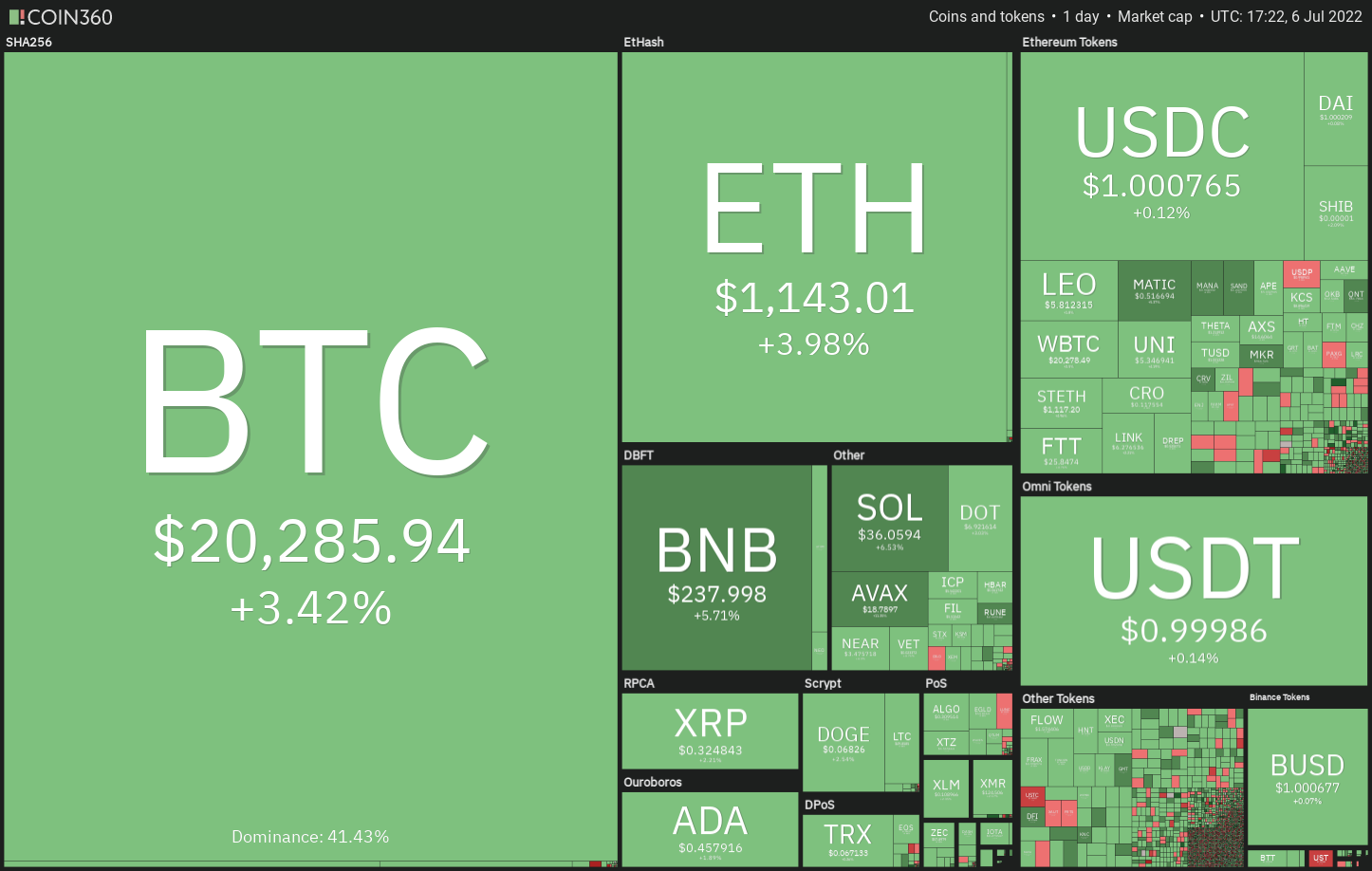

Bitcoin (BTC) is trying to go above the mental degree of $20,000 on This summer 6, an indication that bulls are attempting to stall the brutal bear market. The retail traders are taking advantage of the present fall and therefore are on the buying spree. Evidence of this originates from Glassnode data, showing that wallets holding under one Bitcoin scooped up 60,460 Bitcoin in June, at “the most aggressive rate ever.”

