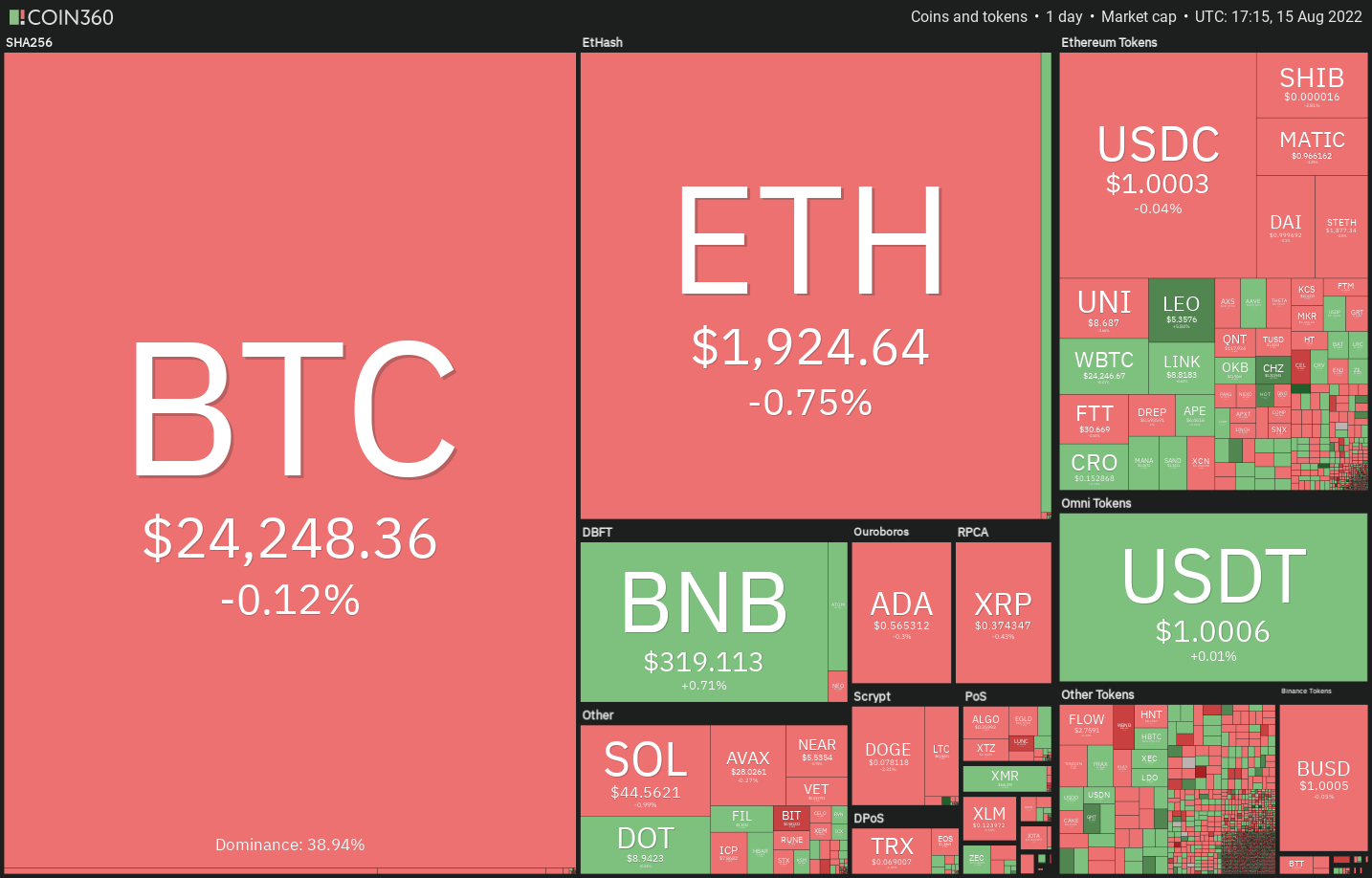

Bitcoin (BTC) continues to be witnessing a difficult fight between your bulls and also the bears close to the $25,000 level. A obvious champion might not emerge for the short term as a result of insufficient a catalyst and since there’s no major macroeconomic data scheduled with this week within the U . s . States. Data points from Asia or Europe may increase volatility, but they’re unlikely to begin a brand new directional move.

