Bitcoin (BTC) is constantly on the exchange a variety using the local tops and bottoms coinciding with elevated whale activity in the area, based on on-chain analytics resource Whalemap.

The number-bound action in Bitcoin has stored the analysts guessing along with a couple of expect the consolidation to carry on for many additional time, while some anticipate another leg lower.

A June 6 Glassnode report stated the aggregated recognized losses from lengthy-term holders reflected greater than .006% from the market capital on May 29. This really is as compared to the peak of .015% from the market capital arrived at throughout the 2018 to 2019 bear market.

Combined with the quantum of losses, investors may also need to be ready for an extended time period of subdued prices. The duration of the present loss for lengthy-term investors is just one month old, as the previous losses continued to be roughly for any year.

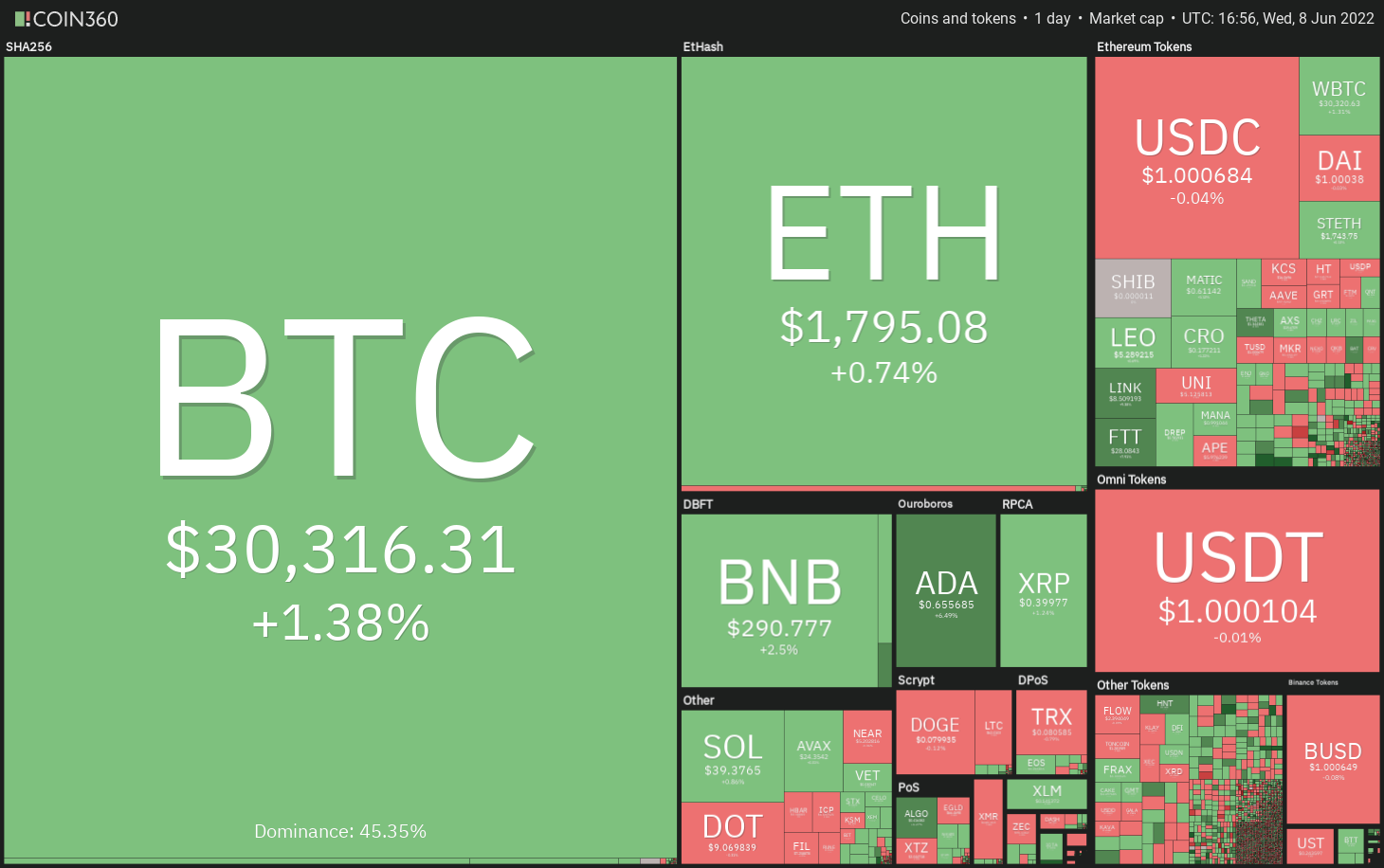

Is the lackluster buying and selling action in Bitcoin along with other major altcoins continue? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin stepped underneath the 20-day exponential moving average (EMA) ($30,565) on June 7 however a positive sign would be that the bulls strongly purchased the dip towards the trendline from the climbing triangular pattern. This led to a powerful recovery as seen in the lengthy tail around the day’s candlepower unit. The climbing triangular pattern remains intact favoring the buyers.

However, a small negative would be that the bulls couldn’t build upon the momentum on June 21. This gave an chance towards the bears who’ve again pulled the cost back underneath the 20-day EMA. This means that bears still sell within the zone between your 20-day EMA and $32,659.

If bears sink the cost underneath the trendline, the BTC/USDT pair could drop to $28,630 where buying may emerge. In the event that happens, it’ll claim that the happy couple may remain range-bound between $32,659 and $28,630 for any couple of more days.

The following directional move will probably begin away above $32,659 or below $28,630. For now, volatile range-bound action will probably continue.

ETH/USDT

Ether (ETH) switched lower in the 20-day EMA ($1,908) on June 6, indicating that bears will not cede ground towards the bulls. The sellers then attempted to sink the cost underneath the critical support of $1,700 on June 7 however the lengthy tail around the candlepower unit shows aggressive buying through the bulls close to the support.

