Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to achieve $.64, its cheapest level since February. 28.

More XRP cost downside ahead?

The plunge elevated the potential of triggering a bearish reversal setup known as climbing down triangular. While these patterns form usually throughout a downtrend, their occurrences following strong bullish moves usually mark the finish from the upward trend.

XRP has been around an identical buying and selling funnel since April 2022, bounded by two trendlines: a lesser horizontal as well as an upper downward sloping.

The pattern now gets near its resolve as XRP pulls back toward the support trendline that’s also coinciding using the 50-week exponential moving average (50-week EMA nowhere wave), five days after testing top of the trendline as resistance.

If your breakdown occurs underneath the triangle’s lower trendline, along with elevated volumes, XRP’s cost could fall to the stage that’s in the length comparable to the utmost distance between your structure’s lower and upper trendline, as proven within the chart above.

That will put XRP on the way towards $.19, about 70% less than April 25’s cost.

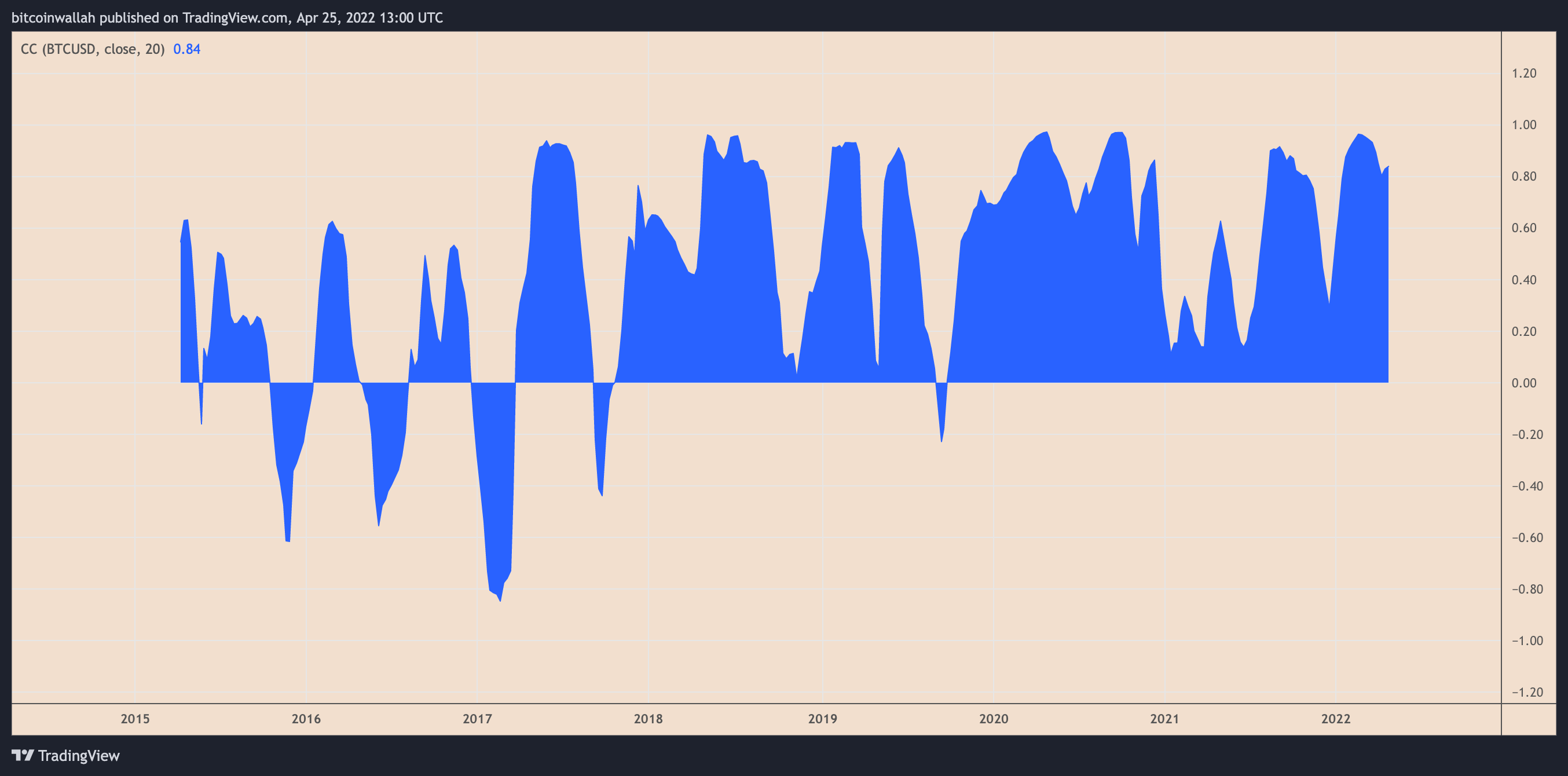

Bitcoin cost correlation

The bearish outlook for XRP comes majorly within the wake of the similar selloff happening across Bitcoin (BTC), Ether (ETH) and all of those other crypto market. The correlation between Bitcoin and XRP was .84 by April 25. An ideal score of just one signifies the two assets move perfectly synchronized with each other.

In addition, Bitcoin could fall to the The month of january lows below $33,000, asserts Mark Newton, a technical strategist at Fundstrat. BTC’s initial pullback to $36,300 “should result in a full retest of $32,950 with no troublel .,” he added.

Related: ‘Something sure seems like it comes down to to break’ — 5 items to know in Bitcoin now

Because of its positive correlation with Bitcoin, XRP could therefore decline further to trigger its climbing down triangular breakdown setup.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.