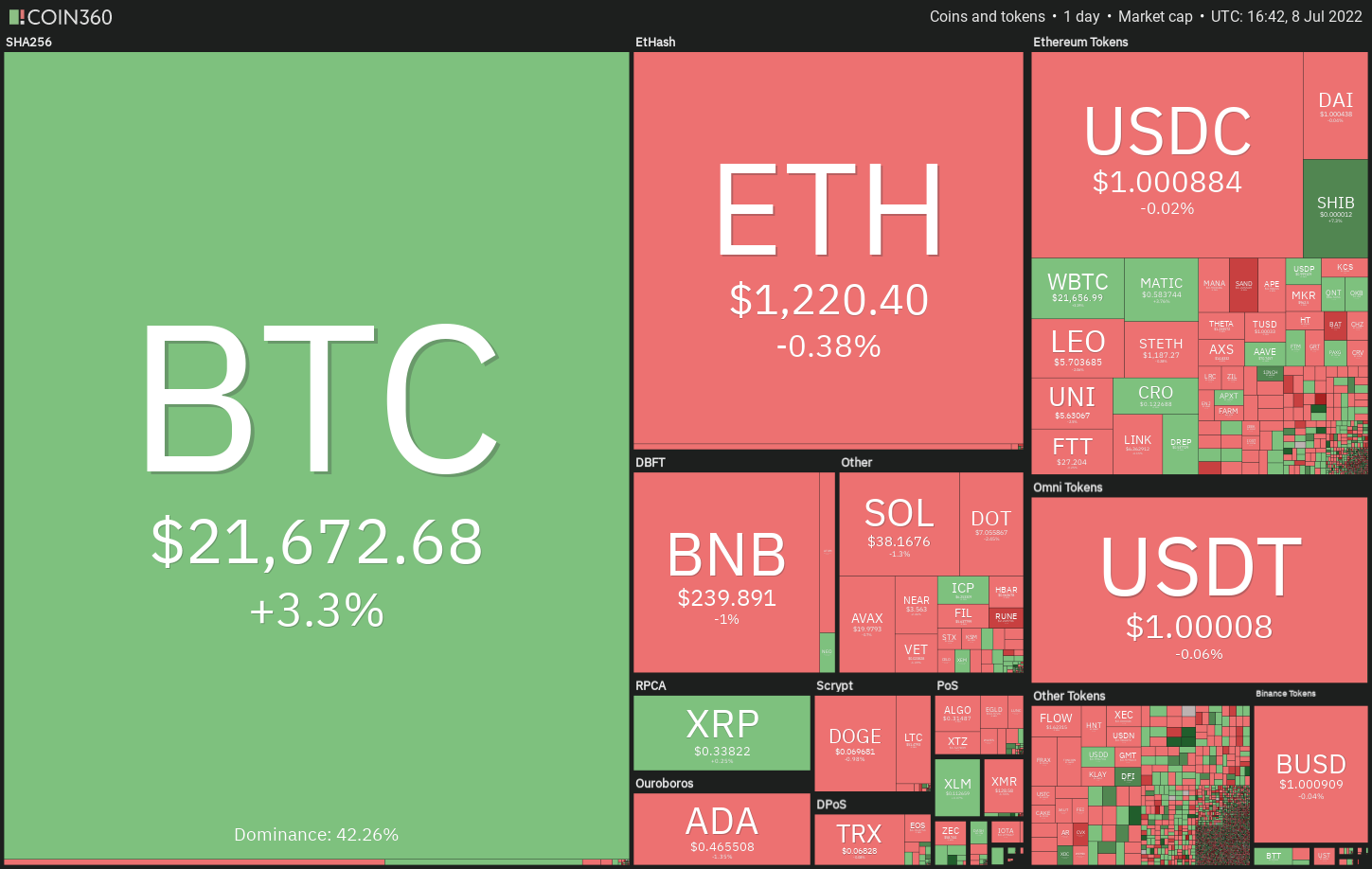

Bitcoin (BTC) rallied towards the 200-week moving average on This summer 8, an amount that may behave as a battleground between your bulls and also the bears. Several analysts are watching this level just because a break and shut above it may be the very first sign that the bear market might be ending.