The cost is presently coiling between your downsloping 20-day EMA and $1,700. This will probably create a range expansion that may set happens for the following directional move.

If buyers drive the cost over the 20-day EMA, the ETH/USDT pair could rally to $2,159. The bears may again mount a powerful defense only at that level. When the cost turns lower from this, the happy couple may spend time within the $2,159 to $1,700 range.

A rest above $2,159 would be the first sign the pair might have bottomed out while a rest below $1,700 could signal the resumption from the downtrend.

BNB/USDT

BNB turned lower in the resistance type of the symmetrical triangular pattern on June 6 and stepped underneath the support line. This means the bears still sell strongly at greater levels.

The bears pulled the cost underneath the immediate support at $286 on June 7 however the lengthy wick around the day’s candlepower unit shows strong buying at ‘abnormal’ amounts. The bulls are trying to push the cost back over the support line on June 21.

When they manage to achieve that, the BNB/USDT pair could attempt to go above the resistance line and trap the aggressive bears. On the other hand, when the cost turns lower in the current level, it’ll claim that the bears have flipped the support line into resistance. That may increase the potential of a drop to $265.

ADA/USDT

The lengthy wick on Cardano’s (ADA) June 6 and seven candlepower unit implies that bears can sell the rallies towards the 50-day simple moving average (SMA) ($.65). Although bears attempted to drag the cost underneath the 20-day EMA ($.58) on June 7, the bulls held their ground.

The buyers are again trying to push the cost over the 50-day SMA. When they succeed, the ADA/USDT pair could rally towards the breakdown degree of $.74. It is really an important level for that bears to protect just because a break and shut above it might advise a potential alternation in trend. The happy couple could then rally toward the mental degree of $1.

Unlike this assumption, when the cost turns lower in the 50-day SMA or $.74, the bears will endeavour to drag the happy couple underneath the 20-day EMA and gain top of the hands.

