolidating inside a downtrend and also the bulls are trying to defend the support at $14.50. The buyers attempted to push the cost toward the breakdown degree of $21.35 on June 16 however the greater levels still attract selling.

When the cost turns lower and breaks below $14.50, it might signal the beginning of the following leg from the downtrend. The AVAX/USDT pair could then decline to $13.

On the other hand, if bulls effectively defend the $14.50 support, the happy couple might make another make an effort to rise to $21.35. It is really an important level to take into consideration since the bears will attempt to switch it into resistance and pull the happy couple lower to $14.50.

The buyers will need to push and sustain the cost over the 20-day EMA ($21.94) to signal a possible trend change.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.