The U . s . States equities markets happen to be within firm bear grip for most of the season. The S&P 500 and also the Nasdaq Composite have declined for 3 quarters consecutively, an initial since 2009. There wasn’t any respite in selling in September and also the Dow jones Johnson Industrial Average is on the right track to record its worst September since 2002. These figures outline the type of carnage that exists within the equities market.

When compared with these disappointing figures, Bitcoin (BTC) and choose altcoins haven’t quit much ground in September. This is actually the first sign that selling might be drying out at ‘abnormal’ amounts and lengthy-term investors might have began bottom fishing.

Within the final quarter of the season, investors continuously concentrate on the inflation data. Any suggestion of inflation topping could produce a clear, crisp recovery in risk assets, but when inflation remains stubbornly high, a round of sell-offs could follow.

Let’s read the charts from the S&P 500 index, the U.S. dollar index (DXY) and also the major cryptocurrencies to find out if your recovery is around the cards.

SPX

The S&P 500 index (SPX) continues to be under intense selling pressure within the last couple of days however the bulls have held their ground. This signifies that bulls are purchasing the dips near $3,636.

The very first resistance around the upside is $3,737. If bulls thrust the cost above this level, the index could rise towards the 20-day exponential moving average (EMA) ($3,818). Inside a downtrend, this is actually the important level to keep close track of just because a break and shut above it’ll claim that the bears might be losing their grip.

Sharp declines are often adopted by strong rallies. That may carry the index towards the downtrend line after which towards the 50-day simple moving average (SMA) ($4,012).

The bears will probably produce other plans. They’ll attempt to extend the downtrend by sinking and sustaining the cost below $3,636. When they manage to achieve that, the index could plummet to $3,500 and then to $3,325.

DXY

The U.S. dollar index surged to $114.77 on Sept. 28, which pressed the relative strength index (RSI) into deeply overbought territory. This might have attracted profit-booking through the short-term traders that pulled the cost close to the 20-day EMA (111).

The bears will need to yank the cost underneath the 20-day EMA to point out the bullish momentum might be weakening. That may obvious the road for any possible drop towards the 50-day SMA (108).

The zone between your 50-day SMA and also the upward trend line will probably witness aggressive buying through the bulls if they neglect to defend the zone, it’ll indicate the index might have capped out.

However, when the cost appears in the current level or rebounds from the 20-day EMA, it’ll indicate the bulls still buy on dips. Buyers will on the other hand make an effort to thrust the cost above $114.77 and resume the upward trend. The following target objective around the upside is $118.

BTC/USDT

Bitcoin bounced from the strong support at $18,626 on Sept. 28, indicating the bulls still very defend this level. The lengthy tail around the candlepower unit of history 2 days implies that bulls are purchasing the intraday dips.

The bulls pressed the cost over the 20-day EMA ($19,602) on Sept. 30 but they are battling to sustain the greater levels. This implies that bears can sell close to the 50-day SMA ($20,621).

If bulls do not let the cost to decrease underneath the 20-day EMA, the probability of a rally towards the downtrend line increases. The bears are anticipated to mount a powerful resistance only at that level but when bulls obvious this hurdle, the BTC/USDT pair could signal a brief-term trend change. The happy couple could then rise to $22,799.

Unlike this assumption, when the cost turns lower in the current level or even the 50-day SMA ($20,625), the happy couple could again drop towards the $18,626 to $17,622 support zone.

ETH/USDT

Ether (ETH) continues to be declining inside a climbing down funnel pattern within the last a few days. For the short term, the cost continues to be stuck between $1,250 and $1,410, indicating demand at ‘abnormal’ amounts but selling close to the resistance.

The cost action within the range is generally random and volatile. Hence, it is not easy to calculate the direction from the breakout with certainty.

When the cost breaks above $1,410, it’ll claim that the bulls have absorbed the availability. That may propel the cost towards the resistance type of the funnel. The bulls will need to overcome this barrier to point out a possible trend change.

