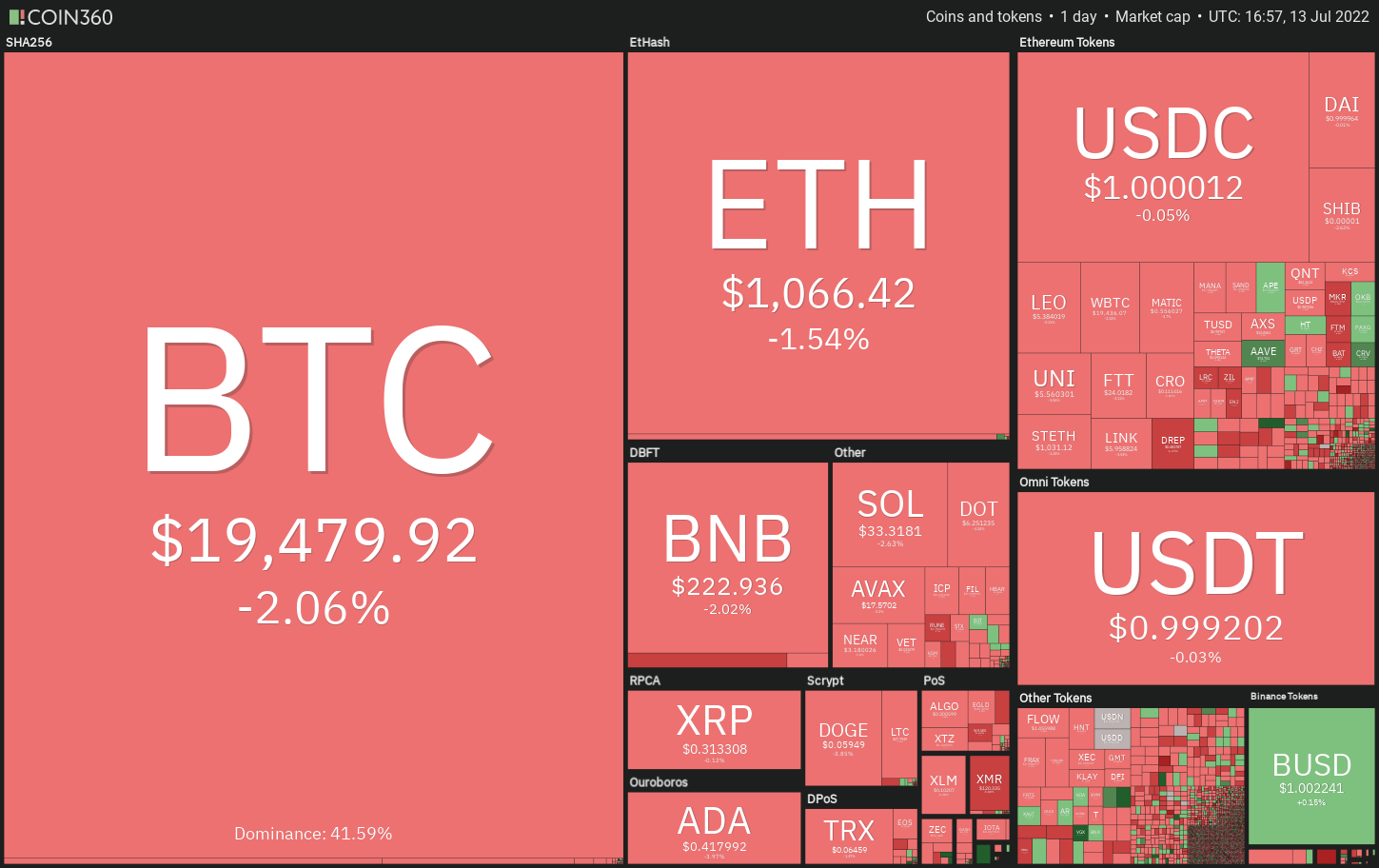

The U . s . States Consumer Cost Index soared to 9.1% in June, exceeding expectations of the 8.8% rise year-on-year. Presently, the Given funds futures indicate an 81 basis points rate hike for This summer, suggesting that some participants anticipate one hundred basis points hike.