Inside a recent report, Glassnode analysts stated the activity around the Bitcoin network implies that “all speculative entities, and market vacationers appear to have been purged in the asset.” Which means that mostly, it’s the lengthy-term investors who’re left holding Bitcoin.

However, not everybody is bullish about Bitcoin’s prospects for the short term. Based on Arcane Research, the ProShares Short Bitcoin Strategy ETF (BITI), the very first exchange-traded fund (ETF) to become “short” Bitcoin, has elevated its short exposure “by greater than 300% a week ago.”

Is the hurry in to the first inverse Bitcoin ETF behave as a contrarian signal that signifies a potential bottom formation? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin is buying and selling in the symmetrical triangular pattern. The buyers attempted to push the cost over the resistance type of the triangular on This summer 5 however the bears held their ground.

The Doji candlepower unit pattern on This summer 5 shows indecision one of the consumers. This uncertainty could tilt in support of the bulls when the cost breaks over the triangular. In the event that happens, it’ll claim that the triangular might have acted like a reversal pattern.

The BTC/USDT pair could then rally toward the 50-day simple moving average (SMA) ($25,324) after which towards the pattern target of $26,490.

This hypothesis could end up being incorrect when the cost turns lower in the current level and plummets underneath the support type of the triangular. That may pull the cost towards the critical support at $17,622. If the support collapses, the following stop might be $15,000.

ETH/USDT

Ether (ETH) attempted a rally over the 20-day exponential moving average (EMA) ($1,186) on This summer 5 however the bears had other plans. The cost action of history couple of days has created an climbing triangular pattern which will complete away and shut above $1,280.

If buyers push the cost over the 20-day EMA, the potential of a rest above $1,280 increases. In the event that happens, the ETH/USDT pair could rally towards the 50-day SMA ($1,500) after which towards the pattern target of $1,679.

On the other hand, when the cost turns lower in the 20-day EMA and breaks underneath the support line, it’ll claim that bears stay in command. That may pull the happy couple towards the crucial support at $881. A rest and shut below this support could signal the beginning of the following leg from the downtrend.

BNB/USDT

The bulls pressed BNB above the 20-day EMA ($232) on This summer 5 however the bears posed a powerful challenge at greater levels. An optimistic sign would be that the bulls didn’t quit much ground and also have again propelled the cost over the 20-day EMA on This summer 6.

The 20-day EMA has flattened out and also the relative strength index (RSI) is close to the midpoint, indicating that bears might be losing their grip.

If buyers sustain the cost over the 20-day EMA, the BNB/USDT pair could start its rally towards the 50-day SMA ($264). This level may again behave as a resistance but when bulls overcome this barrier, it’ll claim that the happy couple might have bottomed out at $183.

Unlike this assumption, when the cost turns lower in the current level or even the 50-day SMA, it’ll indicate that bears still sell at greater levels. The bears will attempt to pull the cost to $211.

XRP/USDT

Ripple (XRP) continues to be stuck between your 20-day EMA ($.33) and also the support type of the symmetrical triangular pattern. Even though the cost rebounded from the support line on This summer 5, the bulls are battling to obvious the overhead resistance in the 20-day EMA.

The 20-day EMA is constantly on the slope lower progressively and also the RSI is incorporated in the negative zone, indicating that bears possess the upper hands. The sellers will endeavour to sink the cost underneath the support line. When they manage to achieve that, the XRP/USDT pair could slide towards the critical support at $.28.

Unlike this assumption, when the cost increases from the current level or even the support line and breaks over the 20-day EMA, the happy couple could rally towards the resistance type of the triangular. A rest and shut above this level could signal the beginning of a rally to $.48.

ADA/USDT

Cardano (ADA) remains sandwiched between your 20-day EMA ($.47) and $.44 however this tight range buying and selling is not likely to carry on for lengthy. Usually, tight ranges result in range expansions.

