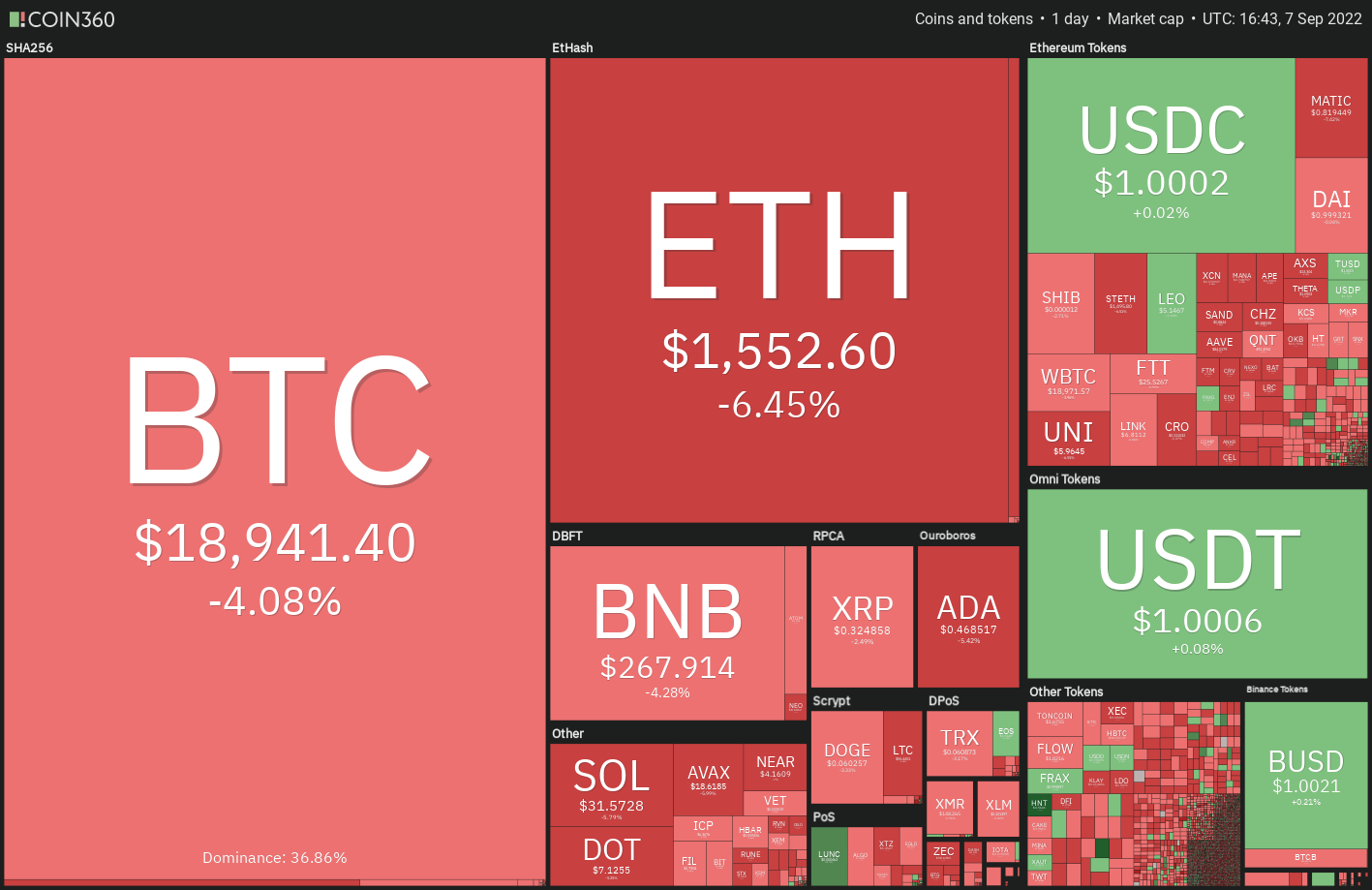

After buying and selling close to the $20,000 level for a few days, Bitcoin (BTC) switched lower dramatically and dropped below $19,000 on Sept. 6. The autumn wasn’t restricted to the cryptocurrency markets because the U . s . States equities markets also closed lower on Sept. 6.