However, when the cost turns lower and breaks below $1,250, the bears will endeavour to cement their advantage by pulling the ETH/USDT pair underneath the funnel. When they succeed, the happy couple could drop to $1,000.

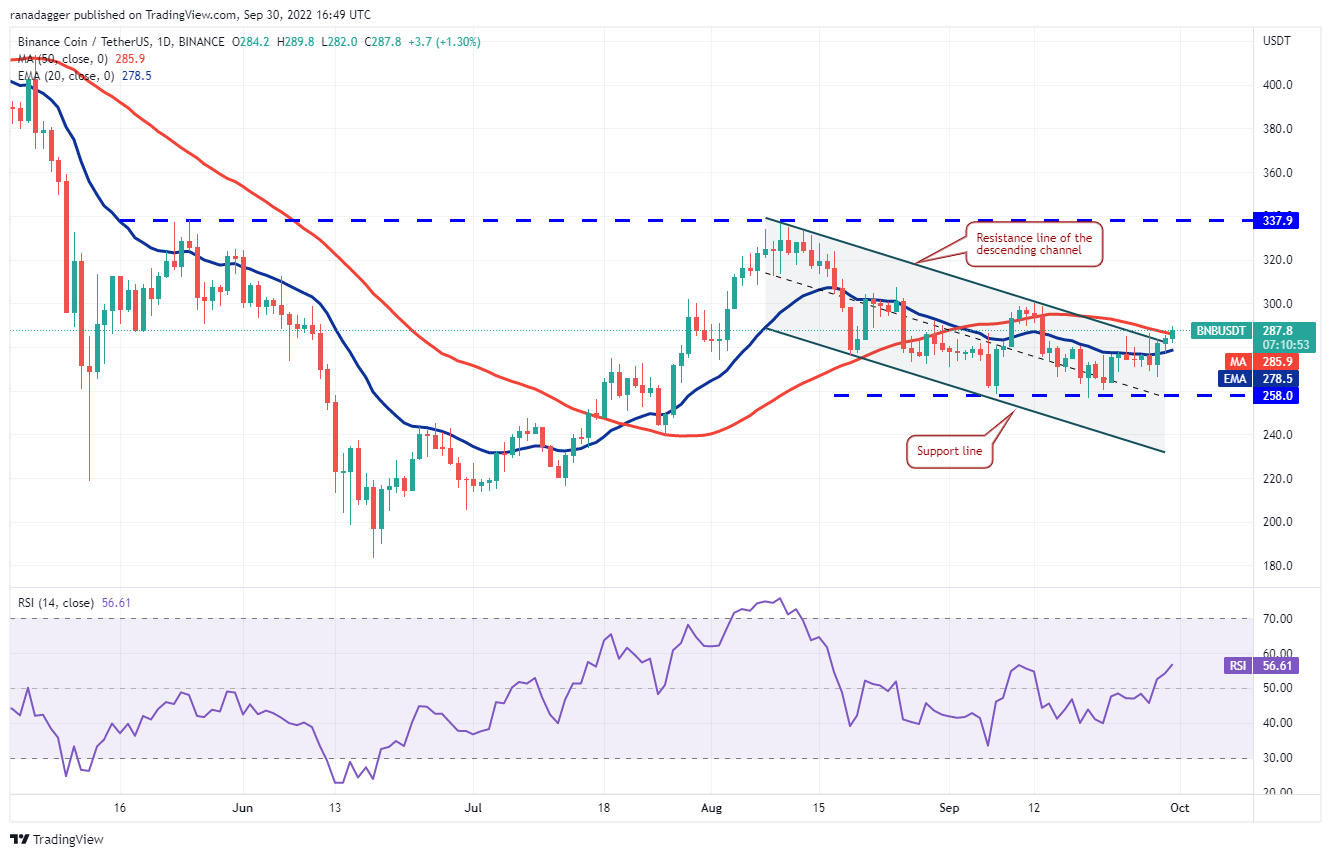

BNB/USDT

BNB turned up dramatically from $266 and broke over the 20-day EMA ($278) on Sept. 28. This signifies that ‘abnormal’ amounts are attracting strong buying through the bulls.