The very first manifestation of strength is a break and shut over the 20-day EMA. That may open the doorways for any break over the important resistance in the 50-day SMA ($.51). In the event that happens, the ADA/USDT pair could rally to $.60.

Another possibility would be that the cost turns lower and plummets below $.44. Which will indicate a benefit to bears. The happy couple could then slide towards the critical support at $.40. If the level gives way, the happy couple could resume its downtrend.

SOL/USDT

Solana (SOL) rose over the 20-day EMA ($36) on This summer 4 however the bulls couldn’t sustain the momentum. The bears pulled the cost back underneath the 20-day EMA on This summer 5.

The lengthy tail around the This summer 5 candlepower unit shows strong buying at ‘abnormal’ amounts. This increases the probability of a rest over the moving averages. In the event that happens, the SOL/USDT pair could rise to $43. A rest and shut above this level could obvious the road for any possible rally towards the mental resistance at $50.

This positive view might be negated for the short term when the cost turns lower in the current level or even the 50-day SMA ($39) and breaks below $30. That may pull the happy couple lower to $26.

DOGE/USDT

Dogecoin (DOGE) continues to be oscillating close to the 20-day EMA ($.07) within the last couple of days. This signifies uncertainty one of the consumers.

The flat 20-day EMA and also the RSI just beneath the midpoint tendency to slack a obvious advantage with the idea to the bulls or even the bears. A rest and shut over the 50-day SMA ($.07) may be the first indication that buyers possess the upper hands.

The bullish momentum could detect a rest above $.08. The DOGE/USDT pair could then rally toward the mental degree of $.10.

Another possibility would be that the cost turns lower in the current level and breaks below $.06. Which will indicate benefit to bears and also the pair may slide to $.05.

Related: Bitcoin mining stocks rebound dramatically despite a 70% stop by BTC miners’ revenue

Us dot/USDT

The bulls couldn’t push Polkadot (Us dot) over the immediate resistance at $7.30 on This summer 4. This means the cost remains stuck within the range from $7.30 and $6.36.

The failure from the bears to drag the cost lower towards the support from the range at $6.36 implies that bulls aren’t awaiting a much deeper fall to purchase. This increases the potential of a rest over the overhead resistance. In the event that happens, the Us dot/USDT pair could rally towards the 50-day SMA ($8.48). The bears will probably defend this level strongly.

Alternatively, when the cost turns lower and breaks below $6.36, it’ll signal the resumption from the downtrend. The happy couple could then slide towards the mental support at $5.

SHIB/USDT

Shiba Inu (SHIB) broke over the 50-day SMA ($.000010) on This summer 5 however the lengthy wick around the candlepower unit implies that bears can sell at greater levels. A small positive would be that the bulls aren’t allowing the cost to dip back below $.000010.

Both moving averages have flattened out and also the RSI is close to the midpoint. This doesn’t provide a obvious advantage with the idea to the bulls or even the bears.

When the cost increases and breaks above $.000011, the SHIB/USDT pair could rally to $.000012 in which the bears may again mount a powerful defense. The bulls will need to obvious this hurdle to spread out the doorways for any possible rally to $.000014.

Alternatively, when the cost turns lower and breaks below $.000009, it’ll claim that the bears have returned in charge. That may boost the prospects of the retest from the critical support at $.000007.

LEO/USD

UNUS SED LEO (LEO) is constantly on the oscillate close to the resistance type of the climbing down funnel as both bulls and also the bears attempt to gain top of the hands.

The cost once more rebounded from the 20-day EMA ($5.66) on This summer 5, indicating the bulls still defend the amount strongly. The bullish momentum could get if bulls push and shut the LEO/USD pair above $6. In the event that happens, the happy couple could rally to $6.50 after which towards the pattern target of $6.90.

On the other hand, when the cost turns lower and closes underneath the 20-day EMA, it’ll indicate the bears have overpowered the buyers. That may pull the happy couple lower towards the 50-day SMA ($5.33).

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.