Bloomberg senior commodity strategist Mike McGlone stated that Bitcoin’s 50-week and 100-week moving averages are showing similar signs as made prior to the 2018 bear market bottom. Therefore, McGlone expects Bitcoin to provide a strong rebound within the other half of 2022.

Another positive sign is the fact that Bitcoin rose above $22,000 on This summer 8 even while the U . s . States dollar index (DXY) ongoing its northward march. This means the strong inverse correlation between Bitcoin and also the DXY might be beginning to weaken.

Could Bitcoin extend its recovery pulling the crypto markets greater? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin broke over the resistance type of the symmetrical triangular and also the 20-day exponential moving average (EMA) ($21,233) on This summer 7, indicating that bulls are earning a comeback.

The flattening 20-day EMA and also the relative strength index (RSI) just beneath the midpoint claim that the selling pressure might be reducing.

When the cost rebounds from the current level or even the breakout level in the triangular, it’ll claim that the sentiment has switched positive and traders are purchasing the dips. That may increase the potential of a rally towards the 50-day simple moving average (SMA) ($25,015) after which towards the pattern target at $26,490.

This positive view could invalidate for the short term when the cost breaks back underneath the 20-day EMA and re-enters the triangular. Which will indicate aggressive selling through the bears at greater levels. The happy couple could then drop towards the support type of the triangular.

ETH/USDT

Ether (ETH) broke over the 20-day EMA ($1,198) on This summer 7 and arrived at the overhead resistance at $1,280 on This summer 8. The bears are protecting this resistance strongly and are trying to sink the cost back underneath the 20-day EMA.

When they do this, the ETH/USDT pair could drop towards the support type of the climbing triangular. It is really an important level to keep close track of just because a break and shut below it might invalidate the bullish setup. That may pull the cost lower toward the critical support at $881.

On the other hand, when the cost rebounds from the 20-day EMA and breaks above $1,280, it’ll complete the bullish climbing triangular pattern. The happy couple could then rise towards the 50-day SMA ($1,470) and then rally towards the pattern target at $1,679.

BNB/USDT

BNB broke and closed over the 20-day EMA ($233) on This summer 6 however the bulls are battling to push the cost towards the 50-day SMA ($262). This means that bears are active at greater levels.

The sellers are attempting to pull the cost back underneath the 20-day EMA. Whether they can accomplish it, the BNB/USDT pair could slide towards the strong support at $211.

However, when the cost rebounds from the 20-day EMA, it’ll claim that the sentiment is popping positive and also the bulls are purchasing on dips. The bulls will make an effort to drive the cost over the 50-day SMA and gain control. That may obvious the road for any possible rally to $300.

XRP/USDT

Ripple (XRP) attempted a rest over the resistance type of the symmetrical triangular however the bears had other plans. They strongly defended the amount and are attempting to sink the cost back underneath the 20-day EMA ($.33).

When they succeed, the XRP/USDT pair could extend its stay within the triangular for many additional time. The flattish 20-day EMA and also the RSI close to the midpoint tendency to slack a obvious advantage with the idea to buyers or sellers.

A rest and shut over the triangular could indicate the beginning of a brand new up-move. The happy couple could then rally towards the pattern target at $.48. Alternatively, a rest underneath the triangular could open the doorways for any retest at $.28.

ADA/USDT

Cardano (ADA) rose over the 20-day EMA ($.47) on This summer 8 however the bulls couldn’t sustain the greater levels. This signifies the bears are strongly protecting the moving averages.

The sellers will endeavour to construct upon their advantage by pulling the cost underneath the strong support at $.44. When they manage to achieve that, the ADA/USDT pair could drop towards the important level at $.40. A rest and shut below this support could indicate the beginning of the following leg from the downtrend.

