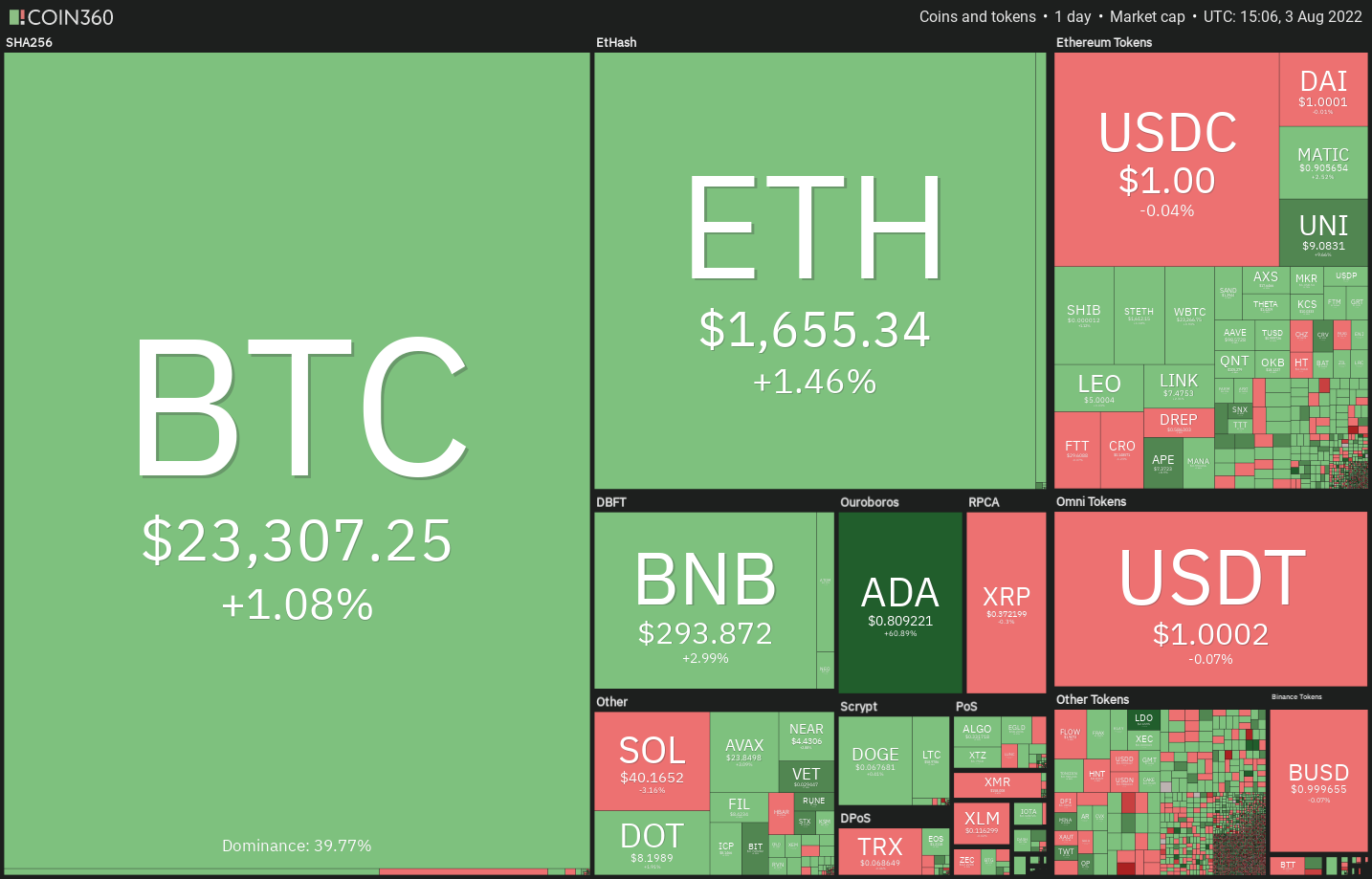

Bitcoin (BTC) and altcoins are tracking the U . s . States equities markets greater on August. 3 as traders purchase the dip.

Smaller sized investors appear to become taking advantage of the bear market in Bitcoin because the quantity of wholecoiners has soared by 40,000 because the sharp fall in June. Compared, wallet addresses using more than 1,000 Bitcoin have declined by 113 since May.

Some analysts think that Bitcoin hasn’t yet created a macro bottom, however. Buying and selling firm QCP Capital expects Bitcoin to progressively rise for the majority of the third quarter among high volatility.

They feel Bitcoin’s rally could hit a roof covering around $28,700. For that lengthy-term, the firm didn’t eliminate your final capitulation in Bitcoin close to $10,000, which might mark a bottom for that bear market.

Nonetheless, Bitcoin miners appear to stay in an upbeat mode because they elevated their Bitcoin holdings in This summer following a capitulation in June. Based on data from on-chain analytics firm CryptoQuant, Bitcoin held through the miners hit the greatest levels since.

Could Bitcoin and altcoins resume their up-move or will the recovery falter at greater levels? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin dropped towards the 20-day exponential moving average (EMA) ($22,632) on August. 2, that is serving as strong support. The progressively up-sloping 20-day EMA and also the relative strength index (RSI) within the positive territory claim that bulls possess a slight edge.

The buyers will make an effort to push the cost over the overhead resistance at $24,668. When they succeed, the BTC/USDT pair could rally to $28,000 in which the bears may mount a stiff resistance. If bulls obvious this hurdle, the rally could include $32,000.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance, it’ll claim that greater levels still attract selling in the bears. A rest and shut underneath the 20-day EMA could sink the happy couple towards the 50-day simple moving average (SMA) ($21,344) after which towards the support line.

