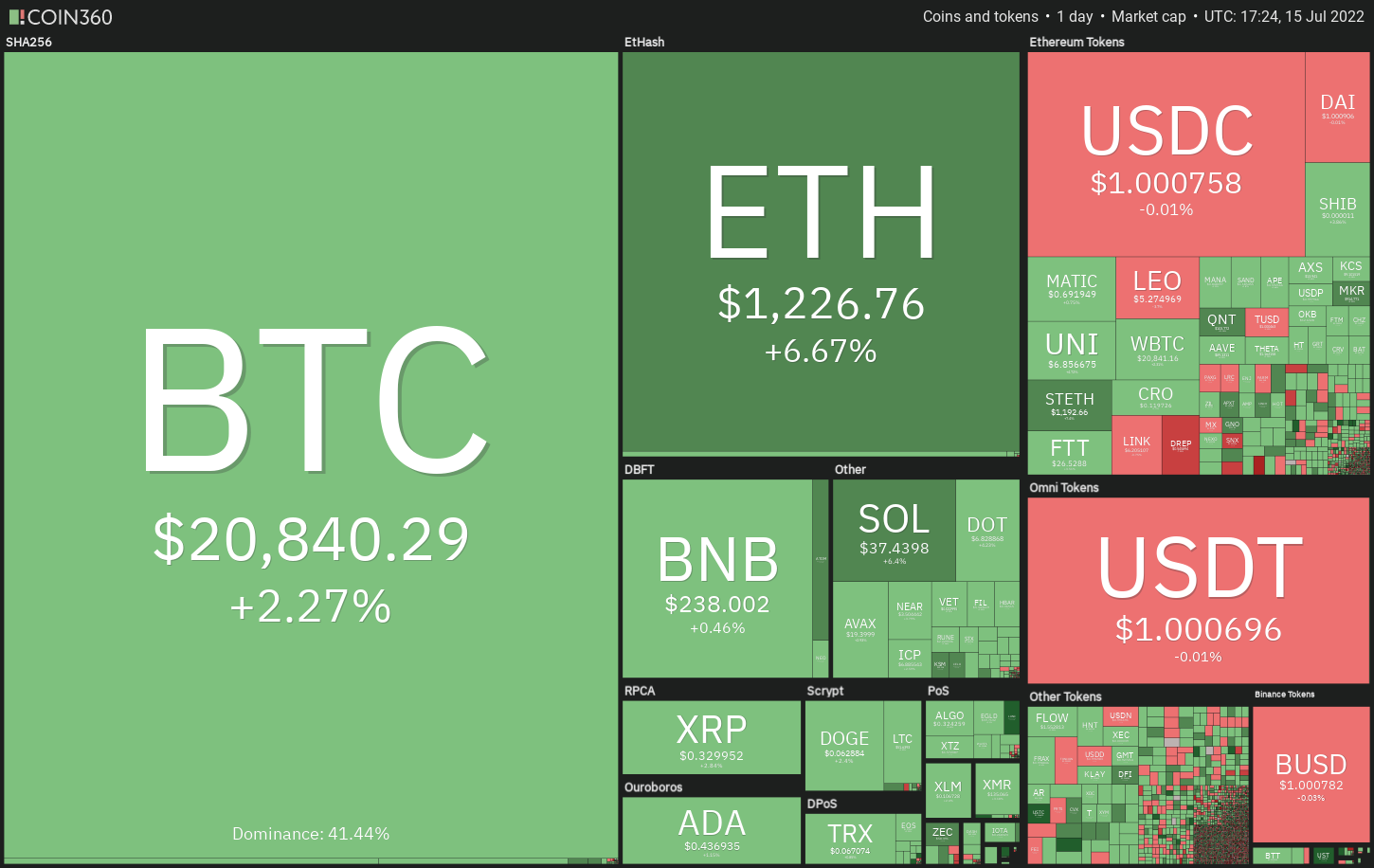

The recovery within the cryptocurrency markets has been brought by Bitcoin (BTC), that has risen over the $21,000 level. However, BlockTrends analyst Caue Oliveira stated that on-chain data shows a decline in “whale activity” because the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse.