To invalidate this bearish view, buyers will need to push and sustain the cost over the 50-day SMA ($.51). When they manage to achieve that, the happy couple could rally to $.60 after which to $.70.

SOL/USDT

The buyers tried to push Solana (SOL) over the 50-day SMA ($38.79) on This summer 5 and 6 but tend to not overcome the barrier. This means the bears can sell on rallies.

The cost gets squeezed in the symmetrical triangular. This points to the range expansion for the short term. When the cost turns lower and breaks underneath the triangular, the SOL/USDT pair could slide toward the critical support at $26.

On the other hand, when the cost appears and breaks over the resistance type of the triangular, it’ll claim that bulls possess the upper hands. The happy couple could then rally towards the mental degree of $50 in which the bears may again mount a powerful defense.

DOGE/USDT

Dogecoin (DOGE) attempted a rest over the 50-day SMA ($.07) on This summer 8 however the bears didn’t relent. The sellers are attempting to make use of the chance to sink the cost back underneath the 20-day EMA ($.07).

The RSI is close to the midpoint and also the 20-day EMA has flattened out, suggesting an account balance between consumers. This equilibrium could tilt in support of the bulls when they push and sustain the cost over the 50-day SMA. This type of move could obvious the road for any rally to $.08 and then to $.09.

On the other hand, when the cost turns lower and breaks below $.06, the bears will make an effort to pull the Us dot/USDT pair towards the vital support at $.05.

Related: DOGE times of summer time: Shiba Inu gains 40% on Dogecoin two several weeks after record lows

Us dot/USDT

Polkadot (Us dot) tried to break over the overhead resistance in the 20-day EMA ($7.38) on This summer 7 however the bears held their ground. This signifies that bears are active at greater levels.

The bears will endeavour to drag the cost toward the critical support at $6.36. It is really an important support for that bulls to take into consideration just because a break and shut below it might indicate the resumption from the downtrend. The Us dot/USDT pair could then decline towards the mental degree of $5.

This negative view could invalidate when the cost appears and increases over the 20-day EMA. In the event that happens, the happy couple could chance a rally towards the 50-day SMA ($8.38). This level may again behave as a resistance but when bulls obvious this hurdle, it might signal a possible alternation in trend.

SHIB/USDT

The tight range buying and selling in Shiba Inu (SHIB) resolved towards the upside on This summer 7 because the cost broke over the immediate resistance at $.000011. The bears attempted to sink the cost back below $.000011 on This summer 8 however the lengthy tail around the candlepower unit signifies strong buying on dips.

The buyers will endeavour to push the cost over the stiff resistance at $.000012. When they succeed, it’ll indicate demand at greater levels. The SHIB/USDT pair could then rally to $.000014 in which the bears may again pose a powerful challenge.

On the other hand, when the cost turns lower in the current level and sustains below $.000011, it’ll claim that the breakout on This summer 7 might have been a bull trap. The bears will attempt to pull the cost back underneath the critical support at $.000010. In the event that happens, the following stop might be $.000009.

AVAX/USDT

Avalanche (AVAX) continues to be buying and selling between $13.71 and $21.35 within the last couple of days, indicating a bottoming formation. The 20-day EMA ($18.78) has flattened out and also the RSI is simply over the midpoint, indicating an account balance between your bulls and also the bears.

If buyers drive the cost over the overhead resistance at $21.35, it’ll signal the beginning of a brand new up-move. The AVAX/USDT pair could rally towards the pattern target of $29 in which the bears may again mount a powerful resistance. When the cost turns lower out of this level but doesn’t drop below $21.35, it’ll claim that a bottom might have been made at $13.71.

Unlike this assumption, when the cost turns lower in the current level and breaks underneath the 20-day EMA, it’ll indicate the range-bound action may go on for a couple of more days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.