Dangerous assets happen to be facing selling pressure previously couple of days as investors are involved the Fed could continue its aggressive tightening policy.

The CME FedWatch Tool shows the probability for any 75 basis point rate hike within the September meeting has risen to 80% from 69% per week back. This extended the increase in the U.S. dollar index (DXY), which closed above 110 on Sept. 6.

The U.S. equities markets and also the cryptocurrency financial markets are attempting a relief rally on Sept. 7 however the recovery will probably sustain once the DXY shows indications of topping out.

Even though the bear market continues to be brutal, it’s an encouraging sign to determine that investment capital firms have ongoing to plow money into cryptocurrency and blockchain companies. Based on a KPMG report released on Sept. 6, the entire investments within the first 1 / 2 of 2022 by these lenders hit $14.2 billion, which will come following the record $32.1 billion investments produced in 2021.

Do you know the critical overhead resistances in Bitcoin and altcoins that should be entered for that bullish momentum to get? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin’s tight range buying and selling between $19,520 and $20,576 resolved towards the downside on Sept. 6. The bears pulled the cost towards the strong support zone between $18,910 and $18,626.

When the cost rebounds from the zone, the BTC/USDT pair could rally towards the breakdown degree of $19,520. The bears will endeavour to switch this level into resistance. When they manage to achieve that, the probability of a rest underneath the support zone increases.

That may sink the happy couple towards the vital support at $17,622. A rest and shut below this level could signal the resumption from the downtrend. The downsloping 20-day exponential moving average (EMA)($20,427) and also the relative strength index (RSI) close to the oversold territory indicate that bears have been in control.

The very first manifestation of strength is a break and shut over the 20-day EMA. This type of move will indicate that bulls try a comeback.

ETH/USDT

Ether (ETH) rose over the moving averages on Sept. 6 however the bulls couldn’t obvious the overhead hurdle at $1,700. The bears offered strongly and pulled the cost back underneath the 20-day EMA ($1,597).

The bears will attempt to construct upon the benefit and sink the cost underneath the neckline from the mind and shoulders (H&S) pattern. When they succeed, the ETH/USDT pair could drop to $1,422 after which towards the important support at $1,280. The pattern target of the bearish setup is $1,050.

Alternatively, when the cost bounces from the neckline, it’ll claim that bulls still view dips like a buying chance. The happy couple could then consolidate between your neckline and $1,700 for a while. A rest and shut above $1,700 could obvious the road for any possible rally to $2,030.

BNB/USDT

BNB turned lower dramatically in the 20-day EMA ($282) on Sept. 6 and broke underneath the critical support at $275. This completed a bearish H&S pattern.

Generally, following the breakdown from the major support, the cost returns to retest the amount. Within this situation, buyers will attempt to push the cost back above $275. When they manage to achieve that, several aggressive bears could get trapped. That could cause a brief squeeze and also the BNB/USDT pair could rally to $308.

However, when the cost turns lower from $275, it’ll claim that bears have flipped the amount into resistance. That may begin a decline to $240 and when this support also gives way, the following stop may be the pattern target at $212.

XRP/USDT

The bulls pressed XRP over the overhead resistance at $.34 on Sept. 6 however the bears trapped the aggressive buyers and pulled the cost underneath the immediate support at $.32.

A small positive would be that the bulls haven’t permitted the cost to sustain below $.32. The lengthy tail around the Sept. 7 candlepower unit shows buying at ‘abnormal’ amounts. When the cost sustains above $.32, the XRP/USDT pair could extend its range-bound action for many additional time.

Unlike this assumption, when the cost turns lower in the current level and sustains below $.32, it’ll obvious the road for any possible decline to $.30. The bulls will probably defend this level with all of their might.

ADA/USDT

Cardano (ADA) closed over the 50-day simple moving average (SMA) (.49) on Sept. 4 and also the bulls defended the amount on Sept. 5. Buyers attempted to increase the relief rally on Sept. 6 but met having a wall of promoting near $.51.