ETH/USDT

Ether (ETH) switched lower and dropped towards the 20-day EMA ($1,545) on August. 2 however the lengthy tail around the candlepower unit shows that the bulls strongly purchased the dip.

The bulls will once more make an effort to obvious the overhead resistance zone between $1,700 and $1,785. When they succeed, it’ll indicate a possible trend change. The ETH/USDT pair could then rally to $2,000 and then to $2,200.

To invalidate this bullish view, the bears will need to sink and sustain the cost underneath the 20-day EMA. That may open the doorways for any decline towards the strong support at $1,280. A bounce off this level can keep the happy couple stuck between $1,280 and $1,700 for any couple of days.

BNB/USDT

Binance Gold coin (BNB) bounced from the $275 support on August. 2, indicating the sentiment has switched positive and traders are purchasing on dips.

The bulls will make yet another make an effort to push the cost over the overhead resistance at $300. When they succeed, the BNB/USDT pair could get momentum and rally toward the stiff overhead resistance at $350.

The increasing 20-day EMA ($268) and also the RSI within the positive territory indicate the road to least resistance would be to the upside. This bullish view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA.

XRP/USDT

The lengthy tail on XRP’s August. 3 candlepower unit signifies that bulls are trying to defend the 20-day EMA ($.36). The progressively up-sloping 20-day EMA and also the RSI within the positive territory indicate a small benefit to buyers.

If bulls push the cost over the $.39 to $.41 resistance zone, the XRP/USDT pair could signal the beginning of a brand new up-move. The happy couple could then rally to $.48 in which the bears may again mount a powerful defense.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance, the potential of a rest underneath the 20-day EMA increases. In the event that happens, the happy couple may continue its range-bound action for any couple of more days.

ADA/USDT

Cardano (ADA) continues to be stuck in a wide range between $.40 and $.55 within the last couple of days. The bulls are presently trying to defend the moving averages.

When they succeed, the ADA/USDT pair could climb towards the overhead resistance at $.55. This remains an essential level to take into consideration. If bulls overcome this barrier, the happy couple could rally to $.63 and then onto $.70.

Alternatively, when the cost breaks underneath the moving averages, the happy couple could slide towards the immediate support at $.45. A bounce off this level could form a brand new tighter range from $.45 and $.55 while a rest below $.45 could obvious the road for any drop to $.40.

SOL/USDT

Solana (SOL) dipped underneath the 20-day EMA ($40) on August. 2 and dropped towards the 50-day SMA ($37) on August. 3. The lengthy tail around the candlepower unit shows that traders are protecting the support line.

If bulls push and sustain the cost over the 20-day EMA, the SOL/USDT pair could progressively ascend to $48. It is really an important level to keep close track of just because a break and shut above it might complete the climbing triangular pattern which has a target purpose of $71.

On the other hand, when the rebound lacks strength, the bears will endeavour to sink the happy couple underneath the support line. When they manage to achieve that, the bullish setup is going to be negated and also the pair may slide to $31.

DOGE/USDT

The bulls are trying to arrest Dogecoin’s (DOGE) pullback in the 50-day SMA ($.07). When the rebound sustains over the 20-day EMA ($.07), a retest of $.08 can be done.

The bulls will need to push and sustain the cost above $.08 to signal the conclusion of the climbing triangular pattern. In the event that happens, the DOGE/USDT pair could rally to $.10 after which towards the pattern target at $.11.

On the other hand, when the rebound lacks strength, it’ll claim that demand dries up at greater levels. That may pull the cost lower towards the trendline support. A rest and shut below this level could invalidate the bullish setup.

Related: Lido DAO: Ethereum’s greatest Merge staker just leaped 30% — will LDO rally into September?

Us dot/USDT

Polkadot (Us dot) switched lower in the overhead resistance and dipped towards the 20-day EMA ($7.70) in which the bulls are attempting to stall the pullback.

The progressively up-sloping 20-day EMA and also the RSI within the positive territory indicate that bulls possess a slight edge. If bulls propel the cost over the overhead resistance at $9, the Us dot/USDT pair could rally to $10.80 after which to $12.

Alternatively, when the cost turns lower in the current level or even the overhead resistance and breaks underneath the moving averages, it’ll claim that the happy couple may extend its stay within the range from $6 and $9 for any couple of more days.

MATIC/USDT

Polygon (MATIC) bounced from the 20-day EMA ($.84) on August. 2, indicating that bulls are purchasing on dips. The cost could next retest the $.98 to $1.01 overhead resistance zone.

Even though the developing negative divergence around the RSI warrants caution, the up-sloping moving averages indicate benefit to buyers. If bulls obvious the overhead resistance zone, the MATIC/USDT pair could rally to $1.26.

On the other hand, when the cost turns lower and breaks underneath the 20-day EMA, the happy couple could drop towards the strong support at $.75. A clear, crisp rebound off this level can keep the happy couple range-bound between $.75 and $1 for any couple of days.

AVAX/USDT

The bears attempted to sink Avalanche (AVAX) underneath the 20-day EMA ($22.71) on August. 2 however the bulls held their ground. This signifies that traders are viewing the dips like a buying chance.

The bulls will endeavour to push the cost over the overhead resistance at $26.38. When they succeed, the AVAX/USDT pair could develop a bullish climbing triangular pattern, with a target objective at $33 after which $38.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance and breaks underneath the 20-day EMA, the happy couple could slide towards the support line. It is really an important level for that bulls to protect just because a break and shut below it might tilt the benefit in support of the bears.

Market information is supplied by HitBTC exchange.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.