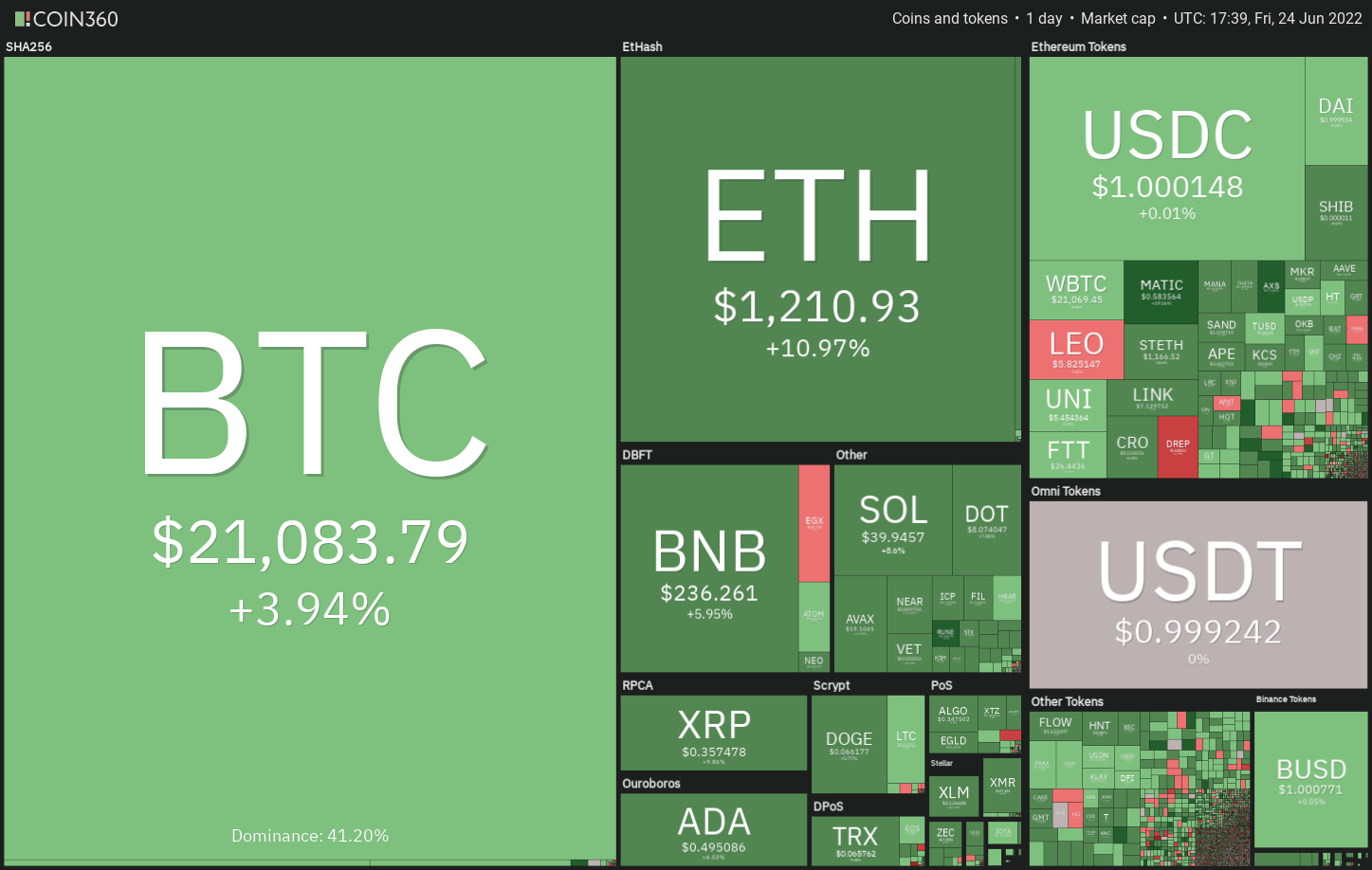

The U . s . States equity markets and also the cryptocurrency space are witnessing a relief rally now. Supporting the increase in dangerous assets may be the U.S. dollar index (DXY), which retreated from the multi-year high. Generally, cryptocurrencies move inverse towards the cost from the U.S. dollar, however this week’s bounce doesn’t always imply that bulls’ grip within the market originates for an finish.