Market research conducted in China implies that most participants think that Bitcoin could fall much further. About 40% from the participants stated they’d buy Bitcoin when the cost dropped to $10,000. Only 8% from the voters demonstrated curiosity about buying Bitcoin whether it drops to $18,000.

Uniform investor Kevin O’Leary told Cointelegraph that crypto markets will probably witness “massive volatility” and enter a condition of “total panic” before entering an faster growth phase. He stated that companies operated by “idiot managers” will face heat, however that can lead to an upswing of more powerful companies.

Could greater levels still witness aggressive selling through the bears? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin tucked underneath the support type of the symmetrical triangular on This summer 13, however the bears couldn’t sustain the low levels. This means the bulls purchased the dip and also have pressed the cost towards the 20-day exponential moving average (EMA) ($20,842).

The bulls will need to sustain the cost over the 20-day EMA to point the bears might be losing their grip. Over the 20-day EMA, the recovery could include the 50-day simple moving average (SMA) ($23,753).

A rest and shut above this resistance could indicate the BTC/USDT pair might have bottomed out.

This positive view could invalidate when the cost turns lower in the current level and breaks underneath the support line. This type of move could increase the probability of a retest from the crucial support zone between $18,626 and $17,622

ETH/USDT

Ether (ETH) broke underneath the support type of the climbing triangular pattern on This summer 12 however the bears couldn’t sustain the low levels. The cost switched up from $1,006 and re-joined the triangular on This summer 13. This means the break underneath the triangular might have been a bear trap.

The buyers will attempt to propel the cost over the overhead resistance at $1,280 and also the 50-day SMA ($1,358). When they succeed, the ETH/USDT pair could begin a rally to the pattern target of $1,679. The bears are anticipated to pose a powerful challenge in the breakdown degree of $1,700.

Another possibility would be that the cost turns lower from $1,280. For the reason that situation, the happy couple could again drop towards the support type of the triangular. The bears will need to sink the happy couple below $998 to achieve top of the hands.

BNB/USDT

BNB rebounded from the strong support at $211 on This summer 13, indicating that bulls are purchasing the dips for this level. The relief rally broke over the 20-day EMA ($233) on This summer 14 and also the bulls will endeavour to push the cost towards the 50-day SMA ($250).

The 20-day EMA has flattened out and also the relative strength index (RSI) is incorporated in the positive territory, indicating that bulls take presctiption a comeback. A rest and shut over the 50-day SMA could boost the likelihood the BNB/USDT pair has bottomed out at $183. That may begin a northward march toward $300.

Alternatively, when the cost turns lower in the 50-day SMA and slips underneath the 20-day EMA, the happy couple could drop to $211. That could keep your pair range-bound between $211 and $250 for any couple of more days. A rest and shut below $211 could obvious the road for any possible retest from the critical support at $183.

XRP/USDT

Ripple (XRP) rebounded from the strong support at $.30, indicating that bulls are protecting the amount with vigor. On This summer 15, the recovery arrived at the downtrend line, that is serving as a formidable barrier.

When the cost breaks and sustains underneath the 20-day EMA ($.33), it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will make yet another make an effort to pull the cost towards the strong support at $.30.

If the level gives way, the XRP/USDT pair could develop a climbing down triangular pattern. That may signal the resumption from the downtrend.

On the other hand, when the cost appears in the current level and increases over the downtrend line, it’ll invalidate the climbing down triangular pattern. The failure of the bearish pattern is generally a bullish sign as it might result in short covering through the aggressive bears. The happy couple could then rise to $.45.