The cost switched lower dramatically and broke underneath the moving averages. Both moving averages are flattish and also the RSI is simply underneath the midpoint, indicating a variety-bound action soon. The ADA/USDT pair could oscillate between $.44 and $.51 within the next couple of days.

The bears will need to sink the cost below $.44 to spread out the doorways for any drop towards the crucial support at $.40. Alternatively, when the cost appears in the current level and breaks above $.51, the happy couple could rally towards the downtrend line.

SOL/USDT

Solana (SOL) rallied towards the 20-day EMA ($33) on Sept. 6 however the bulls couldn’t overcome this barrier. This means the sentiment remains negative and traders can sell on rallies.

A small positive would be that the bulls haven’t permitted the cost to dip underneath the immediate support at $30. When the cost appears in the current level, the bulls will again attempt to drive the SOL/USDT pair over the 20-day EMA. When they succeed, the happy couple could rally towards the 50-day SMA ($38).

On the other hand, when the cost turns lower and breaks below $30, the happy couple could extend its slide towards the vital support at $26. The bulls will probably mount a powerful defense only at that level if this support cracks, the happy couple could resume its downtrend.

DOGE/USDT

The bulls tried to push Dogecoin (DOGE) over the 20-day EMA ($.06) on Sept. 6 however the bears offered the rally strongly and pulled the cost underneath the immediate support at $.06.

Buyers are trying to push the cost back above $.06 on Sept. 7. When they succeed, the DOGE/USDT pair could again rally towards the overhead resistance in the 20-day EMA. This remains a vital level to take into consideration soon just because a rally above it might push the cost to $.07.

Unlike this assumption, when the cost turns lower from $.06 or even the 20-day EMA, it’ll claim that bears can sell on rallies. That may increase the potential of a drop towards the strong support at $.05.

Related: Bitcoin cost hits 10-week low among ‘painful’ US dollar rally warning

Us dot/USDT

Buyers tried to push Polkadot (Us dot) over the moving averages on Sept. 5 and 6 however the bears defended the amount strongly as seen in the lengthy wick around the candlesticks.

The 20-day EMA ($7.38) is sloping lower and also the RSI is incorporated in the negative territory, indicating benefit to sellers. If bears sink and sustain the cost underneath the immediate support at $6.79, the Us dot/USDT pair could slip towards the crucial support at $6. The bulls will probably mount a powerful defense only at that level.

Alternatively, when the cost appears in the current level and increases over the moving averages, it’ll suggest strong buying on dips. That may push the happy couple to $9.17 and then towards the overhead resistance at $10.

MATIC/USDT

Buyers defended the 50-day SMA ($.87) on Sept. 5 and tried to extend the recovery on Sept. 6 however the bears had other plans. They offered strongly at $.92 and pulled Polygon (MATIC) back underneath the moving averages.

The 20-day EMA ($.85) has began to show lower and also the RSI is near 46, indicating that bears possess a slight edge. Sellers will endeavour to drag the cost towards the strong support at $.75.

It is really an important support to take into consideration just because a break and shut below it might develop a bearish H&S pattern. In the event that happens, the MATIC/USDT pair could begin a decline to $.63 and after that towards the pattern target of $.45.

This negative view could invalidate soon if bulls push the happy couple above $.93. The cost could then rise towards the strong overhead resistance at $1.05.

SHIB/USDT

The bulls purchased the dip in Shiba Inu (SHIB) on Sept. 5 but they couldn’t sustain the cost over the 20-day EMA ($.000013). This signifies that bears can sell on every minor rally.

The 20-day EMA has switched lower and also the RSI is simply underneath the midpoint, indicating a small benefit to bears. The sellers will endeavour to sink the cost towards the mental support at $.000010 after which to $.000009. Buyers are anticipated to protect this support zone with vigor.

Another possibility would be that the cost appears in the current level and breaks over the moving averages. This type of move will claim that selling dries up at ‘abnormal’ amounts. The SHIB/USDT pair could first rise to $.000015 and then to $.000018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.