Citing on-chain data, CryptoQuant senior analyst Julio Moreno, stated that Bitcoin (BTC) miners might have already capitulated. Historic data suggests that miner capitulation usually precedes market bottoms.

Another on-chain metric that signifies that Bitcoin’s cost might have arrived at a beautiful level may be the Mayer Multiple. The metric is calculated by dividing the cost of Bitcoin through the 200-day moving average value. It suggests whether Bitcoin is overbought, undervalued or fairly priced. On June 22, the indicator’s studying was .5 and based on crypto entrepreneur Kyle Chasse, Bitcoin’s cost has dipped below this studying only on 3% of buying and selling days.

Several on-chain indicators are suggesting that Bitcoin may bond with a bottom. Let’s read the charts from the top-10 cryptocurrencies to discover exactly what the technicals suggest!

BTC/USDT

Bitcoin is wanting a recovery inside a downtrend however the bulls are battling to push the cost towards the 38.2% Fibonacci retracement degree of $23,024. This means that demand dries up at greater levels.

The very first hurdle for that bulls will probably be $21,723 and so the 20-day exponential moving average (EMA ($23,529). During strong downtrends, bears sell on rallies for this level. Hence, it is really an important level to keep close track of.

When the cost turns lower dramatically in the 20-day EMA, it’ll claim that the bears have been in command. The sellers will make another make an effort to sink the BTC/USDT pair towards the crucial level at $17,622.

On the other hand, if buyers propel the cost over the 20-day EMA, it’ll claim that the bears might be losing their grip. That may open the doorways for any possible rally towards the 50-day simple moving average (SMA) ($27,995).

ETH/USDT

Ether (ETH) have been buying and selling between $1,200 and $1,050 since June 20. This tight range buying and selling resolved towards the upside on June 24 as bulls make an effort to push the cost towards the 20-day EMA ($1,332).

This level will probably attract strong resistance in the bears. When the cost turns lower dramatically in the 20-day EMA, it’ll claim that the sentiment remains negative and traders can sell on rallies.

The bears will attempt to pull the cost to $1,050. A rest and shut below this support could retest the vital support at $881.

Alternatively, if bulls drive the cost over the 20-day EMA, the probability of a rally towards the breakdown degree of $1,700 increases.

BNB/USDT

The bears attempted to drag BNB below $211 on June 22 however the bulls held their ground. This began a relief rally that hareached the 20-day EMA ($243).

If bulls push the cost over the 20-day EMA, it will raise the possibility the break below $211 might have been a bear trap. The BNB/USDT pair could then rally towards the 50-day SMA ($284) in which the bears may again mount a powerful resistance.

Another possibility would be that the cost turns lower dramatically in the 20-day EMA. In the event that happens, the bears will attempt to drag the happy couple below $211 and challenge the June 18 intraday low of $183. A rest below this support could indicate the beginning of a downtrend to $150.

XRP/USDT

The tight range buying and selling in Ripple (XRP) resolved towards the upside having a break over the 20-day EMA ($.35) on June 24. This means the bears might be losing their grip.

The buyers attempted to propel the cost over the 50-day SMA ($.40) on June 24 however the lengthy wick around the day’s candlepower unit shows that bears still defend the amount strongly. When the cost turns lower and breaks underneath the 20-day EMA, the XRP/USDT pair could drop to $.35.

Unlike this assumption, when the cost appears and breaks over the 50-day SMA, it’ll suggest the beginning of a brand new up-move. The happy couple could first rally to $.46 and then suggest a touch toward $.56.

ADA/USDT

Cardano (ADA) continues to be oscillating between your 20-day EMA ($.50) and also the strong support of $.44 within the last couple of days however this tight range buying and selling is not likely to carry on for lengthy.