XRP/USDT

Ripple (XRP) created an outdoors-day candlepower unit pattern on June 7, using the cost rebounding from the strong support at $.38 and shutting close to the overhead resistance in the downtrend line.

However, buyers couldn’t build this move and push the cost over the downtrend line on June 21. This means that bears still sell near resistance levels. The bears will again make an effort to sink the cost below $.38.

When they succeed, the XRP/USDT pair will develop a climbing down triangular pattern. That could cause a decline towards the May 12 intraday low of $.33. If the support cracks, the following stop may be the pattern target of $.30.

This negative view might be invalidated for the short term if bulls propel the cost over the 20-day EMA. The happy couple could then rally to $.46.

SOL/USDT

Solana’s (SOL) make an effort to begin a recovery met with stiff resistance in the 20-day EMA ($45), which implies the trend remains negative and traders can sell on rallies.

The bears will attempt to drag the cost underneath the crucial support zone between $37 and $35. When they manage to achieve that, the SOL/USDT pair could resume its downtrend. The happy couple could then decline to $30.

On the other hand, when the cost rebounds from the support zone, it’ll claim that bulls are accumulating at ‘abnormal’ amounts. A rest over the 20-day EMA would be the first sign the selling pressure might be reducing. The happy couple could then rise to $50 and then to $60.

DOGE/USDT

Dogecoin (DOGE) once more switched lower in the 20-day EMA ($.08) on June 6, indicating that bears can sell on rallies. A small positive would be that the bulls purchased the dip on June 7, indicating buying at ‘abnormal’ amounts.

The DOGE/USDT pair continues to be stuck inside a tight range from the 20-day EMA and $.07, indicating uncertainty one of the bulls and also the bears. Usually, tight ranges resolve by having an expansion but it’s hard to predict the direction from the breakout.

When the cost increases over the 20-day EMA, buyers who might be waiting around the sidelines could enter and push the happy couple toward the mental degree of $.10. On the other hand, when the cost slips below $.07, the happy couple may resume the downtrend.

Related: Ethereum ‘double Doji’ pattern shows a 50% ETH cost rally by September

Us dot/USDT

Polkadot (Us dot) tried to go above the 20-day EMA ($10) on June 6 however the lengthy wick around the day’s candlepower unit shows strong selling through the bears.

The Us dot/USDT pair dipped underneath the support line on June 7, indicating the symmetrical triangular resolved in support of the sellers. The happy couple could next drop towards the strong support at $8.50 in which the buyers will attempt to stall the decline.

This negative view could invalidate for the short term when the cost appears in the current level and increases over the resistance type of the triangular. This type of move will claim that the break underneath the support line might have been a bear trap. The happy couple could then rise towards the 50-day SMA ($12.35).

AVAX/USDT

The buyers attempted to push Avalanche (AVAX) over the 20-day EMA ($28) on June 6 however the lengthy wick around the day’s candlepower unit implies that the bears are protecting the amount strongly.

The cost gets squeezed between your 20-day EMA and also the strong support at $21 however this tight range buying and selling is not likely to carry on for lengthy.

If bulls drive the AVAX/USDT pair over the 20-day EMA, it’ll suggest the beginning of a recovery that could achieve $37. The positive divergence around the relative strength index (RSI) will also support a relief rally soon.

Alternatively, when the range expands towards the downside and also the cost plummets below $21, the happy couple could resume its downtrend and drop to $18.

SHIB/USDT

The bears attempted to sink Shiba Inu (SHIB) underneath the strong support of $.000010 on June 7 however the bulls effectively defended the amount as seen in the lengthy tail around the day’s candlepower unit.

The more the cost trades underneath the 20-day EMA ($.000012), the higher the chance of a rest below $.000010. In the event that happens, the SHIB/USDT pair could drop to $.000009 in which the bulls may make an effort to stall the decline.

To invalidate the bearish view, the bulls will need to push and sustain the cost over the 20-day EMA. When they manage to achieve that, the happy couple could rally to $.000014 in which the bears will probably mount a powerful defense.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.