The bulls pressed the cost over the resistance type of the climbing down funnel on Sept. 29 but they are facing resistance in the 50-day SMA ($288). If bulls do not let the cost to plummet back underneath the 20-day EMA, it’ll enhance the prospects of the break over the 50-day SMA. The BNB/USDT pair could then rally to $300 and then to $338.

On the other hand, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that bears still sell at greater levels. The happy couple could then decline towards the strong support at $258.

XRP/USDT

XRP rebounded from the 20-day EMA ($.43) on Sept. 28, indicating a general change in sentiment from selling on rallies to purchasing on dips. However, the bears are unlikely to stop because they will attempt to stall the recovery within the $.52 to $.56 zone.

If buyers tendency to slack up much ground in the current level, the potential of a rest over the overhead zone increases. A rest above $.56 will signal the resumption from the upward trend. The XRP/USDT pair could then rise to $.66.

On the other hand, when the cost continues lower, the happy couple could drop towards the breakout degree of $.41. The bulls will probably defend this level intensely. When the cost rebounds off this level, the happy couple may enter a variety-bound action for any couple of days.

ADA/USDT

The lengthy tail on Cardano’s (ADA) Sept. 28 and 29 candlepower unit implies that the bulls purchased at ‘abnormal’ amounts so that they can defend the upward trend line. Even though the cost rose over the upward trend line on Sept. 29, buyers couldn’t sustain the recovery.

The cost has again tumbled underneath the upward trend line on Sept. 30. The downsloping moving averages and also the RSI within the negative territory claim that the road of least resistance would be to the down-side. When the cost breaks below $.42, the ADA/USDT pair could decline towards the crucial support at $.40. The bulls are anticipated to protect this level with vigor.

Contrarily, when the cost appears in the current level and closes over the upward trend line, it’ll suggest strong buying at ‘abnormal’ amounts. The bulls will on the other hand attempt to push the cost over the 20-day EMA ($.45) and challenge the resistance in the 50-day SMA ($.47).

Related: Bitcoin surges above $20K after 6% BTC rally gains steam in front of the monthly close

SOL/USDT

Buyers are trying to form a greater lower in Solana (SOL). The cost rebounded off $31.65 on Sept. 28 and arrived at the 50-day SMA ($34.70) on Sept. 30.

The 20-day EMA ($33.30) is attempting to show up and also the RSI is simply over the midpoint, suggesting the bulls try a comeback. When the cost breaks and sustains over the 50-day SMA, the bullish momentum could get and also the SOL/USDT pair could rally to $39. The bears are anticipated to mount a powerful resistance only at that level.

Alternatively, when the cost turns lower in the 50-day SMA, the happy couple could drop to $31.65. A rest below this support could sink the happy couple to $30.

DOGE/USDT

Dogecoin (DOGE) dipped underneath the 20-day EMA ($.06) on Sept. 25 and also the bears thwarted attempts through the bulls to resume the recovery on Sept. 27.

The 20-day EMA is flattish and also the RSI is simply underneath the midpoint, indicating an account balance between demand and supply. This balance could tilt in support of the bears when they sink the cost underneath the support near $.06. The cost could then plunge to $.05.

The bulls will gain top of the hands when they drive and sustain the cost over the 50-day SMA ($.06). The DOGE/USDT pair could then chance a rally to $.07 in which the bears may again mount a stiff resistance.

Us dot/USDT

Polkadot (Us dot) continues to be buying and selling inside a tight range from $6 and $6.64 within the last couple of days. This signifies a difficult fight between your bulls and also the bears.

The progressively downsloping moving averages and also the RSI within the negative territory claim that bears possess a slight edge. When the cost drops below $6, the Us dot/USDT pair could start the following leg from the downtrend. The happy couple could then slide to $4.

To invalidate this negative bias, bulls will need to push and sustain the cost over the 20-day EMA ($6.64). When they do this, it’ll claim that the consolidation close to the support might have been a build up phase. The happy couple could then rise towards the 50-day SMA ($7.26) and then to $8.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.