The RSI continues to be progressively climbing greater, suggesting the bearish momentum might be weakening. That improves the prospects of the break over the moving averages. In the event that happens, the ADA/USDT pair could climb toward $.70.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears are protecting the amount strongly. The sellers will attempt to pull the happy couple underneath the strong support zone of $.44 to $.40 and resume the downtrend.

SOL/USDT

Solana (SOL) switched lower in the 20-day EMA ($36) on June 22 however the bears couldn’t sustain the low levels. The bulls purchased the dip and pressed the cost back over the 20-day EMA on June 23.

If bulls sustain the cost over the 20-day EMA, the SOL/USDT pair could rise towards the 50-day SMA ($45). The flattish 20-day EMA and also the RSI close to the midpoint claim that the bears might be losing their grip. A rest and shut over the 50-day SMA will indicate the downtrend might be over.

Unlike this assumption, when the cost does not sustain over the 20-day EMA, it’ll claim that bears are active at greater levels. If sellers pull the cost below $33, the happy couple could slide to $27.

DOGE/USDT

Dogecoin (DOGE) continues to be buying and selling close to the 20-day EMA ($.06) since June 21. This means the bulls aren’t closing their positions because they anticipate a rest over the 20-day EMA.

The RSI continues to be progressively rising toward the midpoint and also the 20-day EMA is flattening out, which implies the bulls try a comeback.

If bulls thrust the cost over the 20-day EMA, the DOGE/USDT pair could rally towards the 50-day SMA ($.08) in which the bears may again pose a powerful challenge. The bulls will need to obvious this hurdle to spread out the doorways for any possible up-proceed to $.10.

Alternatively, when the cost turns lower in the 20-day EMA, the bears will attempt to drag the happy couple below $.06 and challenge the mental support at $.05.

Related: Bitcoin gives ‘encouraging signs’ — Watch these BTC cost levels next

Us dot/USDT

Polkadot (Us dot) bounced from the $7.30 support on June 23, indicating that bulls are trying to form a greater low. The cost has arrived at the 20-day EMA ($8.15), which is a vital barrier for that bulls to beat.

The RSI has risen above 45 and also the 20-day EMA is flattening out. This means the bearish momentum might be weakening. If bulls push the cost over the moving averages, the Us dot/USDT pair could chance a rally towards the overhead resistance at $12.44.

This level may again behave as a powerful resistance and when the cost turns lower from this, the happy couple could remain stuck between $12.44 and $7.30 for any couple of days. The bears will need to sink the cost underneath the $7.30 to $6.36 support zone to point the beginning of the following leg from the downtrend.

SHIB/USDT

The bears attempted to drag the cost underneath the 20-day EMA ($.000009) on June 22 however the bulls held their ground. Shiba Inu (SHIB) rebounded from the 20-day EMA on June 23 however the buyers couldn’t push the cost over the 50-day SMA ($.000011).

The 20-day EMA has flattened out and also the RSI is simply over the midpoint, indicating equilibrium between consumers. This balance could tilt in support of the bulls when they propel the cost over the 50-day SMA. The SHIB/USDT pair could then rally towards the overhead resistance at $.000014.

On the other hand, when the cost turns lower and plummets underneath the 20-day EMA, it’ll claim that bears have acquired top of the hands. The happy couple could then slide to $.000008.

LEO/USD

UNUS SED LEO (LEO) frequently rose over the resistance type of the climbing down funnel between June 22 and 24 however the bulls couldn’t sustain the greater levels.

This means the bears are strongly protecting the resistance type of the funnel. The failure to sustain the cost over the funnel may tempt short-term traders to reserve profits.

That may pull the cost towards the 20-day EMA ($5.39). When the cost rebounds off this support, the bulls will again make an effort to push the LEO/USD pair over the funnel. When they succeed, the following stop might be $6.50 after which $6.80.

On the other hand, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that the happy couple may remain stuck within the funnel for any couple of more days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.