Anthony Scaramucci, founder and managing partner of Skybridge Capital, within an interview with CNBC, advised investors to ride the current uncertainty in cryptocurrencies and “stay patient and remain lengthy term.” He expects Bitcoin to reward investors hugely having a sharp upward trend within the next six years.

Combined with the concentrate on Bitcoin, investors will also be keeping an eye on Ether (ETH) in front of its Merge scheduled for Sept. 15. A whale address which had took part in the genesis ICO but had continued to be dormant for 3 years has transferred about 150,000 Ether on August. 14. It has brought to differing views with a few speculating the whale may dump his holdings following the Merge but others think that the transfers might have been completed to stake the large volume of Ether.

Could buying emerge at ‘abnormal’ amounts and resume the up-relocate Bitcoin and also the altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The bulls attempted to resume the up-relocate Bitcoin however the bears offered strongly at $25,211 and pulled the cost lower towards the 20-day exponential moving average (EMA) ($23,483). This led to the development of the outdoors-day candlepower unit pattern on August. 15.

The progressively upsloping 20-day EMA and also the relative strength index (RSI) within the positive territory indicate benefit to buyers. When the cost rebounds from the 20-day EMA, it’ll claim that bulls are purchasing the dips for this level. That may enhance the prospects of the break and shut above $24,668.

In the event that happens, the happy couple could start its northward march toward $28,000 in which the bears may again pose a powerful challenge.

Another possibility would be that the bears sink the cost underneath the 20-day EMA. In the event that happens, the happy couple could drop towards the 50-day simple moving average (SMA) ($22,037) and then towards the upward trend line.

ETH/USDT

Ether frequently rose over the mental resistance at $2,000 within the last 2 days however the bulls couldn’t sustain the greater levels. This means that bears are posing a stiff challenge only at that level.

The ETH/USDT pair could decline towards the breakout level at $1,700. It is really an important level to take into consideration if bulls switch $1,700 into support, it will raise the probability of a rest above $2,000. In the event that happens, the happy couple could rally towards the downtrend line.

The upsloping 20-day EMA ($1,756) and also the RSI within the positive territory indicate that bulls have been in control. To invalidate this bullish view, bears will need to sink and sustain the cost underneath the 20-day EMA. That may sink the happy couple towards the 50-day SMA ($1,465).

BNB/USDT

BNB‘s up-move hit a hurdle in the overhead resistance at $338. The bears will attempt to sink the cost towards the immediate support in the 20-day EMA ($306).

When the cost rebounds off this support, the buyers can make another make an effort to push the BNB/USDT pair over the $338 to $350 resistance zone. The upsloping 20-day EMA and also the RSI within the positive territory indicate the road of least resistance would be to the upside.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. In the event that happens, rapid-term traders may hurry towards the exit which could pull the happy couple towards the 50-day SMA ($266).

XRP/USDT

The bulls attempted to push XRP over the overhead resistance at $.39 on August. 13 and 14 however the bears held their ground. This might have attracted profit-booking in the short-term traders, which pulled the cost underneath the 20-day EMA ($.37).

If bears sink the cost underneath the 50-day SMA, the XRP/USDT pair could stay range-bound between $.30 and $.39 for many additional time. The flattish 20-day EMA and also the RSI close to the midpoint also advise a consolidation soon.

On the other hand, when the cost rebounds from the moving averages, it’ll indicate that ‘abnormal’ amounts are attracting buyers. The bulls will on the other hand attempt to obvious the overhead hurdle and push the happy couple to $.48 and then to $.54.

ADA/USDT

The bulls pressed Cardano (ADA) over the overhead resistance at $.55 on August. 13 but tend to not keep up with the momentum on August. 14. This means that bears are active at greater levels.