Several on-chain indicators happen to be pointing to some likely bottom in Bitcoin (BTC) however the analysts from market intelligence firm Glassnode aren’t believing that the reduced has been created. In “The Week On-Chain” set of This summer 11, the analysts stated the market might have to fall further “to fully test investor resolve, and let the marketplace to determine a resilient bottom.”

While short term remains bearish, strategists are confident about its lengthy-term prospects. CoinShares chief strategy officer Meltem Demirors stated on CNBC that Bitcoin may extend its “downward correction” soon but it’s likely to create a new all-time high “in the following 24 several weeks.”

Do you know the important levels on Bitcoin and also the major altcoins that may arrest the decline? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin dropped to the support type of the symmetrical triangular on This summer 12, indicating the break over the triangular on This summer 7 might have been a bull trap.

The buyers are attempting to defend the amount however the lengthy wick around the This summer 13 candlepower unit implies that the bears can sell close to the 20-day exponential moving average (EMA) ($20,796). Both moving averages are sloping lower and also the relative strength index (RSI) is incorporated in the negative zone, indicating that bears have been in command.

When the cost breaks underneath the support line, the BTC/USDT pair could drop towards the $18,626 to $17,622 support zone. It is really an important zone for that bulls to protect if it provides way, the happy couple could decline to $15,000.

The very first manifestation of strength is a break and shut over the 20-day EMA. This type of move will suggest strong buying at ‘abnormal’ amounts. That may increase the potential of a rally towards the 50-day simple moving average (SMA)($24,084).

ETH/USDT

Ether (ETH) broke underneath the support type of the climbing triangular pattern on This summer 12, which invalidated the bullish setup. A small positive would be that the bulls are attempting to push the cost into the triangular.

When they manage to achieve that, it’ll claim that the break underneath the triangular might have been a bear trap. The bulls will make an effort to push the cost back over the overhead resistance at $1,280. A rest and shut over the 50-day SMA ($1,383) could boost the prospects of the beginning of a brand new up-move.

Unlike this assumption, when the cost turns lower in the support line, it’ll claim that bears have flipped the amount into resistance. The sellers will attempt to sink the ETH/USDT pair below $998 and challenge the pivotal support at $881. If the support cracks, the happy couple could start the following leg from the downtrend.

BNB/USDT

The bulls couldn’t take advantage of BNB‘s break over the 20-day EMA ($231). This failure was exploited through the bears who offered strongly at greater levels and pulled the cost back underneath the 20-day EMA on This summer 11.

The BNB/USDT pair attempted a rebound from the strong support at $211 on This summer 13 however the lengthy wick around the candlepower unit implies that the bears can sell close to the 20-day EMA. When the cost breaks below $211, the selling could intensify and also the pair may slide towards the vital support at $183.

On the other hand, when the cost rebounds off $211 and increases over the 20-day EMA, it’ll suggest strong demand at ‘abnormal’ amounts. The buyers will make another make an effort to obvious the overhead hurdle in the 50-day SMA ($253).

XRP/USDT

Ripple (XRP) stepped underneath the support type of the symmetrical triangular on This summer 11. This signifies the uncertainty one of the bulls and also the bears resolved towards the downside.

The bulls attempted to push the cost into the triangular on This summer 13 however the lengthy wick around the candlepower unit shows that bears can sell on minor intraday rallies. When the cost breaks below $.30, the XRP/USDT pair could drop towards the crucial support at $.28. A rest and shut below this level could signal the beginning of the following leg from the downtrend.

The very first manifestation of strength is a break and shut over the 20-day EMA ($.33). This type of move will claim that the slide underneath the triangular might have been a bear trap. The happy couple may signal a possible trend change away over the resistance type of the triangular.

