The U . s . States completed the wide gap in Bitcoin (BTC) mining which was left open by China by the finish of June 2021. Despite looming rumors of high power consumption, officials in Texas, among the fastest growing crypto mining hubs within the U.S., now think that mining operations can, actually, garner a symbiotic relationship using the energy industry.

A e-newsletter in the Texas Comptroller’s office revealed the state’s pro-crypto stance using the intent for hosting lengthy-term miners and operators. Clarifying the overall misconception about Bitcoin’s energy usage, the fiscal note highlighted that unlike “manufacturing facilities or industrial chemical plants, which may be expected to be with for many years,” cryptocurrency mining facilities don’t place big electrical demands around the grid.

With greater crypto miners getting into Texas, concerns around power demand remain because the sudden surge threatens to disturb the total amount between demand and supply. While other power-hungry industries frequently continue production among market fluctuations, among the concerns elevated within the e-newsletter by Texas-based research affiliate Joshua Rhodes was:

“The difference is the fact that Bitcoin mines (mining facilities) comes in so quick and could go away so quick with respect to the cost of Bitcoin.”

Because of the unique positioning from the crypto mining market, Texas officials believe miners can take part in demand response programs — which entail switching off miners’ power during peak demand. This method is broadly adopted by energy-intensive industries for example petrochemical plants.

Furthermore, the research envisioned that elevated mining operations could spur additional energy infrastructure, particularly in remote regions of West Texas.

Related: Bitcoin mining to cost under .5% of worldwide energy if BTC hits $2M: Arcane

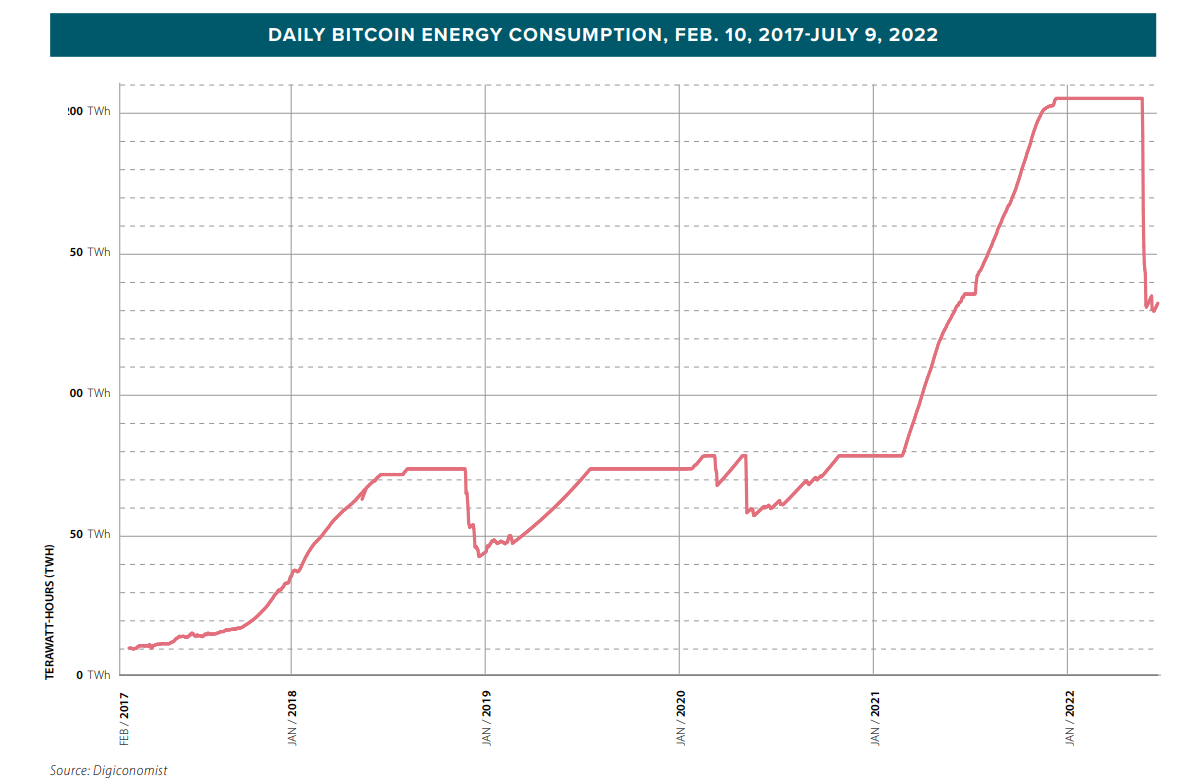

An extended bear market introduced lower mining revenue to record lows in June 2022. However, data from blockchain.com demonstrated that BTC mining revenue leaped nearly 69% in a single month — from $13.928 million on This summer 13 to $23.488 million on August. 12.

Additionally, lower mining equipment (GPU) prices have finally permitted BTC miners to upgrade and expand their mining rigs because they pursue mining the final two million BTC.