The cost switched lower on August. 15 and arrived at the breakout degree of $.55. The zone between $.55 and also the 20-day EMA ($.53) will probably attract strong buying through the bulls. When the cost rebounds off this zone, the buyers will again make an effort to resume the up-move and push the ADA/USDT pair to $.63 after which to $.70.

On the other hand, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that the break above $.55 might have been a bull trap. The happy couple could then drop towards the 50-day SMA ($.49).

SOL/USDT

Solana (SOL) rose towards the overhead resistance at $48 on August. 13 however the bulls couldn’t overcome this barrier. The bulls again attempted to obvious the overhead hurdle on August. 15 however the bears didn’t relent.

When the SOL/USDT pair breaks underneath the 20-day EMA ($42), the following stop may be the support line. It is really an important level for that bulls to protect just because a break and shut below it might invalidate the bullish climbing triangular pattern. The happy couple could then decline to $32.

On the other hand, when the cost rebounds from the 20-day EMA, the bulls will again attempt to push and sustain the happy couple above $48. When they manage to achieve that, the bullish setup will complete and also the pair could rally to $60.

DOGE/USDT

Dogecoin (DOGE) bounced from the 20-day EMA ($.07) on August. 12 and broke over the overhead resistance at $.08 on August. 14. This completed the bullish climbing triangular pattern however the bulls couldn’t sustain the breakout.

The bears offered at greater levels and pulled the cost back underneath the breakout level on August. 15. A small positive is the fact that ‘abnormal’ amounts are attracting buyers, as seen in the lengthy tail around the day’s candlepower unit. When the cost sustains above $.08, the buyers will attempt to resume the up-move and push the DOGE/USDT pair to $.10.

Unlike this assumption, when the cost slips underneath the moving averages and also the trendline from the triangular, it’ll invalidate the bullish setup. The happy couple could then sink to $.06.

Related: Crypto-focused venture firm Dragonfly acquires hedge fund: Bloomberg

Us dot/USDT

Polkadot (Us dot) rose over the overhead resistance of $9.65 on August. 13 however the bulls couldn’t sustain the greater levels. This might have enticed rapid-term traders to reserve profits.

The Us dot/USDT pair dipped underneath the breakout degree of $9 on August. 14 and also the cost arrived at the 20-day EMA ($8.63) on August. 15. It is really an important level to keep close track of just because a break below it might claim that the bullish momentum has weakened. The happy couple could then decline towards the 50-day SMA ($7.68) and remain range-bound for a while.

Alternatively, when the cost rebounds from the 20-day EMA, the bulls will attempt to obvious the overhead resistance at $9.68. When they accomplish it, the happy couple could rise to $10.80 and then to $12.44.

SHIB/USDT

Shiba Inu (SHIB) have been buying and selling above $.000012 since August. 7 however the up-move had unsuccessful to get momentum. That altered using the sharp rally on August. 14, which pressed the cost over the overhead resistance at $.000017.

However, the bears haven’t quit. They offered an upswing above $.000017 and pulled the cost back underneath the level on August. 15. The SHIB/USDT pair may find support at $.000015 after which at $.000014. When the cost rebounds off either level, the buyers will again attempt to obvious the overhead hurdle. When they succeed, the happy couple could rally to $.000022.

On the other hand, when the cost breaks below $.000014, it’ll indicate the pair could oscillate in a wide range between $.000010 and $.000018 for any couple of more days.

AVAX/USDT

Buyers attempted to push Avalanche (AVAX) over the overhead resistance on August. 13 however the bears stalled the attempt for $30.35. This means that bears are active at greater levels.

The AVAX/USDT pair could decline towards the breakout degree of $26.38, that is just over the 20-day EMA ($26.34). The bulls are anticipated to protect this level with vigor. When the cost rebounds off $26.38, it’ll suggest demand at ‘abnormal’ amounts. The happy couple could then consolidate between $26.38 and $31 for a while.

If bears sink the cost below $26.38, several aggressive bulls could get trapped. That may sink the happy couple towards the 50-day SMA ($22.39).

On the other hand, when the cost rebounds from the current level and increases above $31, it’ll suggest the beginning of a rally to $33 and then towards the pattern target of $39.05.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.