ADA/USDT

Cardano (ADA) tucked underneath the immediate support at $.44 on This summer 11, indicating that bears have been in command. The selling ongoing and also the bears pulled the cost towards the important support at $.40.

The buyers tried to begin a recovery on This summer 13 however the lengthy wick around the day’s candlepower unit implies that bears are attempting to switch the $.44 level into resistance. When the cost breaks below $.40, the selling could get momentum and also the ADA/USDT pair could resume the downtrend. The happy couple could then decline to $.33.

To invalidate this negative view, buyers will need to push and sustain the cost over the moving averages. In the event that happens, the happy couple could chance a rally to $.60.

SOL/USDT

Solana (SOL) broke underneath the support type of the symmetrical triangular on This summer 11 and attempts through the bulls to push the cost into the triangular unsuccessful on This summer 12.

However, the bulls haven’t quit and therefore are again attempting to push the cost into the triangular on This summer 13. When they succeed, it’ll claim that the breakdown on This summer 11 might have been a bear trap. The buyers will attempt to overcome the barrier in the resistance line and begin a brand new up-move toward $50.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance and breaks below $31, the selling could intensify and also the SOL/USDT pair could drop to $26.

DOGE/USDT

Dogecoin (DOGE) tucked underneath the 20-day EMA ($.07) on This summer 10. The bears utilized this chance and pulled the cost underneath the strong support at $.06 on This summer 12.

When the cost sustains below $.06, the selling could get momentum and also the DOGE/USDT pair could retest the critical support at $.05. It is really an important level to keep close track of just because a break below it might signal the resumption from the downtrend. The happy couple could then drop to $.04.

Alternatively, when the cost increases in the current level, the buyers will attempt to push the happy couple over the moving averages. When they succeed, the happy couple could rise to $.08 and then to $.10.

Related: Dogecoin misses bullish target after Elon Musk snubs Twitter — what’s next for DOGE cost?

Us dot/USDT

Polkadot (Us dot) broke and closed underneath the crucial support of $6.36 on This summer 12, indicating aggressive selling through the bears. A small positive would be that the RSI has maintained the positive divergence, indicating the bearish momentum might be ending.

The buyers are attempting to push the cost back above $6.36 and trap the aggressive bears. In the event that happens, the Us dot/USDT pair could rally towards the overhead resistance at $7.30. The buyers will need to obvious this hurdle and also the 50-day SMA ($8.04) to point the downtrend might be over.

On the other hand, when the cost does not sustain above $6.36, it’ll claim that bears stay in control. The sellers will attempt to resume the downtrend and sink the happy couple to $5.

SHIB/USDT

Shiba Inu (SHIB) dropped underneath the mental level at $.000010 on This summer 12, indicating strong selling through the bears. A small positive would be that the bulls purchased the dip and are trying to sustain the cost back above $.000010.

Both moving averages have flattened out and also the RSI is simply underneath the midpoint, indicating an account balance between demand and supply. Inside a range, traders generally buy close to the support then sell near to the resistance.

If buyers drive the cost over the moving averages, the SHIB/USDT pair could chance a rally to $.000012. The bulls will need to obvious this potential to deal with open the doorways for any possible rally to $.000014. This view could invalidate away below $.000009.

LEO/USD

The repeated failure from the buyers to sustain UNUS SED LEO (LEO) above $6 suggests too little demand at greater levels. That could have attracted selling in the aggressive bears.

The cost switched lower from $5.91 on This summer 10 and stepped underneath the 20-day EMA ($5.60). It was adopted by further selling, which pulled the cost underneath the 50-day SMA ($5.42) on This summer 12. If bears sustain the cost underneath the 50-day SMA, the LEO/USD pair could drop toward the support type of the climbing down funnel.

On the other hand, when the cost rebounds from the current level, the bulls can make another make an effort to obvious the overhead hurdle in the resistance line and challenge the important level at $6. A rest and shut above this level could signal the beginning of a brand new up-move.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.