Crypto.com’s native token Cronos (CRO) is showing restraint on November. 14 against mounting sell-pressure building within the wake from the FTX’s dramatic collapse a week ago. Now, the CRO/USD pair is eyeing a watershed cost recovery.

On November. 14, CRO’s cost wobbled between profits and losses, buying and selling around $.069 each day after crashing to $.05, its cheapest level since April 2020 — that’s a 60% cost decline from November’s peak close to $.178.

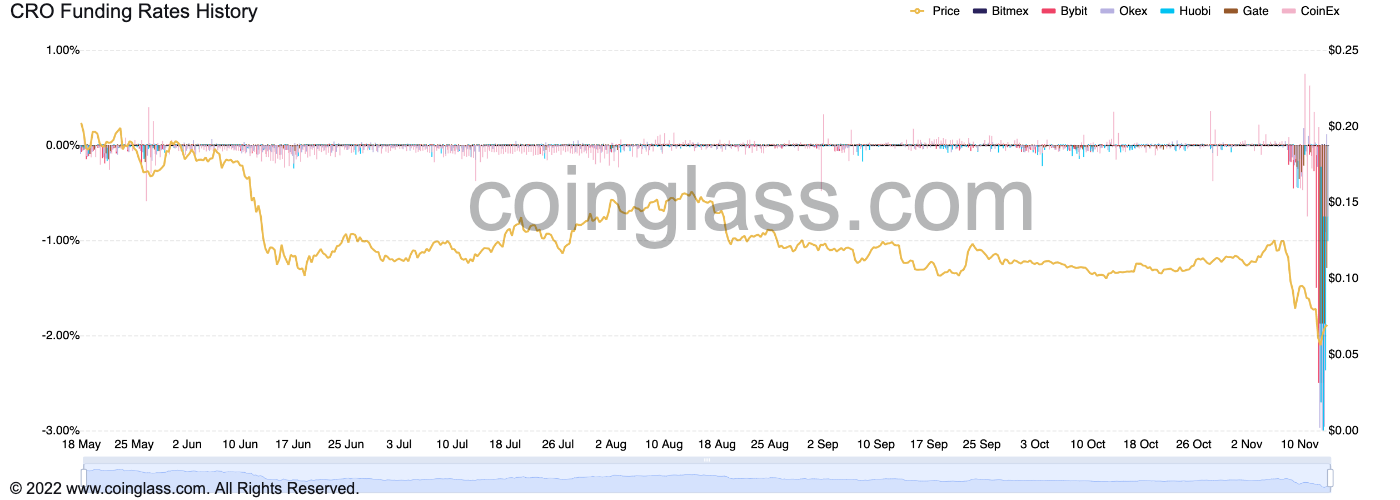

CRO funding rate drops to -3%

The time of CRO’s cost decline happened alongside a clear, crisp stop by the token’s perpetual futures funding rates.

Funding rates are recurring payments produced by traders in line with the distinction between the costs within the futures and also the place market. An optimistic funding rate means bullish traders (lengthy positions) pay bearish traders (short positions), representing their confidence in regards to a cost rally.

On the other hand, an adverse funding rate means short traders pay lengthy traders to have their positions open. On November. 14, CRO’s funding rates on Huobi and OKX dropped to minus 3%, showing traders are very bearish around the token.

“This generally is the very same dynamic that happened before Celsius and FTX collapsed,” cautioned Dylan LeClair, senior analyst at digital asset fund UTXO Management on November. 13, when CRO funding rates were near minus 2%.

FTX contagion fears spread to Crypto.com

The CRO sell-off began from fears of contagion among the FTX fiasco, particularly concerns that Crypto.com, a Singapore-based crypto exchange, would collapse very much the same as FTX.

Fundamentally of those worries is potential insolvency, with analysts mentioning that Crypto.com is holding low-liquid cryptocurrencies like Shiba Inu (SHIB) and it is own token CRO as reserves, which apparently constitute 40% from the exchange’s total assets.

4.https://t.co/INIxikfNzy holds $1.6B price of BTC/ETH/USDT/USDC/DAI/BUSD assets, comprising 60%.

40% of assets are low liquidity assets.

— Lookonchain (@lookonchain) November 13, 2022

Additionally, Crypto.com also moved $210 million price of stablecoins from Binance and Circle before demonstrating its reserves towards the public. Binance Chief executive officer Changpeng Zhao confirmed the move, advocating caution, yesterday CRO dropped to the April 2020 low.

If the exchange need to move considerable amounts of crypto after or before they demonstrate their wallet addresses, it’s a obvious manifestation of problems. Steer clear. Stay #SAFU.

— CZ Binance (@cz_binance) November 13, 2022

In addition to this, Crypto.com also misconducted a $400 million Ether (ETH) transaction, delivering it to some Gate.io exchange wallet rather of their cold storage. Later, the exchange did have the ability to recover the funds, however that also elevated lots of questions.

Crypto_com Chief executive officer is claiming they “accidentally” sent $400 million of the eth towards the wrong wallet.

He’s either laying, or incompetent. https://t.co/hWXvPqBime

— Coffeezilla (@coffeebreak_YT) November 13, 2022

Overall, Crypto.com saw its users withdraw $14 million in ETH and $39 million in other tokens over the past weekend, according to data tracked by Argus Corporation.

50% Cronos cost relief rally ahead?

Strictly theoretically speaking, however, CRO’s cost could nonetheless visit a potential relief rally within the coming days.

Some indicators offer the stated bullish outlook, including CRO’s weekly relative strength index (RSI), which dropped to almost 30, or nearly “oversold” territory. An identical stop by June captured had preceded a 75% recovery rally from $.099 to $.162, as proven below.

Another bullish indicator includes strong historic support of $.061. Additionally, CRO’s current cost selection of $.061 and $.111 has got the token’s greatest volume profile visible range (VPVR) on record.

Quite simply, CRO cost could recover to $.111, up 50 plusPercent in the current cost levels, since it’s next upside target.

Related: Exchange outflows hit historic highs as Bitcoin investors self-child custody

On the other hand, CRO/USD falling alongside funding rates shows that its drop might have been driven by futures markets, that was even the situation with Terra’s collapse in May. Thus, the persistent bearish sentiment over the entire cryptocurrency market could dampen CRO’s recovery prospects.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.