ADA/USDT

Cardano (ADA) bounced from the crucial support at $.40 on This summer 13 indicating that bulls are trying to defend the amount. The relief rally has arrived at the 20-day EMA ($.46), that could behave as a stiff resistance.

When the cost turns lower dramatically in the 20-day EMA, the potential of a rest below $.40 increases. That may start the following leg from the downtrend, that could sink the ADA/USDT pair to $.33.

On the other hand, if bulls push the cost over the moving averages, it’ll claim that the downtrend might be weakening. The happy couple could then rally to $.54 in which the bears may again pose a powerful challenge.

SOL/USDT

Solana (SOL) broke underneath the triangular on This summer 11 however the bears couldn’t take advantage of this advantage and pull the cost underneath the immediate support at $31. The cost switched around from $32 on This summer 13 and it has risen over the moving averages.

The buyers will endeavour to push and sustain the cost over the resistance type of the triangular. When they succeed, it’ll claim that the SOL/USDT pair might have created a minimal at $25. The happy couple could then start an up-move toward $48.

The moving averages are near finishing a bullish crossover and also the RSI is incorporated in the positive territory, indicating that bulls possess a slight edge. To invalidate this positive view, the bears will need to pull the cost below $31.

DOGE/USDT

Dogecoin (DOGE) dipped underneath the immediate support at $.06 on This summer 12 but designed a strong recovery and rose back over the level on This summer 13. This means that bulls are purchasing on dips.

The buyers will make an effort to push the cost over the overhead resistance in the moving averages. When they succeed, the DOGE/USDT pair could rally toward $.08 after which toward $.09.

On the other hand, when the cost turns lower in the moving averages, it’ll claim that bears stay in control. The sellers will on the other hand make an effort to sink the happy couple towards the crucial support at $.05. A rest and shut below this level could suggest the beginning of the following leg from the downtrend.

Related: Bitcoin has become in the longest-ever ‘extreme fear’ period

Us dot/USDT

Polkadot (Us dot) dropped underneath the strong support of $6.36 on This summer 12 but rebounded off $6 on This summer 13. This means the bulls are trying to trap the aggressive bears.

The cost has arrived at the 20-day EMA ($7.02), that could behave as a powerful resistance. If buyers drive the cost above this level, the probability of a rally towards the 50-day SMA ($7.94) increases. A rest above this resistance could claim that the Us dot/USDT pair might have bottomed out.

Unlike this assumption, when the cost turns lower in the 20-day EMA, the bears can make yet another make an effort to sink the cost below $6. When they manage to achieve that, the happy couple could start its downward move toward $5.

SHIB/USDT

Shiba Inu (SHIB) dipped below $.000010 on This summer 12 however the ‘abnormal’ amounts attracted strong buying through the bulls. That propelled the cost back over the mental degree of $.000010 on This summer 13.

The buyers have pressed the cost over the 20-day EMA ($.000010) on This summer 15, which opens the gates for any possible rise towards the overhead resistance at $.000012. This level could again attract strong selling through the bears.

When the cost turns lower from $.000012, the SHIB/USDT pair could again drop toward $.000010 and turn into stuck between both of these levels for any couple of more days.

However, if bulls drive the cost above $.000012, the happy couple could rise to $.000014. The progressively rising 20-day EMA and also the RSI within the positive territory indicate that bulls possess a slight edge.

AVAX/USDT

Avalanche (AVAX) has created an climbing triangular pattern which will complete away and shut over the overhead resistance at $21.35.

The 20-day EMA ($18.73) has flattened out and also the RSI reaches the midpoint, indicating an account balance between demand and supply. This balance will tilt in support of the bulls when they push and sustain the cost above $21.35. In the event that happens, the AVAX/USDT pair could rally towards the pattern target of $29.

This positive view could invalidate for the short term when the cost turns lower in the overhead resistance and breaks underneath the support line. That may invalidate the bullish setup and open the doorways for any possible drop to $13.71.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.